Airbnb (NASDAQ:ABNB) was probably the hottest IPO in 2020 and now that the price has dropped below its IPO price, I decided to research the company on a deeper level. Also, I wrote this deep dive while staying in an Airbnb in Bali. I hope you find value in this article. Enjoy!

Charley Gallay

Investment Thesis

Airbnb is building itself to become the ultimate host through its two-sided marketplace for Hosts and Guests. Many believe that Airbnb is a “travel” or “vacation rental” company, and while that may be true, I believe Airbnb is much more than meets the eye. To me, Airbnb is a hosting platform, and the hosting opportunity is endless.

Airbnb is a high-quality business with durable competitive advantages that will protect it from competitors and macroeconomic distress. This explains why Airbnb is richly valued. Despite the recent selloff, its valuation may still be elevated — I’d be inclined to start a position if we see new lows.

Value Proposition

Let’s rewind back to 2007 in San Francisco. Two broke and unemployed former roommates-schoolmates, Brian Chesky and Joe Gebbia, were struggling to make ends meet to cover the high costs of living in the Bay Area. Fortunately, a small observation sparked a business idea in them. Specifically, the two friends noticed that all the hotel rooms in the city were fully booked due to a nearby conference. As such, they decided to run a little experiment by buying and renting out air mattresses in their apartment to attendees of the conference (who are budget-conscious).

Their experiment proved to be successful as three guests booked to stay in their apartment. This is a revelation for the two founders as it meant that their venture had product-market fit. Not long later, the third co-founder, Nathan Blecharczyk, joined the team as the company’s Chief Technology Officer. The founders launched their official website and named their service “Air Bed and Breakfast” — a website that offers short-term stays as an alternative to expensive hotels. These were all done in preparation for the Democratic National Convention in Denver, which was expected to attract 20,000 people to the city, thus saturating hotels in the area.

Source: The Hustle

Following the convention, Airbnb secured its first funding of $20,000 from Y Combinator, in 2009. The founders used these funds to travel to New York where most of their users reside. One major problem they discovered was that the quality of listing images was lackluster. As such, the founders borrowed cameras from their friends at Rhode Island School of Design, and go door-to-door to take better pictures of the listings. While not a scalable model, the Airbnb team eventually found a way to automate the photography process. By March 2009, the site had 10,000 users and 2,500 listings. As early Airbnb investor Reid Hoffman coined, Airbnb was ripe to “blitzscale”. And so it did, and the rest is history.

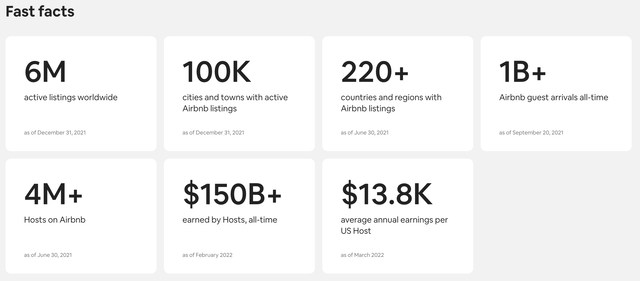

Fast forward to today, Airbnb has grown to over 6 million listings on its platform, attracting over 1 billion guest arrivals across 220 countries and regions.

So what is Airbnb today? What does it do as a business?

In short, Airbnb is the ultimate hosting platform for stays and experiences with the mission to create a world where anyone can belong anywhere.

Two stakeholders form the foundation of Airbnb’s two-sided network: Hosts and Guests.

Hosts

Airbnb provides Hosts with a marketplace to list their homes.

Demand for accommodation has previously been fulfilled predominantly by bigger players like hotels, motels, apartment owners, and whatnot. However, the introduction of Airbnb creates a level-playing field for everyday individuals — Airbnb calls them Hosts. This includes teachers, artists, or virtually any individual that has a spare bedroom or unit. More importantly, Airbnb enables Hosts to provide Guests access to their unique homes (entire homes, tiny houses, micro-apartments, castles, villas, etc.) in every corner of the world (big cities, small towns, rural areas, etc.).

Besides offering Hosts a platform to list their homes, Airbnb also enables Hosts to share their knowledge, interests, and skills through Airbnb Experiences. Here are some examples of what Hosts can offer to Guests:

- Hiking tour

- Cooking lessons

- Water sports

- Bar hopping

- Workshops

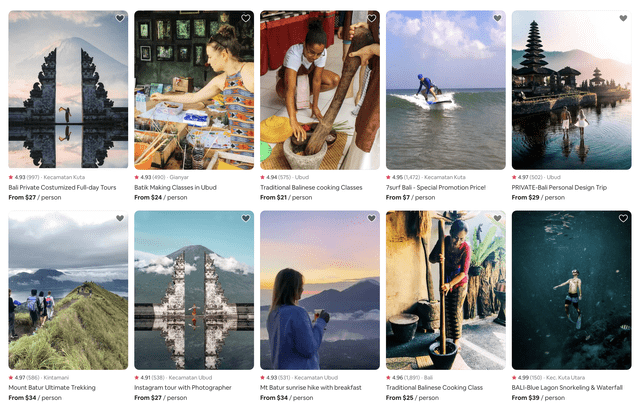

I recently went to Bali and these are some of the Experiences offered by local Hosts:

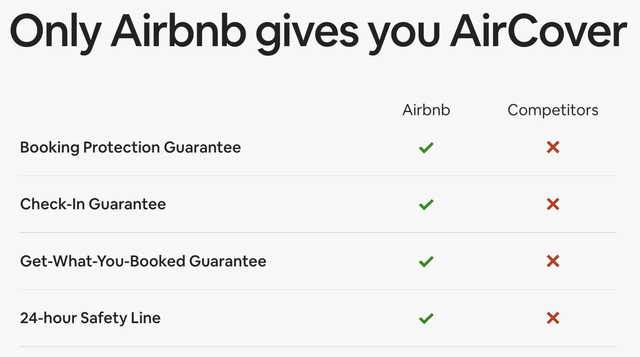

Also of important note, Airbnb has been incredibly effective in removing frictions associated with listing homes or Experiences, one of which is the recent launch of AirCover. I believe that one of the biggest concerns among Hosts is dealing with property damage and liabilities that may arise when Guests stay at their homes. Accordingly, Airbnb launched AirCover, which provides free, top-to-bottom protection for every Airbnb Host. Below list some of the things that AirCover covers as compared to that offered by competitors. With this development in mind, Hosts have a sense of security and peace of mind when listing their homes on Airbnb.

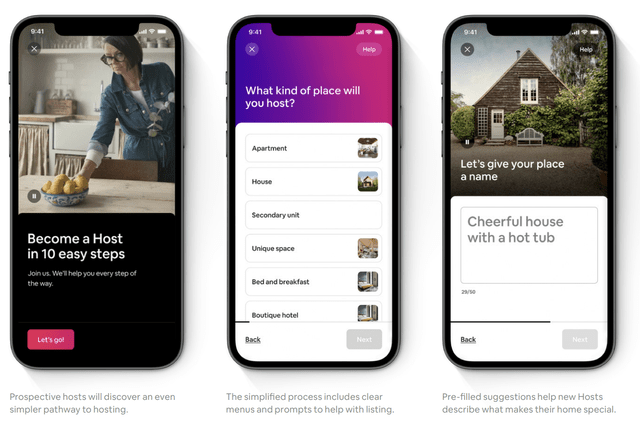

Airbnb has also made it dead simple for Hosts to begin listing their homes. In early 2021, Airbnb simplified the process for creating new listings from dozens of steps to just 10 simple steps. This update includes automated prompts, auto-filled listing descriptions, and AI-powered photo-sorting. All these remove a ton of friction related to listing homes, thus encouraging more listing creation within the platform. Not only that, but it also encourages new Hosts to join the platform without overwhelming them with details.

Source: Airbnb FY2021 Q2 Shareholder Letter

The Ask a Superhost functionality has also made it easy for newer Hosts to connect with more experienced Superhosts. Through this feature, Hosts can get hands-on tips and tricks from Superhosts as well as individual coaching sessions. Such a “mentorship” program makes it less frightening for newer Hosts to get their feet wet as an Airbnb Host.

These are just some of the main value propositions that Airbnb offers for Hosts, but the bottom line is that Airbnb provides a safe and simple marketplace platform for Hosts to list their homes and Experiences.

Guests

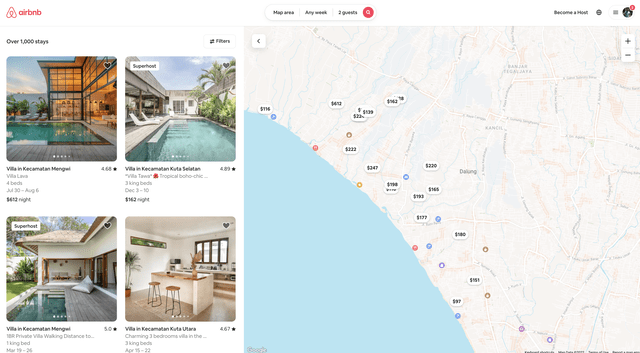

Obviously, the main offering for guests is the ability for them to book stays (both short-term and long-term) and Experiences. The key differentiation factor compared to other platforms is that Airbnb offers unique homes and Experiences offered by individual Hosts, as opposed to traditional hotels which have a more standardized format across all its buildings and rooms. The clean user interface and geotags also create a delightful experience for Guests to find the perfect stay. Here’s an example of what it looks like when I’m looking for a place in Bali.

