ejs9

In a recent Twitter thread, I explained why I believe that real estate investment trusts (“REITs”) (VNQ) are more rewarding investments than rental properties. I listed the following 10 reasons:

-

REITs have better access to capital

-

The management of REITs is extremely cost-efficient

-

REITs enjoy huge economies of scale also on other levels

-

REITs can do spread investing to supplement their organic growth

-

REITs are able to develop their own properties

-

REITs can skip brokers and do sale-and-leaseback transactions

-

REITs can enter additional real estate-related business

-

REITs have the best talent and do a better job of aligning interests

-

REITs are highly tax efficient

-

REITs are able to invest in more rewarding specialty property sectors.

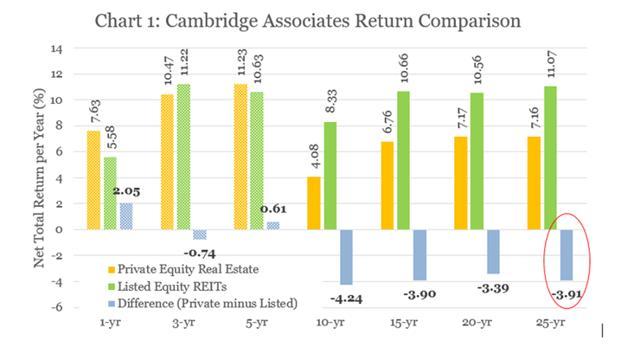

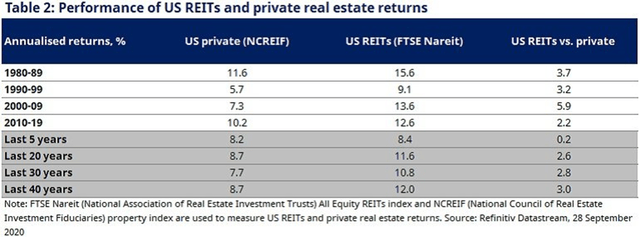

All of these advantages have historically resulted in higher returns for REITs as compared to rental properties.

Here are three studies that come to the same conclusion:

But surely, these higher returns must be the result of higher risk, right?

The efficient market theory teaches us that you can only expect to earn higher returns if you take greater risks.

I have had many rental property investors comment on my REIT articles and tweets that REITs are riskier than rental properties because they are volatile and trade like stocks. They argue that rental properties must be safer because their value is more stable.

But I strongly disagree with this point and actually think that rental properties are far riskier in most cases.

Here are 5 reasons why:

Reason #1: Rental Properties Use A Lot More Leverage

Most REITs finance their properties with a ~30-40% loan-to-value, or LTV in short. Good examples include Spirit Realty (SRC), AvalonBay (AVB), or even Prologis (PLD). They used to use a lot more leverage, but they learned their lesson from the great financial crisis and are today a lot more conservative.

Rental property investors will commonly use double that. Their LTVs are closer to 80% in most cases. Naturally, that also results in a lot more risk.

Rental property investors assume that their equity is not volatile because they are not seeing a daily quote, but just because you lack information does not mean that your equity isn’t changing in value.

Imagine you put your property on the market. You would be getting lots of different offers, each varying by 5-20%. If you are 80% leveraged, a 5% lower offer would reduce your equity value by 25%. A 10% lower offer would result in a 50% lower equity value. So, your equity value would actually be extremely volatile if it was quoted daily, but since you are not seeing it, you sleep better at night.

What you see quoted in the REIT market is their equity value, not their total asset value. It is leveraged, but since REITs use less leverage than rental investors, their equity is less volatile in most cases.

Reason #2: Rental Properties Expose You To Liability Risk

When you invest in a REIT, you enjoy the limited liability of being a minority shareholder of a publicly listed company. This means that you cannot lose more than you invest. You are not signing on any of the loans and tenants, contractors, etc., won’t sue you for being a shareholder.

But when you invest in rentals, there are far greater liability risks. In most cases, you will need to personally guarantee the loans, which puts you at high risk since you will also use high leverage. Moreover, your tenants, brokers, contractors, etc. will be quick to sue you. In some cases, they may sue you even if you did nothing wrong, just to take advantage of the court system.

Yes, you can seek some protection with insurance and an LLC, but it is a myth that those things will perfectly shield you from liability risk.

Reason #3: Rental Properties Aren’t Diversified

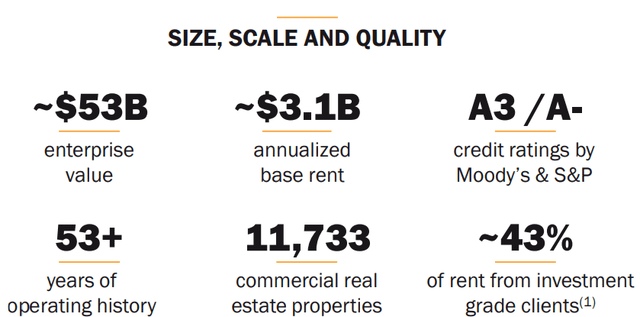

When you invest in a REIT, you are investing in a portfolio of 100s or even 1,000s of properties. REITs are typically well-diversified by geography as well so you won’t rely on a single street, city, or even state. To give you an example: Realty Income (O) owns 11,000+ properties and its portfolio is diversified across almost every state in the country.

Rental property investors will be a lot more concentrated. In most cases, they won’t own more than a few properties and will be entirely exposed to one specific city. If the economy of that city turns south and people start leaving it to seek better opportunities elsewhere, your equity might never recover. If you decide to invest out of state, then you would also be introducing other risks since management would be very complicated.

Reason #4: Rental Properties Put The Lives Of People In Your Hands

There are also social risks in dealing with rental properties. People are literally putting their lives on your property and people can change for the worst.

You will have to deal with people and that’s a risk on its own. I have heard many experiences of landlords being threatened by their tenants.

You could use a property manager to shield yourself from the operations but then you will need to monitor your property manager, who may or may not do a good job and they will eat a large chunk of your returns. Property managers are in the business of making money off fees by managing as many properties as they possibly can. Naturally, the management will then suffer since their interests are different from yours.

REITs will do a better job managing your properties because they have equity in the game and salaries are tied to performance indicators such as the growth of funds from operations (“FFO”) per share. The interests are better aligned and you are completely detached from the operations of the assets.

Reason #5: Rental Properties Are Illiquid

Finally, rental properties are private assets, and this means that they suffer illiquidity risk. Selling your property could be very complicated, costly, and time-consuming. If things really head south, you may not find any buyer for a long time, forcing you to remain the owner and continue to deal with all the issues that come with it.

REITs are public and liquid so you won’t have that problem. Liquidity is typically abundant, especially for smaller individual shareholders.

Bonus Reason: Margin Of Safety

Today especially, REITs are a lot safer because their valuations are a lot lower than those of rental properties.

REIT share prices have dropped a lot in 2022 along with the rest of the stock market (SPY), but real estate prices have yet to adjust lower in any meaningful way.

As a result, you can now buy REITs at a discount to the value of the real estate they own, which provides margin of safety and downside protection.

To give you an example: BSR Real Estate Investment Trust (OTCPK:BSRTF) is a REIT that owns apartment communities in rapidly growing Texan markets. Its assets are highly desirable, it is growing rents rapidly, and it has a low 35% LTV and strong management. Yet, it is currently priced at a near 40% discount to its net asset value, providing a significant margin of safety even if asset values declined a bit going forward.

Owners of rental properties don’t enjoy the same margin of safety. Valuations are historically high today, and affordability is at a near-all-time low.

Bottom Line

REITs are not just more rewarding, they are also a lot safer than rental properties, and especially today.

This is ultimately why I decided to end my career in private equity real estate and became a REIT analyst. Today, the vast majority of my real estate investments are in REITs, and not in private properties anymore.

Be the first to comment