ipopba

A Quick Take On Remitly Global

Remitly Global (NASDAQ:RELY) went public in September 2022, raising approximately $523 million in gross proceeds from an IPO that priced at $43.00 per share.

The firm provides a range of cross-border payment remittance services worldwide.

While the period just ahead may feature a variety of economic cross-currents and management continues to pursue a ‘growth at all costs’ approach, I see no meaningful upside catalyst to the stock until Remitly makes a significant move toward operating breakeven.

Therefore, I’m on Hold for RELY in the near term.

Remitly Global Overview

Seattle, Washington-based Remitly was founded to develop a platform to enable people to send cross-border remittances more easily and at lower cost than traditional banking service providers.

Management is headed by co-founder, president and CEO Matthew Oppenheimer, who has been with the firm since inception and was previously employed by Barclays plc, a multinational bank.

The company’s primary offerings include:

-

Mobile app

-

Website

-

Passbook KYC and identity verification

In 2021, RELY’s coverage map of send and receive countries was as follows:

Company Market Coverage In 2021 (SEC EDGAR)

The firm focuses its development efforts on the over 280 million immigrants and their families who seek to send and receive money worldwide.

85% of the user base interacts primarily through its mobile application.

Remitly Global’s Market & Competition

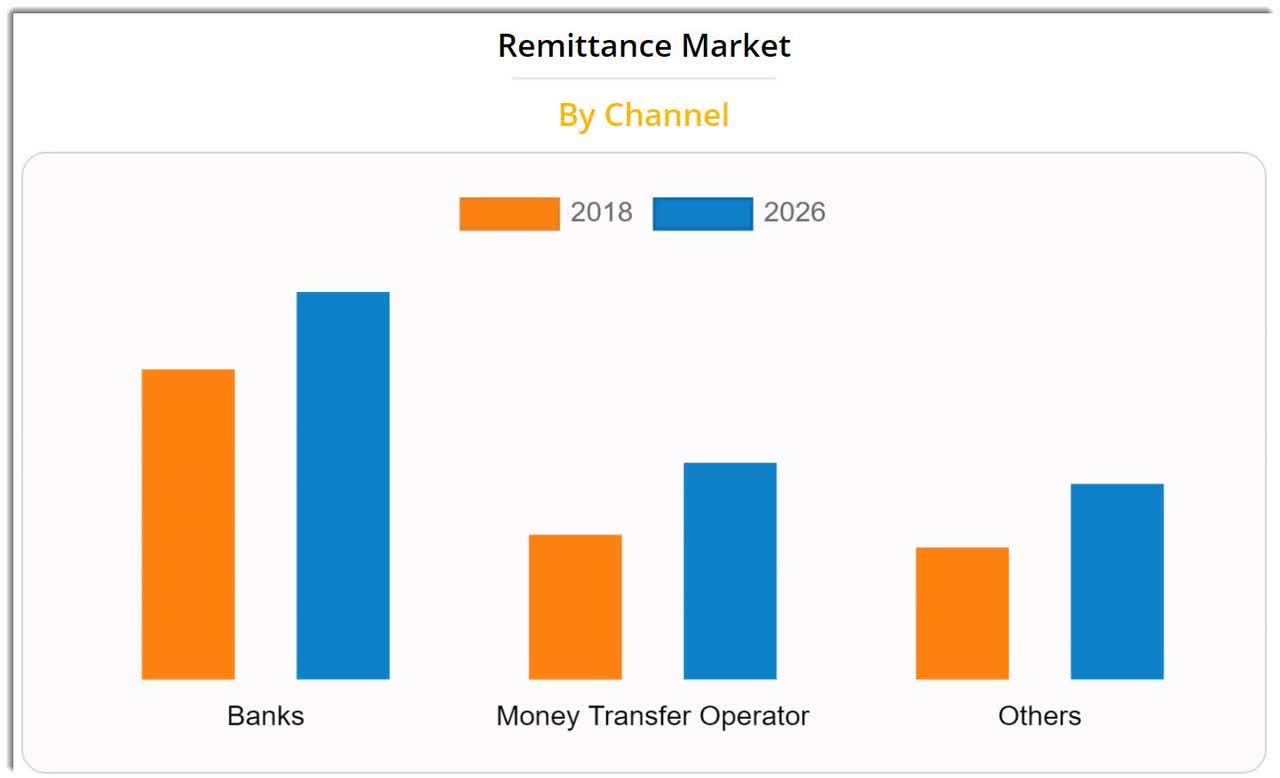

According to a 2020 market research report by Allied Market Research, the global remittance market was an estimated $683 billion in 2018 and is forecast to reach $930 billion by 2026.