Similar to Hosts, Guests experience some level of friction when booking through Airbnb, especially when it involves random individual Hosts with little credibility and guarantee of comfort and security. This is in sharp contrast to widely-recognized hotel franchises like Marriott (MAR), Hilton (HLT), and Hyatt (H) where Guests can expect high-quality rooms, amenities, services, security, and comfort.

This is why Airbnb prioritizes trust and safety like no other. This includes:

- Risk Scoring using predictive analytics and machine learning.

- Watchlist & Background Checks to screen against regulatory, terrorist, and sanctions watchlists.

- Preparedness by running informational and safety workshops with Hosts.

- Secure Payments through Airbnb’s platform.

- Account Protection using multi-factor authentication and account alerts.

- Secure Messaging to communicate with Hosts.

- Profiles for identification and verification purposes.

- Reviews to not only incentivize Hosts and Guests for good behavior but also detect those that are not acting responsibly. Listing and Experience reviews also ensure that Hosts provide Guests with the best service possible.

Just like Hosts, Guests also get AirCover as part of their stays — again, something that competitors do not offer.

Aside from trust and safety, Airbnb has also made it possible for Guests to find stays based on their unique individual needs and preferences, as opposed to hotel chains where they have a one-size-fits-all approach. For example, Airbnb Guests can filter stays down to minute details including property type, Host language, toilet grab bar, EV charger, and many more. Such attention to detail is not seen in other platforms.

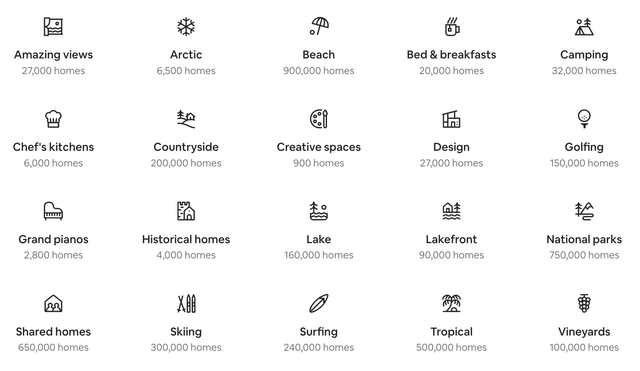

Airbnb has also launched Airbnb Categories which organizes homes into curated collections based on style, location, or nearby activities. This makes it even easier for Guests to find their perfect stay.

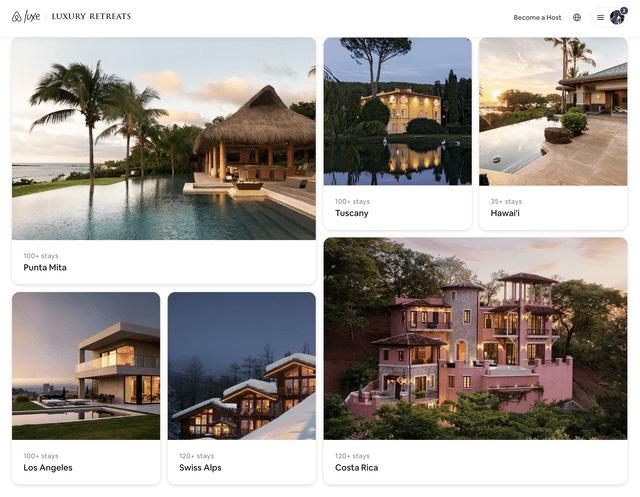

For those that prefer a more luxurious experience, they can turn to Airbnb Luxe, which provides a selection of high-end stays. Airbnb Luxe Guests also get a dedicated trip designer alongside perks such as a personal chef, driver, butler, and more.

These are just some of the many features that Airbnb offers to both Guests and Hosts. There is way too much to cover but the previous few paragraphs should give you a gist of what Airbnb does.

Nonetheless, the platform continues to evolve over time as the company pursues its ambition to become the ultimate host. For example, in 2021 alone, Airbnb added 150+ upgrades to its platform. In addition, the company recently announced its May Summer Release which management dubbed the “biggest change to Airbnb in a decade”.

