Darren415

Canopy Growth (NASDAQ:CGC), once at the top of the cannabis investing world, now finds itself in a bit of an identity crisis. The stock has delivered poor returns over the past several years, which may in part have inspired management to begin diversifying away from its cannabis roots for example through its emphasis on its beverage line BioSteel. The company continues to struggle selling cannabis profitably at scale which, combined with a bloated operating expense structure, has led to a vicious deterioration of the balance sheet. While I continue to find the stock buyable, I caution that it is solely due to valuation and the prospects for success remain far lower than the peers in the south.

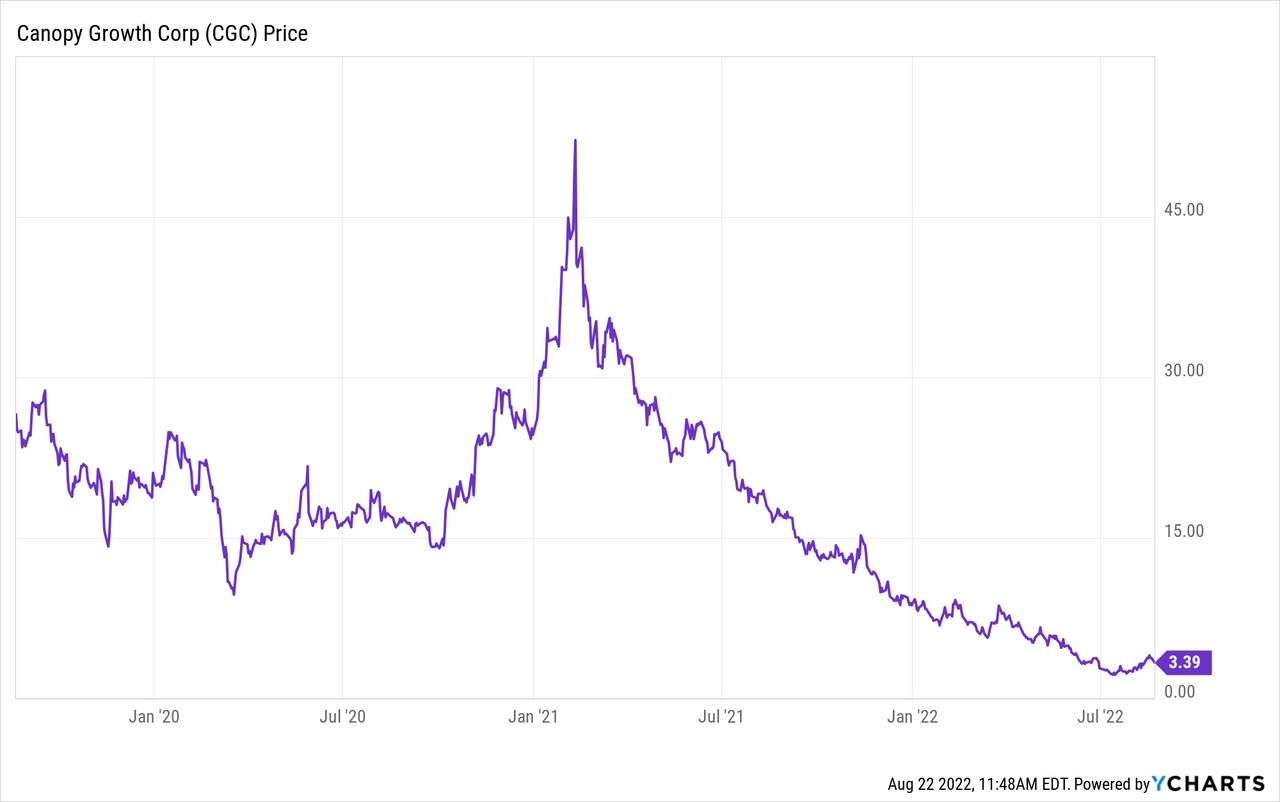

CGC Stock Price

CGC shareholders have had a tough ride. The stock is down 80% over the past year and 90% over the past three years.

I last covered CGC in May where I discussed the hidden value in the stock. CGC has since declined another 30%, though valuation has not been the problem with the stock for quite some time already.

What Were Canopy Growth’s Expected Earnings?

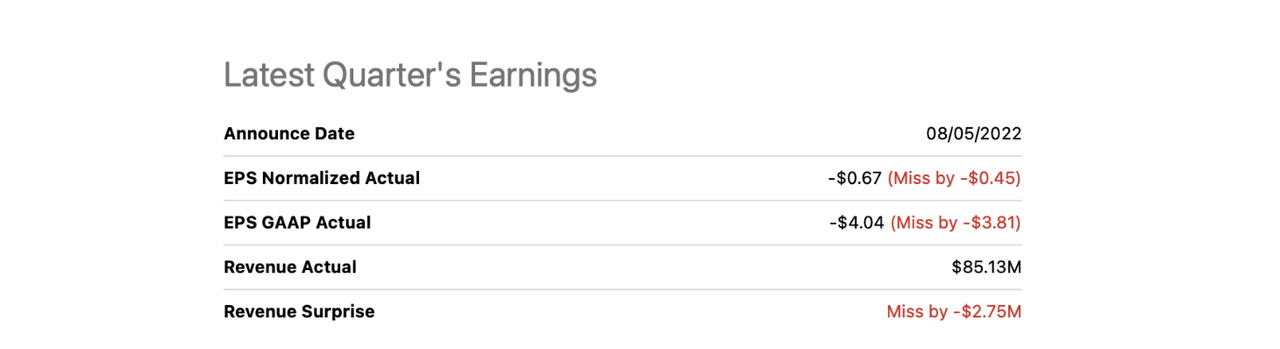

After many years of disappointing earning results, Wall Street has come to expect mild top-line growth and large operating losses.

Did Canopy Growth Beat Earnings?

Based on that expectation, CGC did not surprise, though the company did report greater than expected losses.

