Kimberly White/Getty Images Entertainment

Introduction

The second quarter’s biggest headline was Innoviz’s (NASDAQ:INVZ) reveal of being selected by Cariad to supply lidar sensors to Volkswagen AG (OTCPK:VWAGY). The news was around in Q1, but the OEM was not named at the time. The company took an opportunity to claim to service 15% auto industry, adding the existing deal with BMW and highlighting what it refers to as the order book of $6B revenue potential.

Many investors have been critical of the announcements as not particularly binding. Still, Innoviz, next to Luminar (LAZR), proclaiming a relationship with Nissan (OTCPK:NSANY) in Q1, can produce news that the market likes. The strategy of creating interest in the stock is much needed for extending the lidar companies’ life while they prepare for revenue generation. It is a skill or opportunity that is not equally distributed among the participants.

Innoviz has shown its ability to win, even if the details are not finite. In the end, those relationships may not end as the CEOs want. Yet, they are the industry’s validation today, critical when the revenue forecast has decreased dramatically across the board.

Innoviz has done a great job announcing customers, and the market likes it. As a novel approach, Innoviz, with the Volkswagen deal, declared its designation or perhaps a desire to be a tier-one supplier. In contrast to the company’s role in BMW’s win, Magna (MGA) was a tier-one supplier.

As part of the strategic planning to attract the market’s attention, mass production was a topic highlighted by three companies during the quarter. Earlier in the period, Aeva (AEVA) showed a video of how the company is manufacturing its sensor, Aeries II. Luminar also produced the video about building its production lines and offered ideas about ASP and bill of materials costs. During the conference call with Innoviz, there was a lot of information on how the company could utilize the experience with Magna to build machines and automation for its second-generation sensor.

Financial picture summary

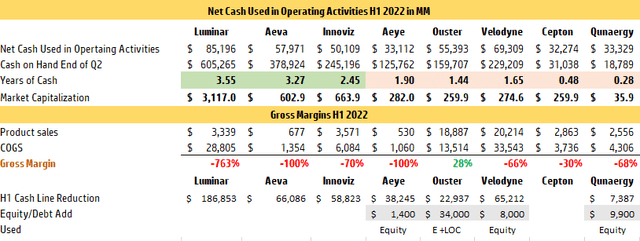

The tables summarize the sector stance with cash, revenue expectations, and opex costs. Cash runways continue to be a compelling argument for how market capitalization is awarded to each company.

As the strenuous time is upon us, some companies are selling equity and getting into debt. The row titled “Equity/Debt Add” illustrates that the most significant cash generation from this activity was by Ouster (OUST), with some 6.75M shares sold at $2.16. Ouster also took on $20M of debt. Quanergy (QNGY) sold 25.1M shares for $9.9M cash, and Velodyne (VLDR) sold 6.47M shares at $1.17 per share.

Net Cash Used in Operating Activities H1 2022 (Author. Financial statements published)

The tracking shows Luminar, Aeva, and Innoviz having much more time than others to generate meaningful revenues. Luminar alone has a market capitalization greater than all other companies combined. However, the gap separating Aeva and Innoviz from the rest has become more evident now, with each company doubling the value of the next contender, AEye (LIDR).

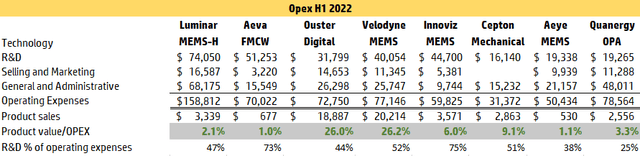

Investment in research and development is essential to the industry’s progress. Including shares’ compensation, the first half of the year saw the following spent:

$178M in MEMS and hybrids,

$52M in FMCW,

$32M in a digital flash,

$19M in OPA,

$16M in MMT.

A total of $297M invested in R&D produced $51M in product sales, excluding service revenues. The group’s combined gross margin was a negative 79%. During the first half of the year, and what has become an expected standard, Ouster was the only company with a positive gross margin of 28% and the second largest revenue for the same period at $18.8M.

Velodyne recorded $20M in product sales, excluding the company’s non-cash adjustment for the warrant issued to Amazon. The company was a net margin negative of 66%.

OPEX H1 2022 (Author. Financial statements published)

Setting benchmarks for ASP and Cost

Omer Keilaf, CEO of Innoviz, described the deal as follows:

“I mean, we’re talking about the penetration rate from 1% to 14% of the total volume out of the 10 million. And which is related, the kickoff is related now to several brands. There are several models that are already planning to launch with the LiDAR, and every year there will be releases of more cars every year, and there will be a ramp-up. So, the total eventually of the entire program is calculated based on the sum of roughly 6 million cars for the duration of 8 to 10 years. But we believe that eventually more brands will eventually use the LiDAR, and the numbers could grow.”

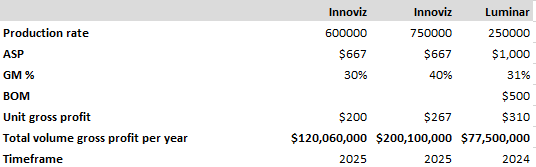

Using Keilaf’s description, Innoviz offers to equip 6M cars for $4B in revenue and an average selling price of $667 per unit. The timeline of it is 8 to 10 years. That sets the production targets from 600K units per year to 750K per year. The targeted gross margin is 30% to 40%. I am assuming less production does lower gross margin percentage; therefore, at 600K units per year and a 30% gross margin, the cost of goods sold or COGS will be $447 per unit. At 750K units per year and 40% gross margin, the COGS are $400.

Luminar modeled its bill of materials (BOM) at $500 per unit for Iris, a sensor planned for AB Volvo (OTCPK:VOLAF). The production is set for 250K per year, starting at this level in 2024. Investors should acknowledge that BOM is only a subset of the cost of goods sold.

Luminar expects to sell Iris at the ASP of $1000. In my previous article, I estimated a gross margin of 31% for this production. The analysis summary for both companies’ mass production is in the table below.

Production Gross Margins (Author. Based on the description of costs from Innoviz and Luminar)

Based on a current OPEX, Innoviz would be close to breakeven if those rates were achieved in the given timeline. However, the OPEX will likely go up with the production costs.

I did not incorporate $100 BOM in the table for two reasons. First, the new design required by Luminar, one which InnovizTwo seems to have with one laser and one receiver—and second, missing average selling price for it.

The above analysis is based on the expectations and speculations given by each company. While each company’s current gross margin is not relevant for comparison, the story of generating revenues for this group has only two examples in Velodyne and Ouster. And they are very different based on gross margin.

The logical cost calculation improves with volumes, but mass production alone does not create margins.

Velarray H800 was heralded in 2020 in Forbes as a solution to a fast adoption at $500. A sensor that Velodyne concluded was too expensive to make in Q2 2022. The lesson here is that Innoviz and Luminar estimates are, at best, forecasts, and not every expectation turns into fact.

Innoviz has done a much more noticeable job of improving InnovizOne results in InnovizTwo than anything done by Velodyne to date. The distance, field of view (FOV), and angular resolution improved. In this Forbes article, Sabbir Rangwala notes that points per second or PPS had gone from 3M to 10M, all while reducing the cost by 70%. But with all those improvements, the cuboid volume of InnovizTwo is larger than InnovizOne by about 78%, and while Luminar’s Iris can keep with PPS at 9M, this sensor is two times larger than InnovizOne.

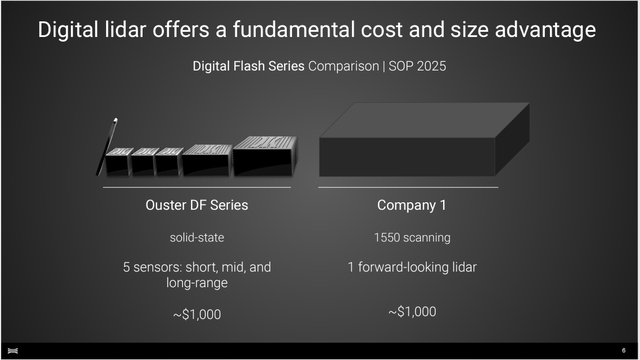

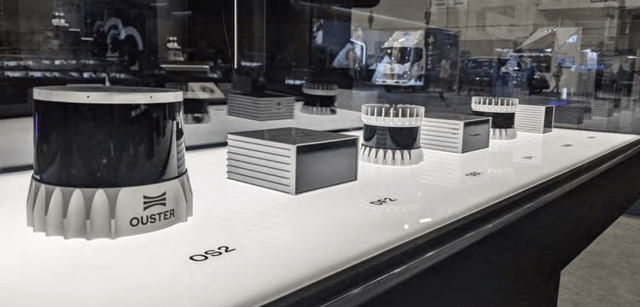

A Cariad’s win for Innoviz comes from a sensor that is 46% smaller and has a 33% lower ASP than Iris. In the long term, I need to take into account that it may be difficult for MEMS technology to deliver if improvements require a larger sensor to reduce cost and increase performance. Precisely when digital flash sensors from Ouster are already delivering on small form factor and the performance, as per quote from Mark Sandoval, VP of Automotive Products and Programs at Ouster:

“The DF sensors are already an order of magnitude smaller than other automotive lidar products, and we have a clear roadmap to further reduce size in time for series production. This is critical for automotive companies which are looking for sensors with best-in-class reliability that can meet small form-factor requirements for sleek vehicle integrations”

Example 1. A comparison of the DF set of sensors pictured below to what is widely assumed to be the Iris sensor from Luminar based on the laser wavelength of 1550nm.

Example 1. Form Factor Comparison (Ouster. Q1 2022 Presentation)

Example 2. A picture of the DF sensors from Ouster during the January 2022 CE event. The company announced eight times reduction of DF during an announcement of showcasing them to over 30 OEMs and Tier-1s in April’s new release.

Example 2. Comparison of Ouster sensors (Ouster. Internet found)

Quanergy and AEye

Quanergy injected $9.9M of cash and has just about $18M of cash left. The company seems to be spending around $16M per quarter, which means it needs to double cash generation from equity sales by Q4 of this year by selling 54M shares at the current price. There is no help from revenue generation as it is likely lost due to negative margins. Its small market capitalization of $35M will lead to delisting and pink sheets; the company received the letter from the exchange on this matter. I doubt technology will attract suitors even at this low price. For the record, the company has accumulated a deficit of $438M since its formation.

AEye has been talking volumes about its technology and associated perception capacity, but it does not appear the talk has yet found any support in selling to customers. AEye has the lowest product sales at $530K, lower than Aeva, which has remained a prototype scale company in Q2.

AEye has an agreement with Continental (OTCPK:CTTAF), a tier-1 that built an HRL131 sensor licensed on AEye’s technology. Mass production for the sensor is targeted to start in 2024, so another wait-and-see project. AEye has $125M in cash, plus two agreements to sell equity worth about $250M when monetized. There was a small equity sale executed in Q2.

Since the Q2 announcement, AEye lost at least $600M in market value. The company appeared significantly overvalued in Q1, and the new “lean” valuation is much closer to the alignment of its cash and market capitalization with peers.

Lidar in warehousing automation

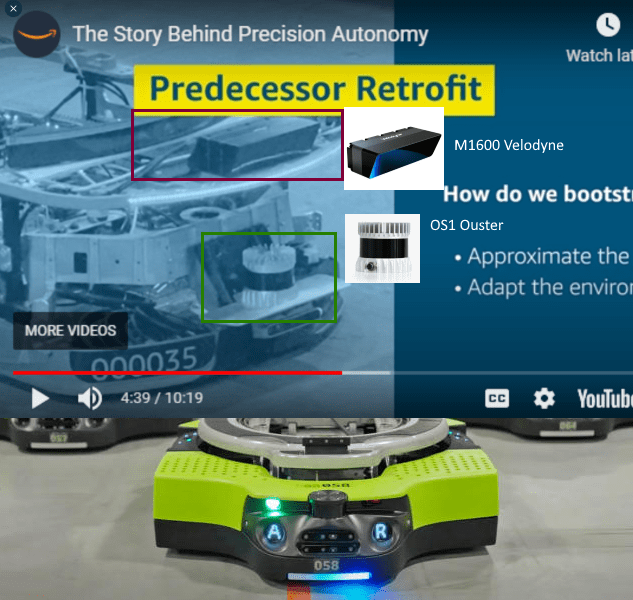

Last week, a video surfaced on YouTube explaining Amazon’s (AMZN) road to precision autonomy. It is unique that Proteus will be sharing the environment with humans, and a new set of sensors have been used to enable it.

I captured a frame from the video that appears to have the Ouster sensor as part of the new design. I have also shown the snapshot of Proteus in its final format, illustrating the previous location of the lidar sensor has a cylinder casing.

Ouster sensor on Proteus robot (Amazon. Modified by the author to highlight the use of Ouster sensor)

The snapshot explains that new sensors were installed on the predecessor (taller) model. An investor on the internet pointed out that the sensor above Ouster is likely M1600 from Velodyne. I am speculating that based on the final shape of the Proteus, a sensor from Ouster is certainly utilized in the robot. Ouster has not commented on the video and the nature of the arrangements with Amazon.

Conclusion

The lidar industry has not progressed as many hoped or expected. The revenues remain minimal, while discussions on mass production started only taking shape. Cash will be the most critical factor in success, and the ability to generate revenue can’t come soon enough.

The segment can likely remain a high-risk environment for months, if not years, to come. A question of when cash will run out and when selling equity makes the most sense will occur. Investors will select a company that capitalizes on relationships, customers, and design wins to achieve the objective at the least cost to equity.

I am hesitant to suggest investment objectives based on the above conclusion. However, looking at the market assessment of Innoviz versus Luminar, I would imagine that value of Innoviz will rise in time, especially if they can continue to capture OEMs into their program. Based on this year’s achievements, I rate Innoviz as a buy.

Be the first to comment