DisobeyArt

Commercial vehicles are an often overlooked part of the transition to electric vehicles. These are used for tasks ranging from cargo and mass passenger transportation to last-mile package deliveries. Vancouver-based GreenPower Motor (NASDAQ:GP) manufactures a range of electric buses and vans for the somewhat nascent but fast-growing North American commercial EV market. The global market for this is huge and set to experience double-digit growth for the foreseeable future on the back of private companies and municipalities across the world pushing to reduce their carbon footprint, eliminate local air pollution, and future-proof their economies. Indeed, analysts expect the market to grow at an 11% compound annual growth rate between 2021 and 2027 from 2020 sales of around $28 billion.

This comes against the passing of The Inflation Reduction Act which allocates $370 billion over 10 years to decarbonization initiatives meant to supercharge the rollout of EVs in the US. Management was extremely upbeat on the bill during the recent earnings call, highlighting the $40,000 tax credit for Class IV vehicles which GreenPower is eligible for as its primary manufacturing facility is based in California. This is important as the bill includes a new requirement for qualifying cars to be assembled in North America, a quandary that has left some of its EV peers who outsourced production to Europe or Asia in the dark. Adding to the positive macro backdrop, last month the Canadian government introduced a $500 million incentive scheme for purchases of medium to heavy-duty EVs. This will provide credits of up to 50% on the price difference between EVs and their combustion engine peers.

Hence, it is hard not to be bullish on the broader structural drivers for GreenPower as governments around the world continue to push through new legislation and financial incentives to ramp up EV rollout.

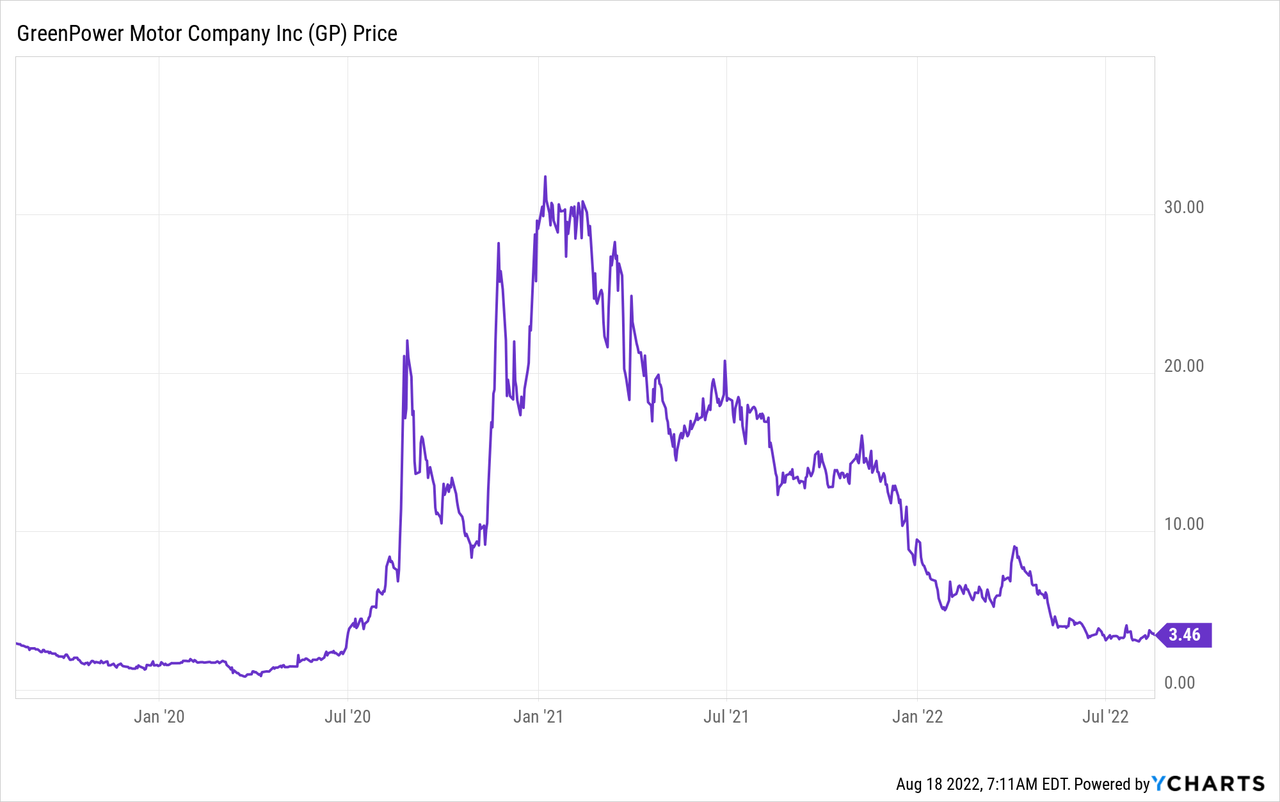

This has come as the speculative froth that once drove shares to highs of just over $30 early last year continues to dissipate. GreenPower’s common shares now trade hands at $3.46 for a market cap of $80 million.

