stevecoleimages/E+ via Getty Images

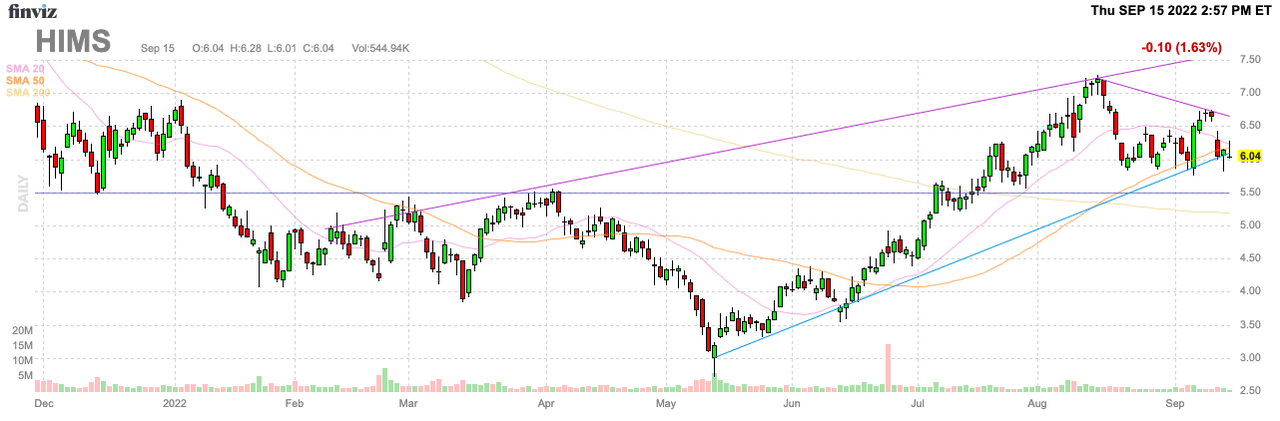

The recent price action on Hims & Hers Health (NYSE:HIMS) highlights why a downturn in a sector can be just what a company needs. The telehealth sector overheated during COVID lockdowns, and the weakness in the sector stocks has likely driven away the competition. My investment thesis is much more Bullish on the stock now, with business booming and the stock still trading at only $6.

FinViz

Subscription Surge

When Hims & Hers when public via the announced SPAC deal back in late 2020, the company had solid subscription growth. The growth rate just wasn’t compelling enough to pay up for the stock with the surge to $15 and even $20.

Now, the company has reported back-to-back quarters with over 100K net new subscriptions. In the process, Hims & Hers has all but eliminated the ongoing large losses that added to the original sour investor mood.

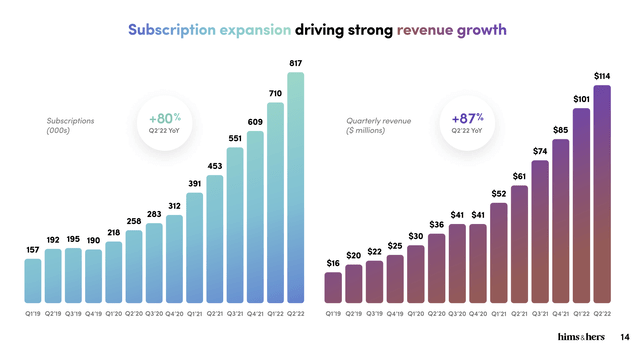

Hims & Hers Q2’22 Presentation

For Q2, the online prescription platform added 107K net new subscriptions, driving the total to 817K. Hims & Hers now derives $114 million in quarterly revenue, mainly from these subscriptions.

The investment story has completely changed since the Q2’20 days where revenue growth was sequentially flat at $41 million to the current environment where revenues were up over 10% sequentially to $114 million. The online platform appears to face far less competition now with the sector hype gone.

The guidance suggests the story is only improving as Hims & Hers launches new modules and products. The company guided to Q3’22 revenues of $129 to $132 million, with the yearly guidance predicting another sequential increase in Q4 to reach the $470 to $485 million sales targets for 2022.

The recent move into skincare is providing the next growth stage. The Hims & Hers skincare collection includes a facial cleanser, moisturizer, daily SPF, amongst others. The skincare products are sold at CVS Pharmacy and online.

Unfortunately, Hims & Hers had to double marketing expenses from $28 million last Q2 to $60 million in the last quarter in order to drive these higher subscriptions. The company has to obtain far more leverage from marketing, which includes maintaining the subscriptions obtained in the last couple of quarters from the higher spending. The downfall of a lot of companies has occurred from building a business model purely on heavy marketing efforts that aren’t sustainable.

Hims & Hers took advantage of the favorable advertising environment and reduced competition in the online prescription area to ramp up brand marketing. If successful, the company could’ve easily built the best-known and most trusted telehealth provider in the sector.

Solving The Last Problem

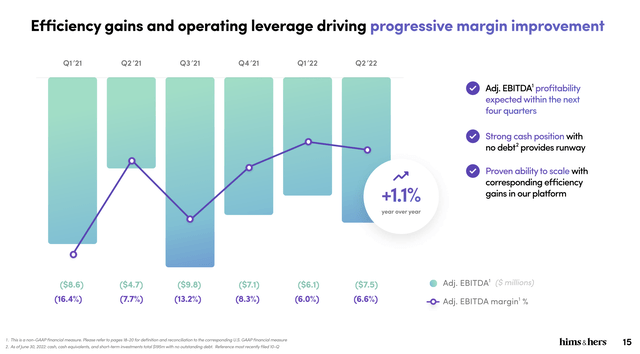

Analysts currently have Q4’22 revenue targets at $135 million, or what amounts to an annualized run rate of $540 million. The company forecasts being adjusted EBITDA profitable within the next year and growing quarterly revenues by $21 million in the 2H of the year with nearly 80% gross margins quickly erases a $7.5 million EBITDA loss in the June quarter.

Hims & Hers Q2’22 Presentation

Management points to some solid margin improvements, but a company growing revenues at this clip should easily obtain much more leverage than a 110 basis point improvement. The stock is stuck at just $6 for this reason.

Hims & Hers has a market cap of only $1.2 billion now, but the company has tons of dilution ahead with an expected stock rally. The diluted share count could easily surge from the 204 million level listed to closer to 230 million due to the additional RSUs and stock options that become dilutive when the company reports a profit.

The company has 14.5 million outstanding stock options with only 8.2 million exercisable now. In addition, Hims & Hers has 9.1 million outstanding RSUs for a combined dilution of 23.6 million shares, if the stock rallies from here.

Takeaway

The key investor takeaway is that Hims & Hers is far more appealing trading at only 2x 2023 sales targets. The company faces less competition in the space allowing for further brand building. The biggest catch is the lack of profitable growth and any signs of leverage in the system with reduced spending on marketing will send the stock much higher to match the growth rates.

Be the first to comment