This represents a forecast CAGR of 3.9% from 2019 to 2026.

The main drivers for this expected growth are an increase in population migration and growth in business remittances, and more businesses producing goods and services for export.

Also, the chart below indicates that the bank segment will continue to dominate the global remittance market, at least through 2026:

Global Remittance Market (Allied Market Research)

Major competitive or other industry participants by type include:

-

Traditional providers and banks

-

Digital-first cross-border providers

-

Cryptocurrency systems

-

Person-to-person informal channels

Remitly Global’s Recent Financial Performance

-

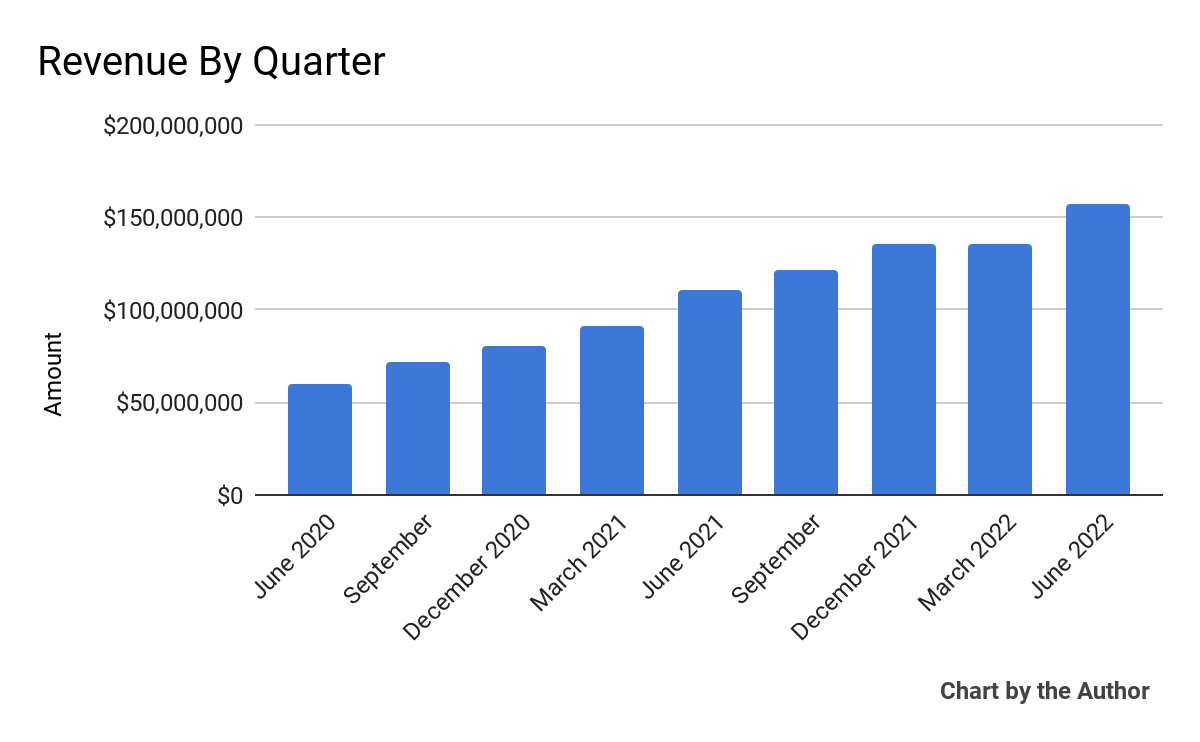

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

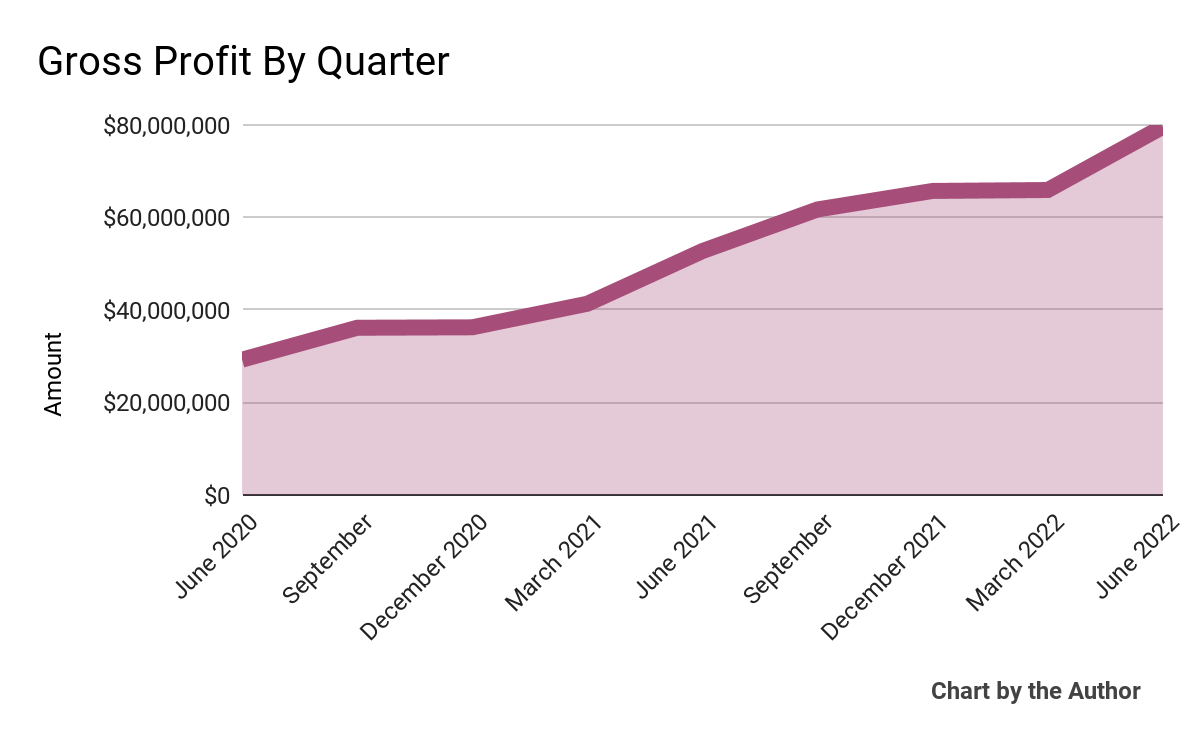

Gross profit by quarter has also risen substantially:

9 Quarter Gross Profit (Seeking Alpha)

-

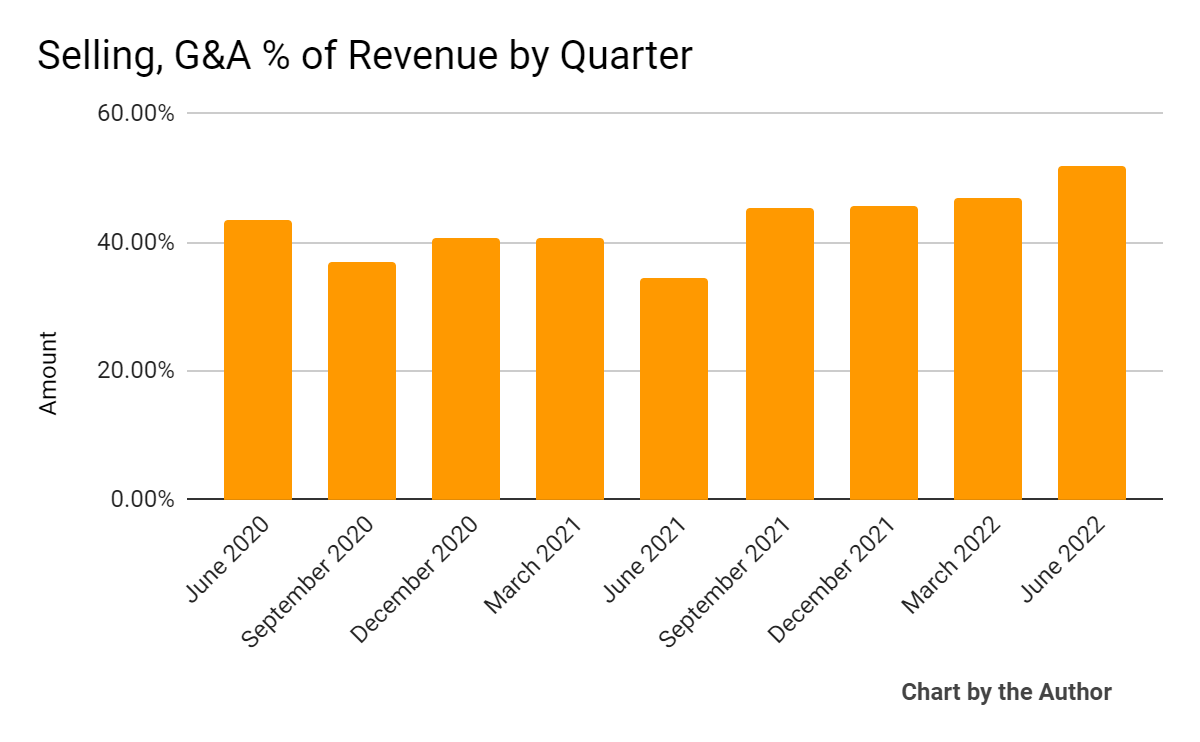

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher recently, indicating the company is becoming less efficient in generating revenue growth:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

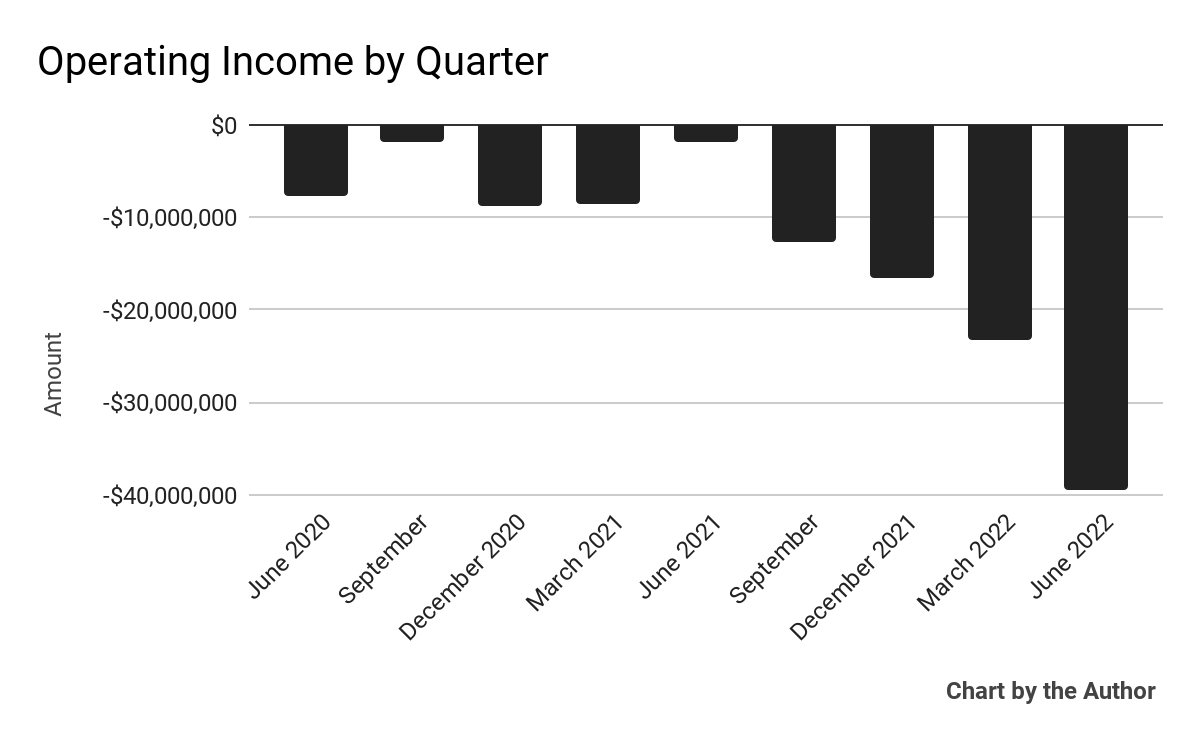

Operating losses by quarter have worsened sharply in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

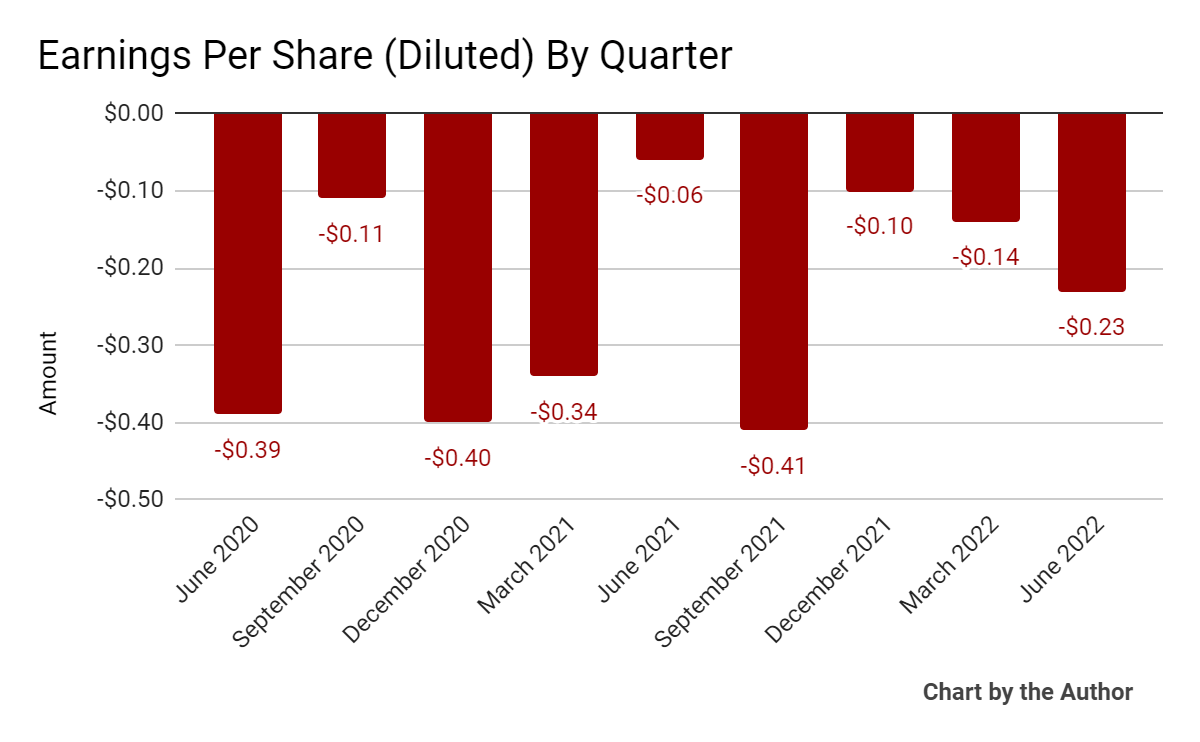

Earnings per share (Diluted) have remained substantially negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

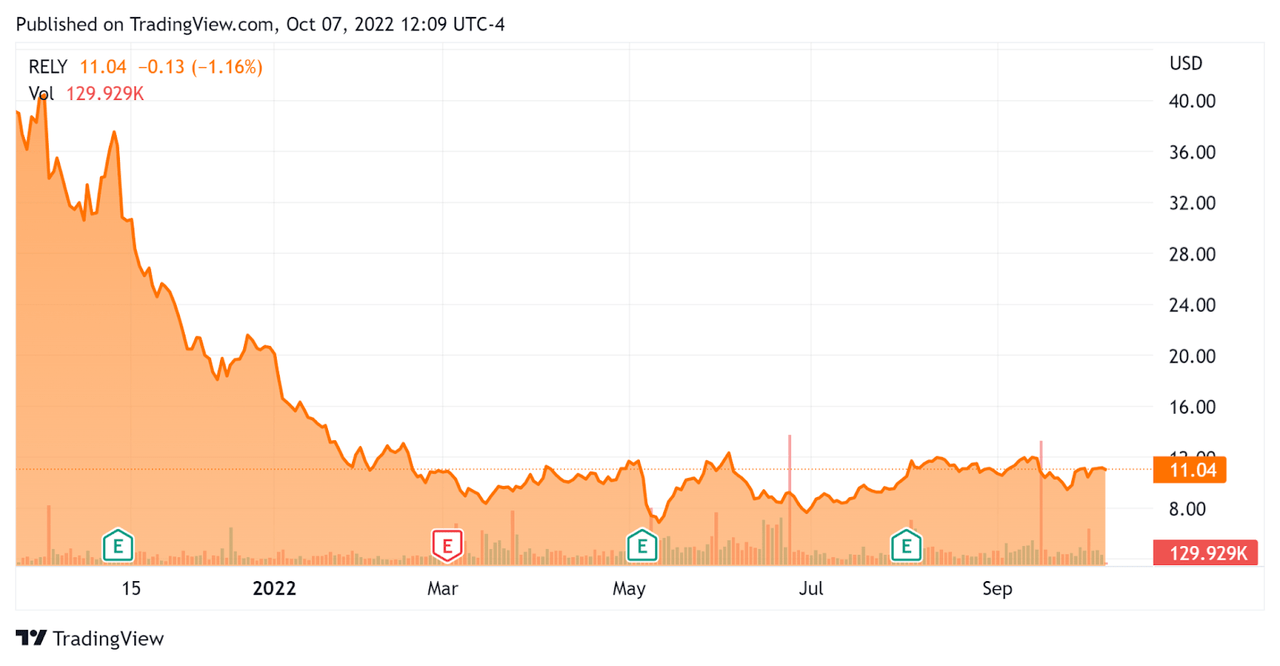

In the past twelve months, RELY’s stock price has dropped 71.8% vs. the U.S. S&P 500 index’s drop of around 16%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Remitly Global

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.64 |

|

Revenue Growth Rate |

55.3% |

|

Net Income Margin |

-16.6% |

|

GAAP EBITDA % |

-16.1% |

|

Market Capitalization |

$1,870,000,000 |

|

Enterprise Value |

$1,450,000,000 |

|

Operating Cash Flow |

-$52,640,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.88 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be PayPal (PYPL); shown below is a comparison of their primary valuation metrics:

|

Metric |

PayPal |

Remitly |

Variance |

|

Enterprise Value / Sales |

4.19 |

2.64 |

-37.0% |

|

Revenue Growth Rate |

10.7% |

55.3% |

419.1% |

|

Net Income Margin |

7.8% |

-16.6% |

–% |

|

Operating Cash Flow |

$5,980,000,000 |

-$52,640,000 |

–% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

RELY’s most recent GAAP Rule of 40 calculation was 39.2% as of Q2 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

55.3% |

|

GAAP EBITDA % |

-16.1% |

|

Total |

39.2% |

(Source – Seeking Alpha)

Commentary On Remitly Global

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the growth in its active customer base, to 3.4 million active users.

The firm continues to expand its geographic footprint, growing its serviceable addressable market by adding 900 new remittance corridors, as people send money across borders more frequently.

Notably, management said it ‘did not notice a material impact on customer behavior from rising inflation or fears of a recession as remittances are not a discretionary item from a customer’s point of view.’

Also, the recent strong US dollar actually contributed to more customer activity, as clients in US dollar regions likely increased their remittance activity or amounts.

Future growth markets include the Middle East and Asia.

As to its financial results, revenue rose 42% year-over-year to $157 million.

The company’s revenue retention rate was 90% and its Rule of 40 results have been successful, nearly reaching this important metric of 40%.

RELY’s marketing costs increased in nominal terms, but management said that during the quarter, it produced new customers at an ‘11% lower CAC [Customer Acquisition Cost] compared to the first quarter as our teams identify efficiencies and by raising our investment thresholds.’

But, operating losses increased sharply as did negative earnings, due in part to sharply increased stock-based compensation.

For the balance sheet, the firm finished the quarter with $429.7 million in cash and no debt.

Over the trailing twelve months, free cash used was $55.4 million, so the firm’s cash use is increasing.

Looking ahead, management raised the midpoints of its full year revenue and adjusted EBITDA guidance, with revenue expected to grow by 36.5% and adjusted EBITDA (ex-stock-based compensation and one-time items) of negative $32.5 million at the midpoint.

Regarding valuation, the market is currently valuing Remitly at an EV/Revenue multiple discount to PayPal, despite RELY growing revenue at a faster rate of growth.

The primary risk to the company’s outlook is a slowing global economy due to higher interest rates, reduced globalization and the impacts of the Ukraine war.

Another risk is the firm’s high and increasing operating losses, which have been sharply penalized in the current stock market environment as a result of rising cost of capital assumptions.

A potential upside catalyst to the stock could include a ‘short and shallow’ global downturn if inflation is brought under control by the middle of 2023.

While the period just ahead may feature a variety of economic cross-currents and management continues to pursue a ‘growth at all costs’ approach, I see no meaningful upside catalyst to the stock until the firm makes a significant move toward operating breakeven.

Therefore, I’m on Hold for RELY stock in the near term.

Be the first to comment