zhengzaishuru/iStock via Getty Images

Introduction

On January 16, 2022, I wrote my first article covering oil and gas giant Pioneer Natural Resources Co. (NYSE:PXD). Back then, I was bullish because of the company’s potential to generate a high yield for its investors in an oil industry that’s seeing significant supply/demand imbalances. In this article, I want to update my bull case and explain how I would deal with this stock from an investor’s point of view given that a number of things have changed.

The bull case has gotten so strong that there’s almost no way to avoid production hikes. It benefits consumers and long-term investors while it’s a headwind for people looking to make a quick buck trading the stock at current levels.

Allow me to explain my view in this article.

Is The Bull Case Too Strong?

It normally would be a bit soon to update my bull case. However, that’s under normal circumstances.

Current circumstances are not normal. But let’s start at the beginning. One of the biggest issues facing consumers of oil (and that’s more or less everyone who’s a part of society) is that production isn’t high enough. This has multiple reasons. It basically started through pressure from sustainability measures like the Paris Climate Agreement. It involves proxy battles like the one at Exxon Mobil (XOM) where Engine Nr. 1 is making sure that sustainability takes a front seat. Production growth is second.

The pandemic accelerated this trend. During the first months of 2020, oil demand imploded, resulting in a short-term oil price decline below zero as there was no storage space left anymore. It deeply hurt oil companies that had to go through yet another life-threatening oil price decline.

