PJPhoto69/E+ via Getty Images

Introduction

Last week, I shared my thoughts on Planet Labs’ (NYSE:PL) upcoming fiscal Q2 earnings. Now the report is out, it’s time to assess how the company’s performance aligns with my investment thesis.

Simply put, the results support my conviction in the business. This quarter, on the back of a solid Q1, is a statement to the market, and the rapid acceleration in growth hints at the long runway ahead of the company.

A single quarter, however, does not make a company. Plenty of work remains to be done, but I’m encouraged by the results and confident in management.

Q2 Breakdown

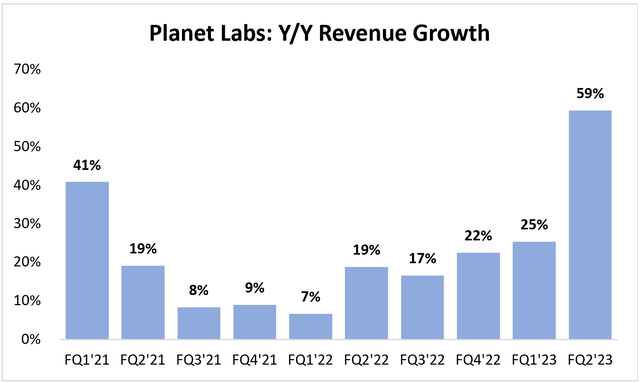

Revenue grew 59% Y/Y and 21% Q/Q to $48.5 million. A significant acceleration from historical growth rates, this supports management’s belief that capital (or lack thereof) was the primary constraint to growth. Flush with over $400 million in cash from going public, the company is quickly executing.

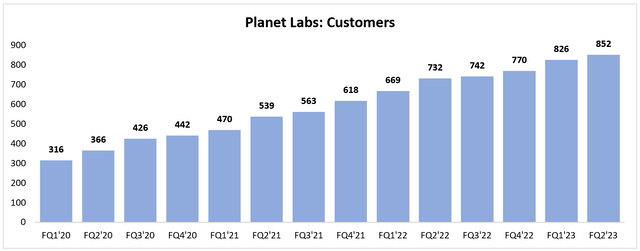

Customer count increased 17% Y/Y to 852. Although customer adds were somewhat low, the trend continues in the right direction, so I’m unphased.

The significant growth in spend by existing customers demonstrates the success of Planet’s “land and expand” strategy. The NDRR (net dollar retention rate) jumped from 105% last quarter to 125% in Q2. Accounting for winbacks (customers who have left and returned), this metric reached 127%.

It is worth mentioning that Planet reports this metric based on ACV (annual contract value) at the beginning of the fiscal year while most companies report it on a Y/Y basis.

By comparing the NDRR in Q2 of last year to the Q4 result last year (the basis for the reported number this year), we can calculate a more traditional number for NDRR. Using this approach, the implied NDRR on a Y/Y basis is ~150%, putting Planet in the same league as several hypergrowth firms.

This metric can function as a gauge of Planet’s success in extracting additional value from customers through new use cases or new geographies. As is clear from the results (and management’s commentary), the company has been incredibly successful in this department.

My thesis largely rests on this use case expansion – made possible by “software-izing” the raw data to derive analytics and predictive algorithms.

As an example of the efficiency gained from Planet’s data, LiveEO uses it to monitor the encroachment of undergrowth on power lines and pipelines. Rather than having to send someone to assess the site in person, an employee can automate daily monitoring on Planet’s platform and be notified at certain points, a much more efficient proposition.

Given the importance of use case expansion, let’s go over a few examples of how customers use Planet’s data and how I think of the possible evolution.

On the FQ3 2022 call, management mentioned Planet data is used by:

- The Federal Emergency Management Agency to assess damages and plan recovery following natural disasters;

- The National Reconnaissance Office to monitor areas of interest; and

- Taranis to help farmers and crop consultants make more informed decisions.

On the FQ4 call, management explored a few more use cases.

- The Welsh government uses Planet data for natural resource management, mapping, and policy measurement.

- SwissRe incorporates the data into its underwriting models for insuring farmers against drought in Europe and Central Asia.

- SynMax uses Planet data to forecast trends in the oil and gas market as well as track “dark” vessels carrying out illegal activity at sea.

Several more in FQ1 2023:

- Bayer analyzes Planet data to understand historical and in-season crop performance and generate insights to support farmers globally.

- Moody’s (NYSE:MCO) is exploring the value of Planet’s data within ESG, supply chain monitoring, commercial real estate, and more.

- Natural Resources Canada uses Planet’s data for emergency management and response planning.

And finally, the FQ2 call added:

- The German Federal Agency for Cartography and Geodesy uses Planet data for crisis response and forest / agriculture monitoring across the country.

- The New Mexico State Land Office uses Planet’s road detection analytics to detect trespassing violations (uncovered $1 million in violations thus far).

- Organic Valley measures pasture health on dairy farms using Planet data (contract set to grow 5x this year).

Most use cases can currently be classified under the umbrella of government or agriculture. But, my thought is this doesn’t account for the work yet to be done on the software side.

For most of these customers, the economic value is derived from layering their own sophisticated algorithms on top of Planet data. Other industries (supply chain, finance, energy, construction, etc.) do not have the requisite geospatial experts to accomplish this.

For that reason, Planet has been developing in-house analytical capabilities. Over the last year, software headcount has increased 55%, which should support use case expansion across industries.

Over the long term, I believe government and agriculture purposes only scratch the surface of the utility a daily, global Earth dataset can deliver.

Profitability

Of course, the primary driver of stock prices in the long-term is a company’s ability to generate free cash flows. While Planet still spends more than it brings in, the company is headed in the right direction.

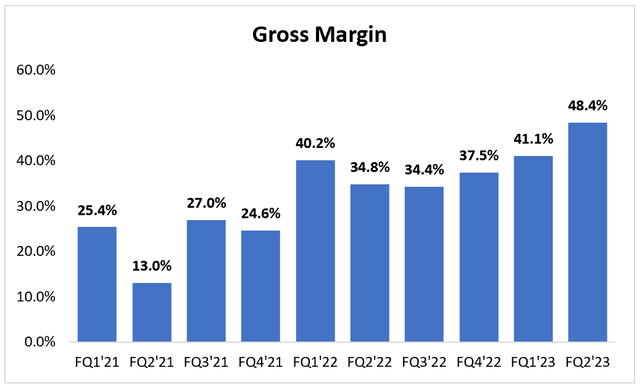

As I’ve frequently mentioned, Planet’s one-to-many subscription model enables a rapid scaling of gross margin as incremental revenue comes with little to no direct costs. This has driven a 1400 basis point increase in gross margin over the three quarters it has been public.

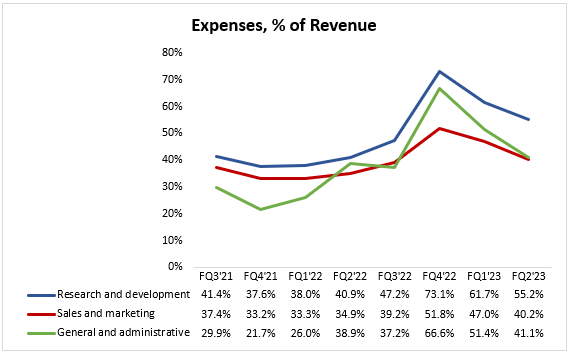

Operating expenses ballooned after the company went public as investments quickly ramped up. Since then, however, expense growth has moderated, demonstrating the business’ operating leverage. All cost centers have declined as a percentage of revenue since FQ4 2022.

Author’s Calculations

Conclusion

The crux of an investment in Planet is revenue growth. If the company can continue to succeed in this department, returns will naturally follow, provided management does not overspend for growth. This quarter hints at the company’s opportunity, as well as management’s ability to execute profitably.

The stock market is a long game, however, and this remains a single quarter. With that said, I’m willing to bet a quarter like this becomes the norm, not the exception.

Be the first to comment