Dilok Klaisataporn

Editor’s note: Seeking Alpha is proud to welcome Ivana Delevska as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Expectations Resetting Lower

Tech giants Microsoft (MSFT) and Google (GOOG, GOOGL) just kicked off the earnings season, after several notable reports and pre-announcements from Snap (SNAP), AMD, Micron (MU), and CarMax (KMX). Demand trends have significantly deteriorated since last quarter, and ultimately, we expect that every sector will be impacted by the sluggish macro.

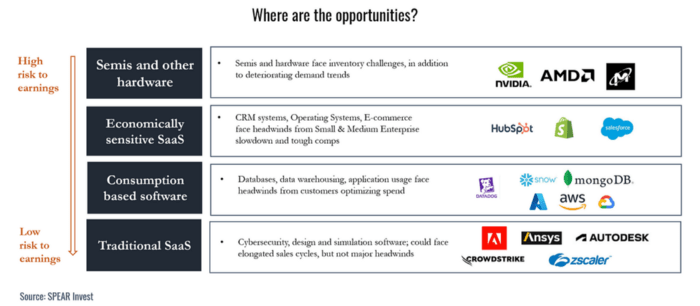

With this set-up in mind, there are many companies that look very attractive on pullbacks, as we expect that secular trends will overcome their cyclical headwinds over the next several quarters. Within industrial/enterprise technology, there is a wide spectrum of business models all providing different risk/reward. On one end of the spectrum are semis/hardware with the most downside but also the most upside in a recovery, and on the other end of the spectrum are software (SaaS) business models, which we expect to be most resilient through the downturn.

Investing Opportunities

- Semis/hardware. Inventory dynamics are significantly exacerbating a difficult macro backdrop. As an example, AMD warned that PC demand will be $1 billion lower revenue on a base of $6.7 billion. PCs are ~33% of AMD’s total revenue, which would imply that the company expects that chips sold to PCs will be down 50%+ yoy while the PC market was down mid-teens during the quarter. This means that even if the market continues to decline, semiconductor earnings will form a floor as inventory destocking comes to an end (usually takes 2 quarters).

- Economically sensitive SaaS, especially ones exposed to small businesses, are facing significant cyclical headwinds. Microsoft noted on its earnings call that small and medium enterprises were disproportionately weak. But ultimately, even in an economic scenario of muted growth, companies will have to invest to run their businesses more efficiently through a downturn, which will create a tailwind for these companies even in a weaker macro.

- Consumption-based software. We expect that spending on cloud infrastructure will be relatively more resilient through a downturn. But there are two trends to note: (1) cloud spending is now a major expense item and most companies will look to optimize it (2) consumption-based business models are likely to experience slower growth. This means that there will be an initial reset before companies can resume strong secular growth. Snowflake (SNOW) flagged this trend as early as March of this year, and it was followed by muted guides from MongoDB (MDB) and DataDog (DDOG). But some investors are still surprised by the slower growth reported by the hyperscalers (e.g., Microsoft just guided to 37% growth for Azure for 2Q23 vs. 42% in 1Q23 and 39% consensus – solid, but a deceleration).

- Traditional SaaS for specific applications such as cybersecurity, design, and simulation we expect to be most resilient. Although we expect some level of uncertainty with deals taking longer to close, spending in these categories is generally non-discretionary.

Overall, while many risks remain, the share prices of most of the companies in the four categories above have declined 50-80% ytd, presenting what we believe to be attractive opportunities, and manageable risks.

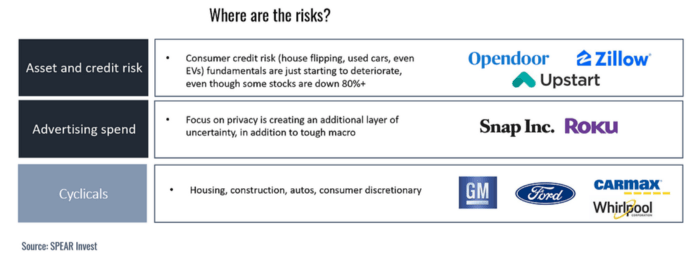

On the contrary, there are many areas where we believe the risks outweigh the potential upside.

- We expect more downside for areas such as advertising, where weak macro trends are exacerbated by privacy policy changes.

- We expect potential downside for companies directly exposed to deteriorating consumer balance sheets driven by higher interest rates.

- Within technology we are avoiding areas where companies are taking asset and credit risks

- In cyclicals we are avoiding housing, autos, and other “big-ticket” items.

Investing Risks

Earnings takeaways from early reports and pre-announcements

Reported earnings are continuing to surprise to the downside, despite expectations declining throughout the quarter. While last quarter we experienced several pockets of weakness (transportation, PCs, semis), this weakness has now broadened to large-cap technology companies that can be viewed as a proxy for the broader economy.

- Microsoft: In-line 1Q23 but weak guidance for 2Q23. Specifically, Azure growth to slow to +37% yoy in F2Q23 from 42% in F1Q23 (-5pts qoq). While lower than expectations, we view anything above 30%+ growth as solid in this environment.

