Olivier Le Moal

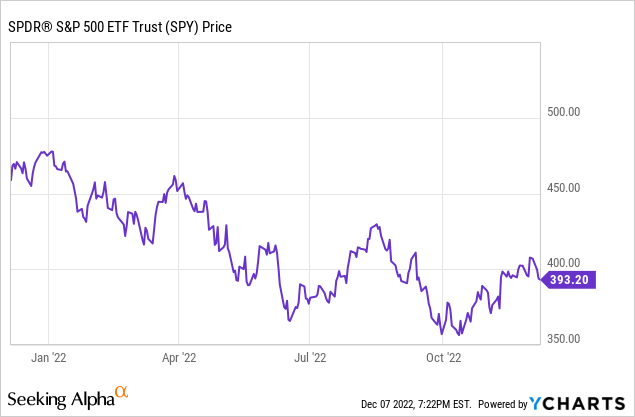

The market made some significant gains in the last month and a half, but that momentum appears to be getting fizzed out now. As we have said before, recently, the market has been all about the Fed policy. When the market gets optimistic that a Fed pivot (a reversal from higher interest rates) is in sight, the market rallies. The Fed, on its part, has indicated that it will slow the pace of rate increases; for example, we now expect only a 50-basis point increase in December instead of 75 basis points. However, there is no pause in sight, at least yet, so the so-called Fed pivot is still elusive at best. Moreover, the yield curve (2-year vs. 10-year treasury rate) has been inverted for some time and is the steepest that it has ever been, indicating a very high probability of a moderate to deep recession in 2023.

That said, irrespective of the market’s short-term movements, as long-term DGI investors, we need to pay attention to the quality of companies that we invest in and the price we pay. In this article, our focus is on selecting and highlighting stocks that have been growing their dividends at a rapid pace and, more than likely will continue to do so in the future for at least the next 3-5 years.

We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right.

Note: Please note that the stocks shortlisted and highlighted in this article are not buy recommendations per se but rather candidates for further research. Please use your due diligence, considering your personal goals and risk tolerance, before making any investments.

Why High Growth Dividend Stocks?

There are two types of dividend stocks that a DGI investor can choose from depending upon their individual situation, goals, and investing time horizon:

- High Growth Low Yield [HGLY]

- Low Growth High Yield [LGHY].

As the names suggest, the HGLY category would have stocks that offer a high rate of dividend growth but usually a low current yield. These stocks would normally have low payment ratios, manageable levels of debt, and rapidly rising earnings.

On the other hand, LGHY-type of stocks would offer a high current yield (generally 3% and higher) but a lower rate of dividend growth. Generally speaking, these companies are more mature and stable businesses that have their hyper-growth period in the rearview but still grow modestly over time to support a low but stable growth in dividends.

Obviously, there will be stocks that fit somewhere in between these two categories, for example, medium growth and medium current yield.

So, who should own HGLY-type stocks? Basically, anyone who is in the accumulation phase and does not need the income currently and/or in the next five to ten years should own some high-growth dividend stocks. In addition, folks, including retirees, who have a large investment capital that generates more income than they need currently (for example, 1.5x or 2x their income needs) should invest at least partially in HGLY type of stocks.

Selection Criteria

We will draw upon our original November data set of nearly 400 stocks, taken from our other DGI series (5 Relatively Safe and Cheap DGI). We will then apply additional criteria to filter out stocks that have provided a high rate of dividend growth in the recent past and are likely to continue on that path for the foreseeable future.

For the month of December, the above dataset contains 362 stocks. To get a complete spreadsheet of this dataset, please see our December 3rd article, “5 Relatively Safe and Cheap DGI.” For the sake of clarity, we will list the original filtering criteria below:

- Market cap > $10 billion ($9 billion in a down market)

- Dividend yield > 1.0% (some exceptions are made to include high quality but lower yielding companies)

- Daily average volume > 100,000

- Dividend growth past five years >= 0.

- Preferably, a minimum of 5 years of positive dividend growth.

Additional Criteria:

A vast majority of these stocks have raised their dividend payouts for five years or more. However, now we will filter out stocks that have increased their dividend payouts by an annual rate of 8% or more. In addition, we will also consider stocks that may not have provided a consistent increase but overall have provided a cumulative 40% increase in payouts in the last five years.

We will now use the following additional criteria to filter out stocks that would fit the mold of High Growth DGI stocks.