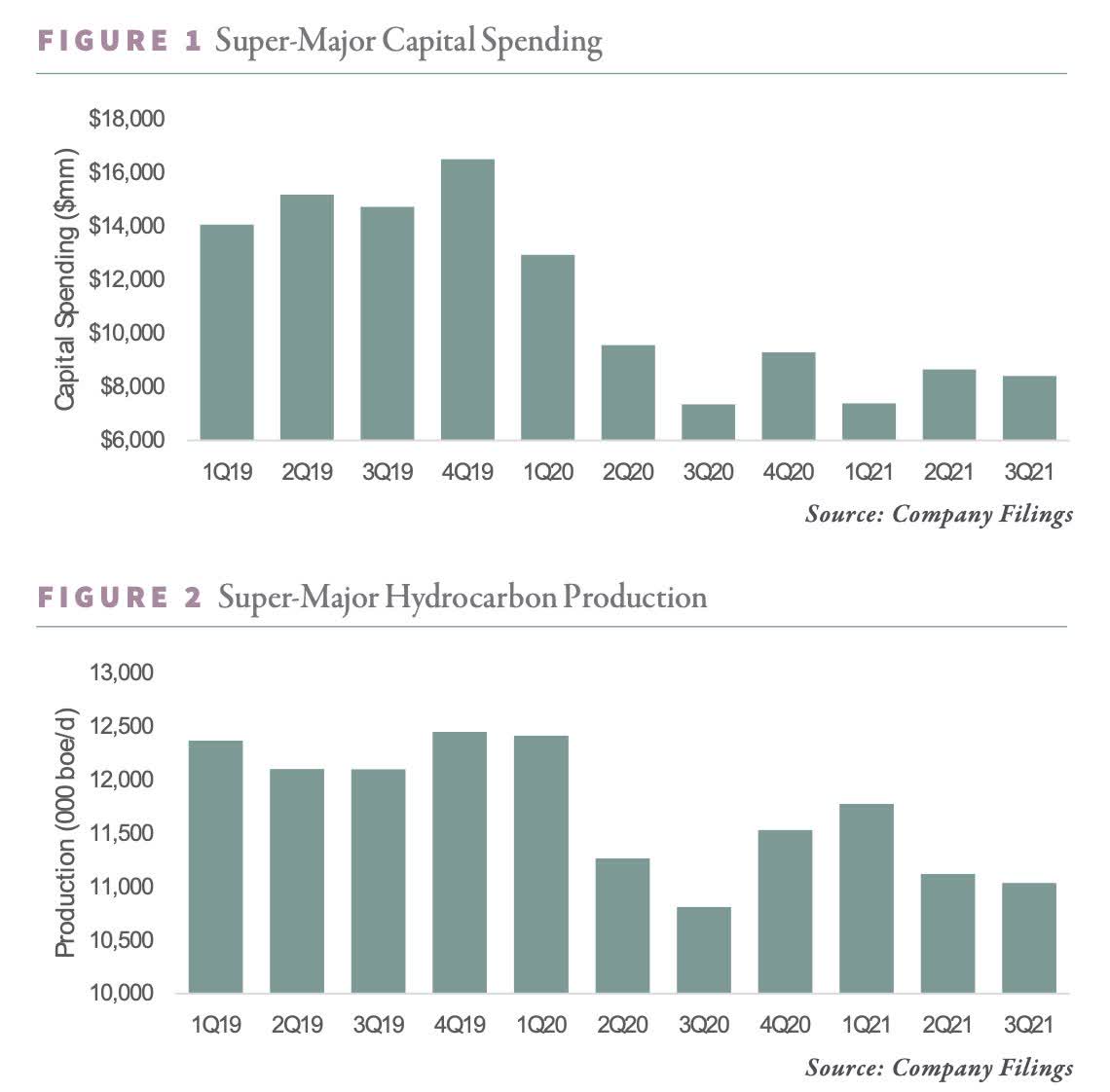

In my last Pioneer Natural Resources article, I used the graph below, which shows that the super-majors in the industry did not increase capital spending in the quarters following the oil price implosion. It resulted in subdued production.

Goehring & Rozencwajg

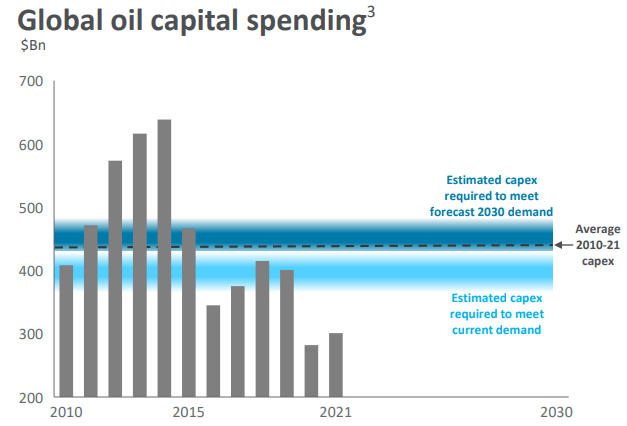

I found another chart on Seeking Alpha that displays the current situation even better. It shows global oil CapEx as well as how much CapEx is needed to meet forecasted 2030 oil demand.

Seeking Alpha

I am fascinated by this chart because it shows that production was way too high prior to 2014 when the American shale boom started and way too low as producers aren’t willing to boost production anymore.

In December, Pioneer CEO Sheffield made the case that this would lead to prices above $100 as he decided to refrain from hedging 2022 production. Boy, was that a good decision in hindsight.

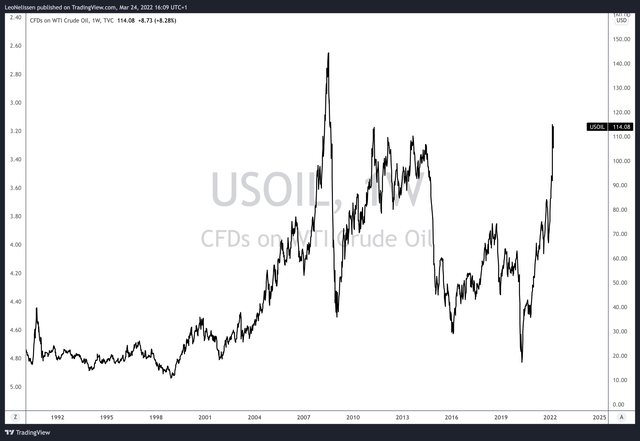

While I am writing this, we’re dealing with WTI crude oil at $114. This is caused by subdued production, high demand, and Russia.

The market is unpredictable. So is the economy. And then there’s geopolitics. While I can take credit for a big part of the bull case, I never expected to eventually benefit from higher oil prices caused by a war, which is not something anyone wants.

According to recently released EIA data, Russia exported 4.7 million barrels of crude oil per day in 2021. In 2021, total oil production was roughly 95.55 million barrels per day. While we can assume that China and India (and a lot of other countries) will not boycott Russian oil, we can assume that roughly 3% of global production will be lost due to boycotts. That’s a big deal and it caused the IEA (often confused with the EIA) to come up with a 10-step plan to reduce demand, which I discussed in a recent article.

EIA

With oil prices this high, the question arises: shouldn’t oil companies hike production? I cannot speak for anyone else, but I’m in favor of higher production even if it means lower potential capital gains. I explained this in a recent Seeking Alpha article, which covered why the short-term oil & gas risk/reward has gotten worse.

The problem is that we’re at a point where production needs to improve. I’m in favor of that because sky-high oil prices hurt economic growth. I am overweight energy, but I rather collect dividends without the capital gains if that avoids a recession.

On March 2, we got a sense of what a turnaround could look like:

In an interview with S&P Global, Pioneer’s (NYSE:PXD) CEO said the past week brought about a “mindset change.” In speaking about the war in Ukraine, and ability for the shale patch to add barrels, he indicated, “if there’s a coordinated effort, we would definitely participate in that.” His comments come after his company guided to falling production in 2022.

[…] Both Sheffield and Devon (DVN) CEO Rick Muncrief have been vocal about the White House calling on OPEC to increase production of late, rather than calling on Houston. Though today’s call for a “coordinated effort” stands out. In the interview released Wednesday, Sheffield suggested the shale patch could grow volumes ~10% for three years, providing ~800kb/d – 1mb/d to the market annually.

Moreover, Democrats came out saying we need a 50% windfall tax on big oil to deal with the impact of higher inflation.

The tax would apply to those companies producing or importing more than 300kb/d. The rate of 50% applies to barrels produced in or imported to the US. Importantly, the windfall tax is a “top line” tax, calculated as the difference between the average price of Brent oil from 2015-2019 and the current price.

My sources tell me this isn’t happening and likely just talk to appeal to voters ahead of the mid-terms. After all, inflation is toxic for the “ruling” party – in this case, the Democrats.

Yet, even if this isn’t happening, we need a turnaround. Why? Because drillers can improve production. At least in the US.