As such, its technology platform gets more powerful over time, solidifying its value proposition as a two-sided marketplace for Hosts and Guests globally.

Market Opportunity

Airbnb operates in the travel and experiences economy. According to the company’s S-1 filed in late 2020, its total addressable market (TAM) is about $3.4 trillion, including $2.0 trillion for short-term and long-term stays, as well as $1.4 trillion for Experiences. On the other hand, its serviceable addressable market (SAM) is estimated to be $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for Experiences. This figure seems gigantic given that Airbnb posted only $53.8 billion of Gross Booking Value in the last twelve months. In a sense, Airbnb has barely scratched the surface of its market opportunity.

Source: Airbnb S-1

While TAM and SAM figures may have been inflated, there are several secular trends that serve as tailwinds for Airbnb.

First, more people are working remotely than ever. During the early days of the pandemic, social distancing and quarantine mandates forced the majority of the global workforce to work from home. The advancements in internet, telecommunication, and software technologies such as Zoom (ZM) and Microsoft Office (MSFT) have made it possible for workers to coordinate, collaborate, and communicate remotely and effectively. Online freelance job sites such as Fiverr (FVRR) and Upwork (UPWK) are also gaining in popularity as people sought ways to work remotely. There’s also the growing popularity of leading the digital nomad lifestyle, as universalized by Tim Ferriss’ The 4-Hour Workweek. Two years have passed since the pandemic began and we can say with utmost confidence that remote work is here to stay and it will continue to be a big part of our working lives. What this means for the lodging/residential industry is that travel will no longer be concentrated in major cities or tourist hotspots, but rather, dispersed to every corner of the globe as people have the ability to be location-independent due to the possibilities of remote work. With more people opting to work-from-anywhere, Airbnb stands to benefit from this trend as people no longer need to reside in their permanent dwellings — Airbnb’s platform is location-agnostic.

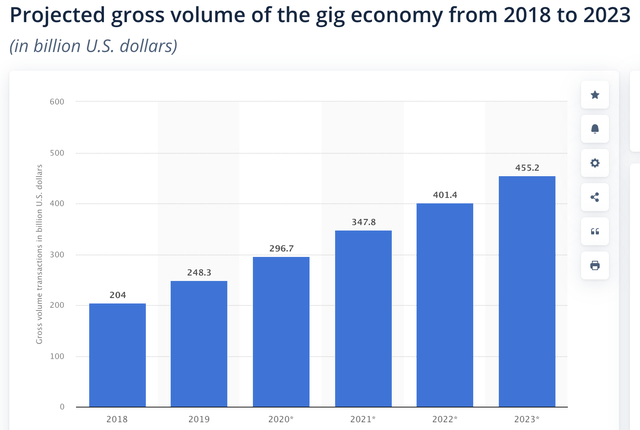

Second, the rise of the gig economy — loosely defined as platforms that enable freelancers to earn income from short-term jobs, contracted work, or asset-sharing — could mean more business for Airbnb. The side-hustle/passive-income culture that is so prevalent today can serve as a tailwind for Airbnb. More specifically, individuals can turn to real estate to earn extra income and there’s no easier and better way than renting their rooms or properties to Guests on Airbnb’s platform. As such, more Hosts/Listings join the platform, expanding the Airbnb network even further. As shown below, the gig economy is expected to reach $455 billion by 2023, which translates to more revenue generation for Airbnb.

Third, the great travel rebound will be a massive tailwind for Airbnb. There’s considerable pent-up travel demand as the pandemic fatigue kicks in. However, mass vaccinations have encouraged government bodies across the globe to slowly lift quarantine and travel requirements. Consequently, the travel and tourism industry has seen some encouraging signs of recovery. For instance, for the month of April, Airbnb saw 30% more nights booked for the summer travel season as compared to 2019, showing strong pent-up demand. As more and more countries open their borders to travelers, we can expect a global travel frenzy happening this year.

Fourth, Guests are staying longer. Due to the trends of remote working, more people are booking longer stays in their preferred destinations. In Q1 2022, long-term stays of 28 days or more continue to be the fastest-growing category by trip length, and it has more than doubled in size from Q1 2019. In addition, 48% of gross nights booked were from stays of at least seven nights. This shows that the lines between travel, living, and working are blurring.

These four trends will act as long-term tailwinds for Airbnb, providing a long growth runway for the company.

Business Model

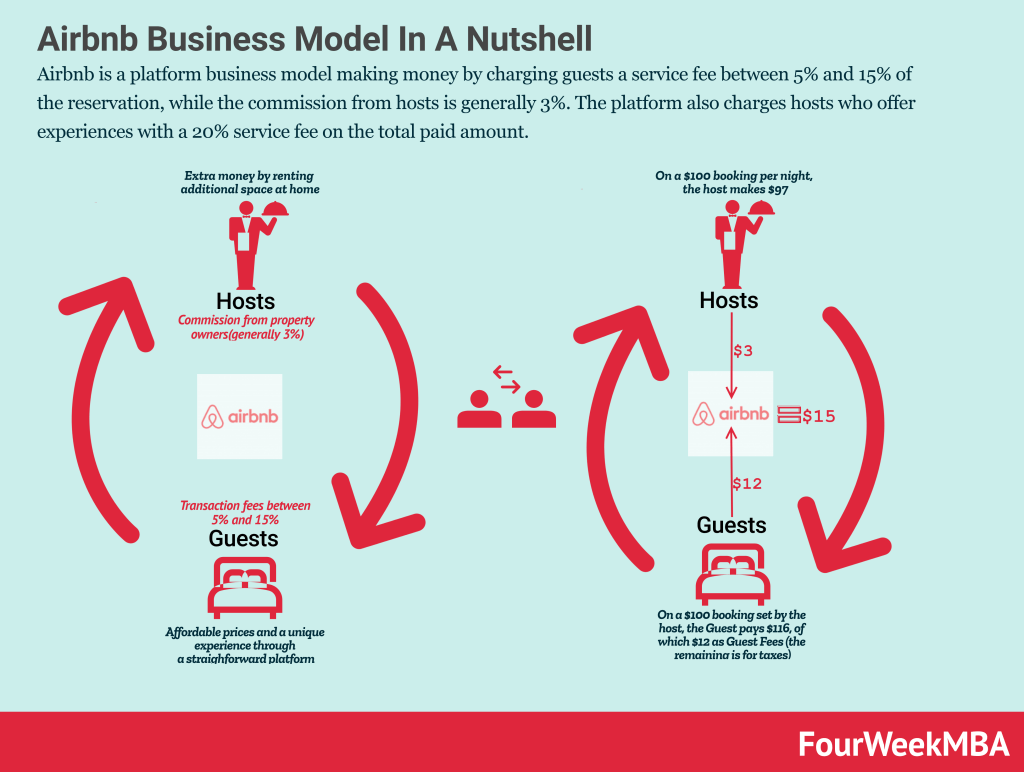

Airbnb operates a two-sided marketplace and it generates Revenue by charging fees to both sides of the network. Guests are charged a service fee which typically ranges from 5% to 15%, according to FourWeekMBA. Service fee varies from listing to listing based on booking value, booking duration, geography, and Host type.

As for Hosts, they are charged a commission of about 3% for using Airbnb’s platform. For Experiences, Hosts are charged a 20% service fee on the total paid amount.

The infographic below shows how Airbnb’s business model works. Here’s a quick example:

- The Host lists a stay for $100/night

- The Host makes $97/night after deducting a 3% commission

- The Guest pays $116/night, which includes a 12% service fee and the rest to cover taxes

- Airbnb receives a total of $15/night from both parties

Source: FourWeekMBA

Revenue from booking is recognized upon check-in, net of incentives, discounts, and refunds. Prior to check-in, the service fee is recognized as Unearned Fees on the balance sheet.

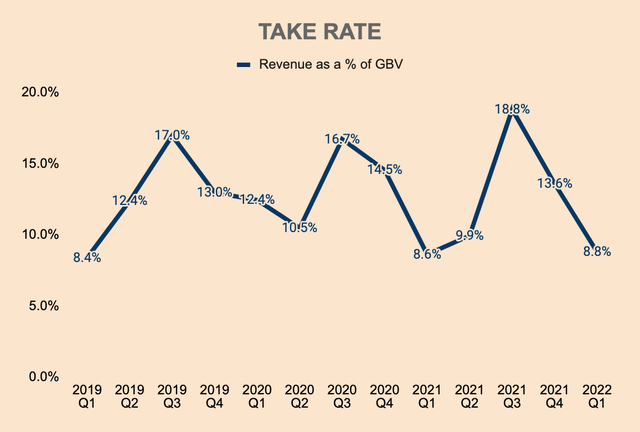

The chart below shows Airbnb’s Take Rate, or Revenue as a % of Gross Booking Value. As you can see, Take Rate follows a seasonal trend where it is typically the lowest in Q1 and highest in Q3. This is due to:

- Higher GBV and lower check-ins in Q1

- Strongest check-ins in Q3 (peak travel season), thus leading to higher Revenue in Q3

Source: Airbnb Investor Relations and Author’s Analysis

While Airbnb has the ability to raise fees further, it is important to note that management is laser-focused on capturing market share at the moment.

Growth

Now let’s look at the company’s growth profile.

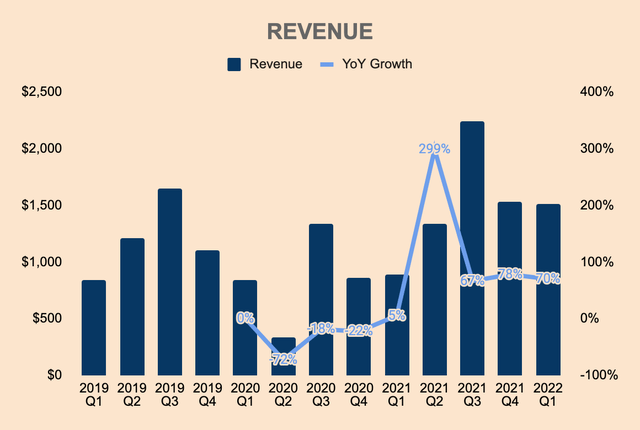

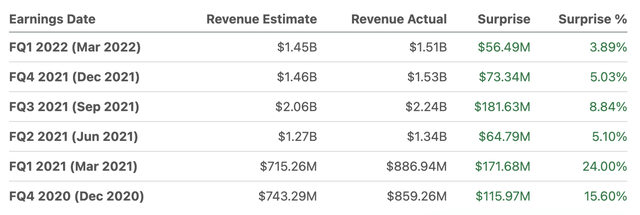

Q1 Revenue was $1.5 billion, up 70% YoY and up 80% from FY2019 levels. A recurring theme that you’ll see is that FY2020 numbers were severely distraught due to travel restrictions and government lockdowns, and therefore, it is better to compare Airbnb’s recent performance with its pre-pandemic FY2019 performance.

In terms of Revenue, Q1 has historically been the softest quarter as people return to their dwellings following the holiday season in Q3 and Q4. However, the pent-up travel demand that has been building ever since the pandemic began led to the strongest Q1 ever for the company, even despite the ongoing Russia-Ukraine war and other macro headwinds. As you can see below, Revenue for the past few quarters has shown strong recovery and outperformance as global authorities ease travel restrictions.

