Moussa81

It has been a while since I have written an article and I’m glad to get back into it. I got roped into helping out in the accounting department of a family business after an abrupt departure, and we were recently able to hire a replacement. I will be back to writing several articles a week and working part time in the business for the next couple months, but the last couple weeks makes me appreciate all the authors who have full time jobs and write articles on the side. The last thing I wanted to do after a day of staring at a computer screen and banging on a keyboard is spend more time doing the same to write articles. I haven’t spent as much time looking at markets, but I would be lying if I said I didn’t keep one eye on the stuff that I owned. The most notable headline I saw in the last week was the acquisition of STORE Capital (STOR).

The recent acquisition of STORE Capital means I will have some cash freeing up in the near future. I plan to hold until after the upcoming dividend and sell if I can get most of the acquisition price of $32.25. I am frustrated by the STORE acquisition because I thought the REIT would be worth far more than that in the coming years, but I’m not going to wait around for the acquisition to close for pennies per share. I will have to decide what I’m going to do with the cash, and I think some of it will end up buying shares of T. Rowe Price (NASDAQ:TROW).

Investment Thesis

T. Rowe Price is the only asset manager I am interested in owning as a long-term investor. There are several reasons for this, from the focus on active management, a debt free balance sheet, and the coveted title of dividend aristocrat. The valuation is currently attractive, but I will be patient with further purchases. I plan to start buying bits and pieces below $100 which would put the forward yield at nearly 5%. Shares now have an earnings multiple of 11.6x, which is attractive for a high margin business like T. Rowe Price. For investors looking to add a financial with a nice dividend, rock solid balance sheet, and conservative management, look no further than T. Rowe Price.

An Update on the Business

The last time I wrote an article on T. Rowe Price was in July, and shares have been basically flat since then (-2%). I don’t think the overall outlook for broader markets has changed a ton since that article and I wouldn’t be surprised to see choppy and volatile markets continue. It is also possible the outflows from the first half of the year continue, but I think the company will be able to weather any declines in the market with its balance sheet.

One thing to keep an eye on will be AUM. It’s not a Goliath like BlackRock (BLK) or Vanguard, but T. Rowe Price still manages over a trillion in assets. AUM is down from the end of Q1, but it has basically been stagnant from June to August ($1.31T to $1.34T). That will be a key thing to keep an eye on as an investor, but if the 2008 and 2009 financial meltdown is any indication, the company should be able to survive and thrive over the long term.

At the most recently quarterly report, the company had over $2.1B in cash and equivalents and another $2.6B in investments. The company doesn’t have any outstanding debt, and the liabilities part of the balance sheet is made of accounts payable, taxes payable, and other miscellaneous items. In short, T. Rowe Price has one of the best balance sheets across the entire financial sector and should be able to weather any market (or economic) turbulence. That doesn’t mean that the stock is going straight up and to the right from here though.

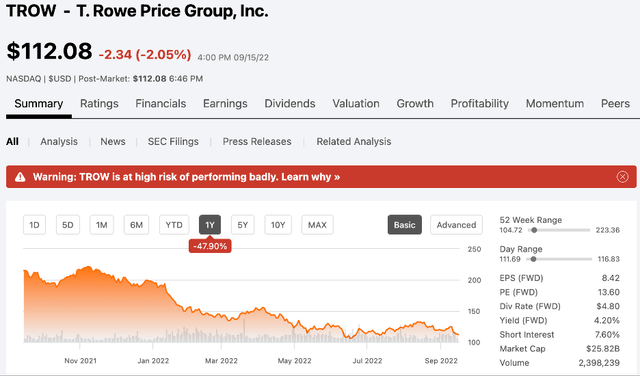

SA Home Page (seekingalpha.com)

It’s tough to buy a stock when the Seeking Alpha home page for the stock has a performance warning. That isn’t going to change my long-term bullish stance on the company, even if the short term is more uncertain. While T. Rowe Price’s balance sheet all but eliminates the risk of bankruptcy, the valuation is why I’m keeping the stock on my watchlist.

Valuation

The stock is basically right back to where it was a couple years ago at the bottom of the lockdown induced panic selloff. Shares hit $90 that March, which was approximately a 10x P/E. We aren’t much higher right now, as shares have basically churned sideways for the last three months. I’ll be the first to admit that the stock performance for the year hasn’t been pretty, as shares are down over 40% YTD.

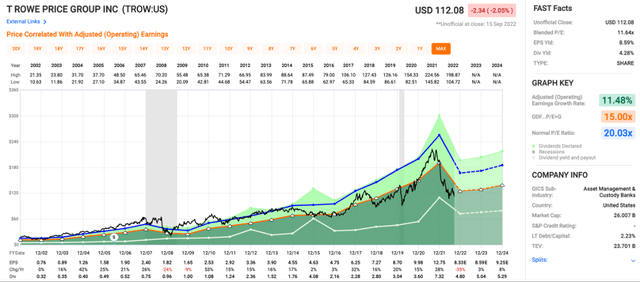

Price/Earnings (fastgraphs.com)

I will be looking to buy more shares below $100, which I think would put a decent margin of safety on the stock. Our current position is small, but I plan to add a couple times if shares continue to drop. With a share price of $100, shares would yield 4.8% based on the current dividend, and as many of you know, T. Rowe Price has a long history of impressive dividend growth.

A Set it and Forget it Financial Dividend Stock

There aren’t many financial stocks that have been as consistent as T. Rowe Price over the years. The company boasts a 35-year streak of dividend raises, and I think that will continue for years to come. Management has resisted the temptation to lever up the balance sheet, even as interest rates have been sitting near zero for years. That conservative management style is what has separated the company from many other companies that participated in the financial blowup in 2008 and 2009.

With a forward yield expected to be around 4.2% at current prices, I still think the risk/reward for investors with a longer time horizon is favorable. On top of a nice dividend, the company has repurchased 3.8M shares in the first half of 2022 for $519.6M. That comes out to 1.6% of the outstanding stock and my assumption is that the buybacks will continue along with the annual dividend raises.

Conclusion

While there is some cyclicality to T. Rowe Price’s earnings (and stock price), the general trend is up and to the right with both. Shares have already been cut in half since November and I am looking to build a larger position in the company. The margins are impressive, even though AUM is down for the year. The valuation is starting to go from attractive to very attractive and the dividend is interesting for investors looking for current income as well as dividend growth. Throw in a decent sized buyback program and you have an impressive capital return program.

There is a lot to like about T. Rowe Price, from its debt free balance sheet to its Dividend Aristocrat status. I’m hoping to add at prices below $100 where the yield would be near 5%, but I think the long-term risk/reward is skewed to the upside. If the market stays choppy, keep an eye on T. Rowe Price. The long-term returns could be impressive from an interesting mix of income and price appreciation.

Be the first to comment