Seeking Alpha

CGC Stock Key Metrics

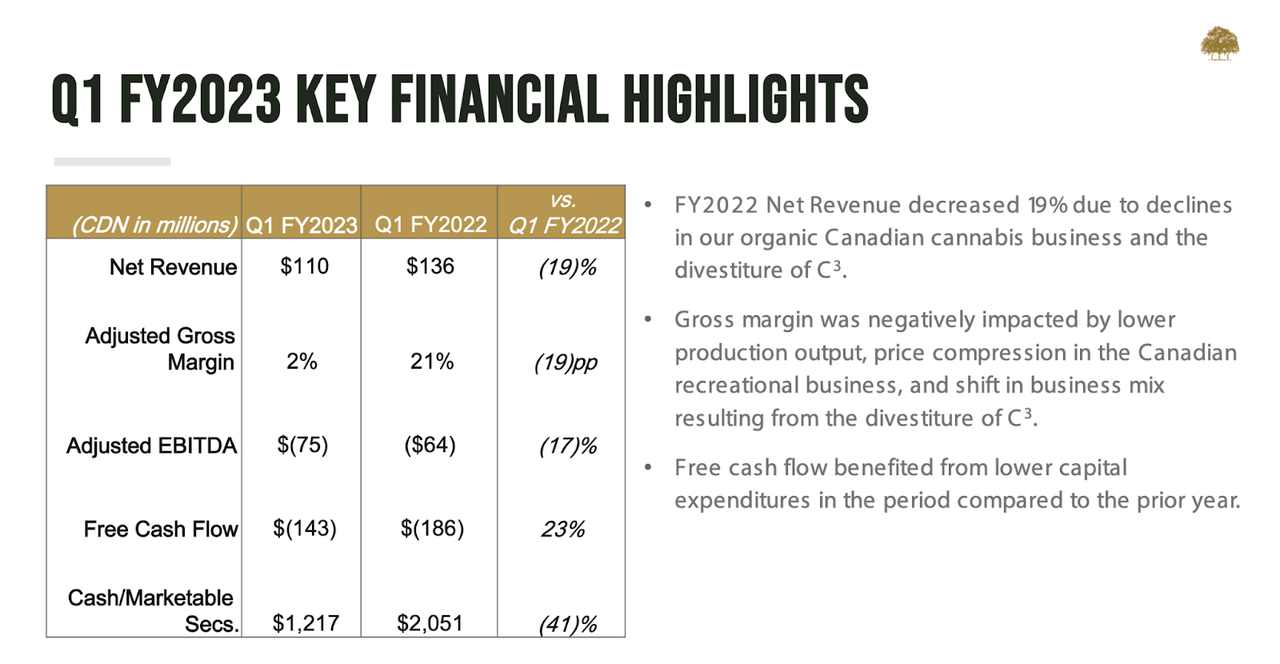

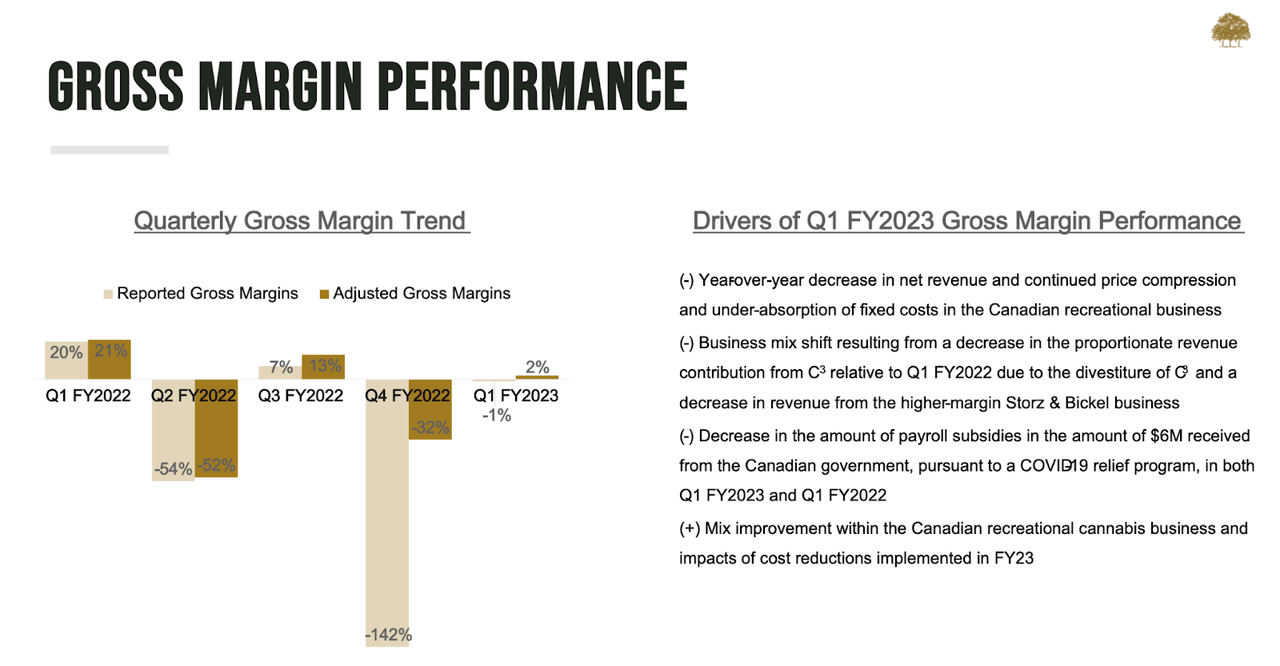

The financial disappointment stemmed from two main factors: disappointing growth and poor margins. CGC saw revenues decline 19% year over year, with gross margins also compressing 19% to stand at only 2%.