Source: Airbnb Investor Relations and Author’s Analysis

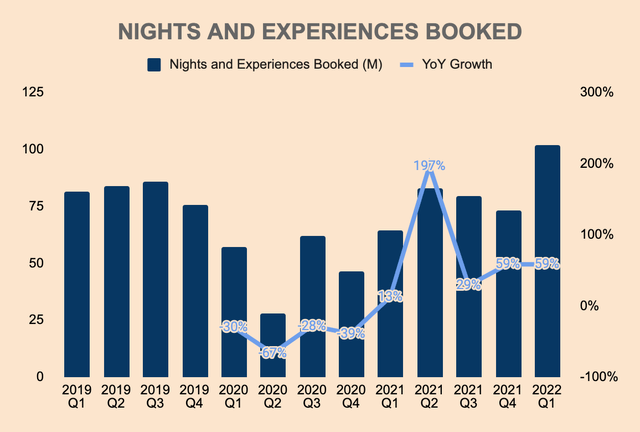

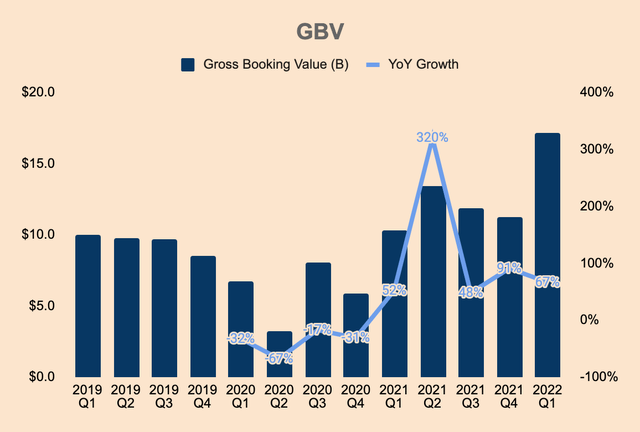

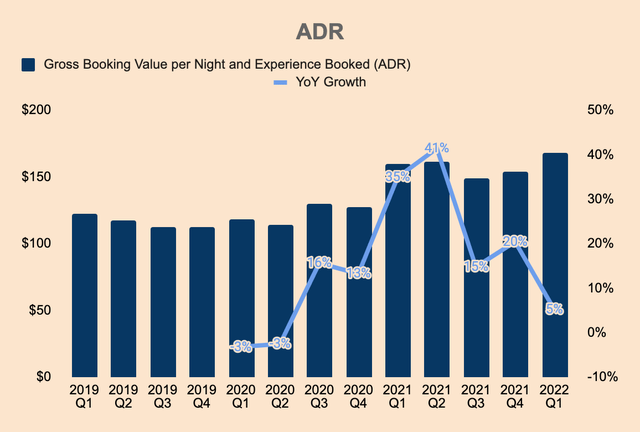

Strong Revenue growth was driven by growth in Nights and Experiences Booked, Gross Booking Value (GBV), and Average Daily Rates (ADR).

Below, you can see how the number of Nights and Experiences Booked has trended over the last few quarters. In Q1, Nights and Experiences Booked surpassed 100 million for the first time ever (102 million, up 59% YoY and up 26% from FY2019). This was driven by strong demand in North America, EMEA, and Latin America, while Asia Pacific remains weak. Excluding Asia Pacific, global Nights and Experiences Booked was up by 40% compared to FY2019 levels.

Source: Airbnb Investor Relations and Author’s Analysis

As a result of record Nights and Experiences Booked, GBV exploded to an all-time high of $17.2 billion in Q1, up 67% YoY and up 73% from FY2019. This shows that people are booking more trips than ever.

Source: Airbnb Investor Relations and Author’s Analysis

The growth in GBV was also due to higher ADRs. In Q1 ADR was $168, up 5% YoY and up 37% from FY2019. The higher ADR was due to both business mix shift and price appreciation. Mix shift has been primarily towards higher ADR regions, notably in North America and Europe, while lower ADR regions like Asia Pacific, remain depressed. Price appreciation also contributed to higher ADR as the hospitality sector enjoys tailwinds from the great travel rebound.

Source: Airbnb Investor Relations and Author’s Analysis

All in all, Airbnb is showing a stronger-than-expected recovery from the depths of FY2020. Despite recessionary headlines and ongoing macro headwinds, Airbnb’s platform proves to be resilient, growing rapidly even in the grimmest of environments.

Profitability

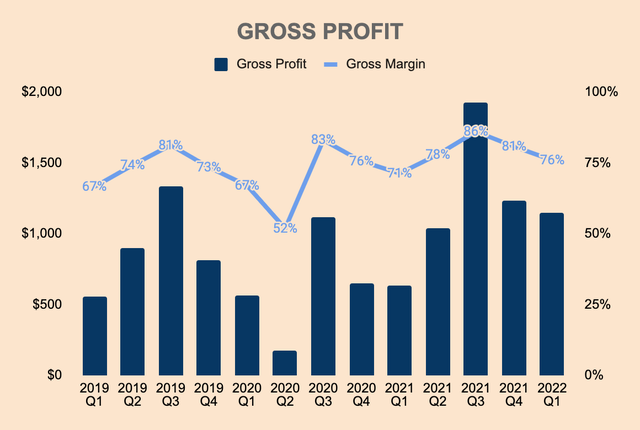

Turning to profitability, Q1 Gross Profit was $1.1 billion, which was a 76% margin. Such a high Gross Margin profile shows high earnings potential for the company. Q1 Gross Margin is typically the lowest compared to other quarters as most of the Revenue is recognized in the back half of the year. Thus, we can see how Gross Margin bottoms in Q1 and peaks in Q3. Being that as it may, Q1 Gross Margin has improved YoY, displaying economies of scale in the business model:

- FY2019 Q1 — 67%

- FY2020 Q1 — 67%

- FY2021 Q1 — 71%

- FY2022 Q1 — 76%

Source: Airbnb Investor Relations and Author’s Analysis

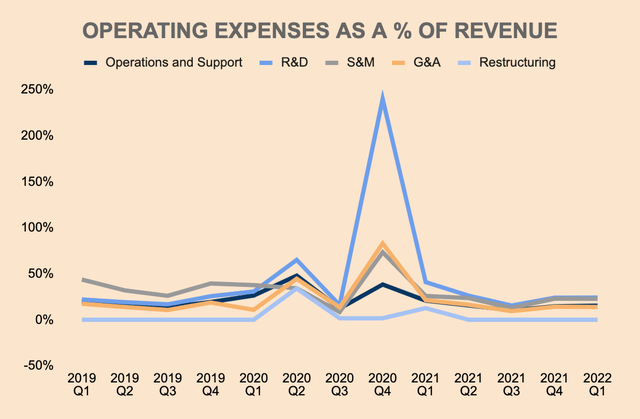

Moving down the income statement, Operating Expenses was $1.2 billion, which grew by only 7% YoY, allowing for margin expansion. The chart below shows the different components of Operating Expenses as a % of Revenue. The big spike in FY2020 Q4 is due to heavy Share-based Compensation (SBC) as a result of the company going public. Since then, Operating Expenses have stabilized to a more sustainable level. As you can see, R&D makes up the largest portion of Operating Expenses at 24% of Revenue, reflecting management’s focus on product and technology innovation.