- The payment Ratio is less than 70%

- 5-Year Dividend growth is at least 8% or greater. This is in line with the growth rate of the benchmark fund, Vanguard Dividend Appreciation ETF (VIG).

- Chowder number (5-YR Dividend-growth plus the Dividend-yield) >= 10.

After we apply these criteria, we are left with 206 stocks on our list. Please note that at this stage, we have applied our base criteria, but we will now perform additional filtering to get to the best candidates.

We know that for a stock to grow its dividend rapidly, it must grow its earnings at a very high pace as well. Without growth in earnings (earnings per share – EPS), the company cannot grow its dividends for long. Sure, some companies may try to do it by taking on more debt or cutting costs, or spending less on R&D, but that cannot be sustained very long before it starts causing wider issues. So, our focus ought to be on earnings growth.

In our spreadsheet, we will add four more columns of data for each of the stocks:

- EPS (earnings per share) Rating

- Last Qtr EPS change % (actual)

- Current Qtr EPS change % (est.)

- Current year EPS change % (est.).

We will now assign weights to these four sets of data for each stock and add them to the original “Dividend Safety Quality Score” to come up with a modified Quality Score tilted in favor of high dividend growth stocks. We will call this column a High-Growth Quality-Score [HGQS]. We will also import the 5-Yr Average Dividend Yield for each stock.

Note: The Dividend-Safety Quality Score was calculated and taken from the original spreadsheet, as attached in our previous article (5 Relatively Safe and Cheap DGI Stocks for Nov 2022).

The factors and data that were considered to calculate the original Dividend Safety Quality Score were:

- Current Yield

- Dividend growth history (number of years of dividend growth):

- Payout ratio – Preferably based on Free Cash Flow.

- Past five-year and 10-year dividend growth

- EPS growth (average of previous five years of growth and expected next 3-5 years’ growth)

- Chowder number – the sum of the 5-yr dividend growth rate and the current yield

- Debt/equity and Debt/asset ratios

- S&P’s credit ratings (Standard & Poor’s Global Ratings)

- Distance from 52-week high (current price minus 52-wk high price)

- Sales or Revenue growth for the past five years.

Note: All tables in this article are created by the author unless explicitly specified. The stock data have been sourced from various sources such as Seeking Alpha, Yahoo Finance, GuruFocus, IBD, and CCC-List (dripinvesting).

Narrowing Down The List To 40 Stocks

From the above list of 206 stocks, we will select 40 stocks based on the following methodology.

- Top 10 stocks based on the highest HG-Quality-Score

- Top 10 stocks based on the highest 5-yr Dividend Growth (selected 11)

- Top 10 stocks based on the excess yield over and above 5-YR Average Dividend Yield.

- Top 10 stocks based on current discount from 52-week highs.

We will now remove the duplicates from this list as many stocks qualify based on multiple criteria.

Appeared two times: AAP, AVGO, CI, CTRA, INTC, PXD, TSM, VALE (7 duplicates)

Appeared three times: LEN (2 duplicates)

We are now left with 32 names.

Next, we will remove any stock that has an HG-Quality Score of less than 65.

This check will remove seven entries (SSNC, BALL, NRG, INTC, AEM, AMH, NGLOY) from the list, leaving us 25 names.

Lastly, we will also remove any names where the revenue growth (over the last five years) has been negative.

Removed one stock: DVN

Finally, we will also remove any over-concentration from one sector or any one industry segment.

Removed four stocks: CTRA, PXD, FANG, SWKS,

We are finally left with 20 names, which are presented in the table below:

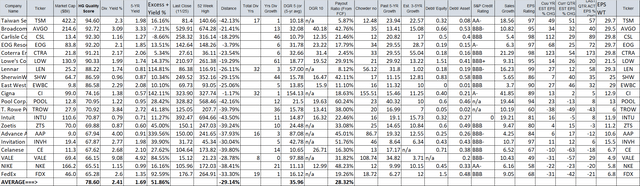

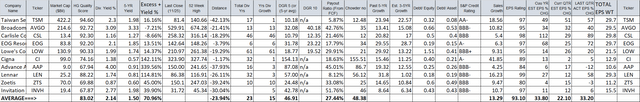

Table 1: Top 20 High Growth DGI Stocks of the month:

Final Step: Selection Of Top 10 High Growth DGI Stocks

To a certain extent, this step is a bit subjective and, to that extent, is based on our perceptions. The readers could certainly differ from some of our selections, and they may come up with their own set of ten companies appropriate for their goals, but they should try to keep the group diversified among different sectors or industry segments. Nonetheless, we describe below how we go about selecting these ten stocks for the month of November 2022.

- As a first step, we will sort out our list of 19 stocks on the basis of the highest quality scores and select the top 5.

- Second, we will select two names from the highest 5-yr dividend growers.

- We will select two stocks from the highest excess yield (current yield minus 5-yr-average yield).

- Lastly, we will select at least one name based on the highest EPS score, provided the stock is not already selected.

Here is the final top 10 list:

December list: (TSM), (AVGO), (CSL), (EOG), (LOW), (CI), (AAP), (LEN), (ZTS), (INVH).

November (previous month) list: (AVGO), (DHI), (EOG), (ODFL), (CSL), (AAP), (CI), (MPWR), (KLAC), (TROW).

List of stocks that are common in the current and previous month lists: AVGO, EOG, CSL, CI, AAP.

Note: Please note that if a stock was in a previous month’s list but is no longer selected in the current list, it does not mean the stock is no longer a good choice. If the stock has still scored an HG-Quality score of >70, we think it could still be a buy or hold. The purpose here is to simply highlight the top candidates every month. Please perform further research and your due diligence before making any buy or sell decisions.

Table 2:

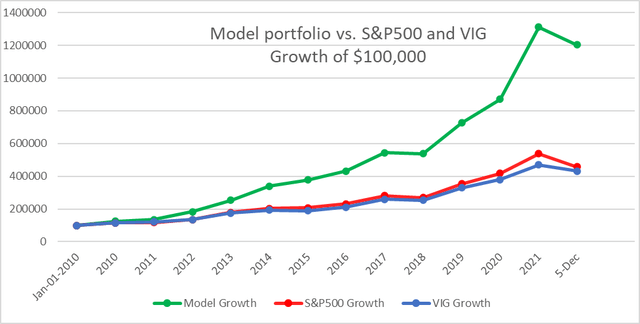

Past Performance

If we were to compare the performance of these ten stocks and compare with the S&P500 and benchmark ETF VIG, the results would be quite encouraging. We assume that our model portfolio was invested equally in the ten selected stocks from Table 2. The performance comparison is for the period from Jan-01-2010 to Dec-05-2022. Please note that INVH did not have a history prior to 2018, so it was excluded prior to 2018. Similarly, ZTS did not have a history prior to 2013, and it was excluded prior to 2013. Also, please keep in mind that past performance is no guarantee for the same level of success in the future.

Chart-1:

How To Structure A Portfolio Based On This Series

Though it would depend a great deal on your personal goals, risk tolerance, investment methodology, and choices; however, if you wish to make a portfolio based on this monthly series, here is one way to do it:

-

- Make a portfolio budget and provision to have a maximum of 25 stocks over time.

- Divide your capital (current + future) into 25 equal parts.

- The first month, buy the 10 (or less if you desire) positions based on the 10 top stocks for that month.

- From the next month onwards, check for the new stocks appearing in the top 10 list that are not part of your portfolio, and add (as many as your process and budget allow).

- Repeat step 4 until you reach the max 25 positions.

- When you have reached the max 25 positions, and you have no more capital to add, look for new stocks that have made it to the top 10 list and see if anyone of them should be added based on your further research. If you decide to add a position, then you need to find a position that you would like to drop and replace with the new one. You can find an existing position to drop that has not made it to top-10 during the last several months (for example, during the last six months).

- It may also be recommended to monitor your positions periodically, preferably monthly.

Concluding Remarks

In the first week of every month, we publish a broader list of DGI stocks that we think would be relatively safe and appropriate for most DGI investors. We provide three lists targeted for different yield goals. It includes all three types of dividend stocks, for example, high-yield low-growth, moderate-yield moderate growth, and low-yielding high-growth stocks. However, in this article, we primarily focus on High-growth dividend stocks, which are likely to offer a high rate of dividend growth but may not offer high current yields.

Based on our rule-based filtering process, we narrowed down the list to roughly 20 stocks. As a final step, we subjectively select ten stocks that form a diversified group and will likely offer high growth at reasonable values.

The top 10 list yields 2.14%, which is slightly higher than 1.90% from the benchmark Vanguard fund, VIG. Also, it is nearly 70% higher than the 5-year average yield for the group. Moreover, the 5-yr dividend growth for this group is much higher (>45%) compared to 8% for VIG. The larger group of 20 stocks yields even higher at 2.40%. Both groups are highly diversified into many sectors and industry segments.

Be the first to comment