FY23 Q1 Presentation

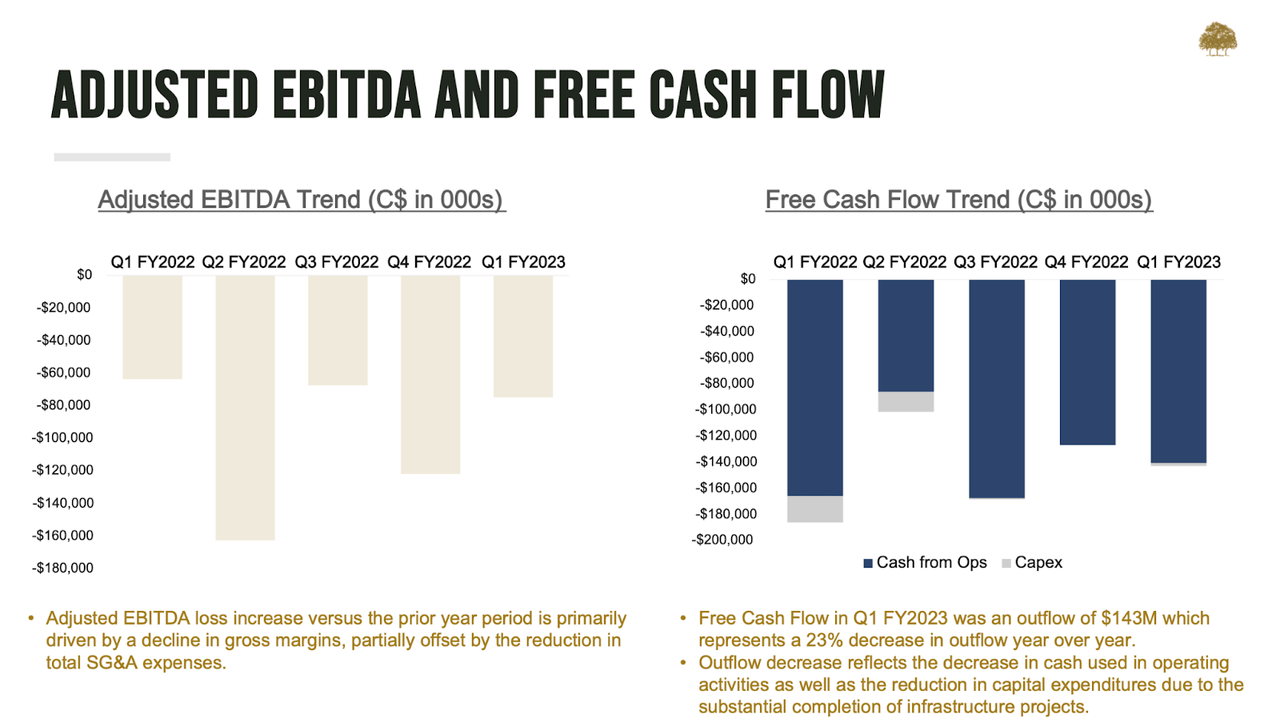

The company burned through $143 million of free cash flow in the quarter, bringing its cash balance down 41% to $1.2 billion. The company ended the quarter with $1.5 billion of debt. This stock was once highly touted for its net cash balance sheet after alcohol company Constellation Brands (STZ) made a $4 billion investment in the company in 2018. That thesis has gone up in smoke, and CGC is even now at great risk of eventually ending up with a highly indebted balance sheet position.

