Marko Geber

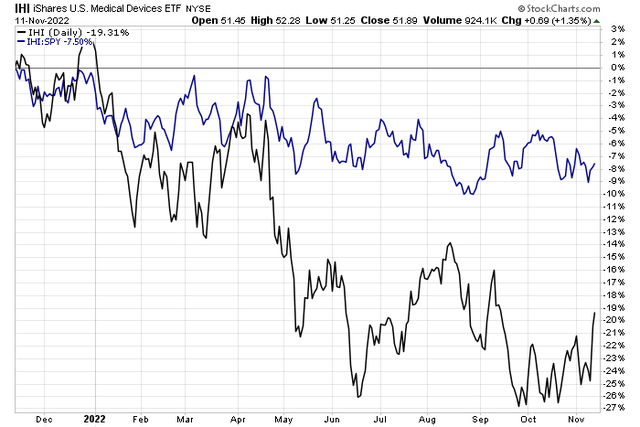

Medical device stocks rose big last week, but the group remains in a modest downtrend against the S&P 500 ETF (SPY) over the last year. The iShares U.S. Medical Devices ETF (IHI) is down nearly 20% on the year. One growth company in the ETF has a shareholder meeting this week and traded lower post-earnings in October despite posting a revenue beat. Is the stock a buy now?

Medical Device Equities Underperforming SPX YoY

Stockcharts.com

According to Bank of America Global Research, ResMed (NYSE:RMD) is a leading developer and manufacturer of medical devices, masks, and cloud-based software applications that diagnose, treat, and manage respiratory disorders. RMD is focused on connected health to deliver better outcomes for sleep apnea and chronic obstructive pulmonary disease sufferers.

The California-based $32.3 billion market cap Health Care Equipment & Supplies industry company within the Health Care sector trades at a high 41.7 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.8% dividend yield, according to The Wall Street Journal.

The company is seeing better production amid loosening supply chain disruptions. That trend should help support meeting improved continuous positive airway pressure product (CPAP) demand. Upside risks include a tapering of Covid-19, a faster product pipeline, the launch of a new CPAP device, and strong SaaS business growth.

Downside risks include reimbursement changes from healthshare ministries and other private health insurers, poor product launches, better technology from competitors hurting margins and threatening market share, and further chip supply shortages.

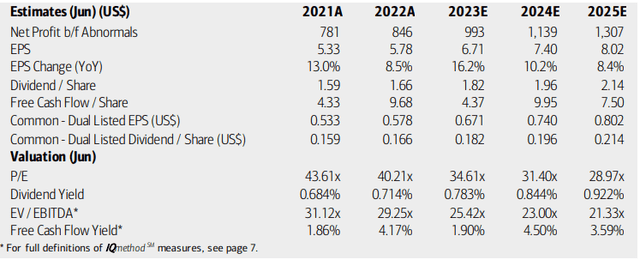

On valuation, analysts at BofA see earnings rising strongly next year after keeping pace with inflation in 2022. Robust per-share profit growth is then seen through 2025 while dividends should grow commensurate with earnings. Moreover, free cash flow is expected to continue upward.

Still, that growth is not enough to offset a high P/E ratio in the years ahead and the EV/EBITDA multiple is high above 20. With a growth stock like this, I like to see what the PEG ratio looks like. According to Seeking Alpha, RMD’s forward PEG is just 1.4 – that is a decent value to me despite its overall F rating.

