miodrag ignjatovic/E+ via Getty Images

Thesis

The recent performance for the ProShares Ultra QQQ ETF (NYSEARCA:QLD) reminded us of a very famous song from the late music legend Prince:

I was dreaming’ when I wrote this/So sue me if I go too fast/Life is just a party/And parties weren’t meant to last

[…]

So tonight I’m gonna party like it’s 1999

Source: Prince – 1999

The ETF seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the Nasdaq-100 Index. Think about QLD as a Nasdaq on steroids. For each $100 of capital invested with QLD, an investor gets a move equal to $200 of capital invested with the Nasdaq-100 Index.

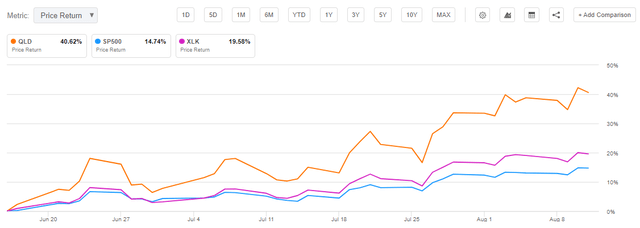

QLD has been on a tear as of late – the vehicle is up +40% since the June lows in the stock market. It seems that the sky is the limit these days for technology stocks and that investors should start partying like it’s 1999! Should they now? We think not. Our article will revisit some of the factors behind this year’s bear market, what has changed as of late and where we believe we are heading.

Low rates, sugar high for stocks

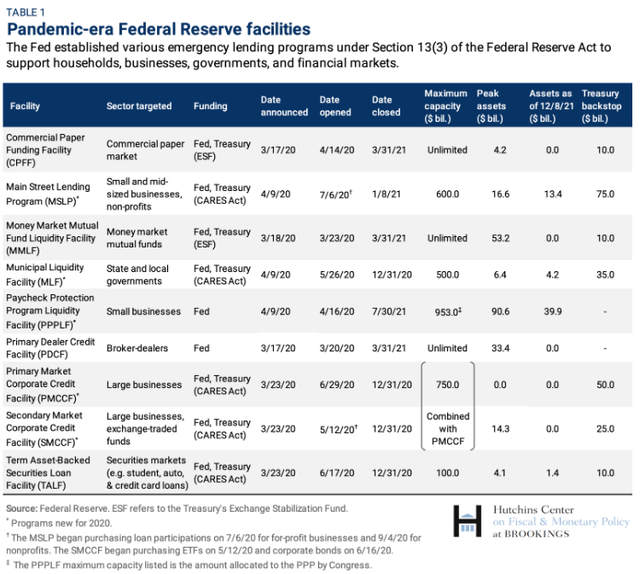

As the world was falling apart during Covid, it seemed that everything we knew was going to change and all financial instruments had no bottom in sight. Then came the Fed. The list is very long in respect to the actions they took in order to support the economy, so we are going to mention just a few points:

- cutting the Federal Funds rate to 0%

- engaging in Quantitative Easing (QE), which means expanding the Fed’s balance sheet by buying Treasuries and MBSs

- backstopping money market funds

- various facilities to support the functioning of financial markets (summarized below)

Fed Facilities (Hutchins Center)

By far the most important lasting aspect for the economy was the zero rates policy. This resulted in “TINA” for stocks and a general massive migration towards risk assets. In a cruel twist of fate, Tina is also slang for a very addictive drug that is hard to shake. It has been the same story with an easy monetary policy induced by the Fed during the Covid crisis. It has been very hard to shake by both the investor community and the Fed. Just like a drug addict longing for that nice rewarding “high” we see massive stock market rallies every time there is a whiff of low rates coming our way again. Call it “Fed Pivoting”, “Peak Inflation”, “Recessionary Scare” whatever you will – let us translate those syntagms for your – “Low Rates are coming!”. And there is nowhere else where those tremors are felt as strongly as in the Technology sector. With companies that are exposed to high P/E ratios and long durations in terms of cash flow discounting valuation methodologies, low rates represent a heaven-sent torrential rain during the drought season.