- Google: Miss on top and bottom line (-3% revenue/-7% EBITDA miss). Revenue was up 6% (11% ex FX). Ad spend weak driven by YouTube and Network, while cloud showed good momentum. Cloud growth accelerated to +38% yoy in 3Q22 (+180bp), although on an easy comp.

- Snap: In addition to weak macro, biggest challenge was customer engagement. Time spent watching content in the U.S. declined 5% yoy. Guide for flat revenue in 4Q implies declines in November and December.

- Advanced Micro Devices: Weak PCs drove $1 billion revenue shortfall, but investors are now worried if enterprise spend is the next shoe to drop.

- CarMax: Same-store sales down -8.3% and disappointing CAF income driven by weak consumer demand and higher-than-anticipated loan loss provisions. Interest rate-driven affordability pressures.

On the positive side, expectations are now reset significantly lower, especially in areas such as cloud (reset with Microsoft earnings), semiconductors (reset with AMD and Intel (INTC)), transportation and logistics (reset with FedEx (FDX)) etc. Consequently, we expect more positive than negative earnings surprises, despite that the earnings cuts trend for the broader market still remains intact.

Macro Backdrop

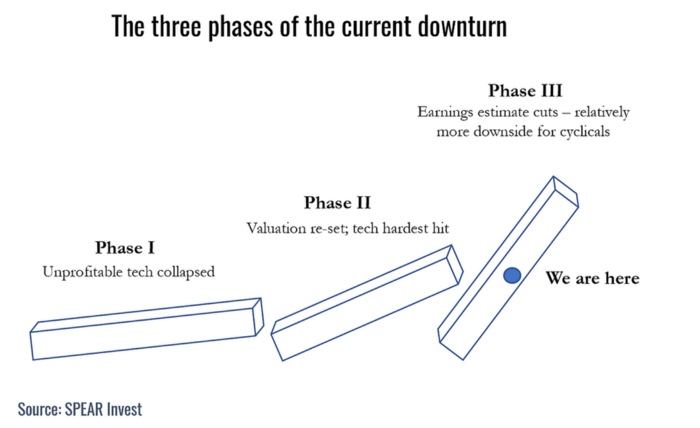

While downturns follow a pattern, each one is slightly different and caused by a different catalyst.

High-risk assets generally sell off first, which was the case in this downturn, with limited differentiation within business models. This phase is followed by a broad valuation reset, in this case pretty violent and exacerbated by higher discount rates; and lastly, earnings estimates get cut driven by broad macro weakness.

3 Phases Of Current Downturn

While the last phase is generally the most violent and volatile, there are several factors that differentiate this downturn from others:

- Unlike prior downturns, where the Fed came to the rescue, monetary tightening is the principal driver of this downturn. Consequently, the Fed’s decisions are well-telegraphed and bad news gets priced in consistently ahead of the announcements and results (e.g., the VIX, a volatility index we closely watch, has been relatively contained).

- In a typical downturn, there is overcapacity in the system, and small changes in demand result in earnings collapse. This is then followed by a sharp recovery as supply and demand comes to balance. In this bear market, there is no broad overcapacity but many dislocations. While some are getting corrected (e.g., semis), others are getting created (e.g., housing). Consequently, on the positive side we don’t expect a sudden collapse in earnings across the board, but on the negative side we expect prolonged headwinds that will ultimately affect earnings in many end-markets.

- There are significant differences between this technology bear market and the tech bubble of 2000. Many tech companies today have proven business models at scale and generate significant cash flow. While correlations have been high and all technology has been treated equally thus far in the sell-off, we are starting to note divergence between good and bad companies.

We believe that industrial technology can do very well in this scenario once the market stabilizes. Our channel checks indicate that while most companies are looking to optimize their spend, which is weighing on earnings and creating elongated deal cycles, investing in technology will be the only way for companies to stay competitive. We therefore expect a very meaningful tech cycle ahead.

Divergence In Fundamentals

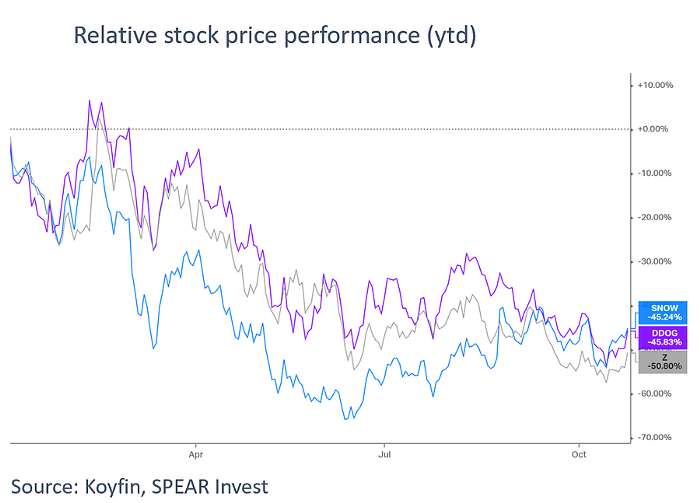

While in the first two phases of the downturn there was limited differentiation between companies with solid versus poor fundamentals, we are just starting to notice some divergence.

