Denis_Vermenko/iStock via Getty Images

Many tech stocks have seen a decent bounce off their recent lows, as in the case of Apple (AAPL), Salesforce (CRM), and Meta (FB). This hasn’t been the case with Cisco (NASDAQ:CSCO), however, as it currently finds itself trading at the low end of its range since February, and is well below its 52-week high of $64 achieved in late December. This article highlights what makes Cisco a good and safe choice for healthy returns, so let’s get started.

CSCO: Why It’s Time To Hop On This Total Return Train

Cisco is the world’s leading networking company, supplying businesses of all sizes with switches, routers, cybersecurity, and complementary networking products. It benefits from its comprehensive suite of networking gear, and from the institutional knowledge base that it’s built up over decades.

This is reflected by the high number of Cisco Certified professionals and by its installed base, which reinforces its incumbency, especially with large enterprises. Morningstar reflects on what it views as a narrow moat for Cisco, as supported by the following commentary in its recent analyst report:

Cisco’s products are mission critical for network performance, stability, and security. Cisco is proliferating software, analytics, wireless, and security offerings to satisfy nascent trends, and we see Cisco as the only one-stop-shop networking vendor. We believe that Cisco is uniquely positioned to interweave complimentary necessities, like networking and security, together to provide comprehensive solutions for clients.

Cisco is benefiting from heightened demand for its products, with product orders increasing by 33% YoY during Q2 FY’22 (ended in January 2022). This marks the third consecutive quarter of more than 30% total product order growth, and was driven by service provider orders increasing by 42% YoY and the Internet for the future business was up 42% year-over-year, led by web-scale cloud customers.

Revenue grew by 6% YoY in the latest quarter, and Cisco continues to make progress towards a subscription-based model, with annualized recurring revenue being up by 11% to $22B during the second quarter.

Looking forward, Cisco’s growth trajectory is showing no signs of slowing down, as it has a record backlog of $14 billion. One potential headwind is in the company’s ability to deliver amidst the current challenging supply environment, which may take time to fully resolve.

In addition, an increasing number of customers migrating to the cloud presents another headwind. Management doesn’t view this as being a near-term threat, however, as they emphasize a multi-IT environment. This was highlighted by the general manager of Cisco’s Security Business Group during this month’s technology industry conference:

Architecture investment is also key because we are in this hybrid world. As much as we all talk about workloads moving to the cloud, what you find is only 15% to 20% of the workloads are moving to the cloud. Only 5% of IT spend is actually in the cloud. So, customer environment is multi IT. It’s on-prem. It’s in the cloud. It’s in the data center.

So, every customer is looking for a security reference architecture. And we invest a lot of time in making sure that we meet the customer where they are, as opposed to prescribing a solution. It’s not about ease of deployment and ease of manageability or simplicity of a solution. What is important to us is depth of efficacy. That’s what we focus on.

Meanwhile, Cisco maintains a stellar AA- rated balance sheet with just $8.97 billion worth of debt sitting against an impressive $21.1 billion worth of cash and short-term investments. It’s also rather shareholder-friendly, as it returned $6.4 billion of cash to shareholders during the latest reported quarter, comprised of $4.8B worth of share repurchases, and $1.5B towards dividends.

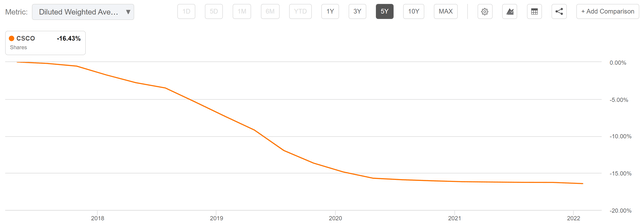

Last month, Cisco added another $15B towards its buyback program. As seen below, it retired 16% of its outstanding shares in just the past 5 years alone.

CSCO Shares Outstanding (Seeking Alpha)

Meanwhile, it pays a 2.8% dividend yield that’s well-covered by a 44% payout ratio, and it comes with a 5-year dividend CAGR of 7.3% and 10 years of consecutive annual growth.

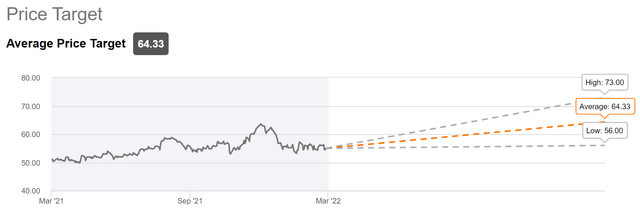

I see value in the stock at the current price of $55 with a forward PE of 16. This is considering the quality of the enterprise, strength of the balance sheet, and the 9%-10% EPS growth that analysts expect in the second half of this fiscal year. Sell side analysts have a consensus Buy rating with an average price target of $64, implying a potential one-year 19% total return including dividends.

CSCO Price Target (Seeking Alpha)

Investor Takeaway

Cisco is a solid pick for those looking for growth and income in the tech sector. It’s transitioning well towards recurring revenues and is seeing very strong demand backed by a record backlog. Meanwhile, it maintains a very strong balance sheet and it’s buying back shares at a brisk pace. I view CSCO as being a sound choice at present for risk-averse investors who prize long-term total returns.

Be the first to comment