spooh

Despegar.com (NYSE:DESP) is the biggest Latin American online travel agency.

DESP has always been valued as a growth business, trading at lofty multiples. The company was able to generate positive net income before the pandemic, and has shown fast recovery after it. With low debt, interesting cash dynamics, and positive EBITDA, the company presents low risks of financial distress.

However, I doubt the business deserves the growth multiples that it received in the past. The company was not able to grow that much before the pandemic, probably influenced by Latin America’s generalized recessions (particularly in Argentina and Brazil). Additionally, I do not like some aspects of the company’s financial reporting practices.

From a fundamental, long-term standpoint, I do not believe DESP is a good investment at these prices. However, it may interest more speculative readers, because of its all-time-low market cap and the possibility of Latin America’s economic recovery and return to growth. It is indeed a high-beta bet on Latin America’s recovery.

Note: Unless otherwise indicated, all information has been obtained from DESP’s filings with the SEC.

Competitive position

DESP’s competitive position has some positive and some negative aspects. Among the positives, I consider its penetration in Latin America, bargaining power with inventory suppliers, and cash dynamics. More nuanced aspects are operational leverage and the fact that the Latin American market is underdeveloped. On the negative I consider its lack of sustainable moat against international competitors, and the industry’s cyclicality.

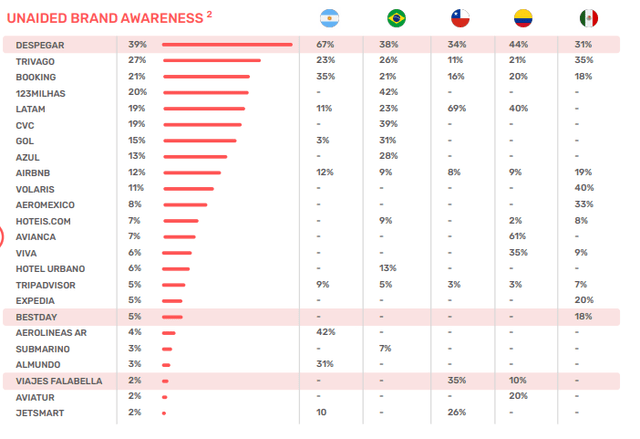

Starting with market penetration, DESP and Decolar (the Brazilian brand) are well known in its core markets. The chart below, presented in DESP’s latest investors presentation, shows general population brand awareness. The chart shows a positive, DESP is known in most markets, but also a negative, it is not significantly more well known than out of region alternatives, like Trivago or Booking (BKNG). Also, the polls were conducted on the general population, not particularly on travel or leisure customers, which could have provided different results.

Travel related brand awareness in core Latin American markets (general population) (DESP’ latest investors presentation)

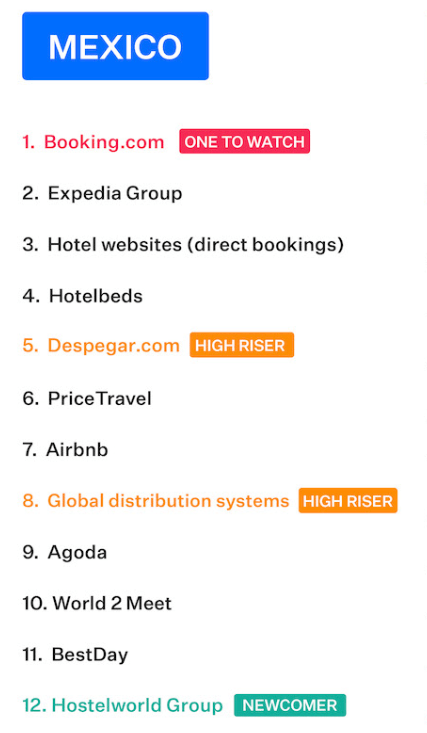

For example, if the above chart is representative, how come that SiteMinder, a hotel management software suite, lists DESP below Booking and Expedia as a revenue generator in Mexico, even though Despegar has higher awareness in that country.

OTA list by hotel revenue generation (SiteMinder)

Although the company may not have a sustainable moat against foreign competitors just because it is a Latin American company, it has enough customer traffic to gain bargaining power against its inventory suppliers. This is the second positive characteristic of the company’s competitive position.

Airlines and hotels have negative competitive conditions, because most of their costs are fixed before providing the product. Therefore, they are willing to push down prices and conditions in order to sell and fill the planes or rooms. This means that a site that moves traffic, like DESP, has the upper hand in a negotiation and can attract significant inventory. Companies want to be listed in DESP. This allows the company to extract a 12% to 15% commission on the gross billings it generates.

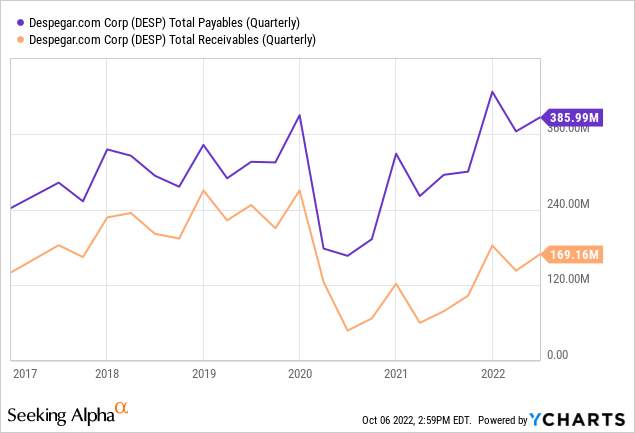

This in turn leads to the third positive condition, which is great cash dynamics. DESP gets paid in advance for 90% of its sales, sometimes months in advance, but only has to pay the supplier of the service (airline or lodging) when the customer consumes the service. This means that DESP has free working capital, as much as $200 million, as the chart below shows.

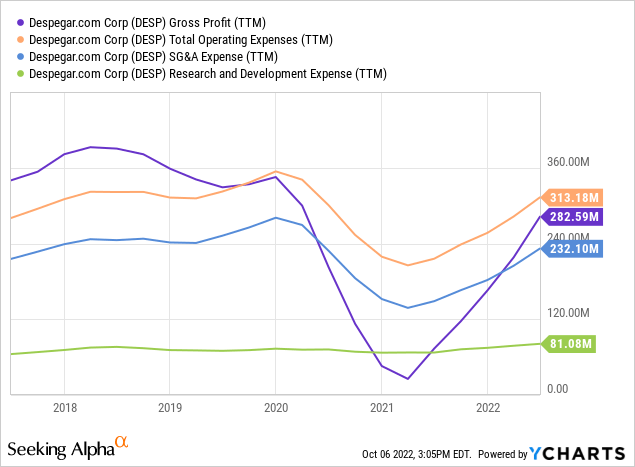

Continuing with more nuanced conditions, DESP has substantial operational leverage, because its SG&A costs have been mostly fixed. This can be considered both an advantage or not. In any case, it definitely increases DESP’s exposure to cycles.

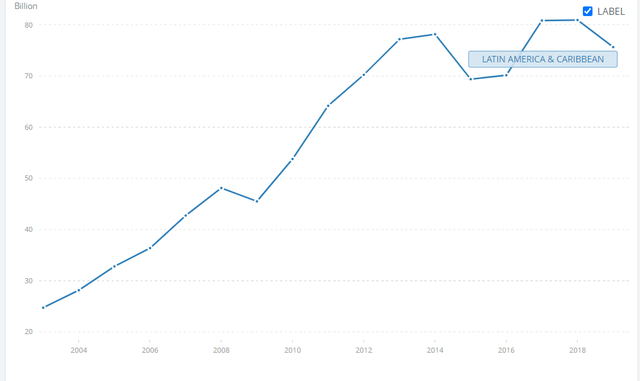

Cycles are a big issue for DESP for two reasons. First, the industry is definitely income elastic, with people traveling more if they have more disposable income. This is a negative aspect. Second, DESP operates in Latin America, an underdeveloped region with an underdeveloped travel and leisure market, that has suffered from significant fluctuations in GDP. This second aspect is also nuanced. On one hand, underdevelopment means the future possibility of faster growth, and the possibility to import good practices and business models from outside. On the other hand, Latin America’s market has a smaller size, meaning that it may not be able to sustain a big structure, or to provide significant scale benefits.

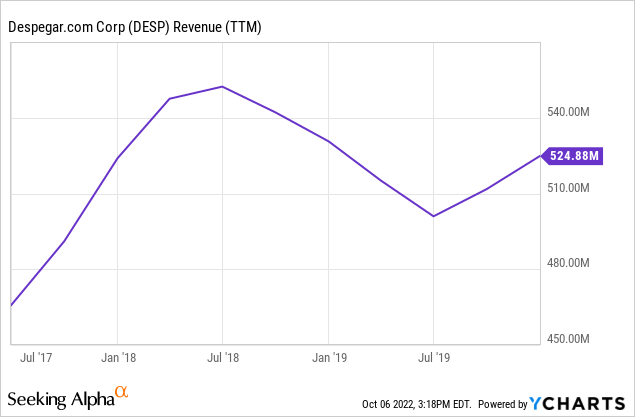

I believe that in fact DESP may have reached the ceiling of Latin America’s market penetration in 2019. The company was not able to grow revenues significantly after IPOing in 2017, and the reason might be that Latin America’s leisure market was not growing, because its main economies were not growing either (Brazil, Mexico and Argentina).

Latin America and the Caribbean outbound tourism expenditure (World Bank )

Another negative aspect of DESP compared to its global competitors is that the company is completely concentrated in Latin America. If the region does well, DESP is probably going to grow. But if the region stagnates (as it has done for more than a decade) then the company suffers.

Corrections to quarterly reporting

Unfortunately, DESP does not provide sufficient quarterly information. The company does not fill complete quarterly reports with the SEC, but only earnings reports. I do not understand how a company with revenue above $400 million cannot provide complete reports. Also, in the reports important information is missing or prone to misinterpretation. Two aspects in particular are worth noting.

First, DESP’s financial expenses include losses for FX variations that companies usually put in other comprehensive income. In 2021, the company reported $10 million in net financial expenses, but these included $5 million of exchange rate variations and $5 million of factoring expenses. The earnings report for 2Q22 shows almost $10 million in financial expenses for that quarter alone, but does not separate across categories. It is improbable that DESP is generating $10 million in net interest expense a quarter, or even a year, given that it only has $30 million in debts, and almost $275 million in cash.

A second aspect absent from DESP’s quarterly earnings reports is the accrued dividends to the two classes of preferred shares the company issued during the pandemic. These include $150 million in class A shares accruing 10% a year and $50 million in class B shares accruing 4% a year. The total expense, from the perspective of the common shareholder, is $17 million a year. However, DESP does not report comprehensive income quarterly, only net income. In this way, the $17 million yearly ($4.25 million quarterly) are ignored.

I am not against the preferred shares. The cash provided by them has helped DESP survive the pandemic financially unscathed and make several small sized ($5 to $30 million) acquisitions of distressed companies (Best Day, Viajes Falabella, Koin, Viajanet, HotelDo, Stays). The problem is not reporting the expense the preferred dividends represent for the common stockholder clearly.

Securitization of receivables

DESP acquired a controlling stake in Koin, a Brazilian buy now pay later solution. When DESP acquired it, in 2021, Koin had $5 million in negative equity. Koin generates significant bad loan losses, but DESP reports this only tangentially. In the report for 1Q22, DESP mentions that adjusted EBITDA for the company was negative $7 million, excluding Koin. However, adding back Koin’s results moves the adjusted EBITDA for the quarter to negative $12 million. In the second quarter, DESP reclassified another $4 million of Koin’s bad debts for the quarter from SG&A to COGS. On its investors presentation from June, DESP mentions that $20 million more will be needed before Koin is cash positive.

The company also comments on its 20-F for FY21 that it would start securitizing Koin’s receivables. The securitization will be carried through a trust that will buy receivables from DESP and sell debt to investors. DESP will carry residual and subordinated tranches of that debt. Although the SPV’s creditors are not supposed to have recourse rights against DESP, the company will keep the SPV as a consolidated entity on its books. DESP’s quarterly reports for 1H22 shows more than $5 million positive cash flows from securitization.

Although the figures might not seem enormous for DESP’s size, Koin has grown its loan generation 5 times on YoY basis, and it represents a completely different line of business. I am worried that DESP may be entering into a risk profile that is unrelated to its core business strategy. Also, consolidating the securitization trust will obscure the company’s balance sheet.

More information should be provided by DESP on Koin on a quarterly basis.

Profitability calculations

What is the revenue and profitability implied in DESP’s current stock price, from a purely business-fundamental perspective?

DESP’s current market cap stands at $450 million, but its EV is $200 million lower because of the company’s cash reserves and low debts. I assume that the company will keep a gross margin of 65%, which is the historical average. SG&A costs probably will surround $330 million. DESP has shown in the past that this cost category is sticky to revenue growth and decrease. Further, I assume yearly financial costs of $10 million (coming mostly from factoring, not net interest), $17 million in preferred dividends and an effective tax rate of 25%.

With that cost structure, DESP can reach breakeven at $550 million in revenues. From then on, operational leverage plays a significant role. With $600 million in revenues, DESP could generate $25 million in net income (10% return on a $250 million EV). With $640 million, it can generate $45 million (10% on the company’s market cap of $450 million).

Can the company reach those revenue levels? My opinion is that it will completely depend on the economic context of Latin America, and not on the company’s operations. During the period before the pandemic, DESP showed that if the Latin American economies do not grow, it cannot grow either. The company currently stands at an annualized revenue level of $500 million and has never before reached $550 million. That is the minimum to reach profitability.

Speculative motives

A fundamental consideration of DESP does not attract me. I try not to invest speculatively, meaning expecting price appreciation that is not justified by fundamental reasons but rather by changes in investor attitudes towards a company or its prospects or expected macroeconomic events (like growth in Latin America).

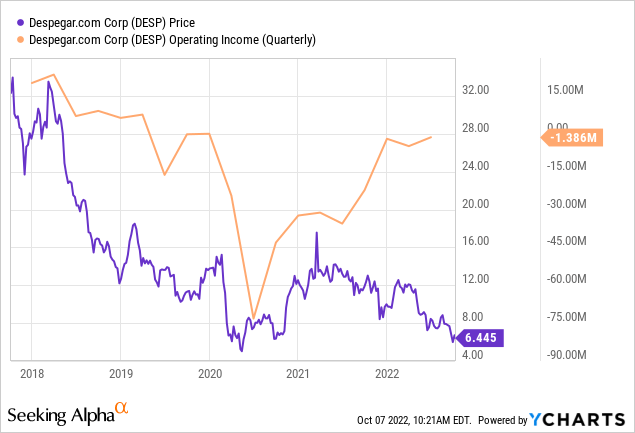

However, DESP could entice some readers, given that it has shown significant operating income momentum at the same time as the company’s share price collapses. DESP currently trades quite close to the minimums seen during the pandemic.

Because of its operational leverage, the income elasticity of its demand and its concentration on Latin America, DESP also provides an interesting, high-beta speculation vehicle for a reader with strong opinions on Latin American growth. If a more macro-oriented reader considers that Latin America is going to grow, then DESP can leverage that bet (contingent on growth materializing).

Conclusion

I am not currently attracted to DESP on a fundamental basis. The main reason is that I believe the company has reached a revenue ceiling, and that breaking it requires external conditions (region growth) that the company cannot control.

For a reader with more speculative investment motives, DESP stock might be more interesting, both in terms of sentiment (multiple) recovery and macro forecasting.

Be the first to comment