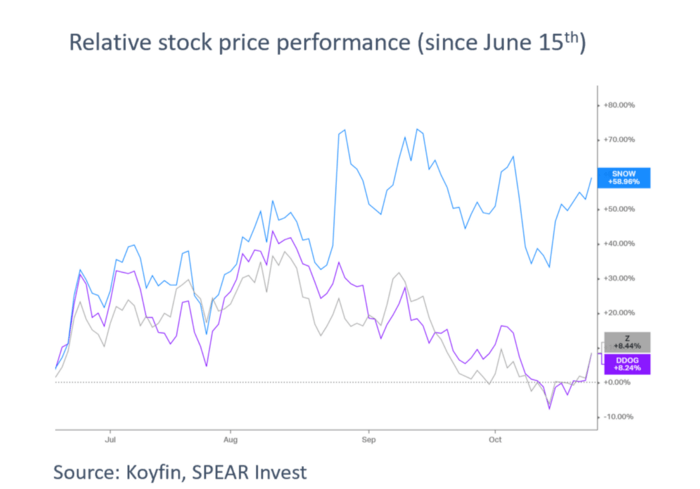

As an interesting data point, we compare stock price performance of Snowflake and DataDog, both leaders in cloud infrastructure, with Zillow (Z), an online real estate platform. While these businesses have seemingly not much to do with each other, all three companies have declined roughly the same amount (~50% ytd).

SNOW, DDOG, Z – Relative Stock Price Performance YTD

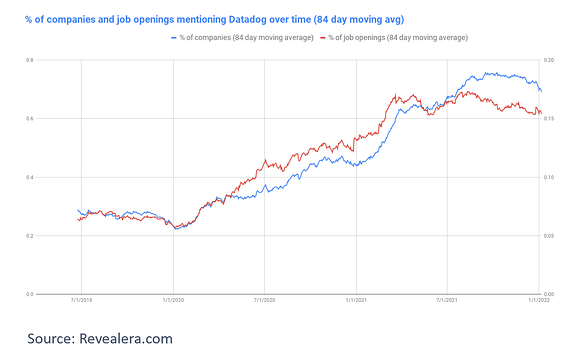

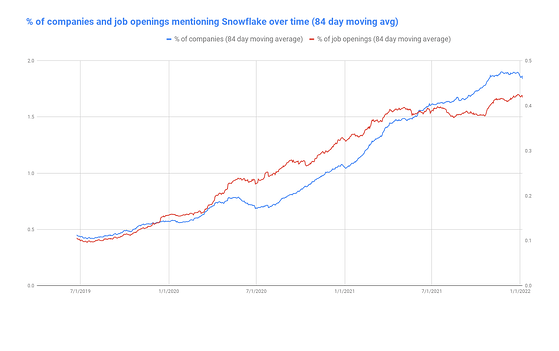

Now turning on to the fundamentals, we compare hiring data provided by Revealera, a company focused on hiring insights in technology. Job openings for both DataDog and Snowflake show a similar but, more recently, a slightly diverging trend.

- Snowflake job openings showed consistent growth.

- DataDog employment growth peaked in 2021 and flattened out in 2022.

% Of Companies And Job Openings Mentioning DataDog Over Time

% Of Companies And Job Openings Mentioning Snowflake Over Time

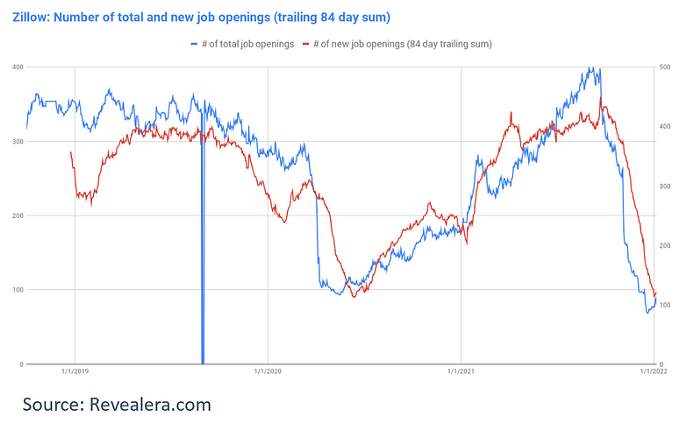

Conversely, job openings for Zillow show a clear deterioration, implying significant divergence in fundamentals. This divergence in fundamentals did not impact the stocks in 1H22, as the sell-off was driven by interest rates and, consequently, valuations rather than fundamentals.

Zillow – Number Of Total And New Job Openings

Interestingly, while fundamentals did not have a meaningful impact on stock prices in the first half of 2022, this has changed since the June lows. Many companies traded down to historically low valuations and found a floor, while others with deteriorating earnings fundamentals continue to find new lows.

SNOW, DDOG, Z – Relative Stock Price Performance Since June 15, 2022

We noted similar trend for cybersecurity companies, which have continued on a path of consistent growth in hiring. Many of those companies did not reach new lows despite the recent leg down for the market.

Disclosures

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment