trait2lumiere/iStock via Getty Images

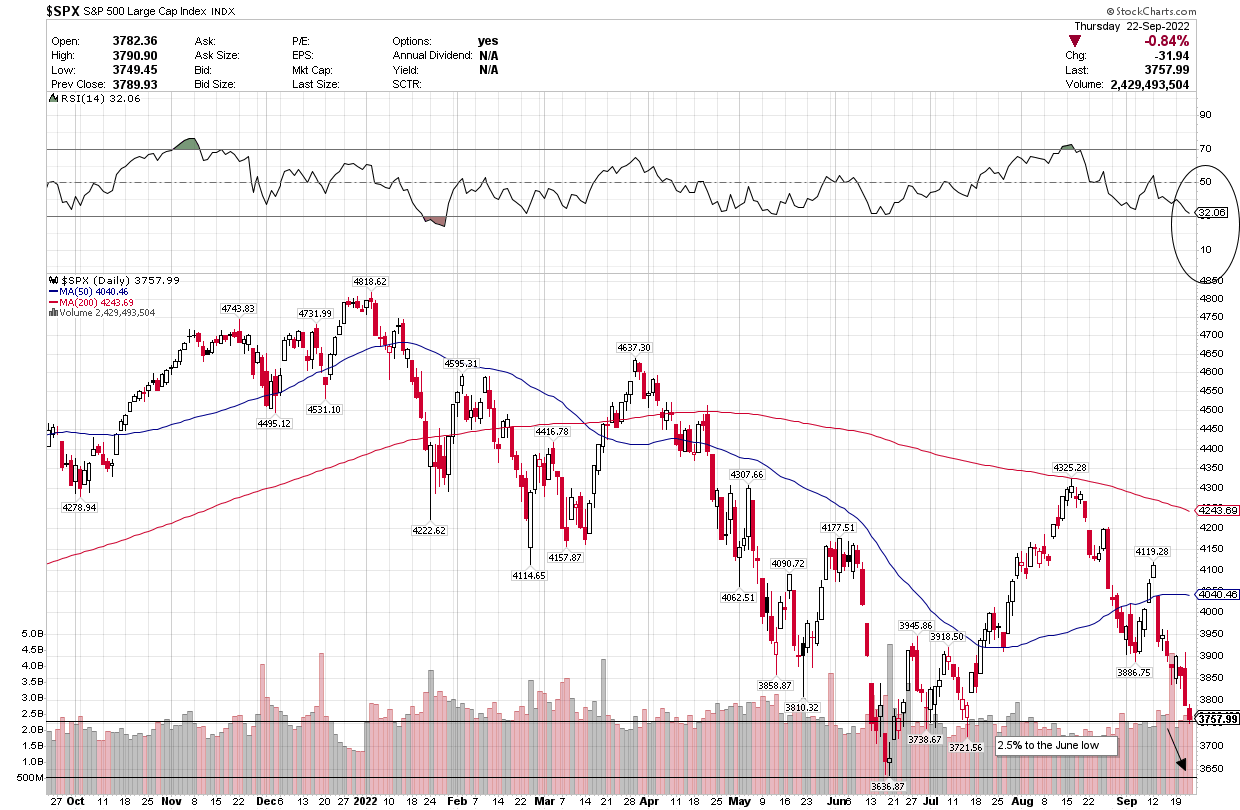

Higher interest rates led to lower stock prices yesterday, as the S&P 500 probes for a bottom following the Fed’s latest rate increase and updated economic outlook. The 10-year Treasury yield rose to 3.7%, which it has not seen since 2011. With the seasonally weakest time of year lasting until mid-October, and the Fed guiding for another 125 basis points of rate increases by year-end, it seems certain that we will test the June low in the days ahead. Whether that test is successful is likely based on the strength of upcoming corporate earnings reports for the third quarter and the level at which bond yields and the dollar peak. If markets look forward, then I still think we see a rally into year-end that strengthens post-midterms.

Finviz

The historical precedent that strengthened my conviction we would not fall below the June low for the S&P 500 is depicted below. As the market was recovering in what most believed to be a bear-market rally, the level at which point 50% of the bear-market losses would be recovered came into focus. This is because there has never been a rally since 1950 that retraced 50% of the losses incurred during a bear market and was followed by a decline that took out the previous low. The S&P 500 broke above the 50% retracement level of 4,231 on August 12 and peaked at 4,325 on August 15.

Bloomberg

That precedent will be tested in the coming days, as we are 2.5% away from the June low. At the same time, the market is approaching oversold technical levels that could trigger a bounce.

StockCharts

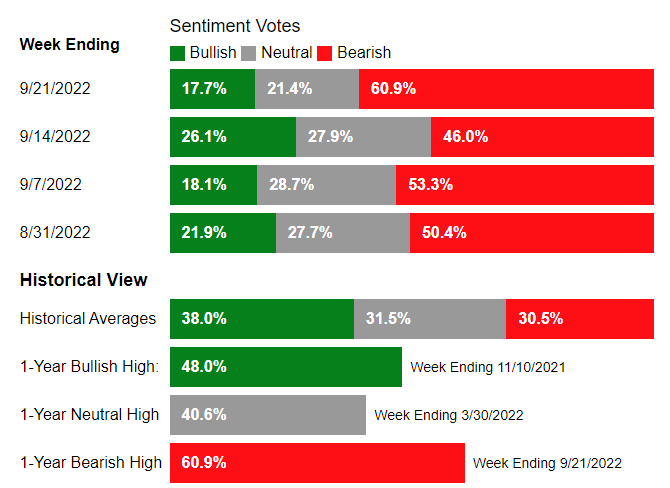

From a contrarian standpoint, investor sentiment is abysmal. The latest survey from the American Association of Individual Investors shows the highest level of pessimism since March 2009. The percentage of bulls at 17.7% is one of the 20 lowest readings in the history of the index going back to 1987. If memory serves, March 2009 was an incredibly horrific point in time when the housing market had imploded, the solvency of our banking system was in question, and we were in the midst of the worst recession since the Great Depression. The concerns investors have today are trivial in comparison.

AAII

Instead of double-digit unemployment, we are fretting about a modest increase from an all-time low of 3.5%. Instead of a collapse in corporate profits and margins, we are concerned that earnings growth may be just low-single digits for the third quarter. The possibility of depression, then, is consternation about a very mild economic contraction today. If we do break below the June low, I think it will be based upon unfounded inflation fears that still result in a market rebound during the fourth quarter of this year. It will also present another opportunity to invest for those who are looking out one year or longer.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment