georgeclerk

Real Estate Earnings Recap

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 7th.

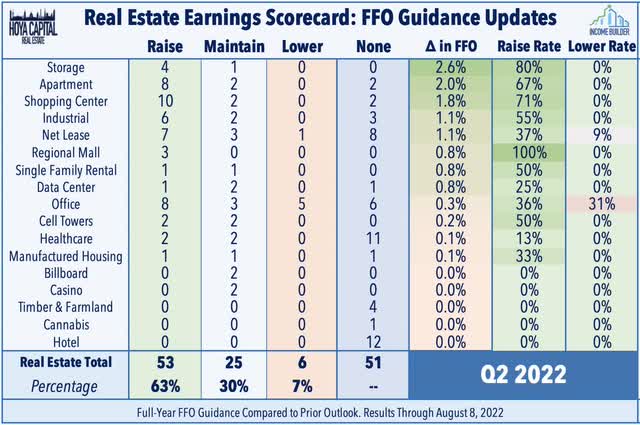

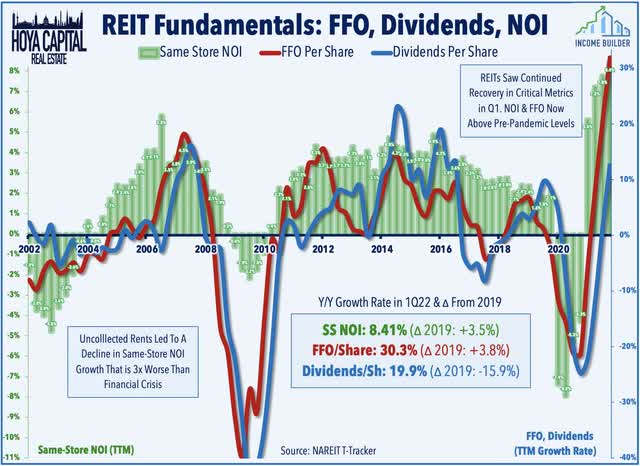

Nearly 200 REITs have reported second-quarter earnings results over the past three weeks, providing critical information on the state of the U.S. real estate industry in a period defined by moderating global economic growth and elevated levels of inflation. The U.S. REIT industry – which remains relatively “early” in its post-pandemic recovery – exhibited few signs of softness in the second quarter. Among the 84 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 53 REITs (63%) raised their outlook while just 6 REITs (7%) have lowered or withdrawn their outlook. Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies boosted their outlook while 52% have lowered their full-year EPS targets.

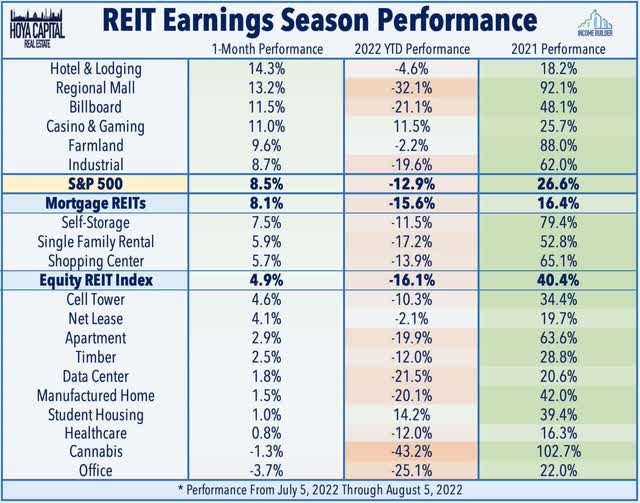

Continuing a theme of recent quarters, earnings results from residential, self-storage, and shopping center REITs were most impressive, followed closely behind by industrial and net lease REITs. Office REITs were perhaps the lone weak-spot among major property sectors – accounting for five of the six downward FFO revisions – but these were largely offset by eight upward revisions. Even amid earnings season, sector performance trends continue to be dictated by macroeconomic factors, as the past month has seen a rotation back into pro-cyclical sectors – namely hotels and mall REITs – while many of the more rate-sensitive sectors have lagged amid lingering questions over the likelihood of a “soft landing” with moderating inflation. Since the start of July, the Equity REIT Index is higher by 4.9% while Mortgage REITs has gained 8.1% compared to the 8.5% advance on the S&P 500 during this time.

Residential REIT Earnings Recap

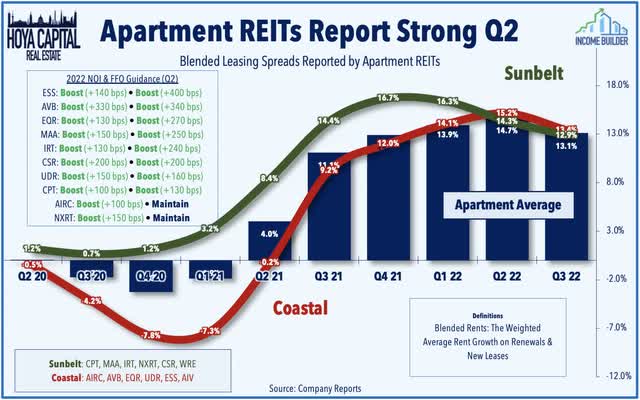

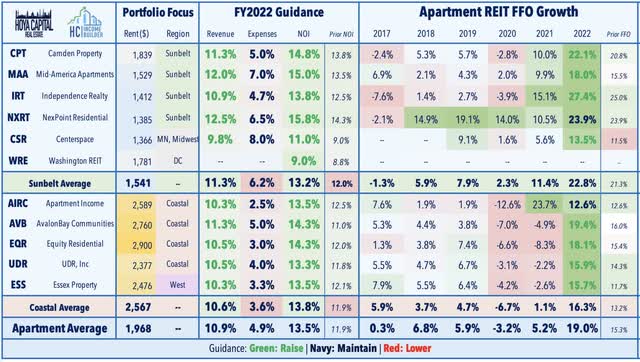

Apartment: (Final Grade: A) Results were impressive across the board in the second quarter with all ten major apartment REITs raising their full-year property-level guidance, indicating that higher mortgage rates have simply shifted the robust housing demand from the ownership market back towards the rental markets while supply growth has so far been insufficient to meet the robust demand. While the era of 15-20% increases in home prices and rents may be coming to an end, both Sunbelt and Coastal-focused REITs are seeing similar trends of sustained low-double-digit rent growth, historically high occupancy rates, and record-low turnover. Notably, the upside boosts from Camden Property (CPT) and Mid-America (MAA) bring their cumulative FFO growth since 2019 to over 30%. Among the coastal REITs, Apartment Income (AIRC) continues to fly under the radar, now having posted six straight quarters of sequentially accelerating rent growth.

How To Play: There’s plenty of “embedded” growth remaining given the historically widespread between new lease rates and in-place rents. We remain bullish on apartment REITs and overweight the sector across our portfolios. Coastal markets are now accelerating at a slightly faster pace than the Sunbelt as these markets “catch up” with national rent levels.

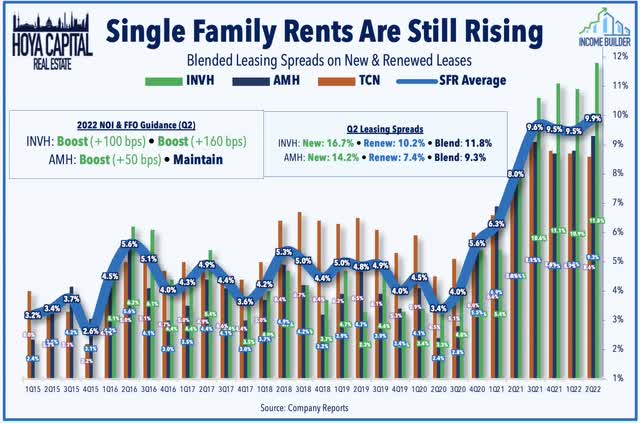

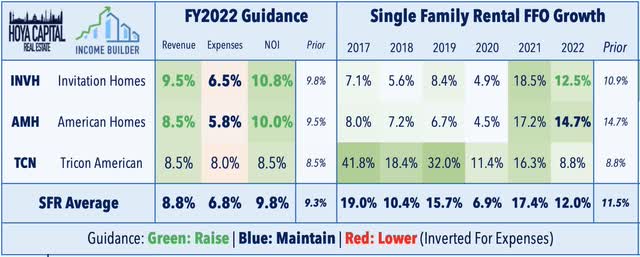

Single-Family Rental: (Final Grade: B+) Perhaps even more so than their multifamily peers, SFR fundamentals remain stellar as the surge in mortgage rates has made renting single-family homes a relative bargain. Invitation Homes (INVH) raised its full-year NOI and FFO guidance while American Homes (AMH) raised its NOI outlook but kept its FFO outlook steady. Citing “favorable supply and demand fundamentals” in its markets, INVH saw an acceleration in rent growth in Q2 to an 11.8% blended rate – its strongest quarter on record while AMH also notched a record-high blended spread of 9.3%. The “embedded” rent growth potential is substantial with INVH estimating that its current leases are 16% below market rate, on average, as SFR REITs have perhaps been a bit too “generous” to existing tenants on lease renewals. The two SFR REITs now expect average FFO growth of 12.0% this year – up 50 bps from the prior outlook – while also raising their NOI growth outlook by an average of 75 basis points to 9.8%.

How To Play: The long-term outlook for SFR REITs is even brighter than apartment REITs, in our opinion, as single-family supply growth remains more constrained than the multifamily sector. We remain bullish on the SFR sector given the secular growth tailwinds, attractive valuations, appealing inflation-hedging investment characteristics, and a boost in near-term demand from the historically swift surge in mortgage rates over the past six months.

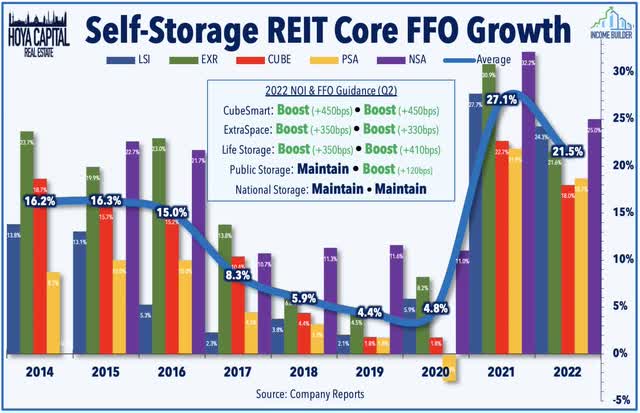

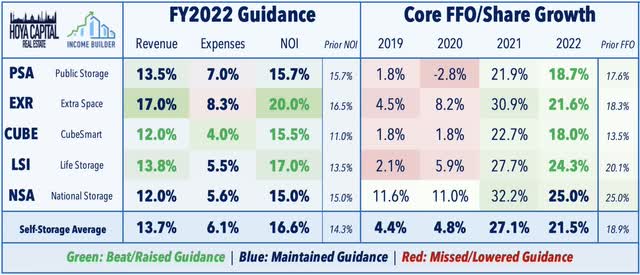

Storage: (Final Grade: A+) The most impressive property sector this earnings season was once again the storage REIT sector, which seemingly continues to defy expectations quarter-after-quarter since late 2020. CubeSmart (CUBE) significantly raised its full-year FFO and NOI outlook. Fueled by strong rent growth in its critical New York metro market, CUBE now projects full-year FFO growth of 18.0% – up 450 basis points from its prior outlook. Extra Space (EXR) was also an upside standout, raising its full-year outlook for the third time this year and now sees FFO growth of 21.6% – up 330 basis points from its prior target – and NOI growth of 20.0% – up 350 basis points. Public Storage (PSA) – the largest storage REIT – boosted its full-year FFO growth outlook by 120 basis points to 18.7%. Notably, PSA commented that “new customer demand through the summer leasing season has been exceptional… We have good pricing dynamics on both, move-ins and with existing customer rate increases, leading to the highest rent levels we have seen historically.”

How To Play: Few REIT sectors have defied expectations as comprehensively as storage REITs since the start of the pandemic, and while several pandemic-fueled tailwinds are waning, the long-term outlook remains quite compelling. The storage REIT sector’s strong balance sheets, low cap-ex profile, inflation-hedging lease structure, and above-average external growth potential warrant an overweight positioning within a balanced REIT portfolio.

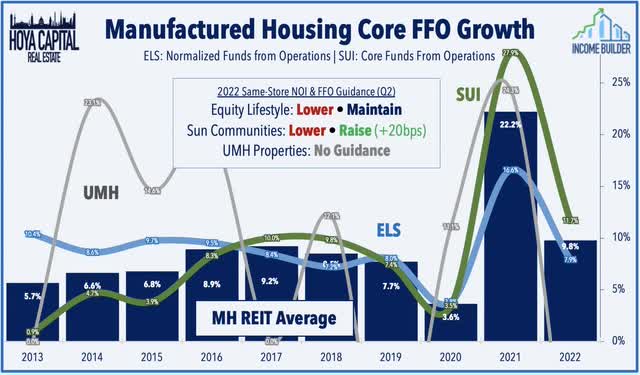

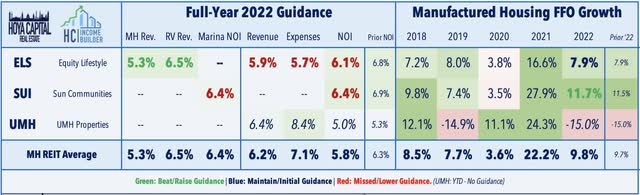

Manufactured Housing: (Final Grade: B) Following a rare “miss” from Equity LifeStyle (ELS) in the first week driven by a gas-price-driven slowdown in transient RV demand, Sun Communities (SUI) reported stronger results, raising the midpoint of its Core FFO outlook based on its newly-reported constant-currency convention – which it began reporting following the acquisition of Park Holidays in the UK. SUI expects FFO growth of 11.7% this year following growth of nearly 30% in 2021 and yet still trades near its “cheapest” level in nearly a decade. We continue to expect core manufactured housing rents to surprise to the upside this year given the Cost of Living Adjustment (“COLA”) effects, which could reach double-digits this year. The stabilization in gas prices should also help to relieve some of the offsetting downward pressure from slowing transient RV demand. UMH Properties (UMH) has benefited from an upward re-rating as forecasts incorporate the significant FFO accretion resulting from its preferred share redemptions.

How To Play: Don’t bet against the best. MH REITs have remarkably delivered nine consecutive years of outperformance over the broader REIT Index, managing to stay under the radar despite their strong operational execution and resilient fundamentals from significant supply constraints, demographic tailwinds, and high barriers to entry.

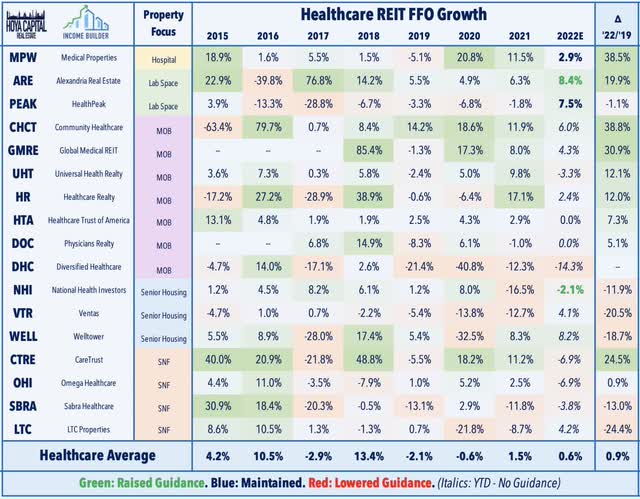

Healthcare: (Final Grade: B+) Lab space-focused Alexandria Real Estate (ARE) was again the upside standout after reporting better-than-expected results and raising its full-year outlook. Lab space demand showed few signs of cooling as ARE’s beat was driven by a record rental rate increase – 45.4% GAAP and 33.9% cash – and a historically high leasing volume. ARE now sees FFO growth of 8.4% this year – up 40 basis points from its prior outlook – and raised its same-store NOI growth outlook by 30 basis points to 7.8% at the midpoint. Skilled nursing REITs have also rebounded considerably during earnings season after results from Omega Healthcare (OHI) and Sabra Health Care (SBRA) provided some hope that tenant operator struggles can be contained as improving occupancy rates and signs of relief on labor shortages have helped some operators make their monthly rent. Results from senior housing REIT Ventas (VTR) were decent, but investors are waiting on the Welltower (WELL) report this week to assess the momentum of the senior housing recovery and whether it justifies the strong YTD outperformance.

How To Play: While healthcare REIT valuations are at the upper-end of the warranted range, we remain optimistic about the long-term outlook for the senior housing, medical office, and lab space REITs given the structural-demographic tailwinds and moderating supply growth.

Technology & Logistics Earnings Recap

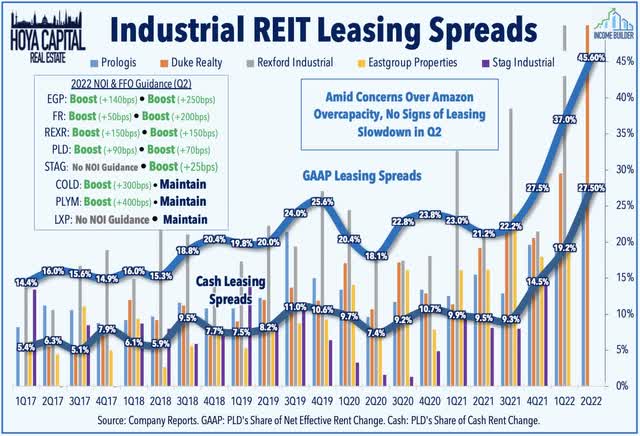

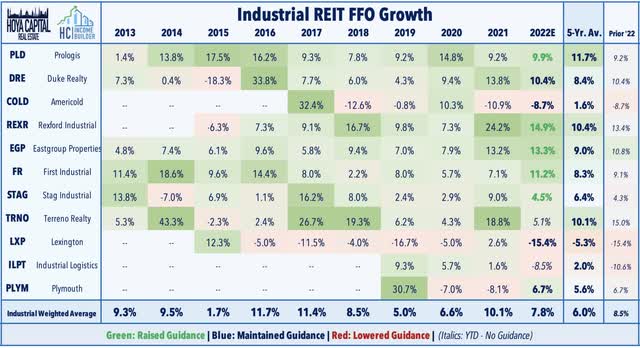

Industrial: (Final Grade: A-) No signs of slowdown here. Industrial REIT results showed that – despite the pullback in logistics spending from Amazon (AMZN) – demand for logistics space continues to outpace supply. Upside standouts have included First Industrial (FR), which significantly raised its full-year outlook citing strong leasing trends and record-high occupancy rates. Prologis’ (PLD) results were also impressive, boosting its full-year NOI and FFO outlook while recording an acceleration in renewal rates with a record-high 45.6% increase in effective rents. Rexford Industrial (REXR), meanwhile, reported incredible leasing spreads of 83% GAAP and 62% cash while maintaining a 99% occupancy rate. STAG Industrial (STAG) also delivered impressive results with rent growth on new leases of over 25%. Cold storage operator Americold (COLD), however, continues to struggle with ongoing margin pressure in its services-heavy business due to tight labor markets and ongoing supply chain difficulties. COLD maintained its full-year outlook which calls for a nearly 9% decline in its FFO as occupancy improvement has partially offset margin headwinds.

How to Play: We had trimmed our industrial REIT exposure prior to the Q2 sell-off given the previously lofty valuations, but have been taking advantage of the carnage to double down on several dividend champions.

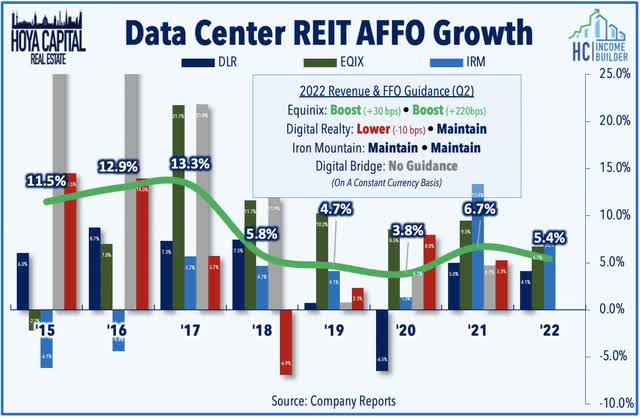

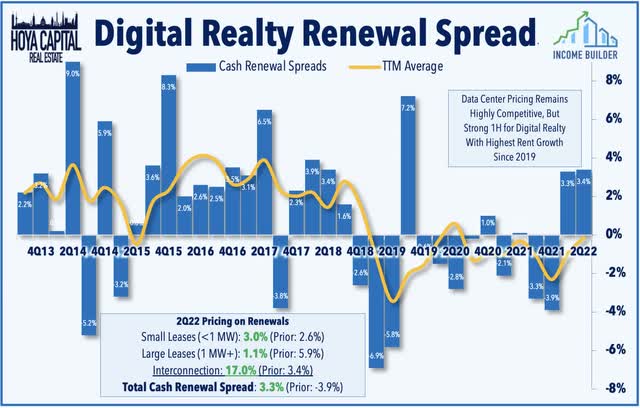

Data Center: (Final Grade: B) Equinix (EQIX) has been among the top performers this earnings season after reporting better-than-expected results driven by record-high levels of gross bookings in the first half of the year. EQIX raised its full-year FFO outlook to 9.5% on a constant-currency basis, up 220 basis points from its prior outlook. Data center REITs have become “battleground” stocks in recent months after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. Results from Digital Realty (DLR) were less impressive, however, with gross bookings falling short of estimates and with a slight downward revision in its full-year revenue outlook, consistent with our belief that network-dense data centers – which are the focus of EQIX – are more immune to the persistent competition from hyperscale cloud companies – Amazon, Google (GOOG) (GOOGL), and Microsoft (MSFT) – with nearly limitless resources.

How To Play: Valuations appear quite attractive given their YTD underperformance, particularly if indeed these early signs of pricing power prove to be sustainable – as similar setbacks in 2014 and 2018 amid rising rate concerns ultimately proved to be rewarding buying opportunities.

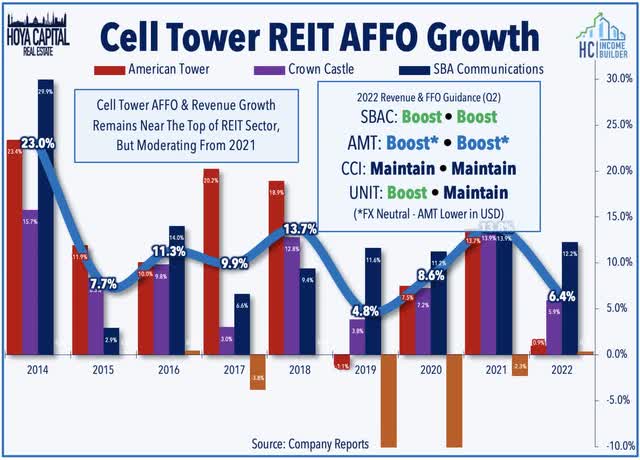

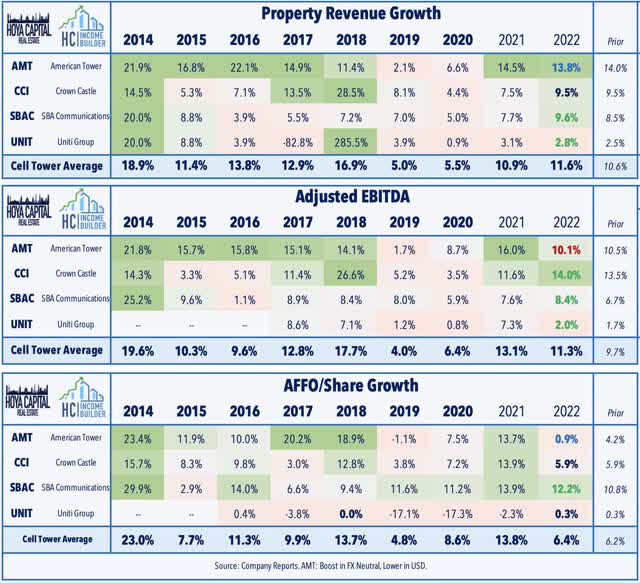

Cell Tower: (Final Grade: B-) After uncharacteristically lagging for most of the year, Cell Tower REITs have been among the best-performing property sector over the past quarter, benefiting from favorable macro shifts and positive industry-specific catalysts. Results from the two largest tower REITs were roughly in-line with expectations. Crown Castle (CCI) maintained its full-year outlook calling for FFO growth of 5.9% and revenue growth of 9.5%. Of note, CCI reiterated its belief that the “U.S. represents the highest growth and lowest risk market in the world for communications infrastructure ownership” and has dropped the “International” from its company name. The strong dollar took a bite out of American Tower’s (AMT) revenue and FFO, but AMT raised its full-year outlook on a constant-currency basis, citing “unabated demand for our communications assets” while results were SBA Communications (SBAC) exhibited similar strength.

How To Play: The near- and medium-term outlook remains quite promising as macro towers should continue to be the primary “hub” of communications networks for the foreseeable future. Like data center REITs, valuations remain further below their historical averages than other most other REIT sectors.

Retail REIT Earnings Recap

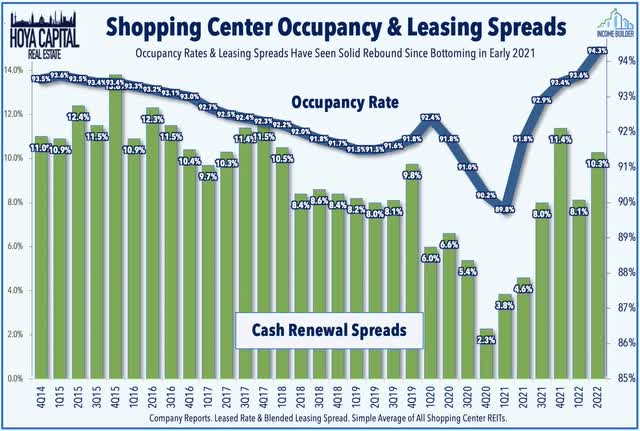

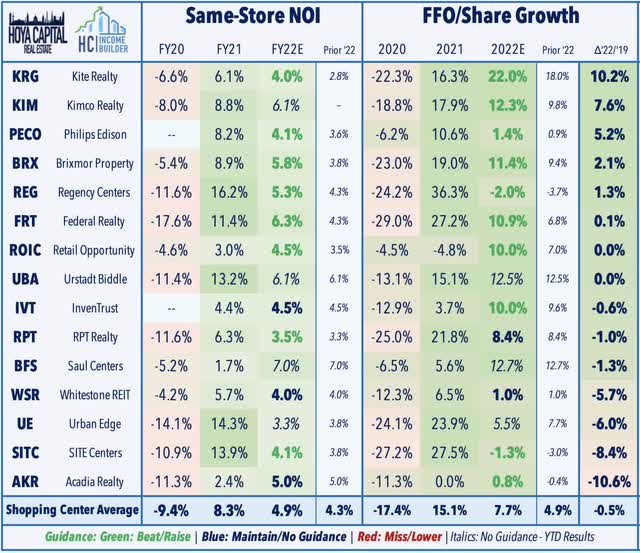

Shopping Center: (Final Grade: A) Results from shopping center REITs were highly impressive as fundamentals are now as strong – if not stronger – than before the pandemic with occupancy rates climbing to the highest level since early 2015 while rental rates have continued to accelerate despite the broader economic slowdown. Upside standouts included Kite Realty (KRG), which reported another strong quarter and raised its full-year outlook. Driven by strong leasing activity with 13% blended cash spread, KRG now projects FFO growth of 22.0% this year – up 400 basis points from last quarter – and 10.2% above its pre-pandemic 2019 rate, the strongest in the shopping center REIT sector. Federal Realty (FRT) was also an upside standout after raising its full-year FFO growth outlook to 10.9% – up 410 basis points from its prior outlook – citing “record levels of leasing.” Regency Centers (REG) also delivered a “beat and raise’ report as its grocery-anchored portfolio saw “robust leasing activity.”

How to Play: The versatility and larger footprint of the strip center format have been a winning formula. With ’embedded’ dividend growth and solid positioning for a variety of economic scenarios, shopping center REITs remain one of our favorite value-oriented REIT sectors.

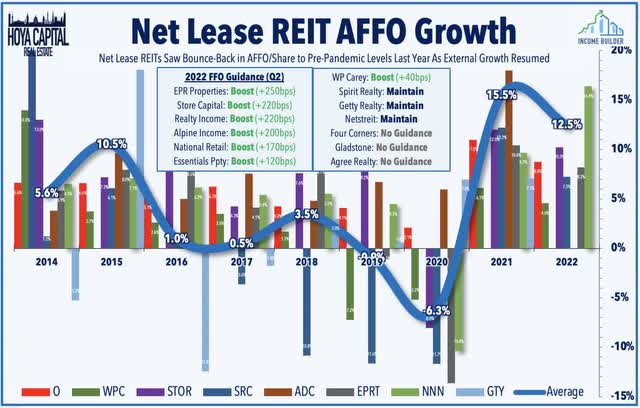

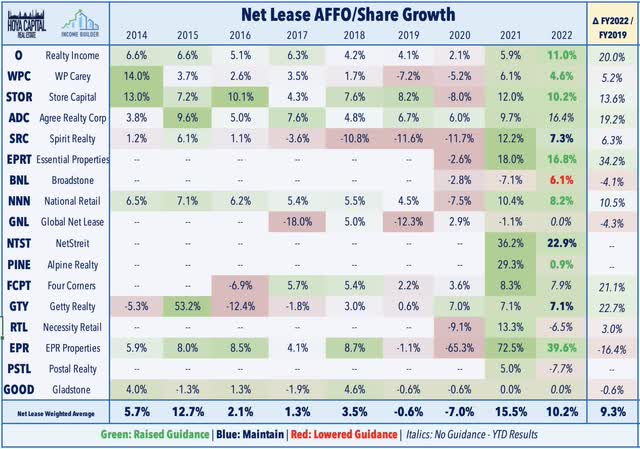

Net Lease: (Final Grade: A-) The post-payrolls jump in interest rates last week overshadowed an otherwise solid slate of net lease REIT reports. Realty Income (O) was among the upside standouts after raising its full-year normalized FFO guidance by 220 basis points and reporting its highest occupancy rate in over 10 years. STORE Capital (STOR) also reported very strong results and raised its full-year FFO growth target to 10.2% – up 220 basis points from last quarter. W. P. Carey (WPC) boosted its outlook, benefiting from its sector-leading upside exposure to inflation through its CPI-linked lease structure. National Retail (NNN) also boosted its FFO growth target to 8.2% – up 170 basis points from its prior outlook. The most significant FFO boost came from EPR Properties (EPR), which now sees FFO growth of 39.6% for the year – up 250 basis points from its prior outlook. Elsewhere, Spirit Realty (SRC) maintained its full-year outlook which calls for FFO growth of 7.3 while Broadstone (BNL) lowered the midpoint of its range.

