Nastassia Samal

Situation Overview

Aimia (TSX:AIM:CA) changed significantly since its Aeroplan days and now is an investment holding company run by the Mittleman Brothers. With the crown jewel asset PLM sold to Aeromexico, Aimia has over $500 million cash on hand ready to be deployed in (hopefully) value-enhancing M&A deals.

Aimia is in an ideal position to be an acquirer. In general, valuation has come down recently, meaning higher quality assets are trading more reasonably. In addition, Aimia has over $800 million in tax losses ($390 million in capital losses and $395 million in NOL) that it can take advantage of. More importantly, with the uncertainty in the debt market, Aimia is able to make all-cash bids (i.e. not subject to debt financing) which increases the likelihood of closing for the target. There is less competition for M&A as the result of the SPAC market went through the boom and bust cycle. Overall, with the combination of ample cash on hand and significant tax losses, Aimia should be able to lock down some good deals in this uncertain market environment. Of course, all of this is subject to Mittleman Brothers’ ability to source and identify attractive targets. I personally believe the “long-term track records of free cash flow generation as well as exciting growth prospects” is a good guiding principle.

Valuation

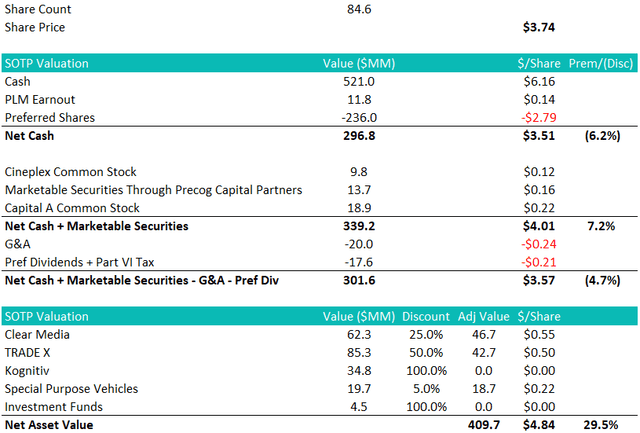

While Aimia’s structural advantage should increase the likelihood of landing better-than-fair deals, the market is not assigning much value to Aimia’s M&A optionality. In fact, at $3.74 Aimia is trading right around its net cash + marketable securities value.

Aimia has $6.16/share in cash and $0.14/share probability-adjusted value for the PLM sale earn-out (range between $0.15 and $0.46 per share), netting out the preferred share, Aimia has a net cash value per share of $3.51 before other items and adjustments. There are another 50 cents of value in the marketable securities, but netting out the G&A expenses and preferred dividends for one year, the net cash plus marketable securities value is roughly around where Aimia is trading today (4.7% higher to be exact, but valuation isn’t a precise exercise).

There is another $1.28/share of value from Aimia’s private investments, but because the market isn’t giving them much credit, I just took a simple discount-to-book-value approach:

- Clear Media is a great business but the zero-COVID policy is hurting the outdoor advertising space in the near term, and the geopolitical risk (China) will probably put pressure on the long-term valuation of this holding. In fact, I believe this small China exposure keeps some investors on the sideline.

- TRADE X is facing near-term pressure from inventory valuation adjustment (lower used car prices) but the business going forward should be a broker model (i.e. asset-light).

- Kognitiv – I’m writing down the entire value of this investment, as the business isn’t profitable and could even require additional funding in the near term. I believe having exposure to unprofitable tech doesn’t help Aimia generate investor interest.

- SPVs: if no transactions are consummated, Aimia should get this capital back plus accrued interest (and thus a small discount).

- Investment Funds: This is Aimia’s ownership in Mittleman Brother LLC.

Company Filings

In summary, Aimia is trading around its net liquid asset value (cash + marketable securities). Investors are receiving the private investment portfolio for (almost) free, and more intriguingly, investors are receiving the option value of future M&A deals for free as well.

Risks

The biggest risk is value-destructive deals. Investors can’t really hedge this risk out, but with Aimia’s structural advantage in an M&A context (as mentioned above: cash on hand that can close deals without financing conditions and huge tax losses to offset operating profits and capital gains), and a more reasonable valuation level, I’d like to believe that Aimia should be able to buy wonderful companies at fair prices and/or buy fair companies at wonderful prices. Insider ownership is fairly high, so I believe Mittleman Brothers will behave like owner-and-operators (they have been so far with the aggressive share repurchase).

Investing in holding companies has a couple of common risks. The SOTP valuation always looks compelling, but the stock almost always trades below NAV. This holdco discount risk is mitigated somewhat with Aimia’s continued commitment to share buyback. Aimia is also free cash flow negative and doesn’t have many meaningful positive cash-flowing investments after selling PLM. The large cash pile and future FCF-positive M&A target should help in this regard.

Catalyst

The next catalyst that could move the stock higher would be a well-received transaction. As an investor, I’m essentially looking for Mittleman Brothers to stick to their own words – a long track record of FCF generation and growth prospects. I believe, as long as Aimia doesn’t obviously overpay for something and the size of the deal is somewhat needle-moving, the stock should react positively to the news.

Other possible catalysts include China’s re-opening, which should ease the concern around Clear Media’s future prospects as a viable business; business stabilization at Kognitiv and TRADE X, EBITDA breakeven will be welcomed by the market.

Conclusion

Aimia is trading around its cash and marketable securities value. While this is somewhat justified because the private investment portfolio is facing some challenges (China’s zero-COVID policy for Clear Media, and recent disappointing operating trends at TRADE X and Kognitiv), the value of the private investment holdings should not be zero. Most importantly, Aimia is in an ideal position to land value-enhancing M&A deals in this target-rich environment. With $1 billion buying power (assuming 50% debt financed) and the depressed stock valuation, I see a lot more upside than downside for Aimia from here.

Be the first to comment