HeliRy/E+ via Getty Images

Last week, seismic data provider ION Geophysical Corporation (NYSE:IO) or “ION” filed for bankruptcy protection after a multi-month review of strategic alternatives failed to “attract actionable bids at sufficient price levels” as revealed in the company’s disclosure statement.

In connection with the Chapter 11 filing, ION entered into a Restructuring Support Agreement (the “RSA”) with the lenders under its Credit Agreement and holders of approximately 80% of its 2025 Notes, whereby the parties agreed to support the Company’s Chapter 11 plan of reorganization (the “Plan”).

The Company and the consenting creditors that are parties to the RSA have agreed to the terms of a comprehensive restructuring, including the Plan premised on (i) a debt-for-equity exchange paired with the potential sale of certain assets to one or more third parties or (ii) a sale of substantially all of its assets. Under the terms of the RSA, ION will continue its ongoing solicitation of interest from third parties in potential sale transactions involving the Company designed to maximize the value of the Company’s assets through an open and transparent process that enables interested buyers to submit bids for assets.

The Company has also secured $2.5 million in debtor-in-possession financing that, along with normal operating cash flows, should support operations during the process.

As a result, ION is looking to restructure an aggregate $147.6 million in funded debt:

- Its first lien revolving credit facility with approximately $15,600,000 in outstanding principal amount of borrowings, in addition to approximately $30,559 of accrued and unpaid interest.

- The company’s new 8.00% second lien notes due December 15, 2025, with approximately $116,193,000 in aggregate principal amount outstanding, in addition to approximately $7,804,684 of accrued and unpaid interest.

- Its original 9.125% second lien notes with approximately $7,097,000 in aggregate principal amount that matured on December 15, 2021, in addition to approximately $902,447 of accrued and unpaid interest.

While the company remains open for a sale of some or all of its assets, a comprehensive restructuring appears to be the most likely outcome at this point.

Under the terms of the restructuring support agreement, revolving credit facility lenders will either receive:

- a) payment in cash in full or

- b) to the extent not paid in full in cash, their pro rata share of an exit facility or

- c) reinstatement or modification of their claims as agreed to by the company and the lenders

Holders of the company’s 2025 second lien notes will become the new owners of the restructured ION with their claims being exchanged into 99.75% of the new equity subject to dilution by the management incentive plan.

General unsecured claims (which include the original 9.125% second lien notes due 2021) will be left holding the bag as the aggregate recovery pool has been set at a paltry $125,000.

Current equityholders will receive their pro rate share of 0.25% of the new equity subject to dilution by the management incentive plan.

The transaction embodied in the Plan and the Restructuring Support Agreement will be subject to a market test. Accordingly, the Debtors will be conducting a comprehensive marketing process in parallel to determine, in the Debtors’ business judgment, if any sale or combination of sales are higher or otherwise better than the proposed lender transaction set forth in the Restructuring Support Agreement and Plan.

Applying the 0.25% recovery for common equityholders to the company’s current market capitalization of $12.5 million, the restructured ION is currently valued at an eye-watering $5 billion (!!!) despite failing to attract bids for covering less than $150 million in debt.

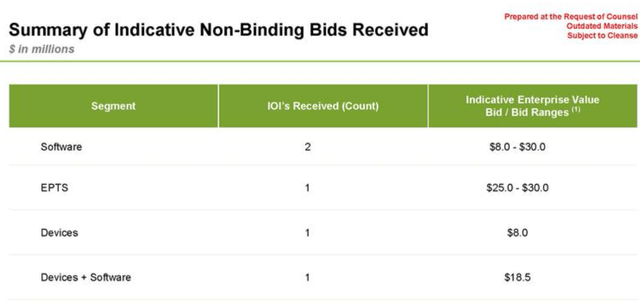

In fact, last year’s review of strategic alternatives only yielded non-binding bids of well below $100 million in aggregate:

While this obvious discrepancy makes the stock appear like the perfect short opportunity, sky-high borrowing rates in conjunction with margin requirements and some uncertainties related to the ongoing comprehensive marketing process are likely to keep potential short-sellers sidelined until the company moves closer to emerging from bankruptcy which is currently expected for late July.

Bottom Line:

As expected by me for some time, Ion Geophysical Corporation will be required to restructure its debt obligations in bankruptcy with equityholders ending up with virtually nothing.

Generously assuming a post-bankruptcy equity value of $100 million, the fair value of an existing share would calculate to just $0.007 thus resulting in 98% downside for the shares from current levels.

Even when considering current borrowing rates of around 70%, the stock appears like a great short with the company anticipated to emerge from bankruptcy in less than four months.

But ugly margin requirements and some remaining uncertainties related to the ongoing marketing process are likely to keep potential short-sellers sidelined for now.

Also, keep in mind that the NYSE is likely to commence delisting proceedings as soon as next week.

Given these issues, existing equityholders should sell their shares and move on.

Be the first to comment