metamorworks

PageGroup (OTCPK:MPGPF) must be celebrating its recent H1 2022 interim results. Gross profit is up 33.3% and even more on the operating level, leading to record financial and operating performance. Commenting on the recent results, Steve Ingham, Chief Executive Officer, said:

“We achieved a strong H1 performance across our geographies, disciplines and brands, and delivered Group operating profit up nearly 80% and an underlying conversion rate of 22.1%. This was particularly pleasing given that 2021 had been a record year for gross profit and operating profit.”

Shareholders must be rejoicing as well after management announced yet another gigantic special dividend on top of the company’s already attractive ordinary dividend. At least until they glance at the share price chart and realize that their investment has dropped over 30% year-to-date despite all the excellent news. All that growth hasn’t prevented the valuation from slumping to just 10x earnings. So, what gives? Do we need to leave the Champagne in the fridge?

Investors trying to explain the odd disconnect between record results and a depressed valuation might scour the financial statements for red flags or hidden flaws. What they find is a pristine balance sheet stacked with net cash and the consistent ability to crank out return on invested capital nicely above 20%, with a management that strategically invests in the company’s future. Our ears are open if anyone has an alternative explanation, but our conclusion is that PageGroup represents an exceptional bargain for an exceptional company.

PageGroup’s strength lies in its long-term thinking and consistent strategic investments

The recruiting industry can be terribly cyclical with rapidly changing market conditions. It can also be local, with large variations between geographies or even industries. The volatile conditions can lead many recruitment companies to drastically cut headcount or cost in downturns to prevent profit decimation and financial stress. Unfortunately, such short-term cost actions can also lead to brand damage, distrust from clients that value a reliable presence and the inability to grow when markets recover as key fee earners are no longer with the company. It’s a difficult situation, but PageGroup has a few key advantages over competitors, which stem from its ability to think long term.

PageGroup is focused on organic growth, and indeed, the vast majority of its impressive growth over the years has come from investments in its business. PageGroup also seeks to have a robust base to operate from through a diversification of geographies and professional disciplines or industries. Diversification in an industry that can often be quite localized is critical. A derivative of diversification is scale and brand awareness, both of which PageGroup has managed to achieve on a global basis. More importantly, PageGroup has developed an effective system to know where and when to increase investment or pull back on costs.

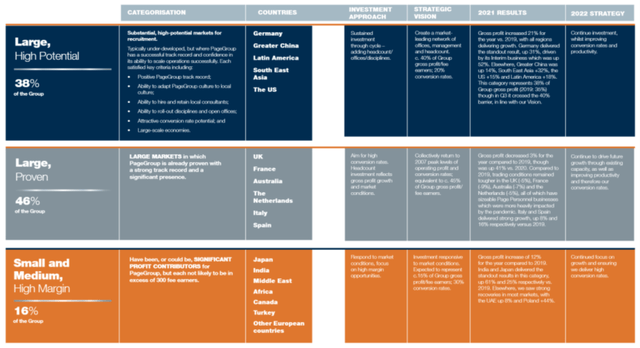

Each geographic area as well as end market discipline is defined in a particular category, which then helps determine whether headcount should be protected during a downturn or whether capital investment should continue during difficult market conditions. If PageGroup has a positive long-term view on particular geographies or industries, the company will strategically invest when competitors are suffering and running for the exits. The short-term impact might be slightly lower profit levels, but the long-term impact is significant market share gains and a respected brand, not to mention employee loyalty to a company that supported them during hard times. The below graphic from the company’s 2021 annual report gives some insight into how the process works.

PageGroup defines markets to direct strategic investment. (PageGroup Annual Report and Accounts 2021)

Other companies might have the ambition, if not the diversification and scale, to apply a similar strategy. But few have the critical component that makes it possible. Long-term strategic investment requires management foresight and discipline, but it also requires a strong balance sheet. Many competitors shut up shop and send their key employees into PageGroup’s open arms because they don’t have the financial strength to survive otherwise. PageGroup has a habit of sitting on a substantial net cash position, helping ward off any short-term panic even in the toughest of times. High-quality peers such as Robert Half (RHI) or Hays (OTC:HAYPF) boast strong balance sheets as well, but that’s not so for the plethora of smaller competitors across their markets.

The 2020 pandemic and its consequent plague of uncertainty and financial stress is a recent example of how PageGroup deploys its strategy. This passage from their annual report sums it up nicely.

“The small size of our specialist teams enables us to grow gross profit quickly with incremental fee-earner headcount. When market conditions tighten, this headcount is reduced mostly via natural attrition, to ensure a lower cost base in a slowdown. We have managed this well through the pandemic and chose to maintain our platform during 2020; this decision has enabled us to accelerate more quickly than our competitors coming out of the pandemic to deliver the record results achieved in 2021. We have retained experienced staff and continue to focus on the training and development of all our employees. We selectively added over 1,100 experienced hires from the competition from Q2 2020 through to the end of 2021. These decisions have helped to drive the productivity gains achieved during the year and put us in a strong position for 2022 and beyond.”

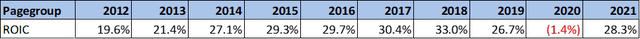

PageGroup’s recent performance clashes with its current valuation

PageGroup’s story sounds nice in writing, but let’s look at some evidence in numbers. The company’s asset-light business model and exemplary capital allocation have created a track record of impressive value creation and growth. We often view value creation through the lens of return on invested capital, both in its absolute form and in its consistency. The only blemish we see below is a result of the pandemic, but as we will see, it set the company up for a swift and impressive recovery with market share gains. Take this metric back another decade, and it looks equally as impressive.

