PixelCatchers/E+ via Getty Images

Very little excites me as much as finding unique companies that might make for attractive investment opportunities. The more unique the company is, the more intrigued I am by how it generates revenue and what its upside potential, if any, might be. One company that is undeniably interesting is Otis Worldwide (NYSE:OTIS). This enterprise is the world’s leading elevator and escalator manufacturer, installer, and service firm. Long term, I suspect that the company will be just fine. Unfortunately, it doesn’t seem to offer real upside at this point in time. Recent fundamental performance has been disappointing, and management has revised down their expectations for the current fiscal year. If shares of the company were trading on the cheap, this might be something we could overlook. But given where shares are priced right now, the company seems to be, at best, fairly valued. And if the stock does rise much further from this point, I do think a case could be made that it is overvalued. For now, I have decided to retain my ‘hold’ rating on the company, with my view on its potential waxing negative.

Disappointment

Back in April of this year, I wrote an article covering the investment worthiness of Otis Worldwide. Although I was intrigued by the company’s business model, and I claimed that its financial condition was robust, I also acknowledged that it didn’t offer investors with significant upside potential. Ultimately, given how shares were priced, I concluded that the stock was more or less fairly valued, suggesting that its returns would probably match the broader market moving forward. Since then, the company has significantly outperformed my expectations. While the S&P 500 is down by 3.1%, shares of Otis Worldwide have generated a return for investors of 4.8%.

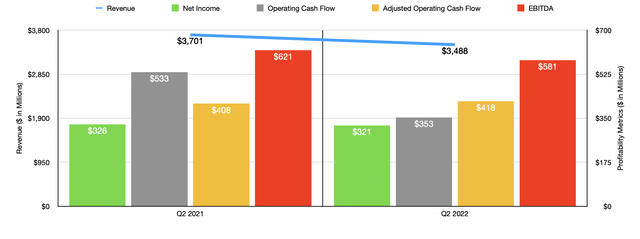

Given this return disparity, you might initially think that the company was doing quite well. Unfortunately, that’s not exactly the case. Consider, for instance, the revenue picture for the company during its latest quarter. This is the second quarter of its 2022 fiscal year, the only quarter for which we now have data that we didn’t have data for when I last wrote about it. Sales for that quarter came in at $3.49 billion. That’s 5.8% lower than the $3.70 billion generated the same quarter last year.

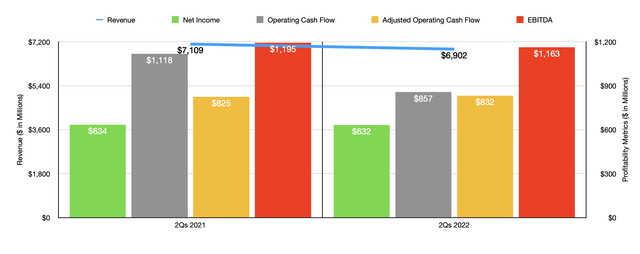

There were multiple contributors to this year-over-year decline. For instance, the company was hit to the tune of 1% by the cessation of operations in Russia. This was only marginally offset by a 0.1% increase caused by acquisitions and divestitures on a net basis. The real big pain, however, came from foreign currency translation, which hit the company to the tune of 5.3%. On the other hand, organic revenue for the company was not awful, adding 0.4% to the firm’s top line. Management attributed this rise in organic revenue to a 5.2% increase in its service category of offerings. However, new equipment organic sales dropped by 5%. As you can see in the chart below, the weakness in the second quarter was instrumental in pushing the company’s revenue for the first half of the year as a whole down compared to what it was the same time last year.

This decline in revenue brought with it a weakening in profitability. Net income declined only marginally, dropping from $326 million in the second quarter of 2021 to $321 million the same time this year. The main reason why profitability didn’t fall further related to selling, general, and administrative costs dropping from 13.1% of revenue to 12.6%. Management attributed this to cost containment actions, other employment-related reductions, lower credit loss reserves, and foreign exchange fluctuations. These improvements, unfortunately, were somewhat offset by annual wage increases and increased restructuring costs, the latter of which grew by 50% from $26 million to $39 million. Other profitability metrics were mixed but generally negative. For instance, operating cash flow plunged from $533 million to $353 million. But if we adjust for changes in working capital, it would have inched up from $408 million to $418 million. During that same time, on the other hand, EBITDA for the company contracted from $621 million to $581 million.

Due to these changes, management ended up revising down their expectations for the current fiscal year. When I last wrote about the firm in April, management said that revenue for 2022 would come in at between $14.1 billion and $14.3 billion. That number has now been revised to between $13.6 billion and $13.8 billion. Organic revenue is now forecasted to grow by between 2.5% and 3.5% compared to the 3% to 4% range management thought at the end of the first quarter. Perhaps the only bright spot here relates to organic service revenue. Previously, management thought this would increase by between 5% and 6%. Now, the expectation is for it to rise by between 5.5% and 6.5%. Earnings per share, meanwhile, are now forecasted to be between $3.17 and $3.21. Before, management thought that they would be between $3.22 and $3.27. Given current expectations, net income should total around $1.35 billion. No guidance was given when it came to operating cash flow. We only have an estimate for free cash flow but with no real guidance for capital expenditures, this is useless. If we assume that the change in net income this year should match the change we should see in adjusted operating cash flow, then that latter metric should come in at $1.73 billion for the year. Meanwhile, EBITDA should total $2.55 billion.

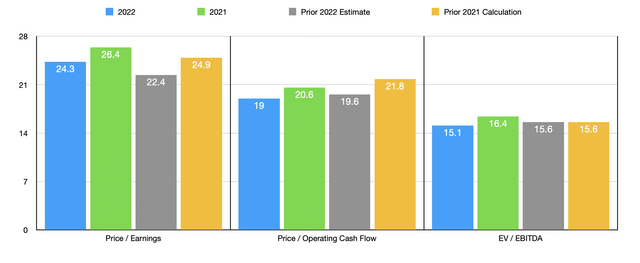

Based on these figures, we can see how shares are priced today. On a price-to-earnings basis, the firm, looking at the forward multiples, should be trading at a multiple of 24.3. This is down from the 26.4 reading we get using 2021 results. The price to adjusted operating cash flow multiple of 19 should be down from the 20.6 reading weekend using 2021 figures. And the EV to EBITDA multiple of the company should drop from 16.4 to 15.1. As you can see in the chart above, pricing for the company on a forward basis is not all that different from what it was when I last wrote about the company. As part of my analysis, I also compared the company to the same five firms I compared it to last time. On a price-to-earnings basis, these companies ranged from a low of 5.8 to a high of 67.1. Using the price to operating cash flow approach, the range is between 7.5 and 21.9. And using the EV to EBITDA approach, the range should be from 4.2 to 18.8. In all three scenarios, four of the five companies are cheaper than Otis Worldwide.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Otis Worldwide | 24.3 | 19.0 | 15.1 |

| Mueller Industries (MLI) | 5.8 | 7.5 | 4.2 |

| Parker-Hannifin (PH) | 17.2 | 13.8 | 13.3 |

| Standex International (SXI) | 14.7 | 15.1 | 9.4 |

| Evoqua Water Technologies (AQUA) | 67.1 | 21.9 | 18.8 |

| Snap-on Inc. (SNA) | 14.0 | 13.1 | 9.8 |

Takeaway

Long term, I have no doubt that Otis Worldwide will do well for itself and its shareholders. But shares the company look, at best, fairly valued at this time. I think a case could even be made, perhaps, that the company is overvalued or awfully close to it. Normally, the pricing of the company might be justified because of how high quality and operator it is. But given the recent decline in profitability and revenue, it’s clear that the near-term outlook for shareholders won’t be great. Given how these shares are priced today and given these recent declines, I’m close to downgrading it to a ‘sell’, but I’m not there quite yet.

Be the first to comment