US PMIs, US Dollar – Talking Points

- U.S. S&P GLOBAL AUGUST FLASH COMPOSITE PMI AT 45.0

- U.S. S&P GLOBAL AUGUST FLASH SERVICES PMI AT 44.1

- U.S. S&P GLOBAL AUGUST FLASH MANUFACTURING PMI AT 51.3

US flash PMI data came in well below expectations this morning, further stoking fears that the US economy may be grinding to a halt. Services and composite both fell into contraction territory, while manufacturing remained above the key “50” threshold. Readings below 50 are considered to be “contractionary” while readings above 50 are deemed to be “expansionary.” The dismal readings saw the US Dollar sink from recent highs above 109, despite the challenges that face major constituents of the DXY basket. Following the release, EURUSD traded back up to parity while GBPUSD soared through 1.1850. US equities also benefitted from the cooldown in the Greenback and US yields, with the Nasdaq 100 leading markets higher by roughly 0.70%.

Economic data remains top of mind for market participants as it appears FX markets remain driven in the near-term by growth differentials. Despite hiking rates, the European Central Bank and Bank of England simply cannot buy a stronger currency, no matter what they do. Weaker currencies across Europe have worsened inflationary pressures, creating a loop as central banks are forced to tighten even more. This may explain why recent rate hikes from the BoE and other G7 central banks have seen domestic currencies drastically sell off, as market participants price in the impact of higher rates on future economic activity. On top of this, USD outperformance only rubs salt in the wounds.

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

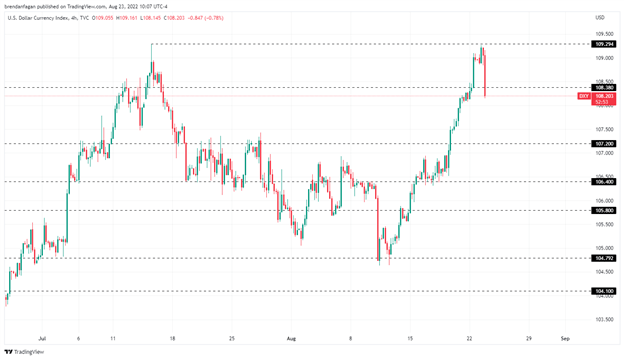

The US Dollar has been on a tear of late as traders look cautiously to the Fed’s Jackson Hole Economic Symposium later this week. As policymakers and economists gather to discuss the current state of affairs, FX markets may be prone to volatility. With EURUSD breaking well below parity, the US Dollar Index has soared up to 109 before cooling following this morning’s data. Price has broken through support at 108.40 as traders digest growing recessionary concerns in the US. If these fears continue to grow, we may see a further pullback into the 107.50 area. The Dollar’s recent advance stalled out at 109.29, which coincidentally marked the July peak. This potential double-top formation could usher in lower prices in the coming sessions. That being said, all may hinge on what Fed Chair Jerome Powell says in his remarks on Friday. It should be noted that this pullback is being driven by USD weakness, and not necessarily by the strength of US peers.

US Dollar 4 Hour Chart

Chart created with TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

Be the first to comment