AHatmaker/iStock via Getty Images

Athersys (NASDAQ:ATHX) is an intriguing biotech with a novel approach to stem cell therapy. It has been so down in the dumps that many have given it up for dead. That was my view until its 04/12/2022 spike caught my attention.

In this article I evaluate its forward prospects, reviewing late information on the stock including recent releases from Healios and Athersys’ Q4, 2021 earnings call (the “Call”).

After a protracted downhill slide, Athersys’ 04/11/2022 surge was heaven sent

My first of three articles on the company, “Athersys: Fare Well”, described its MultiStem cell therapy as an off the shelf therapy having attractions insofar as it is:

…derived from Multipotent Adult Progenitor cells [MAPC] harvested from bone marrow of healthy adult volunteers, they undergo no genetic modification. Once isolated they are used to produce banks of cells yielding as much as millions of doses from a single donor.

MultiStem requires no arduous, expensive, time consuming apheresis or other processing such as required by Gilead’s Kite cell therapy process.

In 05/2021’s “Athersys: Stem Cell Opportunity For Risk-Tolerant Investors – Q1 2021 Update“, I gave an update on the company. I was cautiously optimistic based on its outsized revenue potential if its late stage trials in ARDS and ischemic stroke panned out; judging by its subsequent share price action the caution was well merited, the optimism not so much.

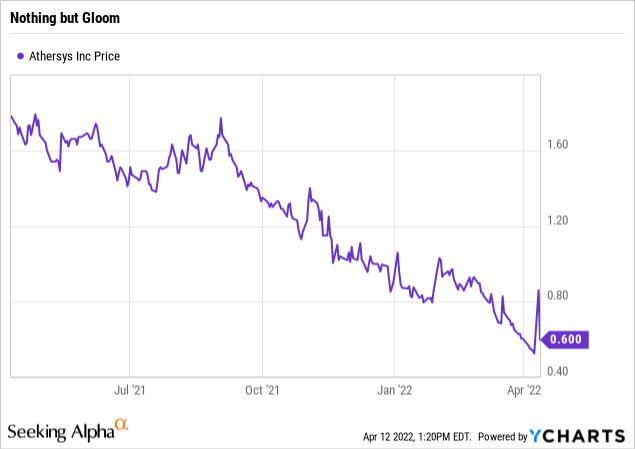

Over the last year, before the spike, Athersys had provided nothing but gloom for its shareholders’ portfolios as shown by the chart below:

Back when I was most optimistic about Athersys, it seemed to be clearly aligned with its Japanese partner Healios. I considered the Athersys/Helios collaborations to be a significant part of Athersys’ value. Ever since that relationship started to unravel in late 2020, Athersys has struggled to sustain any updraft in its shares.

Adding to its woes, Athersys has lacked any kind of management stability since long time CEO and co-founder Van Bokkelen stepped down in 02/2021. William (B.J.) Lehmann was appointed as Interim CEO to take over after Van Bokkelen. Athersys was unable to arrange an effective full time successor.

Finally on 01/20/2022 it announced the appointment of Daniel A. Camardo as the Company’s Chief Executive Officer, effective February 14, 2022. As new CEO, Camardo gave an excellent account of the due diligence he performed prior to leaving his position as an EVP at Horizon Therapeutics (HZNP). I was less impressed by his 04/13/2022 presentation at the Needham Virtual Healthcare Conference.

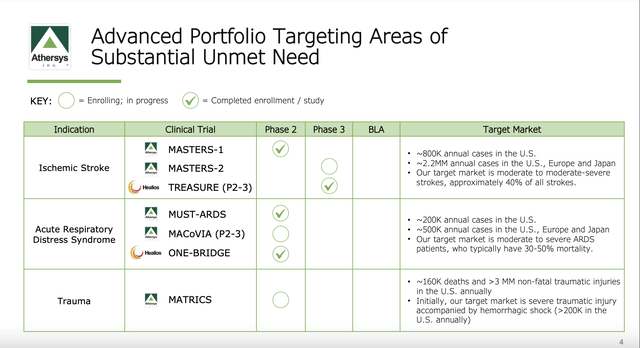

Athersys has a bountiful crop of late-stage clinical trials in big indications

Athersys has been running its MultiStem therapy through a battery of clinical trials in various indications since 2008. The FDA trials that are currently of interest are shown below:

Athersys corporate overview presentation (athersys.com)

During the Call, CEO Camardo advised that MASTERS-2 had been designed based on its learning from MASTERS-1. Enrollment in MASTERS-2 has been delayed on account of the pandemic. The plan is to complete it later this year (2022) by opening additional trial sites, albeit he acknowledged it could get delayed.

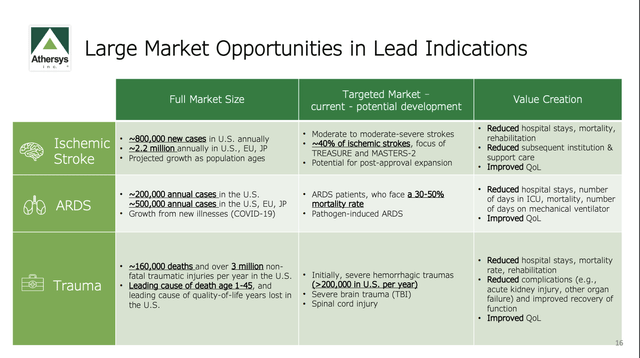

If Athersys hits on any of its indications, the payoff could be huge. Each is a jumbo market as shown below:

Athersys corporate overview presentation (athersys.com)

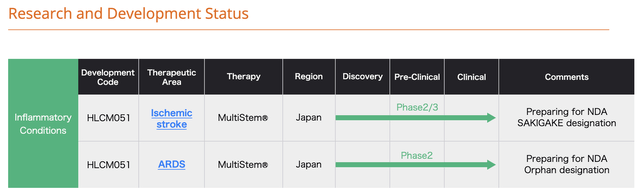

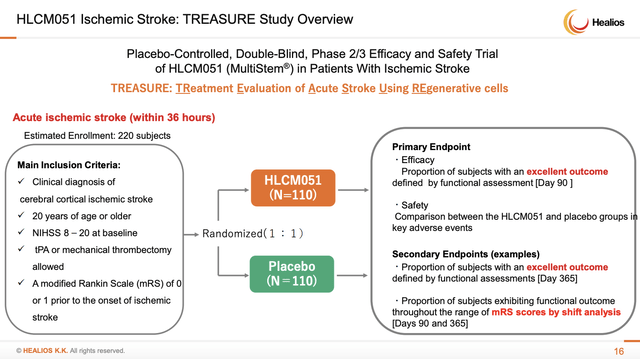

In addition to its US trials, its collaborator Healios has late stage trials in Japan as disclosed by its graphic below:

Healios MultiStem trials (healios.co.jp)

Healios’ ARDS study, also known as its ONE-BRIDGE study, has been a beacon of hope for Athersys investors as a potential near term source of revenues. This potential was blistered on 04/04/2022. At the time, Healios advised that promising efficacy and safety outcomes in the 90 and 180-day ONE-BRIDGE study had encouraged it to prepare for PMDA approval of HLCM051 for ARDS in Japan.

Healios’ late March 2022 meeting with PMDA to discuss its application did not go as Athersys shareholders would have liked. Healios’ 04/04/2022 release noted:

…although a certain level of agreement was reached in relation to the efficacy and safety of HLCM051 for ARDS, Healios was advised that when making a future application for approval for the ARDS indication, it needs to add certain supporting data to the proposed application data package. In light of this guidance, Healios will continue to discuss with the regulatory authorities the nature of the supporting data required, including the potential use of certain clinical data from the MACoVIA [study for the product in the ARDS indication currently being conducted in the United States].

As a result Healios indicated it did not currently plan to apply for approval in Q2, 2022; it further advised that no application for approval was likely to take place in this year [2022].

This leaves Healios’ ischemic stroke trial (TREASURE) still to report. So far all is still clear on Healios’ ischemic stroke front. As expected, the final patient’s 365 day physician follow up visit to assess functional status was completed in 03/2022. Accordingly:

[h]aving completed the collection of this data, the engaged contract research organization can begin its process of preparing for the unblinding of the data, which will take place in May 2022. In the same month, Healios plans to announce top-line results.

Healios’ ischemic stroke website graphic provides as follows:

ssl4.eir-parts.net

Athersys is running out to the tip of its cash runway, additional delays will be challenging

A quick perusal of Athersys’ balance sheet reveals it as a hollowed out operation. As of its latest report, it carries cash and short term investments of $37.4 million. Its current liabilities are $29.9 million. Its long term liabilities are a nominal $14 million.

During the Call, CFO Macleod reported its near term liquidity situation as follows:

At December 31, 2021, we had $37.4 million in cash and cash equivalents compared to $51.5 million at December 31, 2020. Our cash burn in 2021 varied between $17 million and $20 million per quarter, with the burn in the fourth quarter being just over $19 million. We do feel we have adequate cash to fund our near-term priorities through and beyond the publication of Healios’ top line stroke data.

He also mentioned its longstanding share purchase arrangements with Aspire Capital. Athersys advised in its 2021 10-K (p. 41), it has drawn on this periodically in recent years as follows:

- 2019 – sold 14,475,000 shares at an average price of $1.41;

- 2020 – sold 11,425,000 shares at an average price of $1.67;

- 2021 – sold 40,031,000 shares at an average price of $1.61;

Its 2019 Aspire commitment extended to an aggregate of $100 million in shares. It was fully utilized and has been replaced by a $40 million facility on similar terms.

The Agreement has a floor price for shares such that it only applies for any business day on which the closing sale price of Athersys’ common stock equals or exceeds $0.50 per share. As I write midday on 04/15/2022, Athersys has yet to close below this floor so far during 2022; however it is hovering just above that threshold at $0.52.

In response to a question as to whether it expects to receive milestones from Healios in 2022, Camardo deferred to COO Lehmann. He was nonspecific but indicated Athersys was looking for something from Healios in 2022.

The bottom line is that Athersys is going to be quite data dependent for its access to capital beyond its current Q2, 2022 cash runway. CFO McLeod fully expects positive readout from TREASURE to open up several avenues for cash on more favorable terms than currently available.

If the TREASURE data disappoints things could get awfully dicey. CFO McLeod’s plan B is not particularly compelling. In response to a Call question on that score he said:

If the data does not lead to a successful partnership, we have explored other means of financing, which I don’t really want to give the details just yet. We have not pulled the trigger on it. But suffice to say, we have not so far accessed the debt markets. And there are other possibilities that we’re exploring. But our intention is to proceed with our discussions on the partnership. And we do anticipate the readout to be positive.

Conclusion

Athersys has been a tough hold for its shareholders as its price travels down towards $0.50. Just because it has been so abysmal does not mean it can’t continue its slide. Certainly it seems to have used up any margin of error it may once have had. On the other hand, optimists such as myself are holding on hoping for a rebound on good TREASURE data.

At this point the risk reward is solidly in favor of the reward. If it can succeed with one of its late stage indications, the potential reward compared to its paltry $0.133 billion market cap is outstanding.

Athersys has not accumulated liabilities of the sort which would tend to militate towards bankruptcy to wipe its slate clean, zeroing out its shareholders. Between hero and zero, hero is the odds on call.

Be the first to comment