JHVEPhoto/iStock Editorial via Getty Images

Newegg Commerce (NASDAQ:NEGG) is an online, direct-to-consumer retail company. It sells computers, electronics, and related products.

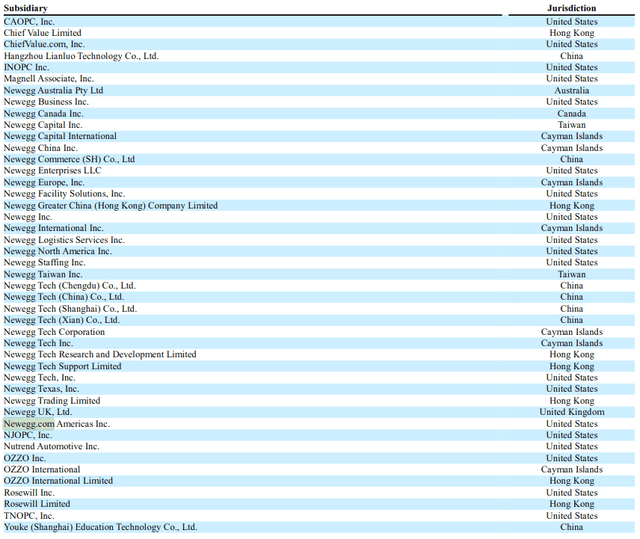

The company is perhaps best known in the U.S. for the site newegg.com. However, the site is only one of its forty-four subsidiaries:

Subsidiaries of Newegg Commerce (Newegg public filing, Form 6-K/A)

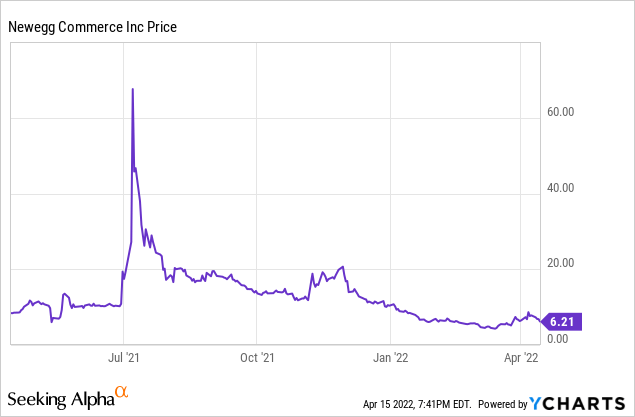

Newegg’s Stock Price Soars And Crashes

The spike in the stock price last July followed hard on the heels of a SPAC merger. Newegg’s parent company Lianluo merged Newegg with another fully-owned subsidiary, Lightning Delaware Sub. Lianluo is also known as “Liaison Interactive Information Technology Company”, “LLIT”, and “Lianluo Smart Limited.” It is now named Newegg Commerce.

The company is a Chinese company publicly traded in China. Its NASDAQ stock ticker was LLIT, but was changed to NEGG.

Shortly after the merger the stock price jumped from $10 a share to more than $70 in the span of about a week last July. Then it fell below $20 before the month was done.

The cause of the extreme swing is uncertain, but perhaps the stock was simply a meme stock, as Brandy Betz, Seeking Alpha’s News Editor, says it was. She reported that the company was a favorite at Reddit’s Wall Street Bets and Stocktwits. She also cited a Seeking Alpha news article that saw the stock as a potential short squeeze candidate.

At the same time, SMB Insights warned in a Seeking Alpha article that the stock price will “plunge back to reality” and that investors should avoid the stock, a statement that proved prescient. The stock price kept falling, enjoyed a resurgence above $20, but then continued to fall. Just last month it hit a low of $4.14.

It is hard not to think that the woes of Alibaba (BABA) and other Chinese stocks has had something to do with the negative sentiment over the past six months. For instance, a bull of Chinese stocks, ALT Perspective, wrote last December that “Chinese stocks have become indefensible”. The three main reasons were:

- A heightened regulatory environment in Beijing.

- Concerns that Chinese stocks would be delisted.

- Fears of potential repudiation of Variable Interest Entities, or VIEs, by the Chinese government. This would result in Chinese ADRs losing their value overnight. Perhaps the best explanation of VIEs comes from Wisdom Tree:

VIE is a structure in which an offshore shell entity, usually in the Caymans, is owned by investors in the U.S. or Hong Kong stock exchanges. This offshore entity has a contractual relationship with the mainland company, but because the relationship is contractual, it is not considered owned.

This gets around China’s laws that forbid foreign capital in areas like telecommunication and Internet news and media. Because foreign investors own the offshore shell company instead of the actual Chinese company, it creates a layer of risk for investors.

Alt Perspective also found that the revulsion towards investing in Chinese stocks was more “overwhelming” than expected.

More recently, DiDi Global (DIDI) put off listing its shares in Hong Kong. The news sparked a broad sell off in the Chinese internet sector. Alibaba, Baidu (BIDU) and Tencent (OTCPK:TCEHY) were all dragged down.

In the most recent article from Alt Perspective just a few days ago, there are several reasons why Alibaba is now a buy. Among them is that Beijing is not out to kill Chinese internet giants. In addition the China Securities Regulatory Commission reiterated its support for the VIE structure. Judging from the comments, that opinion is still hitting resistance.

It is perhaps also possible that the Russian invasion of Ukraine has had a negative impact in the minds of American investors. After all, both the Russia and China are communist companies, and they have a close relationship. As Bloomberg reported on March 14th, “U.S.-listed Chinese stocks resumed a steep selloff on Monday as concerns about Beijing’s close relationship with Russia added to losses spurred by its crackdown on tech giants and the growing risk of U.S. delistings.”

But What About Newegg’s Fundamentals?

An analysis of a business’s fundamentals is critical to understanding how well the business is performing, and how well it is expected to perform. However, Seeking Alpha reports that the data is not available to look at ordinary metrics such as ROA (Return on Assets) and ROE (Return on Equity). This makes the five-year averages of these metrics not meaningful.

Similarly, TIKR.com reports only spotty information. For instance, the ROA for 2020 was 3.1%, and for 2019 it was -8.9%. No other numbers are available for the years following 2009.

The restated Form 6-K/A, for the period ending 11/15/21, is unaudited.

In November, the company guided for net sales of $2.4 billion. For the period ending June 30 of 2021, net sales were $1,206.872, so that seems like a safe prediction, but it is yet unknown whether the company actually achieved those numbers.

In the same November announcement, Anthony Chang, the CEO, said:

Since the beginning of the pandemic, similar to many businesses in our industry, we were and continue to be affected by global supply chain challenges. The disruption in the global supply chain has directly affected our vendors by putting pressure on their profit margins... disruption in global supply impacted consumer prices due to higher shipping costs, slower deliveries, and higher labor and raw material costs.

Conclusions

The VIE structure is an added risk to owning any Chinese stock, including Newegg’s. Fears of the American government delisting Chinese stocks persist. The Chinese government has tempered its statements somewhat, but American concerns about what Beijing will do also persist. With such negative sentiment toward Chinese stocks, it is hard to imagine Newegg’s stock price improving in 2022.

Even if the sentiment of Chinese stocks improves, the lack of adequate data from Newegg hampers any proper analysis of the company, and that could further drag on the stock price. The company’s statements about supply chain issues are not reassuring. The company’s financials are not audited, and had to be restated. In short, the company’s data does nothing to inspire confidence. Ignoring the sentiment and looking at only the company, the stock price is assumed to continue its decline in 2022.

That is not how I would wish it to be. I have been a customer of Newegg. I studied Mandarin Chinese in college, as well as Chinese culture. I have visited the country and walked the Great Wall. I bear no ill will to the company, nor to the country. I would rather see Newegg succeed, but I find nothing to indicate that Newegg’s stock price will improve this year. If the company chooses to disclose more information, I will be happy to reassess the company and its stock.

Be the first to comment