Delmaine Donson

An interesting situation in the asset management industry with potential management changes and/or company sales. Sculptor Capital Management (NYSE:SCU) is an alternative asset management firm focusing on multi-strategy, credit and real estate investment strategies. Recently, Daniel Och – the company’s founder and one of its largest shareholders (12% voting power) who left the company in 2018 – started pressuring the firm, criticizing SCU management’s self-dealing. In his letter, Och claims that SCU’s board – despite rather lackluster recent operational performance – has been enriching themselves with excessive salaries. Apparently, SCU’s CEO James Levin (20% voting power) received $146m last year – more than the CEOs of JPMorgan Chase or Goldman Sachs. In light of this, Och and several founding partners filed a lawsuit, asking the company for its books and records related to the board’s decision on the CEO’s pay. Interestingly, Och has also stated that the has been approached by several third parties interested in a “strategic transaction” if the current management team were to be replaced. The share price reacted favorably to the founder’s involvement, spiking by as much as 19% in early October before retracing back to pre-announcement levels upon SCU’s board response, denying the founder’s claims.

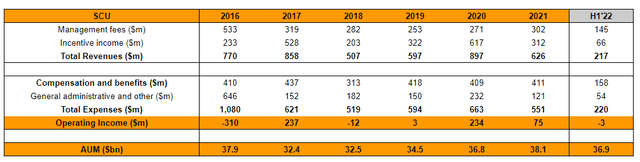

Och’s recent actions follow managerial turmoil at SCU – see the section below for more background. However, despite the turmoil, SCU’s management has, since Och’s departure, managed to significantly improve the company’s financial standing as adjusted net assets increased from negative $56m in 2018 to $304m as of Jun’22. Meanwhile, total AUM has continued to increase from $32.3bn in FY2018 to $38.1bn in FY2021. That said, this year the business has underperformed amid macroeconomic headwinds and market sell-off as AUM declined – now at $36.9bn. Lower incentive and management fees drove SCU operating income from $51m in H1’21 to negative territory (-$3m) in H2’22. Reflecting quite poor recent performance, SCU’s stock is down 53% year-to-date – significantly below share price changes for peers Patria Investments (PAX, -18%), Vinci Partners (VINP, -8%), Fiera Capital (FSZ:CA, -21%), Man Group (OTCPK:MNGPF, -7%) and BrightSphere Investment (BSIG, -28%).

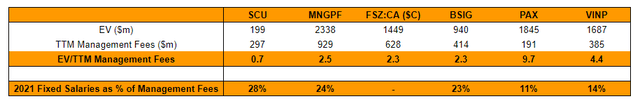

Looking at SCU’s valuation from an EV/Revenues from a management fees perspective – the company trades at 0.7x multiple. Peer MNGPF (debt/multi-asset/equity and RE strategies – similar to SCU) is valued at 2.5x. Equity-focused BSIG and FSZ:CA both trade at 2.3x. Meanwhile, credit/PE/RE-focused PAX and VINP fetch much higher 9.7x and 4.4x. Interestingly, SCU’s management also seems to think that the company is cheap – $13.2m was repurchased in Q2’22 at $11.30/share – 9% above current levels. From a cost perspective, there is room for salary cuts versus peers. SCU’s fixed salary expenses stood at 28% of revenues from management fees in 2021 – above PAX (11%), VINP (14%) and MNGPF (24%). At a more reasonable 20%, SCU cost savings would be $24m vs $75m 2021 EBIT. Overall, both undervaluation and the potential for compensation cuts suggest that SCU might be ripe for activism. In this light, the involvement of a prominent investor/founder is very intriguing.

Management Turmoil

After leaving the CEO role in 2018, Och appointed former Credit Suisse executive Robert Shafir as the CEO. The move caused disagreements over CEO succession and eventually one of the board members, William Barr (who would later become the US Attorney General), left the company. Later in 2018, Och left the chairman role. Eventually, Levin went on to become the CEO in 2021. Interestingly, in 2017, Och awarded Levin a co-CIO role and a $250m pay package.

It is worth noting that more recently, in Feb’22 one of the board members, Morgan Rutman, stepped down from SCU’s board in protest over Levin’s compensation. Rutman was initially nominated to SCU’s board in 2019 as part of the agreement between Och and SCU upon his departure.

Business, Financials and Valuation

SCU focuses on credit (58% of AUM), multi-asset (30%) and real estate strategies (12%). The company collects its revenues from management fees and incentive income. Management fees are derived as a percentage of AUM – in 2021, the average management fee rate was 0.76% (0.72% in 2020). Incentive income is typically 20% of profits (net of management fees).

SCU’s historical financials are provided below:

Management has noted that the year-to-date AUM decline has been driven by the “worst on record” macroeconomic environment as displayed by the worst 60-40 portfolio performance in 90 years. The decline in SCU’s AUM has mostly been driven by the poor performance of multi-strategy funds (37% of YTD revenue). That said, the overall drawdown was somewhat limited by the company’s exposure to credit (33%) and real estate (30%) where the markets have been relatively strong thus far. Notably, in the latest earnings call, the CEO was optimistic about the company’s prospects going forward given the number of attractive investment opportunities, particularly in the credit space:

Notably, within that, credit markets, which had been relatively well behaved for the initial part of the year that contingent hit towards the end of the second quarter and started to create meaningful dislocations across pretty much all types of credit assets, both public and private.

As it relates to Sculpture, this has created a robust and ever-expanding universe of attractive investment opportunities for our funds. Across our businesses, we do a lot of different types of investing, but I would say, simply said, the same type of investments that nine or 12 months ago offered mid-single-digit rates of prospective return, today offer mid-double-digit rates of prospective return.

From a valuation perspective, given SCU’s excessive executive compensation, the company might be valued on an EV/revenue from management fee basis. This allows us to observe how the market would value the company given a more reasonable compensation structure. On this front, the company seems undervalued at 0.7x compared to other publicly-listed competitors, including MNGPF, which trades at 2.5x.

Note: EV is calculated as a sum of market capitalization and debt less cash, cash equivalents and investments. Figures for FSZ:CA are provided in C$.

Conclusion

At current price levels, SCU presents an interesting investment opportunity. The company seems undervalued while management’s compensation seems to be excessive with room for cost cuts. Coupled with lackluster year-to-date business performance and the involvement of a prominent investor/founder, management and/or compensation changes might be brewing here. This suggests that investors might potentially be looking at a substantial upside.

Be the first to comment