How To Play: The counterintuitive outperformance for net lease REITs in recent months is consistent with the phenomenon discussed earlier this year in which net lease REITs actually outperformed the REIT sector during the prior Fed rate hike cycle from 2015-2019 after significantly underperforming in the 18-month lead-up to the first hike – a similar backdrop to the current dynamic.

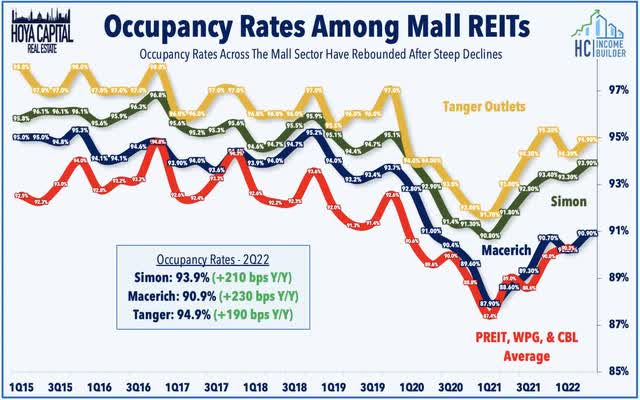

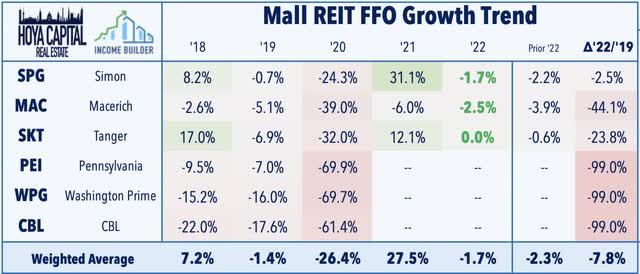

Malls: (Final Grade: B) Simon Property (SPG) raised its full-year outlook and hiked its dividend for the third time this year. Citing “extremely strong” demand for its space that drove a third-straight quarter of increases in its average bases rent, SPG raised its full-year FFO growth target by 50 basis points Occupancy rates increased to 93.9% – up 210 basis points for the year – but still below its pre-pandemic rate of roughly 95%. Macerich (MAC) posted in-line earnings results, and slightly raised the midpoint of its full-year adjusted FFO outlook, but to levels that would still be more than 40% below its pre-pandemic 2019 full-year FFO. Recession concerns continue to overshadow the recent signs of stabilization reported by Simon and Macerich, but mall REITs have managed to claw back some of their year-to-date declines over the past month with a double-digit rebound. On Monday, Tanger Factory Outlet (SKT) reported decent results – raising its full-year NOI and FFO growth outlook by 60 basis points, but to levels that are still 24% below 2019-levels. Encouragingly, SKT did record its strongest 12-month average rent spread in nearly five years of 4.1%.

How to Play: With the three larger mall REITs – SPG, MAC, and SKT – now having fully “normalized” their dividend, the sector is no longer as “uninvestable” as it was early in the pandemic. These REITs appear fairly valued with P/FFO multiples in the 10x range for Simon and Tanger.

Office, Hotel, & Casino Earnings Recap

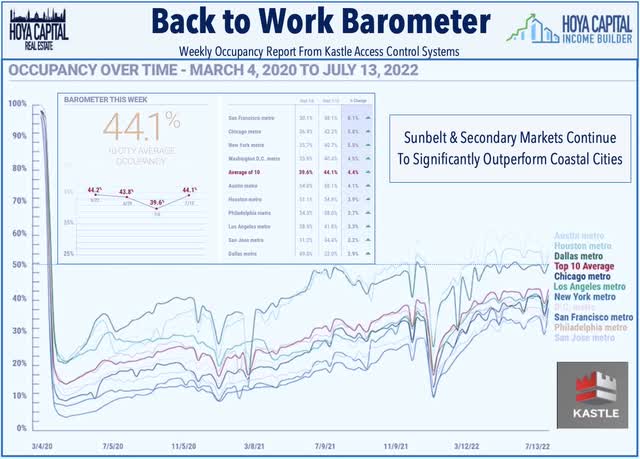

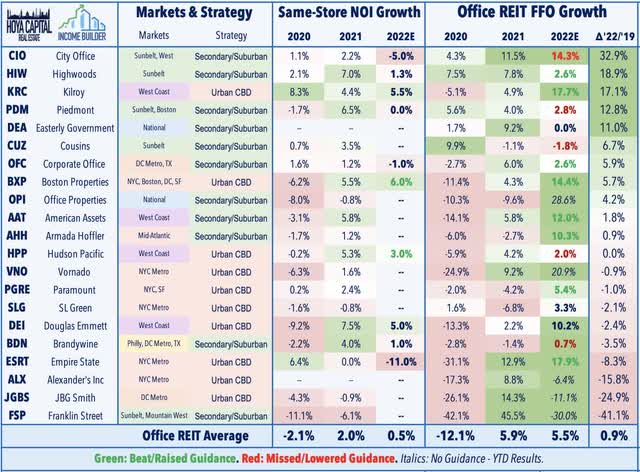

Office: (Final Grade: B-) Office leasing demand – and earnings results from these office REITs – have been surprisingly resilient, particularly for REITs focused on business-friendly Sunbelt regions and specialty lab space, but there were some early signs of weakness with five office REITs lowering their full-year FFO outlook. Upside standouts included Sunbelt-focused Highwoods Properties (HIW), which raised its full-year FFO target to levels that would amount to nearly 19% cumulative growth since the end of 2019 – tops in the sector. Coastal-focused Boston Properties (BXP) also delivered surprisingly strong results as strong lab space demand and solid leasing trends at high-tier “trophy” assets offset softness in other segments. Results thus far have been consistent with the theme that despite persistently low utilization rates at offices across most major markets, corporate decision makers have been reluctant to make permanent decisions to reduce square footage.

How to Play: We continue to see significant mispricing between the handful of Sunbelt-focused office REITs – which are on a solid growth trajectory – and the Coastal-focused REITs – which are focused on trying to hold on to what they’ve got. Sunbelt-focused Highwoods and Piedmont each of which expect their 2022 FFO to be around 15% above 2019-levels.

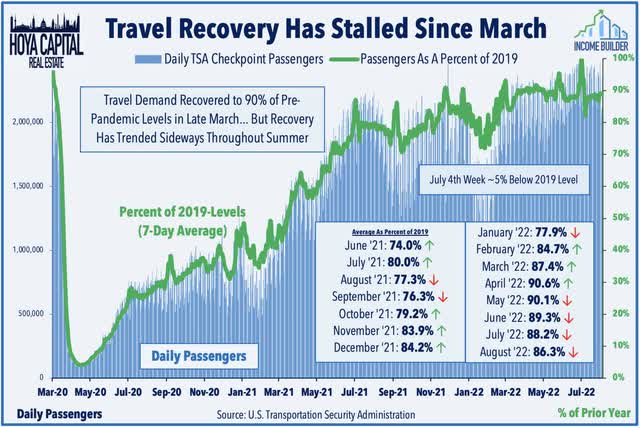

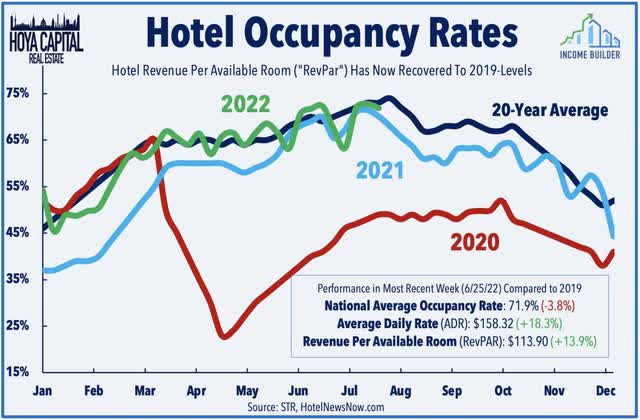

Hotel: (Final Grade: B) Helped by the growth-to-value rotation and by signs that the pandemic may finally be ending once-and-for-all, hotel REITs are the best-performing major REIT sector this year. More than two years after slashing their dividends to zero early in the pandemic, we’re now seeing a growing number of hotel REITs resume their shareholder distributions as hotel occupancy returns to pre-pandemic levels. Host Hotels (HST) reported strong results and doubled its dividend rate for the second-time this year in Q2. Apple Hospitality (APLE) – which was the first hotel REIT to meaningfully restore its dividend – also reported strong results, highlighted by RevPAR which surpassed its second quarter 2019 by approximately 4%. Recent TSA Checkpoint data has shown that domestic travel recovered to 90% of pre-pandemic levels by late March, but has trended sideways since then.

How To Play: Given looming questions over the ultimate recovery in business and international travel – combined with shaky balance sheets and non-existent dividend yields – we remain cautious on full-service coastal hotel REITs, but see long-term value in select limited-service hotel REITs. We used the recent pull-back to increase our position in Apple Hospitality.

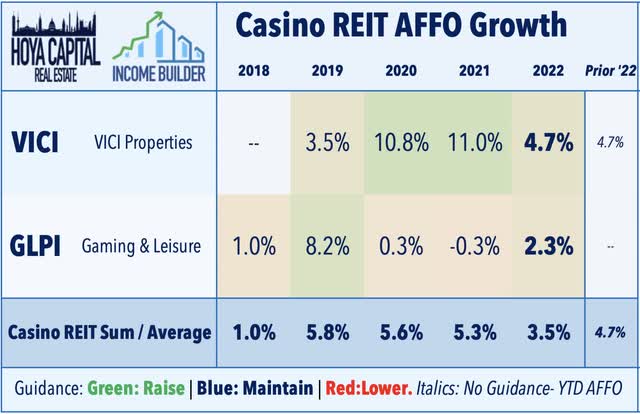

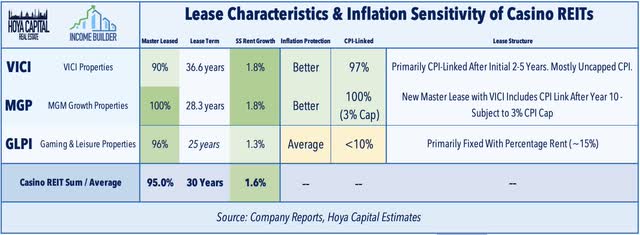

Casino: (Final Grade: B) Casino REIT results were in-line with estimates with no major surprises. VICI Properties (VICI) maintained its full-year outlook calling for FFO growth of 4.7% while Gaming and Leisure Properties (GLPI) reinstated guidance targeting 2.3% FFO growth for the year. Of note, with REITs now owning a significant share of casino real estate properties in the U.S., VICI reiterated that it is looking at non-gaming asset classes for future growth opportunities, hiring a new Chief Investment Officer to “focus on non-gaming.” Casino REITs have been among the best-performing property sectors this year, benefiting from an upward “re-rating” from investors as the sector has matured following the VICI acquisition of MGM Growth Properties and resulting in an investment grade credit status and inclusion in the S&P 500.

How To Play: Casino REITs have been the single-best performing property sector this year, benefiting from the upward “re-rating” that we’ve forecasted for several quarters. We remain bullish on casino REITs, but VICI and GLPI are currently trading at the upper-end of their warranted range.

Mortgage REITs

Residential mREITs: While the mortgage-backed-bond market posted historic gains in July, the three months before that were historically rough. Consensus expectations called for Book Value Per Share (BVPS) declines of around 10% in Q2 during a historically brutal quarter for fixed income securities – particularly MBS securities – and that’s just about exactly what we saw. Annaly Capital (NLY) and AGNC Investment (AGNC) each reported BVPS declines of 12.9%, but reported better-than-expected earnings-per-share growth with NLY citing “historically attractive new investment returns” on Agency MBS. Rithm Capital (RITM) – formerly New Residential (NRZ) – reported the most modest BVPS decline at 2.2% while Invesco Mortgage (IVR) reported the steepest decline at 22%. Elsewhere, Great Ajax (AJX) raised its quarterly dividend for the second time this year to $0.27 per share.

