PixelCatchers/E+ via Getty Images

Time is the friend of the wonderful company, the enemy of the mediocre. – Warren Buffett

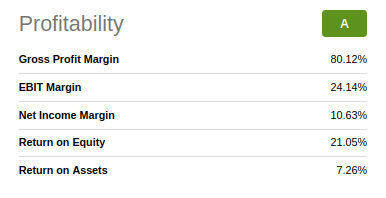

One of the best strategies to fend off inflation is to invest in wonderful companies even if it is at only fair prices, since this type of company is rarely significantly undervalued. We consider Booking Holdings (NASDAQ:BKNG) a wonderful company for many reasons, including its high margins, high returns on equity, excellent profitability, and its ability to grow earnings while needing to reinvest only a small portion of them.

Seeking Alpha

There are a few reasons why a company with wonderful financial characteristics such as Booking Holdings can provide significant inflation protection, these reasons include:

- Intangible assets like brands and IP that don’t require significant capital expenditures that rise with inflation. The value of a strong brand that affords pricing power will tend to maintain its real value amid inflation.

- High and stable margins that reflect the pricing power of the company, that allows it to adjust prices higher to counter inflation and maintain real earnings growth.

- High returns on equity meaning that retained earnings will still provide returns above inflation and will not lose economic value.

- Relatively small exposure to raising interest rates, thanks to debt that is long-term, fixed-rate, or with low interest rates. And no significant short-term debt or variable rate debt, since interest rates tend to increase during periods of high inflation.

- It has growth opportunities with investment returns significantly above inflation, which is especially important if the company retains all or most of its earnings.

Despite these characteristics, we believe Booking Holdings is still somewhat undervalued as a result of the impact the Covid crisis had on the company, and that investors are still not entirely comfortable getting back into the shares. We believe the Covid crisis will be in the rear-view mirror soon and would like to point out that Booking noted during its February 23rd Q4 earnings call, that 2022 summer bookings were above 2019 levels, including Western Europe summer bookings which were up low double digits versus pre-pandemic levels.

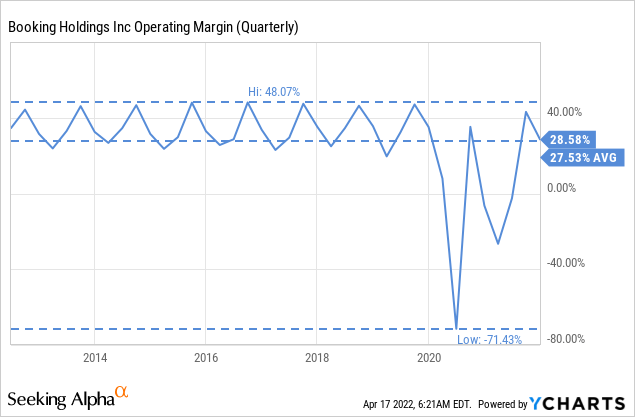

We can also see the recovery in the company’s operating margin, which is getting close to pre-pandemic levels. It is also interesting to note how high the operating margin is, and how stable it is, despite some cyclicality during the year due to normal travel patterns. This high and stable margin is a reflection of the pricing power the company has and the quality of its intangible assets.

Inflation Tailwinds

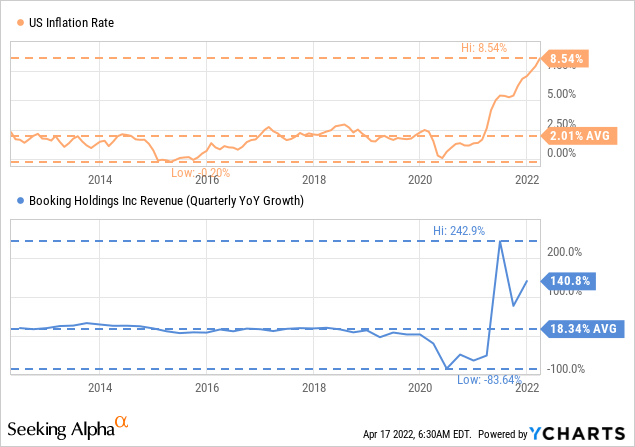

While we don’t see the company particularly benefiting from inflation on the operational side, we believe that it can maintain growth significantly above the inflation rate. Below we compare the US inflation rate to the year-over-year revenue growth rate of the company. As can be seen, it has outpaced inflation by a wide margin for a long time. Recently it has done that mostly because of the recovery in travel, so it will be interesting to continue monitoring these indicators going forward.

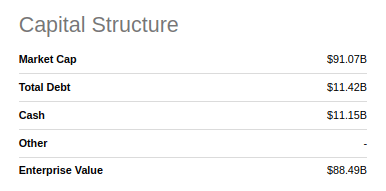

Where we think the company can actually benefit from inflation is on its balance sheet, given the fact that the company carries a good amount of debt which is mostly fixed-rate and of long-term duration. The debt is also at low rates, so we think that much of it will actually be paying negative real interest, meaning that the company is being paid in a way to carry debt, at least during the period of high inflation.

Seeking Alpha

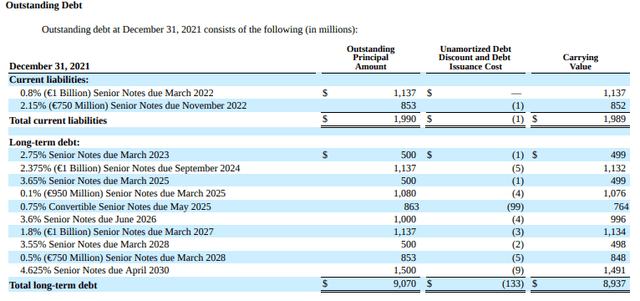

Below we show more details on the company’s outstanding debt. There is a small amount classified as current liabilities, that will probably have to be refinanced at higher rates, but most of it matures after 2025. Note that in all cases the interest rate is below the current inflation rate, both for dollar-denominated debt and euro-denominated debt.

Booking Holdings Annual Report

Valuation

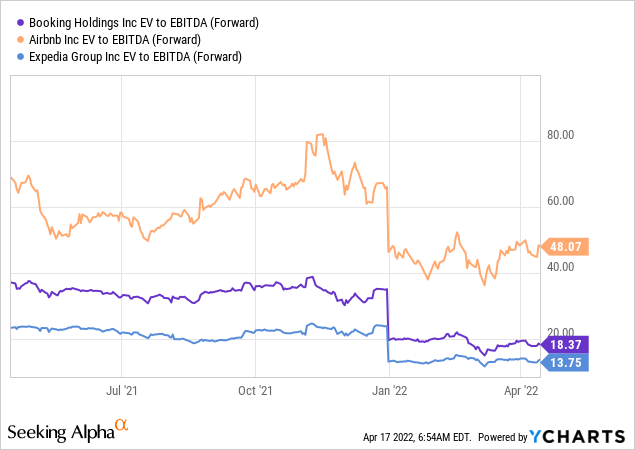

We view shares of Booking Holdings as somewhat undervalued, especially when compared with its main peers Expedia Group (EXPE) and Airbnb (ABNB). At a forward ~18x EV/EBITDA, Booking is trading at less than half the valuation for Airbnb and just slightly more expensive than Expedia. However, we consider Booking Holdings to be of much higher quality compared to Expedia, and fully deserving its premium.

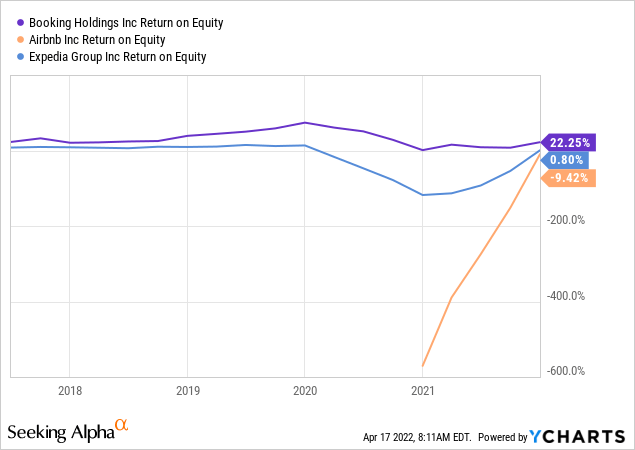

We can see why Booking deserves its premium over Expedia, seeing that it has a much higher return on equity (ROE). Its ROE is current 22%, which compares quite favorably to Expedia’s 0.80% and Airbnb’s negative one.

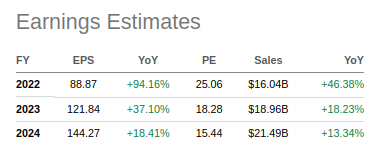

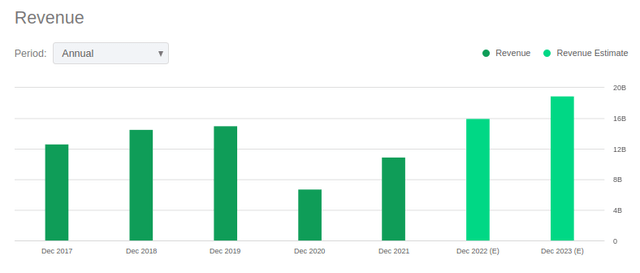

Going forward analysts expect revenue growth to return, with an expectation of almost $20 billion by Dec 2023.

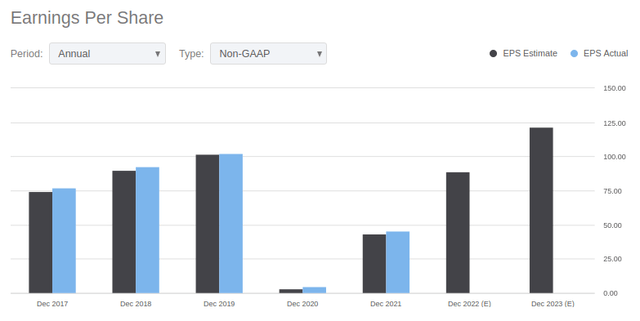

Earnings per share are also expected to start growing above pre-pandemic levels soon, with an EPS estimate of ~$122 per share by Dec 2023.

This gives the company an estimated P/E of ~18x for FY23, and looking at FY24 this is further reduced to only 15x. We think these multiples are cheap for a fast-growing, high-quality, inflation-resistant company such as Booking Holdings.

Seeking Alpha

Risks

The main risks we see with an investment in Booking Holdings include:

- The risk that the pandemic could make a significant return, resulting in massive travel restrictions again.

- That the war in Ukraine spills over to other European countries significantly affecting European travel.

- A global recession that would likely reduce discretionary spending such as travel.

- Home rentals taking significant market share from hotels, though this is mitigated by the fact that Booking Holdings is offering home rentals now.

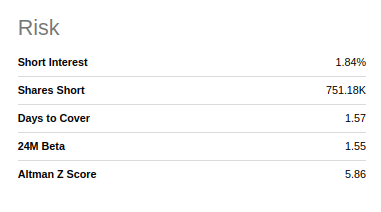

We are reassured that the company is in a good position to withstand temporary setbacks, and we can see this from Seeking Alpha’s risk profile, where we see that the short interest is relatively low, which means few funds are betting against the company. We can also see that the company has a high Altman Z-score. As a reminder, the Altman Z-score is the credit-strength measure developed by NYU Stern Finance Professor Edward Altman. It considers a company with a score that’s below 1.8 as having a high risk of heading toward bankruptcy, and companies that have scores above 3 as not likely to go bankrupt.

Seeking Alpha

Key Takeaway

Booking Holdings should not only offer substantial inflation protection to investors, but it should continue growing at a fast pace, as it was doing before the pandemic. Because of the pandemic impact, shares are still somewhat undervalued, and this seems like a good time to invest if one believes the worst of the pandemic is over. There are a few risks, as with any investment, but we think this is one of the best possible places for investors looking to protect their capital from the erosion brought by inflation.

Be the first to comment