Revenue Grows But Comes Below Consensus Estimates

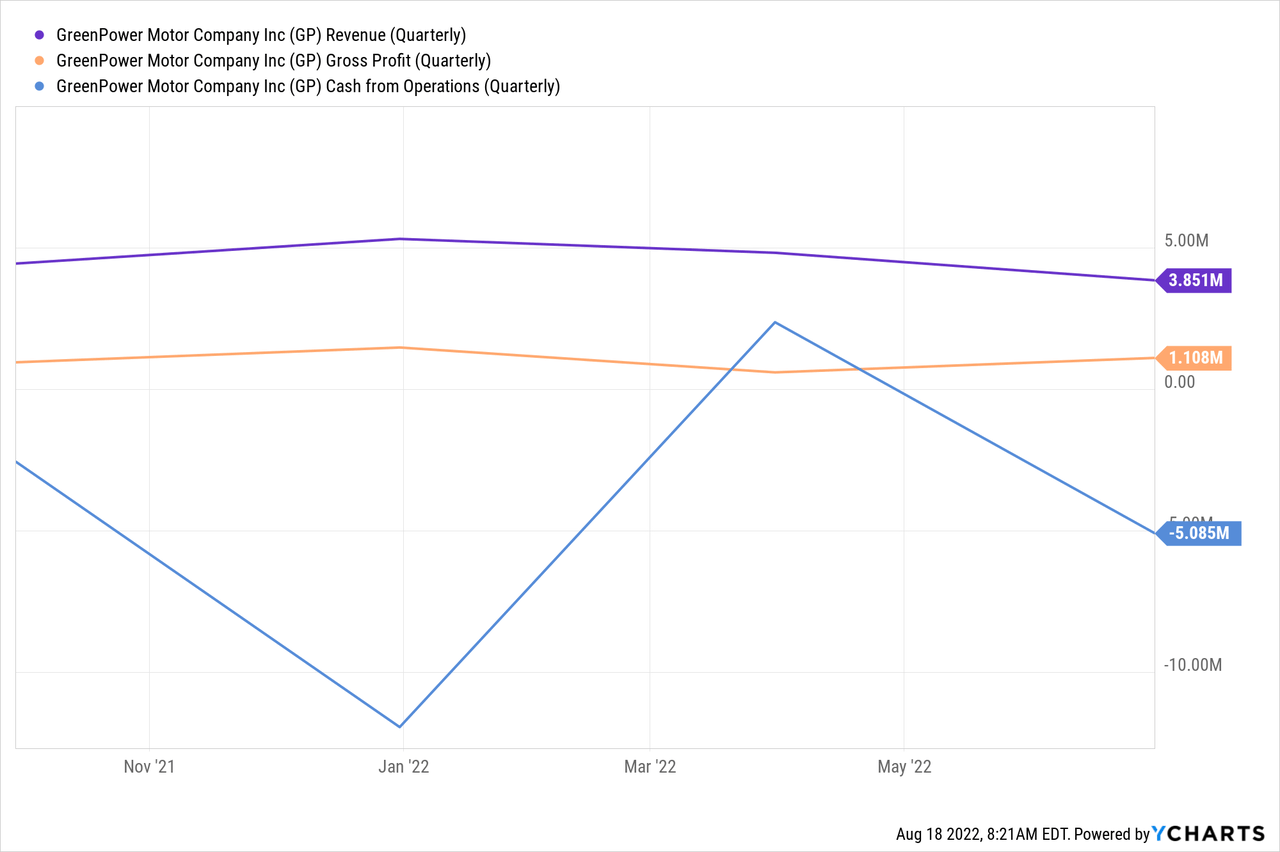

GreenPower last reported earnings for its fiscal 2023 first quarter which ended in June. The quarter saw revenue come in at $3.85 million, an increase of 44.8% from the previous year-ago quarter but a miss of $2 million on consensus estimates. Whilst gross profit margins at 28% was a decrease from gross margins of around 33% recorded a year ago, it was a sequential increase from a margin of 12.5% realized in the preceding quarter.

With operational and other expenses at $5.3 million, GreenPower recorded a net loss of $4.35 million during the quarter.

The company’s cash burn from operations came in at $5.1 million, a decline from a positive operational cash flow of around $2.4 million in the preceding quarter. Hence, with cash and equivalents at $5.4 million, GreenPower’s runway comes in at over three months. The company’s short-term borrowings have also skyrocketed, increasing from zero a year ago to $9.7 million as of the end of its last reported quarter.

Near-term capital needs are likely to increase with the company ramping manufacturing of its EV Star Cab and Chassis to fulfil the contract with Workhorse (WKHS) signed earlier this year. This will see GreenPower deliver 1,500 of the step vans over a 21-month schedule which started last month.

Commercial Vehicles Also Require Electrification For Net-Zero

Net-zero describes an ambition by a number of governments around the world to reduce reliance on fossil fuels and cut greenhouse gas emissions to near zero across most sectors of their economies. Whilst it has been partly blamed for the current energy crisis, it presents an immense investment opportunity for the related companies.

Commercial EVs also need to be electrified and GreenPower is chasing this market. There are quite a few companies like Proterra (PTRA), Lion Electric (LEV), and Rivian (RIVN) also competing for a slice of this but the market is large and growing. As both private industry and government ramp up spending on decarbonisation in the years coming, GreenPower could stand to see its sales continue to grow. The immensity of the shift towards electrified transportation paints a vivid picture of an industry set to see ever greater riches with its constituents riding the tailwinds of growth for the foreseeable future.

However, GreenPower’s current cash burn against its cash position renders an investment too risky. Also, with management stating during their earnings call that they anticipate their cash costs increasing through to the end of the year, the situation is unlikely to get better soon. Whilst, they also stated they remain focused on securing a solution to this shares are to be avoided pending the communication of any such solution.

Be the first to comment