ADragan

Co-produced by Austin Rogers.

In the last year or so, the fundamentals for nearly any kind of housing in the United States have scarcely ever looked better

- Home prices have soared 30-40% or more

- Rent rates have climbed 20-45%, depending on the market

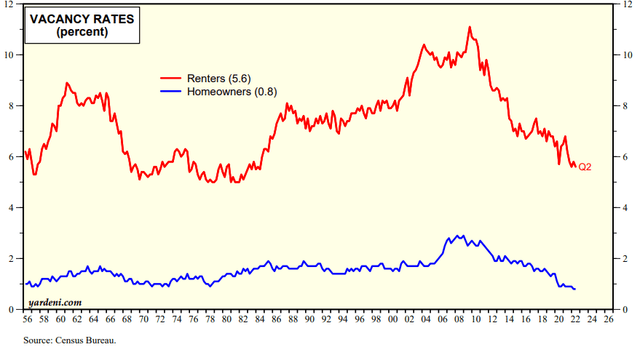

- Vacancy rates for both rental properties and owner-occupied homes has collapsed to nearly its lowest levels ever

Yardeni Research

But nothing lasts forever. Trees don’t grow into the sky.

In fact, as longtime investors are well aware, overdone movements in markets often reverse violently – typically, the more overdone the trend, the more violent the reversal. Rather than merely returning to the mean, overdone price movements often reverse and move well past the mean in the other direction.

Despite this ominous setup, we do not necessarily predict a home price crash akin to the Great Financial Crisis. The future is unknowable, and investing based on such dire predictions turns out poorly more often than it works in one’s favor.

However, the data does not look good for the housing market. In what follows, we present three reasons why home prices could soon begin to sink. And we finish with a brief discussion of one of our favorite types of investments right now.

1. Rapidly Eroding Affordability For Home Buyers

The first and most obvious reason why the housing market could be in for some significant pain ahead is the simple fact that the affordability of homes has dramatically eroded this year.

We need only consider two factors to come to this conclusion: home prices and mortgage rates. While there are some all-cash buyers out there, including institutional investors like Blackstone (BX) along with real estate investment trusts (“REITs”) like Invitation Homes (INVH) and American Homes 4 Rent (AMH), most buyers need to use financing in order to make such a huge purchase.

For most buyers, home affordability basically comes down to the total monthly payment rather than the sale price of the house itself. That is why falling mortgage rates tend to push home prices up, while rising mortgage rates tend to slow or reverse the growth in home prices.

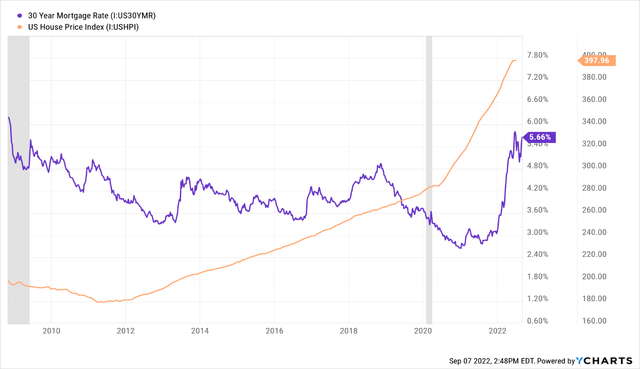

So far this year, mortgage rates have soared rapidly higher, even while home prices have continued to go up.

The 30-year mortgage rate has not been this high since late 2008, and yet home prices have roughly doubled since then.

The same mortgage rate combined with dramatically higher home prices equates to a far larger monthly payment for incremental buyers. This has priced a huge portion of would-be homebuyers out of the market.

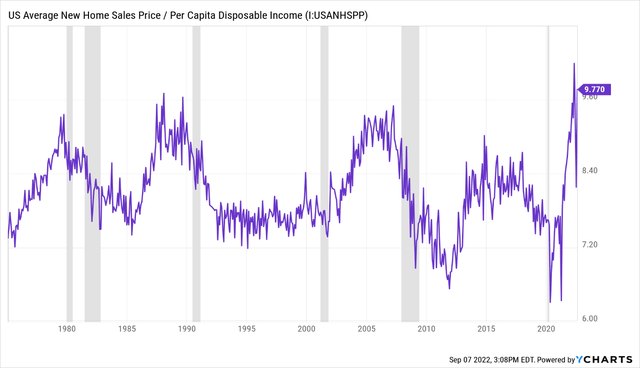

Eroding affordability of homes can also be seen in the ratio of new home prices to disposable income per capita:

Average new homes in the U.S. sell for around 10x per capita disposable incomes right now. That ratio is higher than at any point in the last 50 years and may very well be an all-time high. This ratio could only rationally be supported by ultra-low mortgage rates, which we no longer have.

2. Surging New Home Inventory

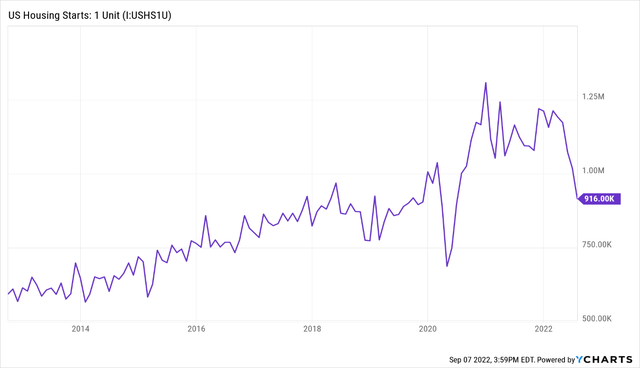

As a result of rapidly eroding home affordability for new buyers, fewer homes are selling. That is a problem for homebuilders (XHB). Though single-family home construction starts are now plummeting, builders began construction on a large number of homes in late 2020 and 2021 that are now set to be delivered into a market with much less demand than they expected.

It’s hard to overstate how violent this whipsaw effect is shaping up to be. Ultra-low mortgage rates combined with loads of government-injected stimulus money in 2020 and 2021 resulted in a huge burst of demand, which sent signals to homebuilders to build, build, build. They responded to those signals, but then mortgage rates spiked up and government stimulus dried up.

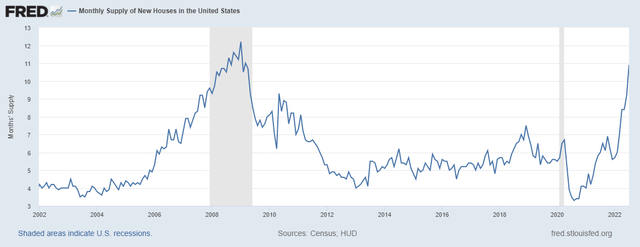

Now a glut of newly built homes has quickly surged to its highest level since March 2009.

Federal Reserve

There were 11 months of supply on the market in July 2022, and there are no signs as of yet that this glut of available new homes is peaking.

The laws of supply and demand would seem to indicate that excess supply will require prices to fall for the market to clear and the glut to be reduced.

3. Plummeting Sales Volume

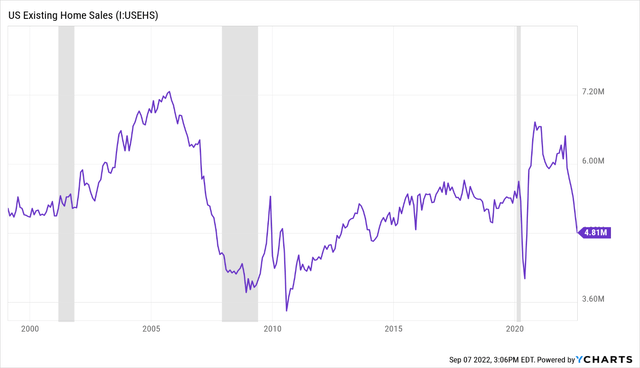

Unsurprisingly based on the previous two points, sales volume of existing homes (a much larger market than the one for new homes) is also plummeting. Again, it’s hard to overstate the speed with which the trend of rising existing home sales volume from 2010 to 2021 has reversed.

In itself, falling home sales volume does not necessarily lead to lower home prices. But historically, that correlation exists, and it is pretty strong.

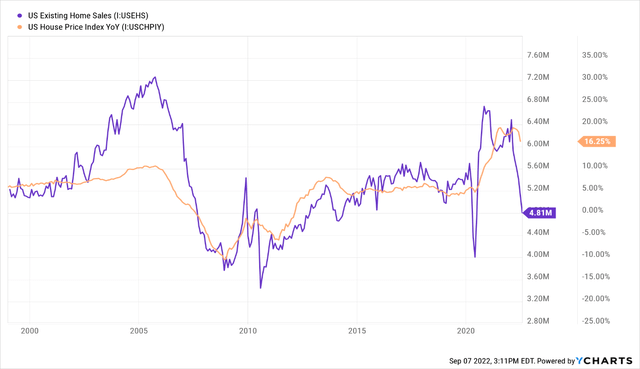

Below, let’s look at the same chart of existing home sales (purple) overlaid by year-over-year changes in house prices (orange):

As you can see, there’s a pretty strong correlation between home sales volume and home prices. When home sales volume is rising, home prices are generally as well. When home sales volume is falling, home price growth tends to follow it lower, sometimes into negative territory.