How To Play: We continue to emphasize that when buying individual mREITs, quality is absolutely essential. BVPS declines can be “temporary” for well-managed portfolios with reasonable leverage and effective hedges but can become “permanent” for less-prepared mREITs.

Commercial mREITs: Book value changes across the commercial mREIT space have been far more muted – but nevertheless better-than-expected – with an average BVPS increase of 0.4% ranging from a high of 10.3% to a low of -2.3%. Starwood Property (STWD) – which we own in the REIT Focused Income Portfolio – was among the upside standouts, reporting that its book value rose 1.2% in the second quarter. Blackstone Mortgage (BXMT) also posted better-than-expected results with Q2 distributable EPS of $0.67, topping the $0.63 consensus and rising from $0.62 in Q1 2022. Citing its “floating-rate portfolio and strong liquidity position,” BXMT’s book value per share (“BVPS”) was essentially unchanged. Arbor Realty (ABR) reported better-than-expected results driven by strong multifamily fundamentals and raised its dividend for the ninth consecutive quarter.

How To Play: As with the residential mREIT space, we look exclusively to the highest-quality names in the sector when selecting individual mREITs with expectations of long-term holding periods.

Specialty REIT Sectors

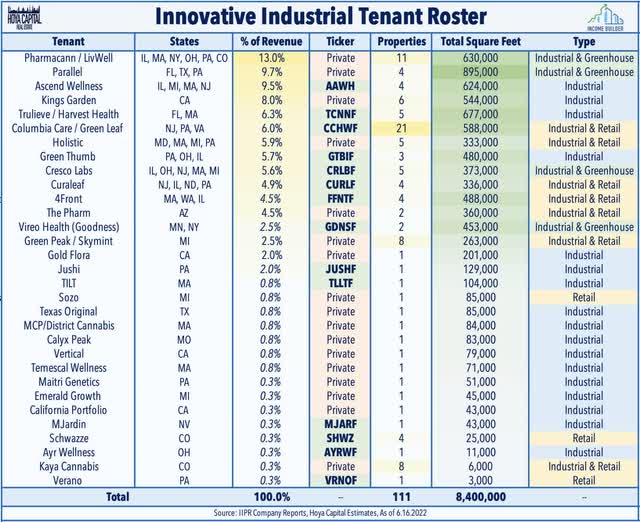

Cannabis: Innovative Industrial (IIPR) – a perennial outperformer that has been slammed this year on concerns over tenant credit issues and coming into the crosshairs of short-sellers – remained under pressure this week as solid second-quarter results were offset by mixed updates on the status of rent payment from two troubled tenants. In early July, IIPR reported that one of its tenants, Kings Garden, defaulted on its rent and property management fees for July while another major tenant, Parallel, is named in a lawsuit from several of its private investors. On its earnings call, IIPR noted that it has commenced legal proceedings against Kings Garden – which represented about 8% of its revenues last year – but noted that Parallel and all of their other tenants have “continued to pay rent in full in July and August. The ten largest publicly-traded cannabis REIT tenant operators have plunged between 50% and 80% over the past year, hurt in part by a slowdown in stimulus-fueled sales growth and a far more-difficult capital raising environment.

How To Play: We’re not giving up on IIPR, as we believe that tenant issues will remain relatively limited given the lease structure and regulatory framework of cannabis licensing which grants cannabis REITs significant protection that isn’t fully reflected by market pricing. While inherently speculative, with the legal cannabis market expected to more than double in size over the next five years, we continue to see value in owning “Pharmland.”

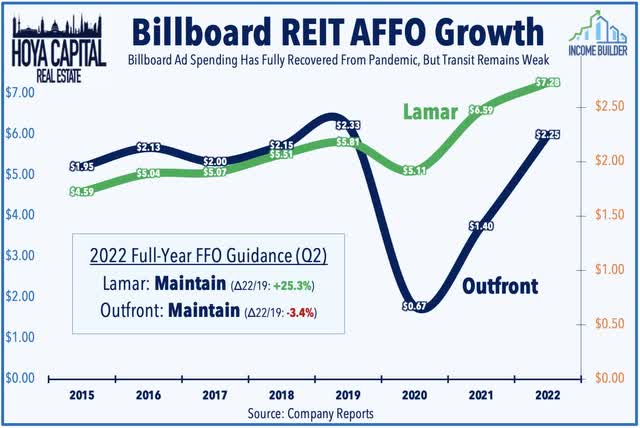

Billboard: Lamar Advertising (LAMR) reported solid results and affirmed its full-year outlook which calls for FFO growth of 10.4%. LAMR commented that it saw “strong growth across all business lines and geographies” with billboard revenue up more than 10% while its transit business has now recovered to pre-COVID levels following sharp revenue declines in 2020. Despite recession concerns, Lamar noted that was able to push pricing in Q2 with rates up “high single-digits” versus Q2 2021. Of note, LAMR reported that it’s seeing particular strength in political advertising, which is up 82% in ’22 over 2020 with about 50% of that spend on its digital platform, which Lamar is “aggressively” growing with 250-300 analog-to-digital conversions now expected this year. Outfront Media (OUT) affirmed its full-year outlook as well, but the slower recovery in transit ad spending remains a headwind given its massive MTA contract. LAMR is on pace to record cumulative FFO growth of over 25% from 2019-2022 while OUT won’t fully recover in 2023.

How To Play: We see value in the billboard REIT sector’s supply constraints and see the conversion to digital displays as a catalyst to drive mid-single-digit same-store revenue growth and margin expansion throughout this decade.

Earnings Recap: REITs On Solid Footing

Despite the strong slate of earnings reports across most property sectors, performance trends continue to be dominated by macroeconomic factors which continue to create near-term dislocations which create value opportunities for long-term investors that are keyed in on fundamentals. Critically, the fundamentals across the REIT sector remain quite impressive across most property sectors with over 60% of REITs raising their full-year outlook, reflecting a high degree of confidence among REIT executives that the growth momentum will be sustained beyond the initial post-pandemic recovery despite the broader global economic slowdown. The thesis for maintaining an overweight allocation to U.S. real estate equities in a balanced portfolio remains compelling given their domestic focus, early-cycle fundamentals, and their historical outperformance later in the Fed rate hike cycle.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment