lyash01

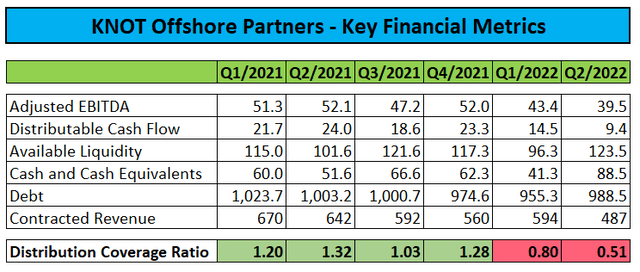

Last week, leading shuttle tanker operator KNOT Offshore Partners (NYSE:KNOP) reported its weakest quarterly results in recent history and the second quarter with a distribution coverage ratio of well below 1.00 in a row:

Results were pressured by an elevated number of scheduled drydockings with additional impact expected for the current quarter.

On July 1, the company acquired the shuttle tanker “Synnøve Knutsen” from its sponsor Knutsen NYK, which should increase contracted revenue and add to distributable cash flow going forward. Adjusted for the cash portion of the deal, available liquidity as of the end of Q2 was down to approximately $91.5 million, the lowest number for quite some time.

Contracted revenue of $487 million also hit a new multi-year low and was down an eye-catching 18% sequentially, partially due to the company’s decision to accept an early redelivery for the North Sea shuttle tanker “Ingrid Knutsen” in exchange for the charterer (Eni) committing to a new three-year time charter contract on “similar commercial terms” which is expected to commence in January 2024.

In addition, Eni (E) has notified the partnership of its intent to redeliver the North Sea shuttle tanker “Hilda Knutsen” next month.

Keep in mind that Eni is also the charterer of the North Sea shuttle tanker “Torill Knutsen” with the current contract scheduled to end later this year.

Please note the fact that Eni is redelivering older units to the partnership while at the same time taking delivery of newbuilds from parent Knutsen NYK:

In July 2022, Frida Knutsen was delivered to Knutsen NYK from yard in Korea and will commence on a seven-year time charter contact with ENI for operation in North Sea. The charterer has options to extend the charter by up to three further years.

Another vessel, Sindre Knutsen, is planned to be delivered by the end of August 2022 from the yard in Korea and will commence on a five-year time charter contract with Eni for operation in the North Sea. The charterer has options to extend the charter by up to five further years.

While the company managed to enter into short-term charters for the shuttle tankers “Tordis Knutsen” and “Lena Knutsen” and secured a new one-year contract for its oldest vessel “Windsor Knutsen” which is expected to commence in January 2023, the unit might very well sit idle for the remainder of the year following the completion of its 15-year special survey.

In combination with the upcoming redelivery of the “Hilda Knutsen“, two of the company’s vessels are likely to be without employment for most of the third quarter and potentially even longer given the current weakness in the North Sea market:

However, the delayed resumption of activity in the North Sea continues to dampen a return to high shuttle tanker demand in our secondary market, and we believe that this situation could persist for several more quarters.

Should Eni also redeliver the “Torill Knutsen” to the company later this year, KNOT Offshore Partners would be down to just one vessel operating in the North Sea.

Suffice to say, the company’s near-term outlook isn’t great at this point and management’s commentary in the press release wasn’t exactly suited to instill confidence in the partnership’s generous common unit distribution (emphasis added by author):

Although the North Sea market gives some cause for concern, the Partnership is working to address the gaps in vessel employment that have occurred and is looking at all commercial and financial avenues to ensure that the best interests of the Partnership’s unitholders are respected during what the Partnership believes is a bumpy, but temporary, period.

In the past, sponsor Knutsen NYK has helped the partnership to bridge employment gaps but apparently not this time. In fact, the parent appears to have contributed to the subsidiary’s current issues as customers like Eni and Galp (OTCPK:GLPEY, OTCPK:GLPEF) are returning older vessels to the company while at the same time taking delivery of newbuild shuttle tankers with better unit economics from the parent.

Currently, Knutsen NYK operates five modern shuttle tankers which are basically waiting for being dropped down to the partnership but after the recent “Synnøve Knutsen” acquisition, KNOT Offshore Partners will be challenged to purchase another vessel from its sponsor without diluting common equity holders.

Bottom Line

While management remained optimistic about the mid- and long-term prospects of the shuttle tanker market with substantial growth expected offshore Brazil, the ongoing weakness in the North Sea market is causing growing pains for KNOT Offshore Partners.

The company is currently facing substantial idle time for up to three North Sea shuttle tankers and on the conference call, management wasn’t exactly enthusiastic about trading idle vessels in the conventional tanker market despite a very strong charter rate environment.

Given the current headwinds, I would expect the company’s Q3 distribution coverage ratio to be well below 1.00 for a third quarter in a row. Should management indeed fail to secure sufficient near-term contract coverage for its North Sea fleet, a temporary distribution cut might be in the cards.

While I neither doubt the long-term prospects of the shuttle tanker market nor management’s commitment to the quarterly distribution, I view risk/reward as highly unfavorable at this point.

Investors should remain on the sidelines or even consider selling existing positions until the current weakness in the North Sea market abates.

Be the first to comment