Note that sales volume of existing homes has dropped (quite rapidly) to around the same level at which home prices began declining in the late 2000s. Does this necessarily mean that home prices will fall? No. But at the very least it indicates that nominal home price growth should fall down to the low single-digits.

It should also be noted, though, that a substantial decline in home prices is not beyond the realm of possibility.

Why We Like REITs

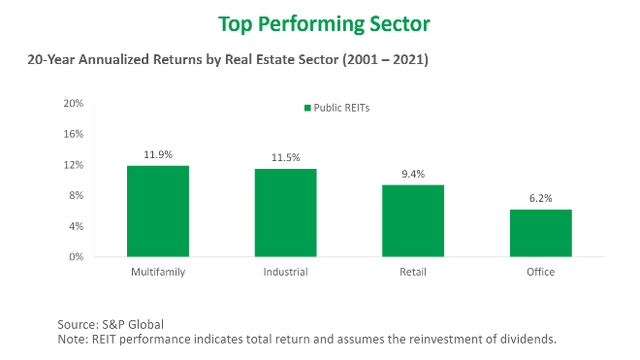

At High Yield Investor, REITs are some of our favorite sectors of the stock market. Though starting yields are lower, the asset type is highly defensive, benefits from higher inflation, and has tended to outperform private real estate over long periods of time.

This is especially true of apartments:

BSR REIT

Armada Hoffler

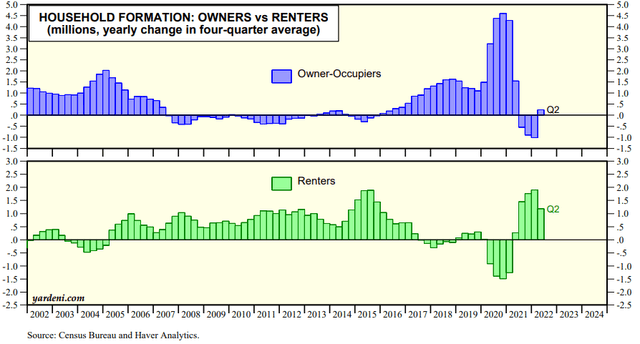

Though we think apartment occupancy and rent growth will probably continue to moderate this year as the economy approaches recession, it’s important to note that homeownership’s loss is multifamily’s gain.

See, for instance, the more or less inverse relationship between growth in owner-occupied household formation and renter household formation over the last two decades:

Yardeni Research

As more and more would-be homebuyers are priced out of buying a home, the benefit steadily accrues to apartment landlords.

Even beyond falling homeownership affordability, there are several tailwinds still in place supporting demand for rental housing, especially apartments:

- Low unemployment

- Job growth and rising labor force participation rate

- Rising income

- Large cohort of Gen Zers able to replace older Millennials moving into single-family homes.

In other words, we do not see the same vulnerabilities present for the performance of apartments as we do for the housing market.

With that said, here are some of our favorite multifamily REITs:

- AvalonBay Communities (AVB): This primarily coastal, Class A apartment owner/developer is the bluest blue-chip multifamily REIT focused on East and West Coast markets. Its huge development pipeline, which is largely located in faster-growing cities in the Sunbelt, presents a huge opportunity for value creation, as it can develop new properties at a much higher yield than it can buy existing properties. Despite that, it is currently priced at a 20% discount to NAV, which is a historically low valuation for the company.

AvalonBay Communities

- BSR REIT (OTCPK:BSRTF): BSR is a small, Class B multifamily REIT traded on the Toronto Stock Exchange as well as over-the-counter in the U.S. Over 90% of its apartment community portfolio is concentrated in the “Texas Triangle” of Houston, Dallas/Fort Worth, and Austin. These hot markets are fueling BSR’s peer-leading same-store NOI growth rate in the high teens. It is currently priced at a huge 25% discount to NAV despite growing the fastest in its history.

BSR REIT

- Camden Property Trust (CPT): Houston-based CPT is an $18 billion enterprise value, primarily Sunbelt multifamily owner/developer. Its portfolio is split roughly 60% Class B and 40% Class A properties, which should make its rental revenue more resilient in the midst of high inflation and through a potential recession. It is also priced at a large 20% discount to NAV, which is rare for a REIT of this quality.

Camden Property Trust

In short, though we are growing increasingly concerned that the U.S. housing market could be in for some serious pain ahead, we remain bullish on apartments, especially those located in the Sunbelt.

Be the first to comment