RichVintage/E+ via Getty Images

Investment Thesis

I have covered Relay Therapeutics (NASDAQ:RLAY) twice before for Seeking Alpha, once in September 2020, when I recommended the recently IPO’d company at a price of $35 per share, and later, in February 2021, when I again suggested the company was a “Buy”, at $43 per share.

Relay’s IPO in July 2020 raised $400m at a price of $20m making it the third largest biotech of all time. The company – seeded via the biotech accelerator Third Rock Ventures, which also helped seed the likes of CRISPR gene editing specialist Editas Medicine (EDIT), central nervous system (“CNS”) disorder drug developer Sage Therapeutics (SAGE), and Sickle Cell Disease pioneer Global Blood Therapeutics (GBT) – recently acquired by Pfizer (PFE) in a $5.4bn deal – is engaged in “next generation drug discovery”.

What that means is that Relay uses cutting edge biochemistry and biophysics techniques and advanced AI simulation to try to discover new drug targets and turn these targets into new drugs with superior efficacy and safety profiles than current standards of care. To simplify, Relay uses a 3-step drug discovery process that begins with a “modulation hypothesis”, followed by “hit identification”, followed by “lead optimisation”.

The problem with starting at the very beginning of the drug development process is that it takes years to advance into the clinic, let alone into pivotal trials or submitting a New Drug Application (“NDA”) or Biologics Licence Application (“BLA”) to the FDA seeking commercial approval.

Frankly, during the savage bear run that saw the SPDR S&P Biotech ETF fall from an all-time high of $167 in February 2021, to a 5-year low of $67 in June this year, investors lost faith in early stage drug developers, focusing on the high cash burn and remote chances of near-term revenue generation, instead of the potential to develop blockbuster (>$1bn sales per annum) in the future.

Relay was no exception – its share price fell from a January high of $61, to a June 2022 low of $14 – a loss of >75%. Overall, companies that have listed after being seeded by Third Rock have performed almost universally badly – most have lost between 10% – 85% of their value since IPO – but now that the worst bear market in biotech history appears to be over, the underlying investment cases behind these companies are worth revisiting.

In Relay’s case, for example, the company is now working with 3 clinical stage assets, and remarkably, is now on a pathway to a potential accelerated approval of its lead candidate RLY-4008 in bile duct cancer, or cholangiocarcinoma (“CCA”), after producing some stellar results in a Phase 1 trial.

This rapid progress has seen Relay’s share price make some upward progress – climbing by 69% across the past 3 months, from $14 to $23.5 at the time of writing. Relay began life with a substantial market cap valuation – when I covered the company in February 2021 it stood at $3.7bn – and it now stands at $2.55bn, so investors should not get too carried away.

The bile duct cancer market is apparently worth only a couple of hundred million dollars so even if RLY-4008 were approved – perhaps as early as next year – the drug will not justify a $2.5bn market cap on its own. It will serve as a strong validation of Relay’s approach however, and its ability to target proteins with greater specificity and accuracy than rival drug developers, and there are also plenty of expansion opportunities for a drug targeting Fibroblast growth factor receptor 2 (“FGFR2”), a gene and protein involved in cell signalling and proliferation.

In this post I will take a closer look at the RLY-4008 data, discuss the opportunity in some more detail, and discuss whether Relay can have similar success with the 7 other programs it is actively working on.

RLY 4008 Wows at ESMO – Agrees On Registrational Trial Protocol

Relay presented its latest RLY-4008 data at the European Society for Medical Oncology, and the data can also be found in this post ESMO presentation.

First of all, the drug demonstrated a favourable tolerability and safety profile across 195 patients, emphasising its ability to target FGFR2 with high selectivity i.e. not interfering with the processes of other genes and proteins and causing unintended damage to patients.

Efficacy wise RLY-4008 appears to have been a slam dunk. The drug achieved an Objective Response Rate (“ORR”) of 88% – 15 of 17 patients – at its pivotal 70mg dose, and a 63% ORR – 24 of 38 patients.

