Recommended by Zain Vawda

Get Your Free GBP Forecast

GBP/USD Fundamental Backdrop

GBP/USD saw its rally cut short yesterday as the pair declined 300-odd pips from the key psychological level. The move came on the back of a bounce in the Dollar index which reached a high of around 112 before settling at 111 in the Asian session. The change is risk sentiment boils down to markets adjusting bets on whether we will see a pivot by the US Federal Reserve in November or not.

The shock experienced by UK markets following the mini budget and around tax cuts in particular has disappeared as the pound has recovered the majority of losses across the board. The UK faces growing headwinds despite the recent rally as Fitch has followed S&P global in downgrading the credit outlook as questions remain regarding growing government debt levels. Confidence in the economy has been shaken as 10-year UK government bond yields surpassed 4% for the first time since 2010. Yesterday we heard from PM Liz Truss, who gave a speech at her party’s conference in Birmingham in an effort to appease market concerns. In the aftermath of her address the pound posted further declines to the dollar which in fairness was not solely down to the Prime Minister’s speech. As skepticism grows around the proposals by the PM and the Chancellor of the Exchequer, we could see further tweaks of policy moving forward.

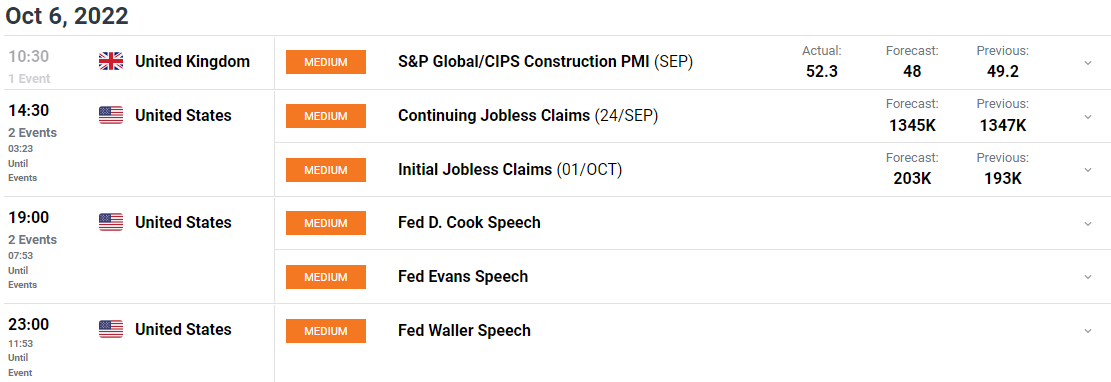

In what was a rare positive for the UK, this morning’s S&P Global/CIPS UK Construction numbers for September returned to growth with a print of 52.3 vs 48 forecast. The total industry activity rose for the first time in three months, however the growth in output has been linked to work on delayed projects. This is evidenced by the lack of growth in new orders with business optimism dropping to its lowest level since July 2020.

For all market-moving economic releases and events, see the DailyFX Calendar

As the day progresses, we have a host of policymakers speaking from both the Bank of England (BoE) and the US Federal Reserve. Should Fed policymakers continue with their hawkish outlook, a further dollar rally is on the cards.

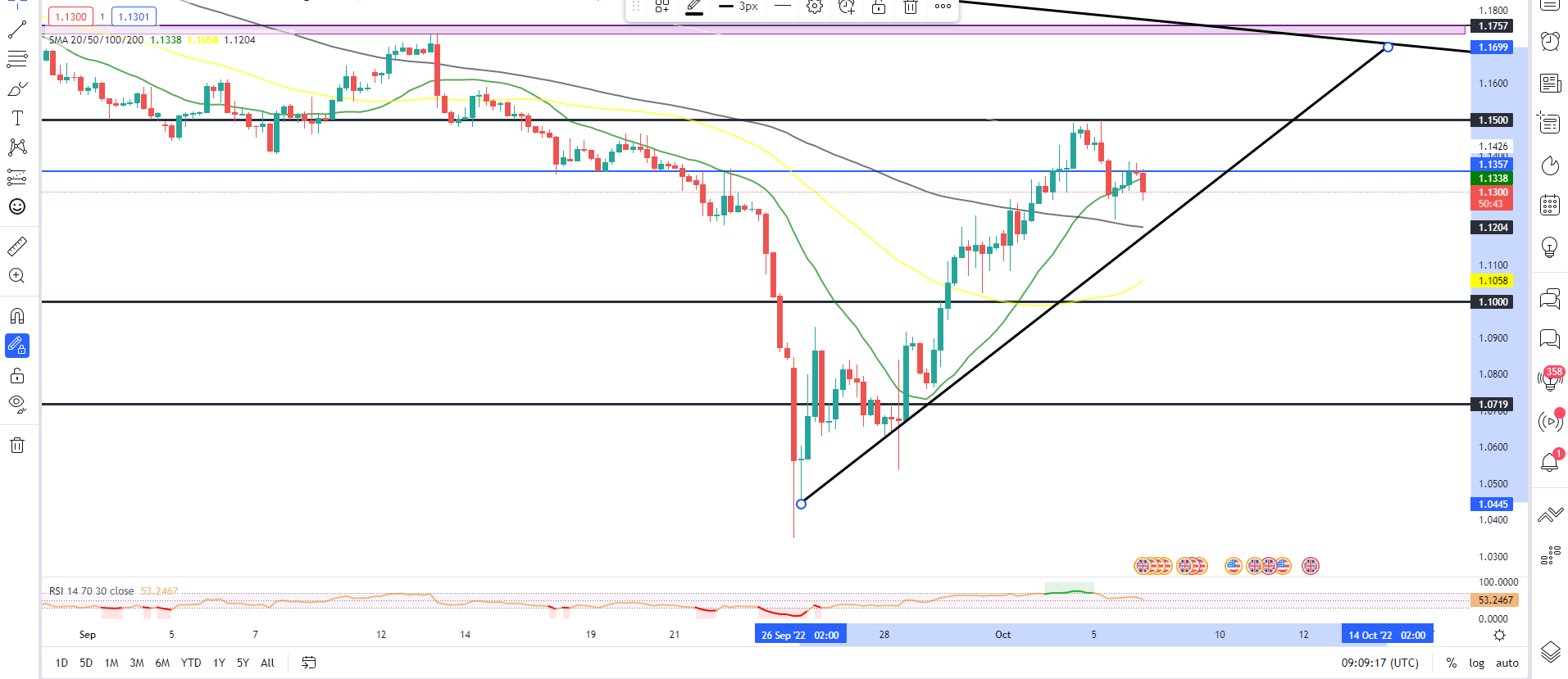

GBP/USD Four-Hour Chart – October 5, 2022

Source: TradingView

From a technical perspective, we have seen a 1150-odd pip rally since the YTD low which was capped by the key psychological 1.15 level. We have since declined by 280-odd pips while trading between the 20 and 100-SMA.

The steep trendline on H4 chart above is an indication of the momentum behind the recent rally. A pullback to retest the ascending trendline which coincides with the 100-SMA may provide support which could result in one more push higher into the long-term trendline hovering around the 1.1750 area. Alternatively, we could decline from here should we see continued dollar strength with 1.1000 remaining vulnerable in the short-to-medium term.

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•1.1200

•1.1050

•1.1000

Resistance Areas

•1.1360

•1.1500

| Change in | Longs | Shorts | OI |

| Daily | 3% | 0% | 1% |

| Weekly | -30% | 39% | -7% |

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Be the first to comment