sankai

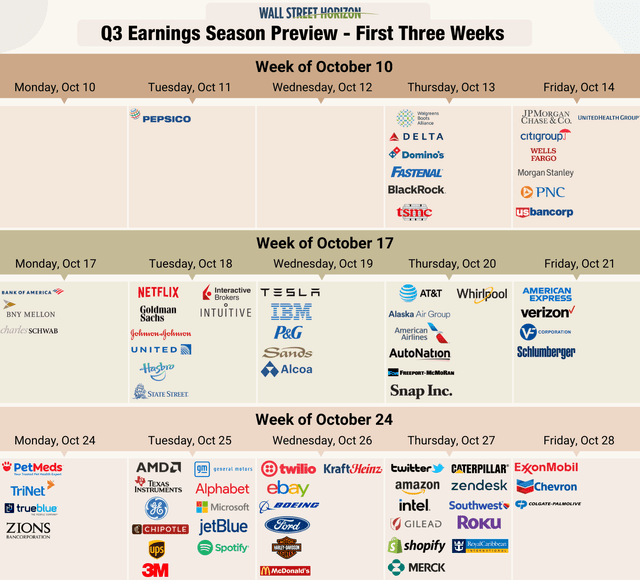

The third-quarter earnings season kicks off next week with Pepsi (PEP) on Tuesday and some big banks reporting to wrap up a busy data week on Friday. In the middle will be reads on a few areas from the airlines, to the consumer, and to even the semiconductor industry. One small chip testing company reported a strong quarter late this week and reiterated its positive guidance.

Earnings Calendar Next 3 Weeks

According to CFRA Research, Aehr Test Systems (NASDAQ:AEHR) provides test systems for burning-in semiconductor devices in wafer level, singulated die, and packaged parts form worldwide.

The California-based $379 million market cap Semiconductor & Semiconductor Equipment industry company within the Information Technology sectors trades at a very high 50.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

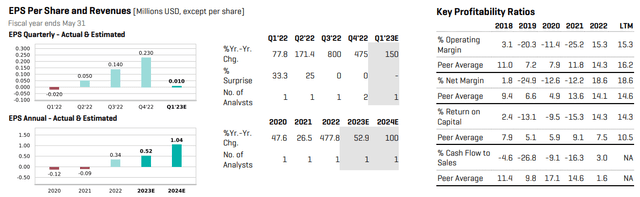

The firm beat earnings estimates earlier this past Thursday night, and shares soared. Seeking Alpha reports that Aehr also crushed its Q1 revenue estimate of $10.67 million by more than $2 million. Boosting investors’ confidence was a confirmation of guidance of $60 million to $70 million versus the consensus forecast of just $62 million. Aehr expects bookings to grow in its fiscal year 2023. While the firm’s forward operating earnings multiple is high near 27, sales are expected to rise by a whopping 81% in the coming year. On valuation, a price-to-sales ratio north of 6 seems high, but it has been more than cut in half from 2021 levels. A forward PEG ratio near 1.8, according to Koyfin Charts, looks good to me.

AEHR Stock Beats Q1 2023 EPS Forecast of $0.01 by $0.04

AEHR Historical Forward Price-to-Sales Ratio

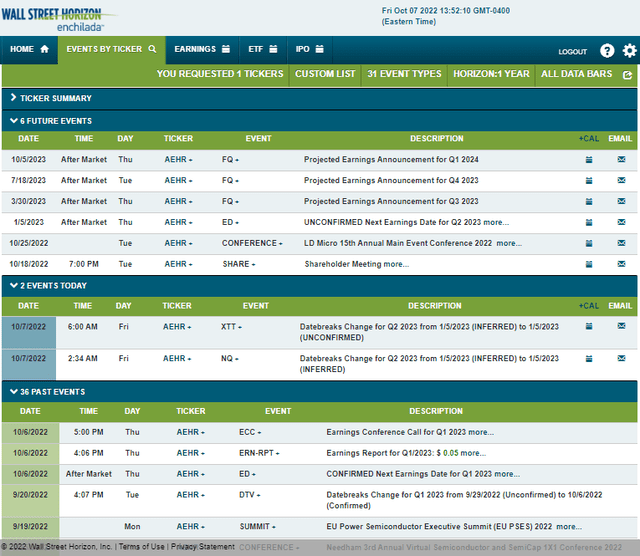

Looking ahead, corporate event data provider Wall Street Horizon shows a shareholder meeting set to take place on Oct. 18 before the company speaks at the LD Micro 15th Annual Main Event Conference. So there could be some volatility before its Q2 2023 earnings date unconfirmed for Thursday, Jan. 5.

Corporate Event Calendar

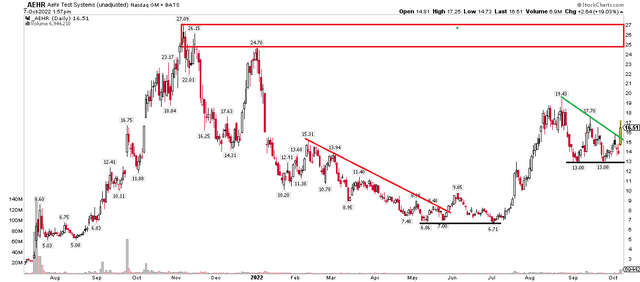

The Technical Take

AEHR is one of the few stocks with solid price action and upward momentum right now. The stock soared on Friday following a strong earnings beat and reiterated sales guidance. The stock appears to be breaking out from a bullish descending triangle formation which suggests a price objective to near $22, just below its highs from late last year to early 2022 in the $25 to $27 range.

Notice how the stock went through a basing pattern during much of the second quarter before breaking out above $9, then holding the upper $6s on a July retest when so many software and semiconductor stocks hit a temporary low. AEHR, however, put in a more robust bottom while other industry players have fallen to fresh 2022 lows.

Overall, I like the relative strength here and today’s bullish breakout. Long with a stop under $13 makes sense. Profits should be taken in the mid-$20s.

AEHR: Shares Lift Off Following A Strong Q3 Report

The Bottom Line

Ahead of earnings season, one small chip-testing stock reported strong results this week. While trading at a high P/E, compared to its growth outlook, AEHR stock’s valuation looks reasonable to me. What’s more impressive is the relative strength versus the market and its industry in the last three months. I expect shares to continue outperforming.

Be the first to comment