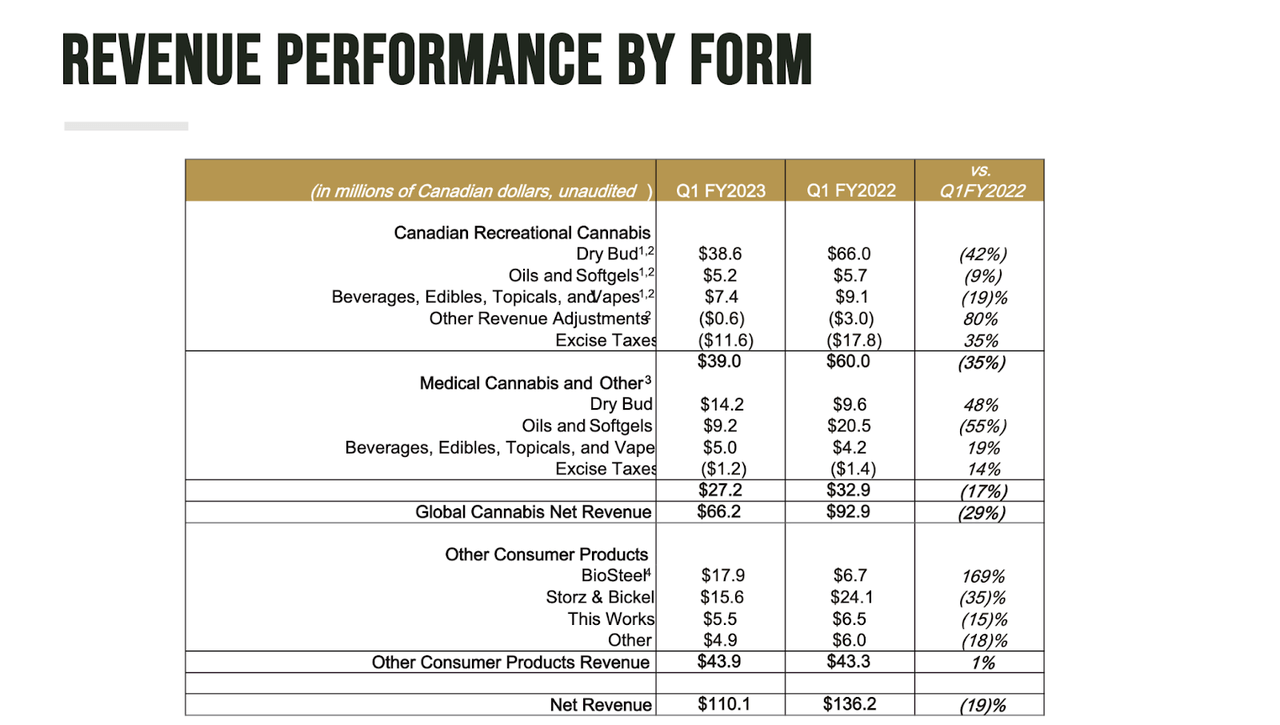

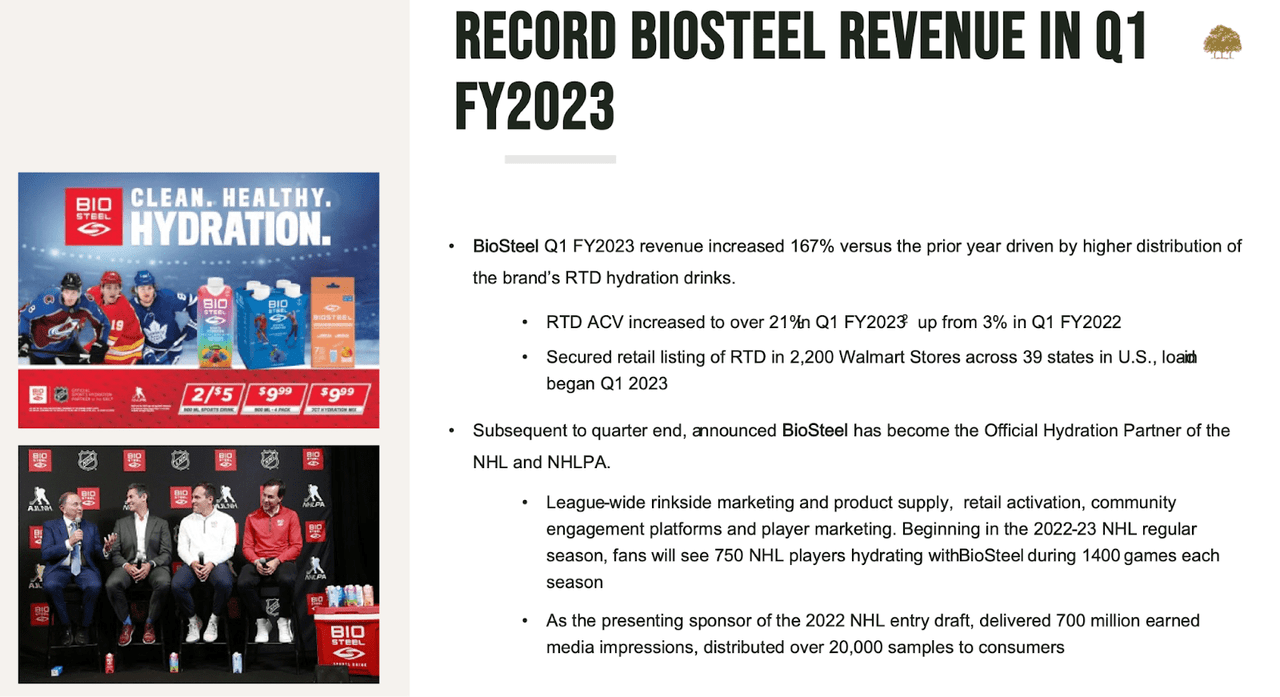

We can see below that the company saw great weakness in its cannabis operations, with revenues declining 29% globally. The company was able to offset the weakness with strong 169% growth in BioSteel.

FY23 Q1 Presentation

Regarding BioSteel, CGC has seemingly begun emphasizing this business segment. BioSteel has become the official hydration partner of the NHL and NHLPA.

FY23 Q1 Presentation

BioSteel also earned Walmart as a retail seller, with the initial agreement bringing the beverage to 2,2000 stores across 39 states.

The 2% adjusted gross margin posted in the quarter was actually a solid mark as compared to the past few quarters.

FY23 Q1 Presentation

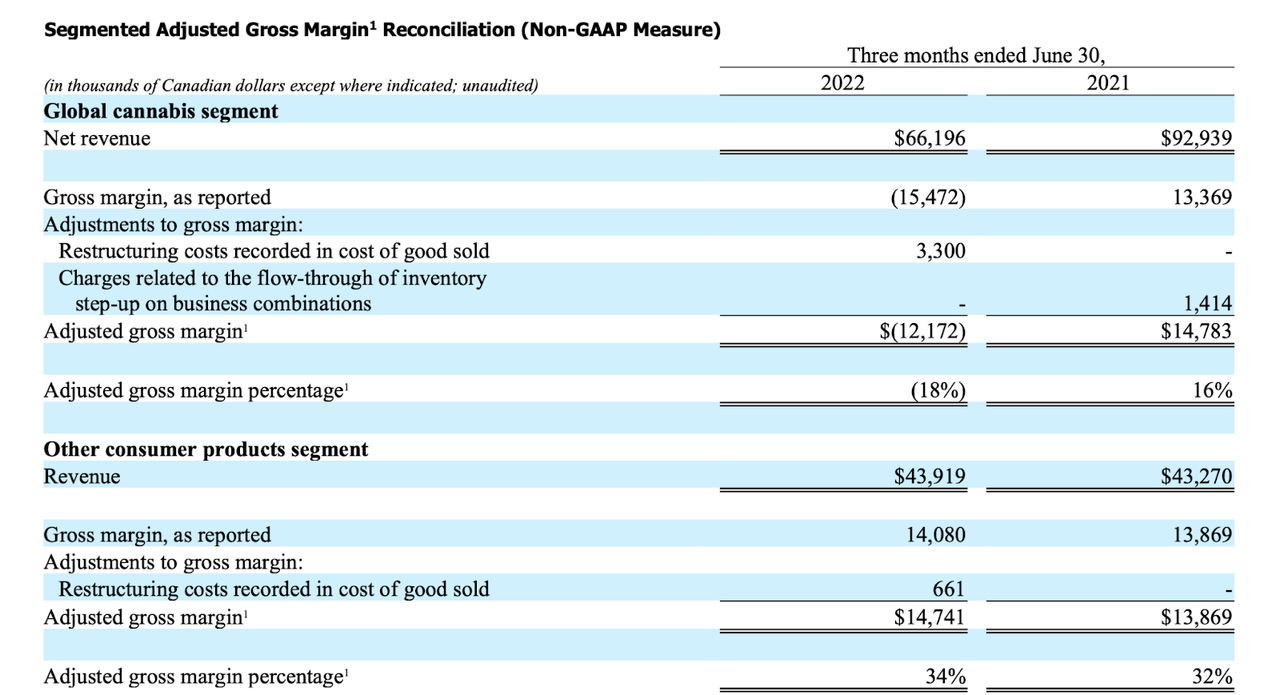

We can see below that whereas cannabis gross margins were -18%, the 34% gross margin of the non-cannabis business segments helped to offset that.

FY23 Q1 Press Release

I note that the -18% gross margin of the cannabis business already accounts for any restructuring costs.

These poor gross margins were only exacerbated by high operating expenses. CGC reported yet another quarter of free cash flow burn.

FY23 Q1 Presentation

What To Expect After Earnings

Looking forward, CGC expects more cost savings in the second half of the year. On the conference call, management reiterated its guidance that it is “on track to achieve positive adjusted EBITDA in fiscal 2024, excluding our strategic investments in BioSteel and US THC.”

It is worth reminding readers that management has a long history of disappointing on profit guidance – it had previously guided for positive adjusted EBITDA in the second half of fiscal 2022 (the latest quarter was Q2 FY23).

Is CGC A Good Investment Long-Term?

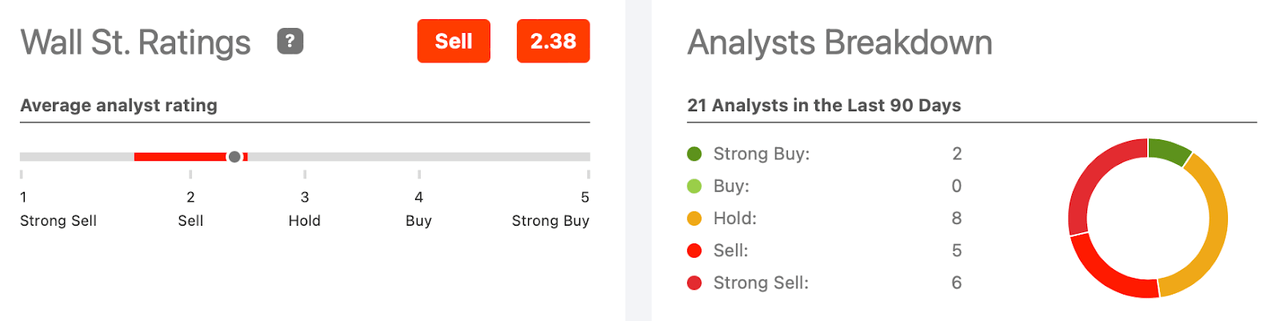

Wall Street appears to have lost faith in the stock. The average rating is 2.38 out of 5.

Seeking Alpha

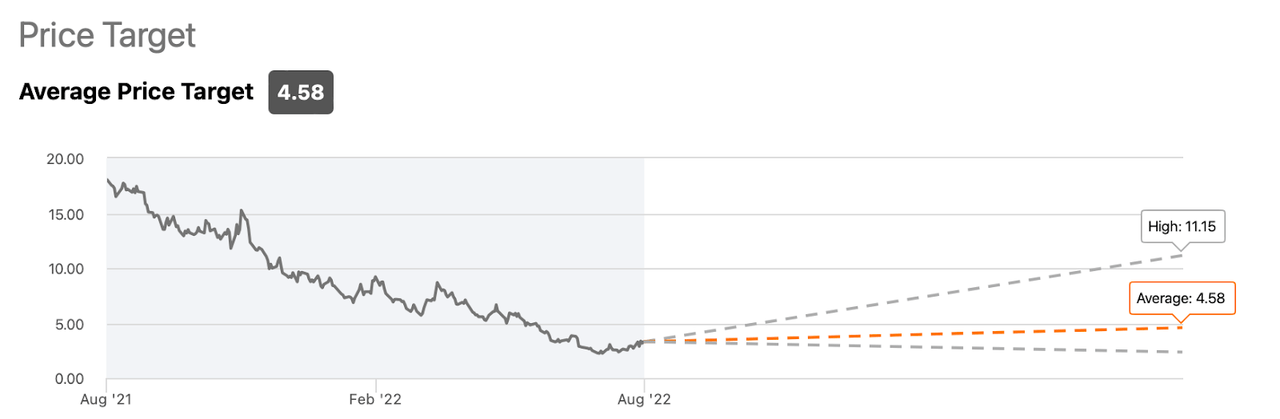

The average price target of $4.58 per share implies nearly 40% potential upside.

