Ian Tuttle

Thesis

Roblox Corporation (NYSE:RBLX) stock has seen a remarkable recovery as it also rode the positive wave from retail traders on the WallStreetBets forum in early July. Notably, RBLX rallied nearly 100% from its May lows, demolishing any bearish thesis on its way back up.

We noted that RBLX was at a bottom in our previous update. Therefore, a short-term rally attracting dip buyers was expected (which is why we held on to our shares and did not dump them). But, we certainly did not expect the magnitude of the recovery, given the premium valuation attached to the stock, amid worsening macros. Therefore, investors who bought the dips on RBLX’s May bottom have done exceptionally well.

Notwithstanding, the extent and speed of the surge have also sent RBLX well into technically overbought zones (and it can stay there for a while to trap more buyers). Therefore, we believe investors who rode the massive surge from its May lows can consider cutting exposure, as we don’t think the recent rally is sustainable. In addition, investors can consider rotating some of those massive gains to other higher-quality growth stocks, given the tech/growth bear market.

As a result, we revise our rating from Hold to Sell.

Roblox’s Near-Term Headwinds Are Known

Roblox is slated to report its FQ2 earnings card on August 9. The company’s May metrics disappointed the market initially, as it demonstrated growth has continued to slow. The Benchmark Company also highlighted in a June commentary (edited):

The monthly results are disappointing, with the metrics continuing to show weakness as player engagement normalizes after the pandemic. We are cautious that the pandemic pulled forward growth, and normalized behavior may dampen outlier engagement trends. The metaverse platform was a social utility during the pandemic, in our view, which could unwind as social restrictions are now removed, schools stay open, and parental spending reallocates. – Barron’s

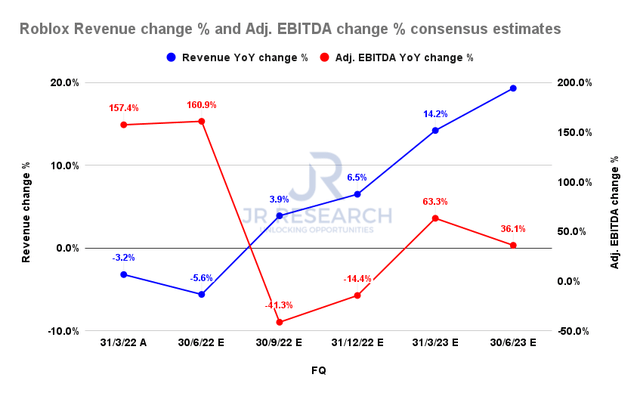

Roblox revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

But, Benchmark’s commentary is nothing surprising. Investors who have followed work-from-home stocks in 2022 would have felt the drawdown impact as these stocks crumbled, as growth moderated significantly from the unsustainable pandemic-induced rush.

Therefore, we believe the market justifiably shrugged off the reaction in RBLX, as it has anticipated these headwinds, given its steep fall to its May lows.

Moreover, the consensus estimates (bullish) suggest that Roblox could continue gaining operating leverage as bookings growth climbs out of its nadir from FQ3’22. Therefore, we believe it could partially explain why the market was confident that its near-term headwinds had been priced in accordingly.

But, RBLX’s Medium-Term Growth Metrics Don’t Inspire Confidence

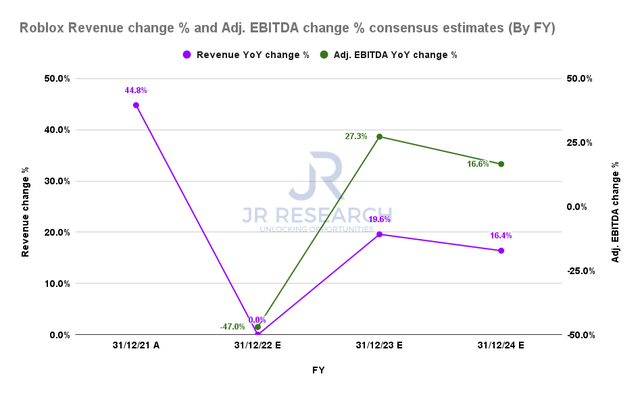

Roblox revenue change % and adjusted EBITDA change % consensus estimates (By FY) (S&P Cap IQ)

However, Roblox’s medium-term growth estimates don’t suggest that the company could recover its previous gangbusters growth. Therefore, we believe a structural shift in its growth cadence may have occurred.

While the metaverse opportunity holds promise (depending on who you ask), RBLXs’ growth premium is unlikely to justify what seems like pretty anemic growth moving forward, as seen above.

Roblox’s adjusted EBITDA growth is expected to moderate to 16.6% by FY24, nothing spectacular for a so-called high-growth play.

RBLX Is Priced At A Steep Premium For Slowing Growth

| Stock | RBLX |

| Current market cap | $25.5B |

| Hurdle rate | 20% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2% |

| Assumed TTM FCF margin in CQ4’26 | 14.5% |

| Implied TTM bookings by CQ4’26 | $7.88B |

RBLX reverse cash flow valuation model. Data source: S&P Cap IQ, author

We used a market-outperform hurdle rate of 20% (the minimum that we will accept for a high-growth stock). We also used a free cash flow (FCF) yield of 2%, which we believe has already factored in its high-growth premium.

Note that RBLX last traded at an FY24 FCF yield of 2.27%. Even though we modeled for Roblox to cover its FCF profitability, we still need the company to deliver TTM bookings of $7.88B by CQ4’26, based on our valuation metrics. Therefore, we believe that RBLX is highly unlikely to meet our bookings target at the current valuation.

Is RBLX Stock A Buy, Sell, Or Hold?

We revise our rating on RBLX from Hold to Sell.

We believe the recent surge in RBLX is unsustainable. RBLX was at a near-term bottom, but it has since moved well into technically overbought zones.

Coupled with a structural slowdown in its growth cadence, we don’t believe its current valuation can be sustained moving forward.

Therefore, investors who bought its May bottom can consider layering out and taking profits while retaining an appropriate level of exposure as a hedge.

Be the first to comment