PageGroup’s impressive ROIC. (Refinitiv Datastream)

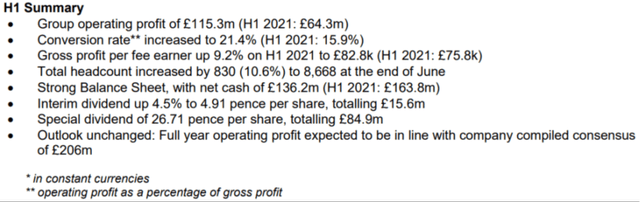

The company’s most recent results from the first half of 2022 include a number of impressive highlights. The company is sitting on net cash of £136.2m – not bad for a company with about a £1.5b market capitalization. Operating profit grew nearly 80% year-over-year while earnings per share more than doubled. Productivity metrics were up essentially across the board. The ordinary dividend increased, and a gigantic special dividend was announced. In summary, the results are stellar.

PageGroup’s H1 2022 results. (PageGroup Half Year Results for the Period Ended 30 June 2022)

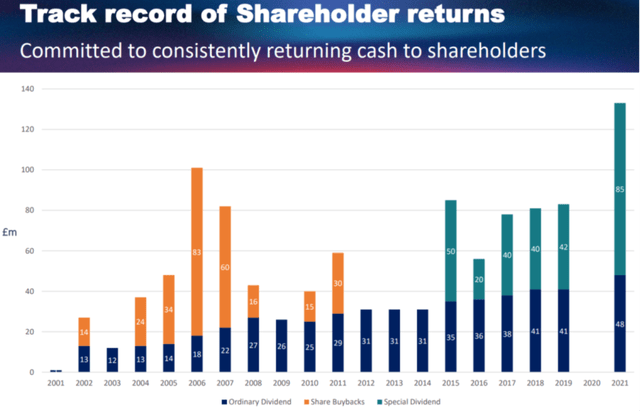

The company’s strong cash flow production supports PageGroup’s shareholder-friendly capital allocation as well. We feel that many investors might be missing the significant special dividends when reviewing the company’s true dividend yield. The ordinary dividend is attractive and growing steadily, but the reoccurring special dividends often double shareholder distributions. When viewing the graphic below, keep in mind that a special dividend of close to £85 has already been announced for 2022 as well as a 4.5% increase to the interim dividend.

PageGroup’s track record of Shareholder returns. (PageGroup Half Year Results 2022 Presentation)

So how much should we pay for a rapidly growing company with impressive return on invested capital, a pristine balance sheet and exemplary capital allocation? 20x earnings? Or maybe 25x earnings? PageGroup’s average long-term P/E multiple is indeed near 20x according to Refinitiv. But to our great confusion, the market thinks the company is currently only worth 10x earnings.

PageGroup valuation. (Refinitiv Datastream & I/B/E/S Mean valuations)

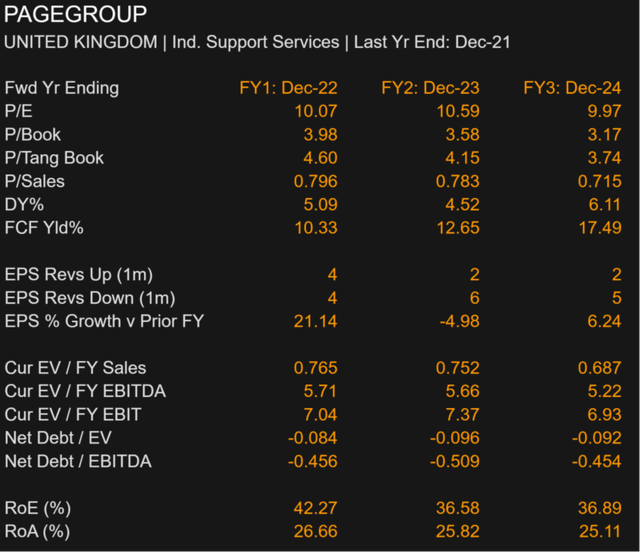

Investors that don’t fancy P/E ratios might note that an EV / EBITDA ratio below 6x and a double-digit FCF Yield appear less than demanding.

We recognize that the company’s results can reflect the cyclicality of its industry, but the investment case is partially de-risked at these valuation levels. Especially since only a global pandemic has pushed the company below respectable return levels in the past 20 years or more.

Our only conclusion is that the current valuation does not effectively reflect the true prospects of the company and that it is an excellent buying opportunity, even if volatility is likely in the short term. We have been long PageGroup stock since 2016, buying the majority of our shares between 350 GBX (Pence Sterling) and 400 GBX in 2020. We invest via the company’s primary ticker on the London Stock Exchange. We are mulling an increase in our position at the current price (and would likely initiate a position if we didn’t already have one), but levels below 400 GBX would likely be irresistible for a top-off on our part.

It’s hard to find such quality and growth at this price

PageGroup is a smaller cap British company that seems to be flying under the radar of many investors, despite the global scale of its business. The cyclicality of its industry leads to share price volatility that can scare capital allocators away, while its dividend profile may be misunderstood due to the regularity and size of special dividends. For those that look closer and can stomach some turbulence, a truly compelling opportunity awaits. PageGroup sits atop its net cash, consistently producing double-digit returns on invested capital while continuing to strategically invest in its future. Recent results demonstrate the potential for growth and the strength of PageGroup’s market position. It’s hard to find such a combination of quality and growth, and with a bit of luck, investors will be able to buy the company at a single-digit P/E multiple. Some might call that value. We are targeting a level below 400 GBX to increase our position, but our finger hovers ever closer to the buy button with each update from this exceptional company.

Be the first to comment