Rates higher for longer

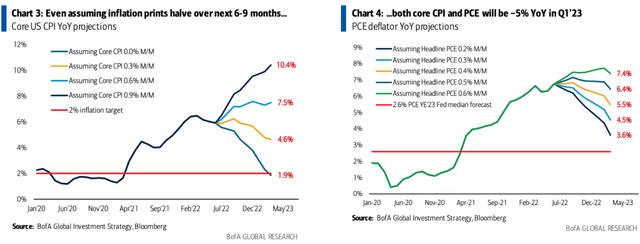

With a labor market that is stubbornly strong, we believe the Fed has learned its lessons from past stagflationary periods and will keep rates higher for longer in order to bring inflation down for good. We are not asserting here that rates will be at 4% for three years, but we believe rates will stay elevated (i.e., above 2.5% for the Fed Funds rate) for longer than investors realize. We are not going to see a Fed pivot to extremely low rates again. We believe the Powell slip of “neutral rates” actually speaks to a long-term threshold they see as appropriate for a new economic environment. A “soft landing” in our view is not a warm, fuzzy economic environment where growth is high, inflation low and all market participants are happy. We rather see it as an era of moderate unemployment, decreasing inflation and mild recessionary symptoms (low to non-existent GDP growth, higher corporate default rates). If we have a look at how inflation will perform in various scenarios, we will notice it will take some time for inflation to come down:

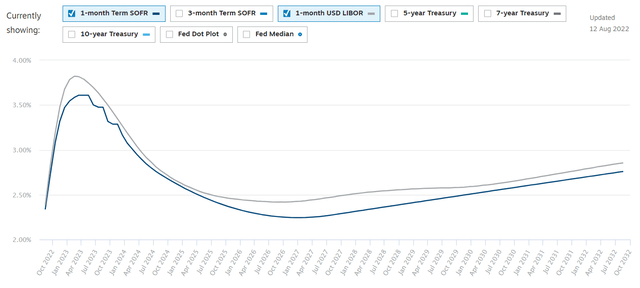

Most market participants are expecting a “Fed pivot” at some point, and one can speculate they are expecting a pivot back to low rates. However, as the rates market is currently pricing, “low rates” actually equate to the Fed neutral rate of 2.5%:

We can see from the above forward SOFR and Libor curves that the rates market expects a reversion to the 2.5% neutral rate somewhere in the spring of 2025, with higher levels until that point.

We feel the ingredients for a “v-shaped” recovery in tech are not there, and rates are going to reset at a higher rate going forward with Quantitative Tightening also taking a toll on financial conditions and rates as it starts kicking into a higher gear in September.

We feel the current massive rally in Tech since the June market lows is the result of oversold technical conditions, the first signs of cooling inflation and wishful thinking by clients pursuing the “hot” trades of the recent past. We do not think the ingredients that helped push so much capital into the technology sector in the past years are there anymore (very low rates, TINA-effect, allure of the gamma squeeze trades). We are of the opinion we are witnessing a relief rally where the market is finally getting some indications around what peak Fed Funds rates will look like, it is finally seeing a cooling down of inflation and earnings came in better than lowered expectations. Going forward the market cannot feed itself on relief, but it will again look for growth and earnings. We are of the opinion that the relief rally will be followed by renewed weakness and higher VIX levels (VIX just fell under 20) since the market will start slowly pricing in a “sticky” inflation scenario, higher rates for longer, weaker consumer credit environment and the propensity for the Fed to continue its inflation fight even with the toll of a mild, prolonged inflation. From that angle, QLD holders would do well to take what the market has given them in July and wait for a lower entry point in the future as the market digests the new macroeconomic set-up.

Performance

The vehicle is up over +40% since its June lows:

We can see that the vehicle achieves its stated leveraged daily return, with the (XLK) ETF up “only” almost 20%, while the S&P 500 is up a little bit over 14% as of the writing of this article.

However, the vehicle is still deeply negative on a year-to-date basis:

YTD Performance (Seeking Alpha)

The year-to-date chart is a stark reminder to investors that leveraged vehicles experience magnified violent moves when the primary market moves significantly during a calendar year. 2022 was the story of a market down move.

Conclusion

QLD is a leveraged ETF that seeks daily investment results that correspond to two times (2x) the daily performance of the Nasdaq-100 Index. The vehicle is up more than +40% since the market lows witnessed in June. We believe we are witnessing a relief rally in tech driven by oversold technical conditions and the emergence of certain “green shoots” in the macro setup such as lower inflation figures, earnings which came in better than lowered expectations, and a more concise picture regarding the highest level that can be reached by Fed Funds. Just like the famous Prince song 1999 “parties weren’t meant to last” hence we believe the current state of euphoria will be followed by the reversion to the “worry” trade as the new macro reality sets in.

Be the first to comment