iLexx/iStock via Getty Images

Regeneron (NASDAQ:REGN) is a biotech pharmaceutical company best known for therapies for diseases of the eye. It also had its revenue greatly enhanced this last year from its COVID therapy. That was likely a bolus, a larger-than usual mass moving through a system, like a mouse swallowed by a snake. I have watched investors, including myself, be fooled by boluses in the past. In my case it was the Hepatitis C therapy revenue bolus Gilead (GILD) had last decade. While having a revenue bolus is better than not having one, it does make pricing a stock problematic for longer-term investors. Here I will focus on Regeneron’s long-term prospects, post bolus, and also likely given the effect of patent expirations for its leading revenue generator.

Regeneron Q1 Results Summary

Regeneron reported first quarter results on May 4, 2022 and will report second quarter results on August 3. Revenue showed strong, 17% growth y/y to $2.97 billion from $2.53 billion. Yet revenue was down 40% sequentially from $4.95 billion in Q4 2021. Typically, as with most pharmaceutical companies, Q1 revenue dips from Q4 because of the Medicare reimbursement system. The sequential plunge was greatly amplified by the drop in Regen-Cov sales, which I will talk about in more detail below.

On a GAAP basis net income was $970 million, down 13% from $1.12 billion year-earlier and down 57% from Q4 2021. Similarly, EPS was $8.61, down by similar percentages. Eliminating the usual items, non-GAAP net income was $1.32 billion, up 19% y/y. EPS was $11.49. Given that cash from operations was $2.1 billion, I would say that in this case non-GAAP numbers are more reliable. Regeneron ended Q1 with a phenomenal $14 billion in cash and only $2 billion in long-term debt.

The following table of sales of individual therapies will help inform the discussion below.

Regeneron product sales (incl. by partners), $ millions

|

Therapy |

Q1 2022 |

Q4 2021 |

Q1 2021 |

y/y |

|

Eylea |

$2,386 |

$2,481 |

$2,158 |

11% |

|

Dupixent* |

1,810 |

1,774 |

1.263 |

43% |

|

Praluent* |

111 |

103 |

104 |

7% |

|

Regen-Cov* |

636 |

2,870 |

439 |

45% |

|

Kevzara* |

106 |

104 |

69 |

54% |

|

Libtayo |

125 |

121 |

1-1 |

24% |

|

other |

30 |

na |

27 |

12% |

Table 1, compiled by author, from Q1 2022 press release

The Regen-Cov Bolus

Regen-Cov is a COVID therapy. It combines two monoclonal antibodies, casirivimab and imdevimab. On November 21, 2020, the FDA issued an EUA for Regen-Cov for adults and pediatric patients 12 years of age and older who tested positive for COVID-19 and who are at high risk of progressing to severe disease or hospitalization. Regen-Cov represents a remarkably quick and effective response to the pandemic.

Sales began in late Q4 2020, ramped rapidly, and hit a peak in Q2 2021. Then a secondary peak was hit in Q4 2021. Predicting future sales is difficult because they depend on the course of the pandemic and competition from other therapies, including newer oral therapies. On the whole, however, unless sales ramp up again, this represents a classic revenue bolus.

|

Quarter |

Sales, $ millions |

|

Q4 2020 |

146 |

|

Q1 2021 |

439 |

|

Q2 2021 |

3,061 |

|

Q3 2021 |

1,196 |

|

Q4 2021 |

2,870 |

|

Q1 2022 |

636 |

Table 2, compiled by author, from Regeneron press releases

Eylea Generic Competition

Referring back to Table 1, revenue from Eylea has been critical to Regeneron’s success up to the present. Eylea, or aflibercept, is a fusion protein that binds to and inhibits VEGF (vascular endothelial growth factor). Although originally intended as a cancer therapy, and approved by the FDA for colorectal cancer, its main use is for treating wet macular degeneration in the eye. Since this is mostly a disease of aging, it is mainly paid for through Medicare.

Eylea is protected by several patents, but the consensus is that key Eylea patents will expire in 2025 and 2026. Biosimilars from Sandoz (NVS), Amgen (AMGN), and Samsung Bioepis are likely to be ready for the market, but exact timing depends on litigation outcomes. Usually when biosimilars, priced competitively, enter a market there is a steep downslope in sales of the original drug. However, there has been some argument that Eylea may be a partial exception. There has already been considerable competition in the wet macular degeneration market, including Novartis’ Lucentis and Beovu plus the off-label, relatively low-cost use of Roche’s (OTCQX:RHHBY) Avastin. Eylea seems to be favored by physicians; that may not change when biosimilars are introduced.

That leaves investors uncertain. Worst case scenario is that biosimilars hit the market relatively early, say 2025, and force both price reductions and losses of market share. In that case in 2028 Eylea sales might be a fraction of what they are this year. If biosimilars can be kept off the market longer, and physicians stick to the name brand, sales might stay reasonably near peak to the end of the decade. That makes it difficult to determine the longer-term value of the company, if by longer-term we mean 2028. But if we mean 2035, then it seems highly probable that Eylea sales will see a major decline.

Currently Ramping Therapies

Referring again to Table 1, some Regeneron therapies with longer patent lives have been ramping revenue. Dupixent, a therapy for atopic dermatitis and asthma, generated $1.8 billion in revenue in Q1, up 43% y/y. Praluent, a PCSK9 inhibitor for controlling cholesterol, Kevzara for rheumatoid arthritis and Libtayo, a PD-1 antagonist approved for squamous cell carcinoma, each generated over $100 million in revenue, and all are continuing to ramp. Dupixent and Libtayo are likely to see label expansion as trials in new indications are completed. In April the European Commission approved Dupixent for the treatment of severe asthma in children aged 6 to 11. In the U.S., for children aged 6 months to 5 years, the FDA PDUFA date in June 9, 2022. For Libtayo for non-small cell lung cancer the FDUFA date is September 19, 2022.

Pipeline Prospects

In Q1 2022 Regeneron spent $714 for research and development. It has an extensive pipeline consisting mostly of antibodies, well-balanced between Phases 1, 2, and 3. Because the pipeline is so large, here I can only point mention a couple of potential therapies. In addition, given its cash balances, Regeneron is capable of buying promising clinical-stage therapies, or even entire companies. For instance, in May 2022, Regeneron acquired Checkmate Pharmaceuticals at a total equity value of approximately $250 million. This is the first time Regeneron has acquired an entire company.

In the unusual category are REGN1908-1909 and REGN5713-5715, which are for allergies to cats and to birch. While I do not think very much can be charged for an allergy medicine, the numbers of people who might get prescriptions is a large multiplier. They are in Phase 3 trials. If FDA approval is gained, I expect other targets will get pushed through the pipeline. At the other end of the price and severity spectrum we have fianlimab, a LAG-3 antibody for treating first-line metastatic melanoma, also in Phase 3.

In Phase 2, going outside the antibody box, Regeneron has cemdisiran, a C5-targetting RNAi potential therapy for immunoglobin A nephropathy. Evinacumab is an antibody for possible prevention of acute pancreatitis. Among the Phase 2 cancer therapies is REGN5458, a BCMA X CD3 antibody targeting multiple myeloma.

The takeaway is that, with a proven track record and many shots at FDA approval in a wide variety of diseases, revenue from newly approved drugs is likely to grow over time.

Conclusion

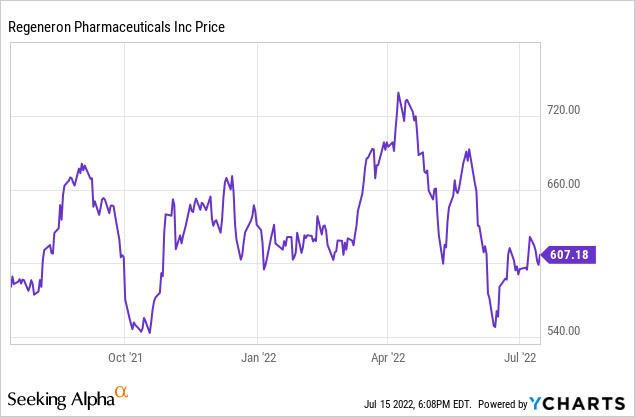

I think the safe course is to assume that Eylea revenue will be eroded to a large extent by the end of the decade. I also would plan on Regen-Cov revenue to wind down over time. Despite that, I am optimistic for the long run. Approved and pipeline drugs will likely eventually surpass current levels. That leaves the question of whether today’s stock price is a good entry point. It closed on July 15 at $607.54 per share. That is a bit south of midrange for the past year, which has seen a 52-week low of $538.18 and 52-week high of $747.42. Currently the forward P/E (price-to-earnings) ratio is 13.96. That is a return on capital of 7%. With so many unknowns going forward, despite potential upside, that return is lower than I like to pursue. On the plus side is the cash balance. I will be listening in and taking notes on the Q2 conference on August 3 for anything that might tip me in one direction or another. But given the decline in biotechnology stocks this last year, there are a large number of them that are more clearly undervalued, so I am neutral on Regeneron. I could buy some if the price dipped or a pipeline event gave me more confidence in its profitability between 2025 and 2030.

Be the first to comment