fcafotodigital/iStock via Getty Images

Thesis highlight

I believe Sweetgreen, Inc. (NYSE:SG) is undervalued as of today. The current consumer base can easily access information to guide their purchasing decisions easily. Awareness about chronic and lifestyle illnesses has also increased in the recent past. Both of these factors have led to a switch by consumers from junk food to healthy eating.

Businesses that have recognized and capitalized on this opportunity stand to benefit. Sweetgreen is one such company operating a chain of restaurants.

Company overview

SG is an American fast casual restaurant chain that has a mission to serve healthy food at scale.

Investments merits

Several key trends that are shaping the food industry

There is a radical change in the food industry occasioned by ever-changing consumer preferences. This opens up a huge and significant opportunity for brands that can align with changing consumer preferences. These preferences are driven by:

- Increased emphasis on health and wellness: raising awareness and providing information about the health benefits of eating well. Wellness is influencing consumer behavior. Consumers are spending money on high-quality foods that come from good sources, have known ingredients, and are prepared well.

- Massive shift in consumer preference for plant-based foods: Plant-based meals have numerous advantages, not only for consumers but also for the environment. This leads the consumer to make purchase decisions that are good for their health and the environment.

- Digitization: Before COVID, only a few businesses provided delivery options to customers. Post-Covid, a rapid adoption of digital platforms and delivery options is being witnessed as customers prefer to order their food when and where they are. I expect this trend to continue into the future.

- A growing preference for brands with a purpose: consumers are four to six times more likely to purchase from companies with a strong purpose, according to the 2020 Zeno Strength of Purpose Study. Zeno defines purpose as the unique role and value in society that allow the company to positively impact the world while also growing. Consumers feel that when they consume products or services from these companies, they are also contributing to their purpose.

Plenty of addressable markets in the U.S.

There are huge gaps in the way customers’ needs are being met in new markets (i.e., markets that SG is not in) throughout the United States. SG believes that by opening up stores, they can expand their consumer base with new customers and also serve existing customers who move with them to new cities. This is fueled by the need to meet the growing demand for healthy and convenient foods.

Their market expansion strategy had been successful in new markets. For example, their new restaurants in Miami and Austin achieved larger initial sales volumes than had been predicted. This is despite the fact that they were opened during the COVID-19 pandemic.

Companies often see a reduction in sales when they introduce a similar product to the same market. This has not been the case for SG when they open new restaurants in the same geographic market. In markets where they started operations at the beginning of fiscal year 2014, they’ve more than tripled their restaurant units by fiscal year 2019, while increasing the total sales per restaurant unit by approximately 85% in the same period.

In all but one of their locations, SG has built restaurants with robust secondary lines that can handle higher order volumes with the same production costs. This allows them to meet the rising demand for off-premise dining and hence generate more digital revenue.

By adding drive-throughs and pickup-only locations, SG should diversify and densify their markets. This will also broaden SG’s customer base.

Well-thought-through menu to address increasing focus on healthy food

With signature salads, warm bowls, and plates complemented by a seasonal menu that changes five times a year, SG offers:

- Delicious,

- Customizable, and

- Convenient menus to their customers.

By offering freshly prepared or cooked ingredients, SG allows their consumers to create unique and customized orders to accommodate any flavor profile or dietary preference. By dividing the business day into several parts (breakfast, brunch, lunch, and dinner), SG increases their revenue and their average unit volume.

SG’s simple menus and flexibility of their ingredients have been the secret to making SG part of their customers’ regular routines.

Modern-tech restaurant

SG’s digital platform allows for a direct relationship with its customers. Through it, they can deliver a personalized experience and offer options to the consumer. As a result, consumers’ experiences with SG are improved.

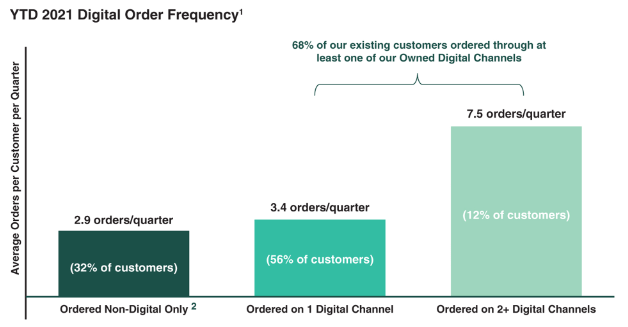

A notable increase from 50% (in FY19) to 67.4% (in FY21) of SG’s total sales is from their digital platforms. The digital platform offers personalized content and recommendations, e.g., exclusive menus and curated collections, which help SG create a highly engaged and loyal fan base. Customers who ordered through these digital platforms in the first fiscal quarter of 2021 ordered 1.5 times more often than customers who used non-digital channels. Customers who ordered through two or more of SG’s digital channels in a fiscal quarter in 2021 ordered 2.5 times more often than customers who placed non-digital orders. This is as per the data reported in SG’s S-1.

Prospectus

Scalable supply chain

SG’s competitive, functional start-to-end supply chain begins with over 200 domestic partners and ends with a delicious, high quality meal for consumers. Domestic partners, like local farmers and bakers, are grouped by how close they are to a retail location and paired with regional distribution networks so that the food can be tracked and seen from seed to bowl.

Prior arrangements are made with farmers to ensure only the best products are supplied to the market. SG’s supply chain drives and informs key decisions pertaining to seasonal menus and fresh produce preparations in their kitchens. This integrated approach ensures:

- High product quality,

- High standards of food safety, and

- Trustworthy relationship with customers.

In line with their transparency policy, SG is proud to display the names of their food partners on the walls of all their restaurant.

Price target

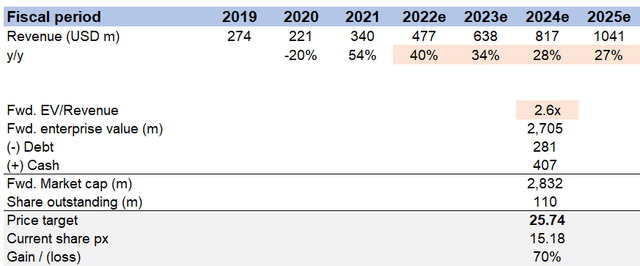

My model suggests a price target for Sweetgreen, Inc. of $25.74, or 70% upside in FY24 from today’s share price of $15.18. This assumes that revenue growth will grow at high rates (20%++) and the forward EV/Revenue multiple will be 2.6x in FY24e.

I have similar estimates as the consensus over the next few years, where SG will continue to grow at high rates, supported by the opening of new stores and improving average unit volume. I understand that SG gave a weak commentary on its FY22 guidance (FY22 revenue to be slightly below 2Q22 guidance). I believe this is just a short-term issue due to the current macroeconomic environment. There should be no issues with it growing at a high rate over the mid-to-long-term given that it still has many rooms to grow.

As for a valuation, SG currently trades at 2.6x forward revenue, which seems reasonable relative to Shake Shack Inc. (SHAK), hence, I assumed no change in multiples.

Risks

Easily replicable

Low initial investment in the Food and Beverage industry, particularly in salad production, saturates the market with competitors. If the competitors have huge financial abilities, they can offer the same products and services, target other markets, and reduce the total available market that SG could expand to.

Current food trend may not last

The wave of “healthy food” might be a passing trend. If it passes, then businesses grounded in this trend will also face contraction. The way SG has branded itself, it proves difficult to switch from their salads to other food categories like pizza or chicken burgers.

New markets may not like the salads

Taste and preference of markets differ. The market share that SG boasts of today might have different tastes and preferences than the markets that they will seek to penetrate in the future. This will cause the new units to take longer to achieve expected sales and profit levels. The new units might also have higher costs for building, making, training, and running, which would make the profit margins even smaller.

Conclusion

I believe Sweetgreen, Inc. is undervalued as of today. A number of factors point towards the upward growth of SG:

- Healthy-food eating trends cause customers to shift to providers of healthy foods.

- For any business to succeed, trust must be built. SG has built trust by being transparent from farm to plate. This creates a loyal customer base that will act as a marketing tool for greater market reach.

- Digital platforms have become the new norm. People resort to digital companies for solutions. SG’s digital platform enables purchase and consumer engagement.

- The specific salad market also has SG as an authority and specialist. This boosts the confidence of customers, and by word of mouth, sales are set to increase.

These, among other factors, point to the gradual growth of SG. An investment in Sweetgreen, Inc. is therefore sound and is likely to generate worthy results.

Be the first to comment