ResMed: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

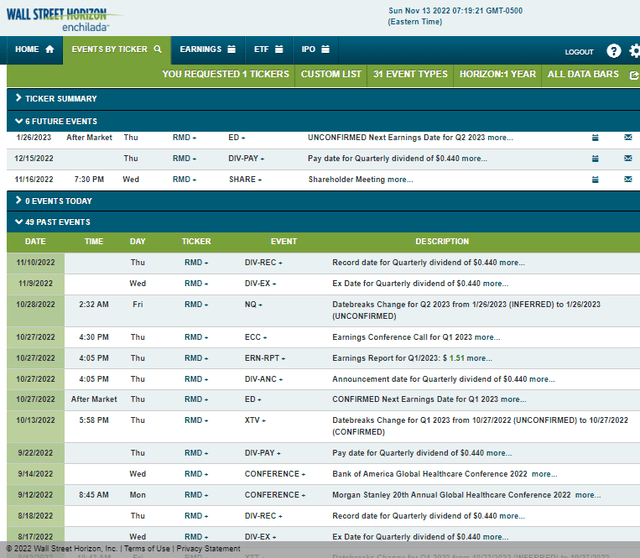

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Thursday, January 26 AMC. Before that, though, RMD has a key shareholder meeting this Wednesday night, so there could be volatility later this week. Finally, a quarterly dividend is to be paid on Thursday, December 15.

Corporate Event Calendar

Wall Street Horizon

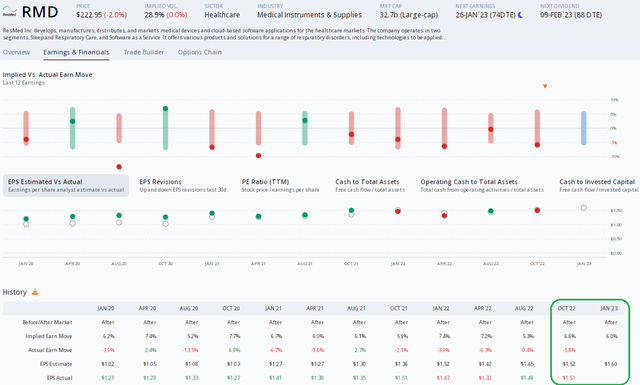

The Options Angle

Option Research & Technology Services (ORATS) data show that ResMed once again missed its earnings forecast recently. The Q1 2023 report released in late October featured a small miss, and the stock declined nearly 6% the day after results hit the tape, about in line with what the options market had priced in. It was the fifth straight negative earnings reaction by RMD.

Looking ahead, ORATS shows a $1.60 consensus Q2 EPS forecast, which would be about a 10% earnings climb from the same period a year ago. There have already been six upward EPS revisions for the quarter.

RMD: Solid Earnings, But Weak Post-Reporting Price Action

ORATS

The Technical Take

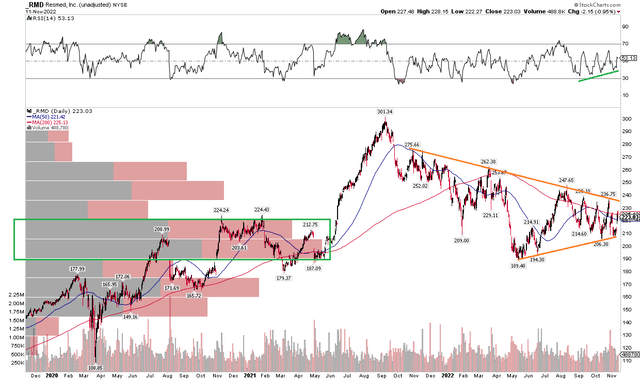

RMD has been consolidating off its all-time high notched in September of 2021. Generally, these coils tend to resolve in the trend of larger degree – which would be down in this case. Before we can call that, though, traders want to see a breakout or breakdown from the current symmetrical triangle to confirm the move. Notice in the chart below that the RSI is increasing while the has stammered lower lately – that’s a bullish sign. Also, there is a high number of shares traded in the $190 to $210 range that should offer support.

Still, we must monitor the $205 level on the downside and $240 price on the upside. A move below $205 would suggest more downside ahead, while a breakout above $240 could lead to a sustained move higher.

RMD: Shares Consolidating With Improving RSI

Stockcharts.com

The Bottom Line

I like RMD’s valuation given robust growth trends, but the technical picture is mixed. I would like to wait and see how this stock behaves on a breakout or breakdown from this consolidation pattern on the chart.

Be the first to comment