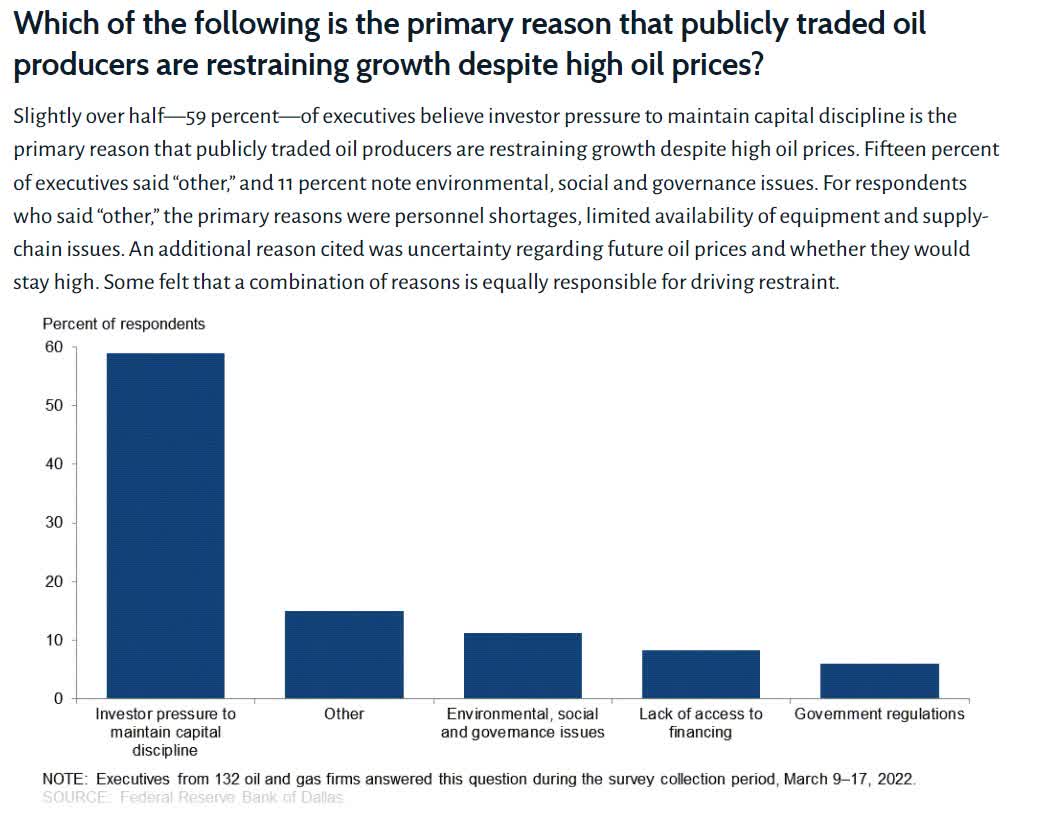

According to the Dallas Fed, almost 60% of all energy companies in the Dallas Fed district say that investor pressure to maintain capital discipline is the reason for restrained production growth.

Dallas Federal Reserve

It gets even more interesting, more than 30% of respondents say that production growth is NOT dependent on the oil price. 40% say prices above $80 facilitate growth.

Dallas Federal Reserve

Now, don’t get me wrong. I’m not attacking “big oil” here. I have significant (relatively speaking) exposure in Exxon Mobil (XOM), Chevron (CVX), and smaller drillers like Pioneer (PXD). The problem is that the current problems are justified. Oil and gas companies get attacked by environmentalists 24/7 for “polluting the world”. That’s one reason to focus on free cash flow instead of production. However, a lot of smaller producers, sometimes referred to as Sh*tCos have a terrible track record of investing in their business. In that case, it’s understandable that investors prefer free cash flow.

Hence, the reason why I sold some oil trades (no long-term investments) is that if some companies start to produce more, others might follow, creating a situation where demand accelerates in the short term. After all, the current situation is not sustainable. The perfect scenario for long-term investors would be if oil were to fall to $70-$80. At these prices, companies can repair their balance sheets and still pay a ton of dividends without the risks of windfall taxes or economic damage caused by inflation.

So Much Free Cash Flow

One reason why I like Pioneer is that it creates a lot of free cash flow, even if prices fall. That makes it an attractive long-term investment instead of just a medium-term trade.

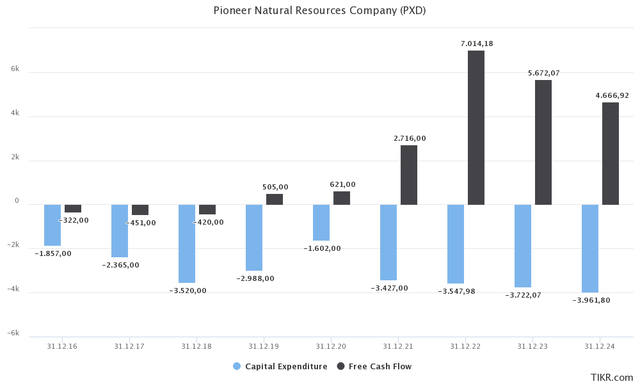

The estimates below show analyst consensus estimates, which are in line with the company’s own estimates. In 2022, the company expects more than $7 billion in free cash flow based on $10.5 billion in operating cash flow and a CapEx budget of $3.3-$3.6 billion. This will result in the production of 350 to 365 thousand barrels of oil per day. Including natural gas (liquids), production will end up between 623 and 648 thousand barrels (of oil equivalent) per day.

These numbers are absolutely wild and will become even better if oil remains above $100. However, using $7 billion in FCF estimates, we’re dealing with an FCF yield of 11.5% based on a $61 billion market cap.

Bear in mind, the company will distribute 75% of its post-base-dividend free cash flow as a special dividend. In 1Q22, this was $732 million or $3.78 per share. The dividend has already been paid on March 14. The share price is $253, which implies an annualized yield of 6.0%. This number will be higher as oil crossed $100 after the Russian attack four weeks ago.

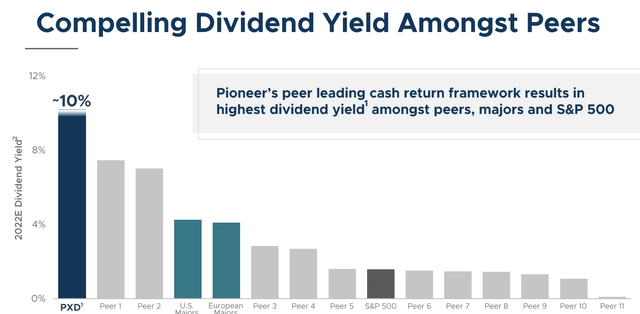

Based on the situation in March, we’re looking at an implied yield of 10% this year, which is absolutely stunning and much higher for people who’ve been in this stock since lower prices.

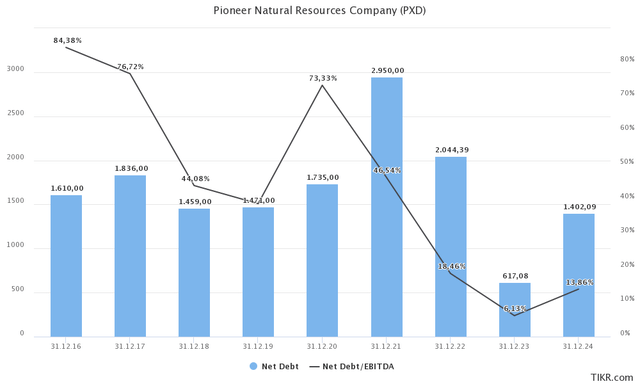

Moreover, and looking forward, one big issue in oil and gas was debt. A lot of companies had a high debt load. That’s now changing as a lot of money goes towards debt repayment. This is not just handy in general, but very important in case environmental protection rules get more strict. If (that’s a huge *if*) banks reduce energy loans for the sake of environmental protection in the future, companies can rely on internal funding (free cash flow). That’s also a reason why investors aren’t that eager to boost production. It’s protection against outside factors (mainly political).

In this case, the company is set to lower net debt to a mere $620 million in 2023. That’s a fraction of the pre-pandemic debt load and it implies a net leverage ratio of just 0.06x (EBITDA). This leverage ratio will increase if EBITDA goes down, but the total debt load is extremely sustainable.

With all of this said, here’s what I would do.

Takeaway

This year has been wild so far. Energy stocks have outperformed the market as oil has crossed $110. This surge is supported by subdued oil production, high and improving demand, and new geopolitical tensions fueled by the war in Ukraine.

Pioneer is one of my favorite long-term oil and gas investments as it has a very healthy balance sheet, efficient production, and the intention to distribute most of its free cash flow through base dividends and special dividends.

Given current circumstances, investors are looking at an implied dividend yield of 10% this year, which is one of the best yields on the market.

However, and this is the reason I’m writing this article, I’m not recommending anyone to buy this stock for short and mid-term gains. Yes, the stock can go higher, but there are risks that somewhat spoil the risk/reward. The biggest reason is the need to increase production. Current oil prices have risen too fast and too high. This is not sustainable and calls are getting louder to increase production. I believe it’s necessary to protect the economy and could see a situation where the bigger players start to give in. Investors who are currently the biggest force against higher production will find out that even lower oil prices support high returns. I prefer this over sky-high prices that risk a recession and give politicians fuel to call for windfall taxes. More political involvement is the last thing big oil needs as it would make sure that long-term production remains subdued.

Investors reading this article should not buy Pioneer for short-term gains. They should see PXD as a way to benefit from energy inflation due to the high payout of dividends. These dividends will decline when oil crashes (whenever that might be), but if history is any indication, the payout will bounce back as oil rebounds. It’s a perfect hedge against your gas bill and an attractive long-term investment for income.

(Dis)agree? Let me know in the comments!

Be the first to comment