Seeking Alpha

CGC is expected to see revenue growth accelerate meaningfully over the coming years.

Seeking Alpha

I caution that such expectations have been quite normal as of late, namely, investors have been hoping for acceleration in growth rates to be “just around the corner” for many corners now. CGC will need the Canadian legal market to take market share from the illicit market for that growth to materialize.

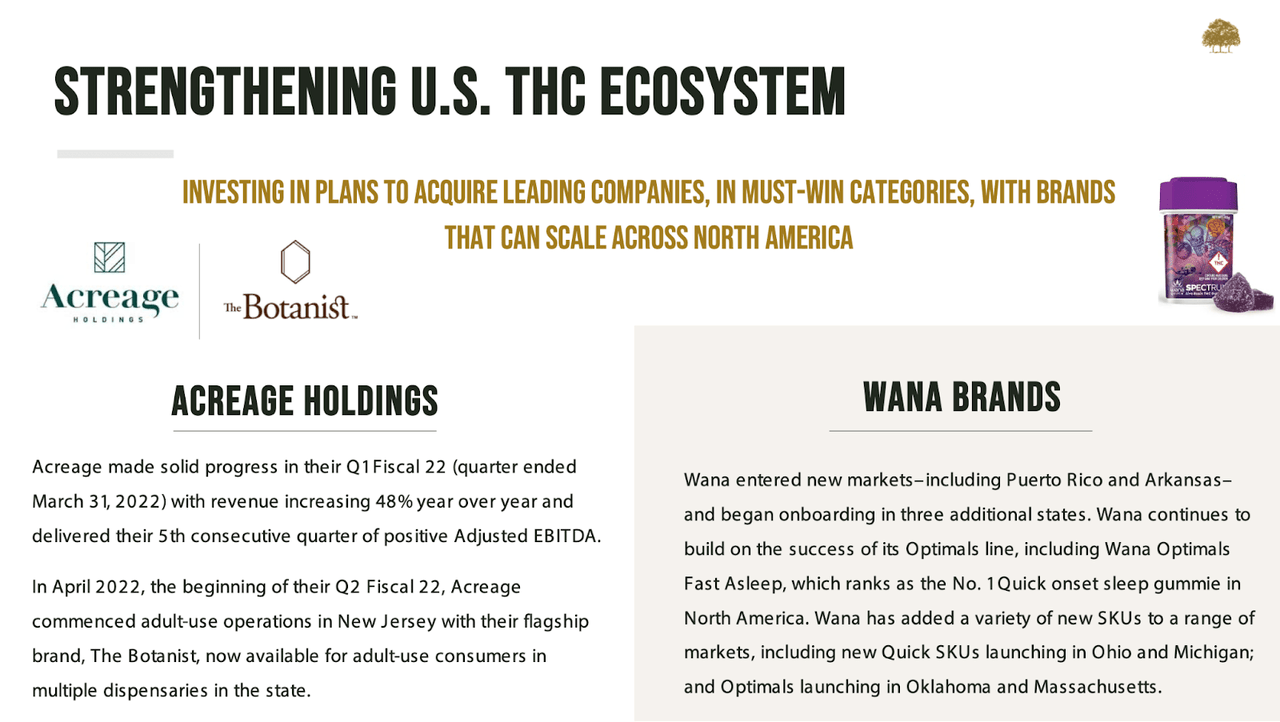

Over the long term, CGC has tried to position itself in preparation of federal legalization of cannabis in the United States. CGC has done this through its investments in multi-state operators (‘MSOs’) Acreage (OTCQX:ACRHF) and TerrAscend (OTCQX:TRSSF) as well as the edibles company Wana Brands.

FY23 Q1 Presentation

Is CGC Stock A Buy, Sell, or Hold?

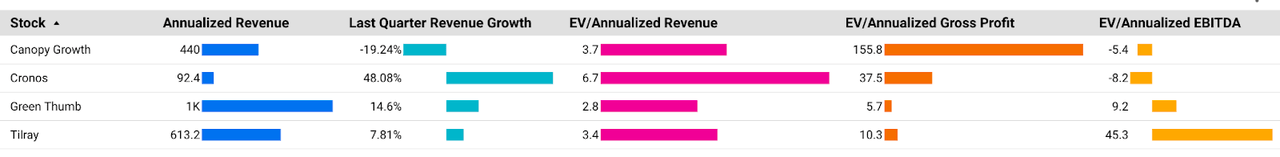

CGC trades at some discount to Canadian peer Cronos (CRON) but at a premium to Tilray (TLRY) and an even bigger premium to the US operator Green Thumb (OTCQX:GTBIF).

Cannabis Growth Portfolio

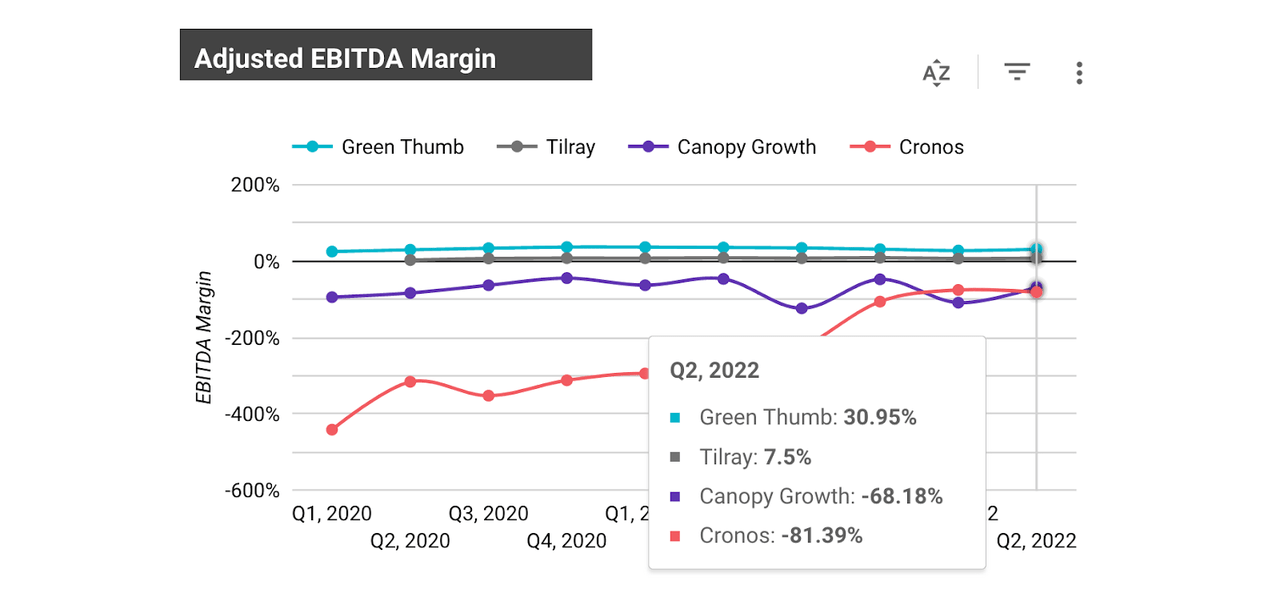

What’s more, it’s worth noting that unlike the margins posted by public Canadian cannabis operators, GTBIF generates robust adjusted EBITDA margins and even generates positive GAAP net income.

Cannabis Growth Portfolio

That achievement is even more remarkable when one considers that US cannabis operators pay egregious corporate tax rates due to being unable to deduct operating expenses from taxable income. Canadian operators are not encumbered by the same difficulties, yet they still struggle mightily even with EBITDA profitability (or in CGC’s case, unit-level profitability). At 3.7x annualized sales, the valuation makes sense for a lottery-ticket-sized position in the stock. That hasn’t always been the case as CGC had previously traded at bubble valuations.

The risks should not be ignored. CGC has already burned through its net cash position and now stands with net leverage. The company is burning through around half a billion dollars annually, meaning that this may quickly become a financial solvency risk. There is no clear indication that margins should improve in Canada, and legalization in the United States may likely be many years away. The company may eventually need to try to sell off its investments in US operators, but given where prices stand today, it might end up doing so at poor valuations.

Many institutional investors are unable to invest in the stocks of US cannabis operators due to cannabis still being illegal at the federal level. In that case, I could see the argument for owning some exposure to the stocks of Canadian operators like CGC. However retail investors typically are not constrained by such restrictions and it is hard to justify buying cash-guzzling stocks like CGC when US cannabis operators are showing strong fundamentals with even cheaper stock valuations. Moreover, CGC seems to be a play largely centered around US legalization, but I expect legalization to benefit US operators to a much greater degree.

Be the first to comment