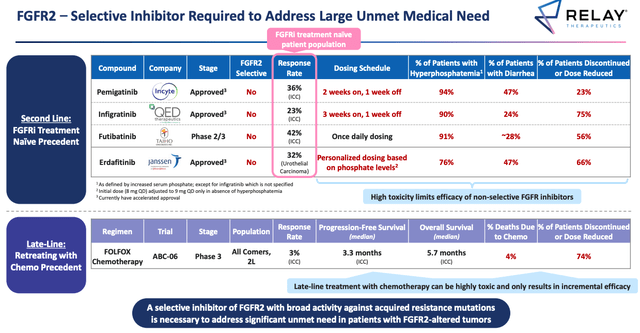

Performance of approved FGFR inhibitors as 2nd line therapies. (Relay ESMO presentation)

Source: Relay ESMO presentation.

In the above table we can see the much lower response rates achieved by, respectively, Incyte’s Pemazyre (Pemigatinib), approved for CCA in April 2020, and making $37m sales in H122, BridgeBio’s (BBIO) Truseltiq, approved in June 2021 for CCA (sales data unavailable), Taiho Oncology’s Futibatinib (not yet approved), and Johnson & Johnson (JNJ) subsidiary Erdafitinib, approved in 2019 for bladder cancer, and pegged for blockbuster sales.

It is never necessarily a good idea to compare trial data, but it is hard to ignore the apparent superiority of RLY-4008 in terms of both safety and efficacy over its potential competitors.

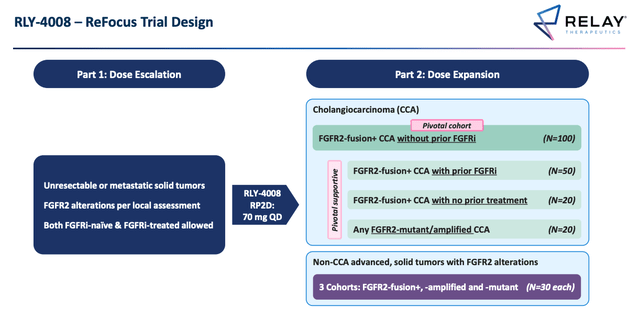

Relay’s Phase 2 trial as agreed with FDA. (Relay ESMO presentation)

Source: ESMO presentation.

As above, the Phase 2 study which can potentially secure RLY-4008 will look at patients who are FGFR treatment naive primarily, but also patients who have already had some form of FGFR therapy, and those who have had no prior treatment of any kind, potentially bringing an approval as a first line therapy into play.

Admittedly, none of the patients treated with RLY-4008 have experienced a complete response (“CR”) – most have experienced a confirmed partial response, but 13 out of 15 patients receiving the 70mg dose remain on treatment, with one patient experiencing 68% tumor regression.

It seems that however you slice and dice the Phase 1 data it looks impressive, and superior to what is currently on the market. There may be opportunities outside of CCA also – breast cancer is one other type of solid tumor in which early signs of activity have been observed.

Building a Potential Breast Cancer Franchise

As mentioned, RLY-4008 may provide some valuable validation of Relay’s approach, technology, and cash burn – the company made a net loss of $138m in 1H22, and a $235m loss in the prior year period – but it is unlikely to drive much more than $100m – $200m of revenues in its CCA indication, if approved.

Responsibility for opening up a far larger market in breast cancer – 195k patients are diagnosed with either HR+, or HER2- breast cancer annually in the US – falls primarily to RLY-2608 – a pan mutant selective allosteric inhibitor – supported by 2 other candidates – a selective CDK2 inhibitor, and an ERα Degrader.

Targeting the allosteric sites on proteins – harder to reach, but offering more fertile ground for inhibitors, meaning better efficacy and greater selectivity – and protein degradation – marking oncogenic proteins for destruction by the immune system – are the types of approaches that allowed the likes of Relay, Kymera Therapeutics (KYMR), and Black Diamond Therapeutics (BDTX) to raise hundred of millions of dollars in the public markets, so it is encouraging to see Relay’s early work begin to take shape.

Relay says that RLY-2608 is the first known allosteric, pan-mutant and isoform-selective phosphoinostide 3 kinase alpha, or PI3Kα, inhibitor in clinical development, and in April 2022, Relay initiated the second arm of the dose escalation part of a Phase 1 trial, evaluating RLY-2608 in combination with fulvestrant for patients with HR+, HER2–, PI3Kα-mutated, locally advanced or metastatic breast cancer.

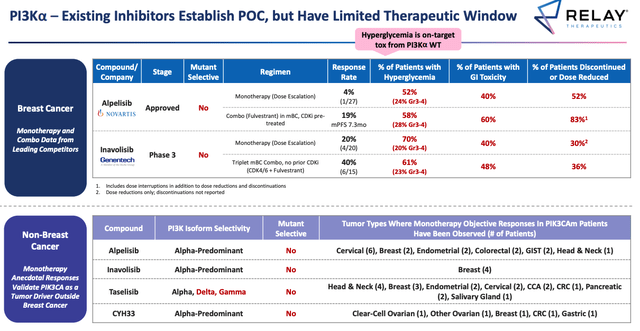

We don’t have much in the way of data yet, but once again the efficacy and safety bar to beat is not a high one, Relay suggests, as per the table below.

Overview of competitor PI3Kα data. (Relay ESMO presentation)

Source: ESMO Presentation.

A somewhat simplistic thesis goes that if Relay repeats its success with RLY-4008 data with RLY-2608, and the gates of a major oncology opportunity swing open. Pfizer’s Ibrance achieved sales of >$6bn treating metastatic breast cancer last year, whilst Roche’s (OTCQX:RHHBY) Herceptin made sales of ~$4bn. Ibrance is an inhibitor of CDK 4/6 – Relay’s second breast cancer targeting drug inhibits CDK2, and is expected to begin clinical trials in 4Q23, or 1Q24, whilst the degrader candidate will be nominated in 2023.

Conclusion – Relay’s Early Data Shows It Can Prove The Doubters Wrong

As mentioned, despite the heavy share price losses across the past year, Relay is still valued at $2.6bn, whilst the only drug likely to be approved within the next 3 years likely has a peak sales opportunity <$200m, which would arguably suggest Relay remains overvalued.

That may not necessarily be the case however. Relay came to market with a specific purpose – to advance the process of drug discovery and identify new and better targets than those currently on the market – and its first set of clinical backs that thesis up emphatically. If RLY-4008 reproduces the data seen so far in its Phase 2 study then the drug will look a class apart compared to its rivals.

Breast cancer is a different indication and Relay’s drug candidates targeting this indication have different mechanisms of action to RLY-4008, but to have 3 differentiated candidates entering clinical trials in the next 2 years is a good achievement nonetheless, and once again the standard to beat is not high, although the unmet need is.

I may not have had much luck backing Relay in the past, but in fairness, the severity and length of the biotech bear market was unprecedented (surprising given the validation the sector ought to have gained producing 2 >95% effective MRNA vaccines against COVID-19) – and it has made certain companies share prices look very attractive.

I am keeping the faith in Relay – it is hard to criticise the progress the company has made with RLY-4008 and the company’s approach to building a breast cancer franchise seems methodical, and is based on a fundamentally strong understanding of what drugs are out there, and where the best targets can be found.

If, in a years time, Relay has won an accelerated approval in bile duct cancer and its early breast cancer data is anything like as strong as its CCA data, I would expect to see Relay’s share price rise above $35, and trade in a range of $45 – $50. The company has >$800m cash to burn through, and its net losses are shrinking.

Perhaps the company will become an acquisition target like its fellow Third Rock stablemate Global Blood Therapeutics, or at least attract a Big Pharma partner of 2, which would also help drive its valuation upwards.

Be the first to comment