Source: Airbnb Investor Relations and Author’s Analysis

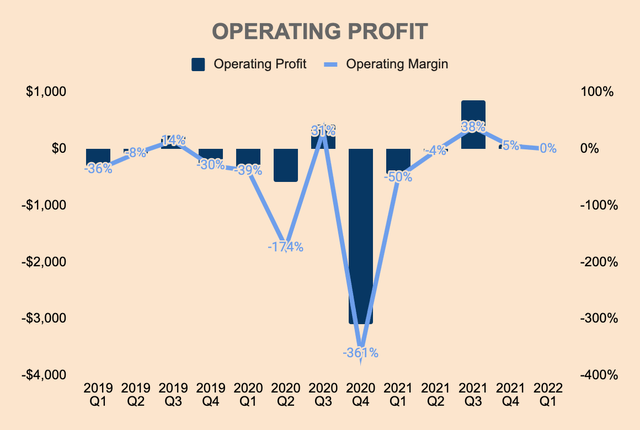

With that said, GAAP Operating Profit came in at $(5) million in Q1. As mentioned earlier, Q1 is historically the weakest quarter, and thus, the weaker margin profile. However, we should see GAAP Operating profitability in subsequent quarters fueled by the surge in GBV that we discussed previously.

Source: Airbnb Investor Relations and Author’s Analysis

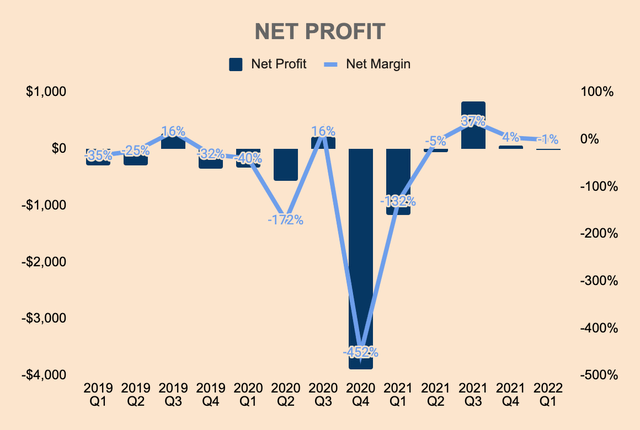

Here, we can see the same pattern for GAAP Net Profit. Net Loss was $(19) million in Q1, which was a substantial improvement from last year’s $(1.2) billion loss. The positive change this recent quarter was due to higher Revenue, as well as $782 million of significant one-time expenses incurred in FY2021 Q1.

Source: Airbnb Investor Relations and Author’s Analysis

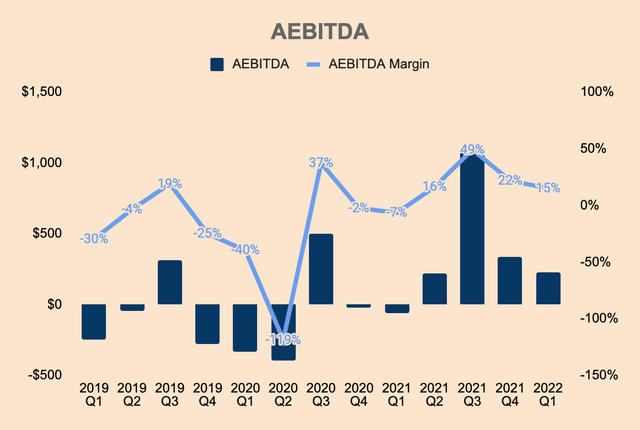

Adjusting for extraordinary items, Airbnb posted its first positive Q1 AEBITDA quarter. AEBITDA was $229 million, a margin of 15%. This substantial improvement was due to the strong Revenue recovery and disciplined spending by management.

Source: Airbnb Investor Relations and Author’s Analysis

Overall, Airbnb has high earnings potential as demonstrated by its high and improving Gross Margin profile. Operating, Net, and AEBITDA Margins have also improved and the company should achieve consistent profitability sooner than later.

Financial Health

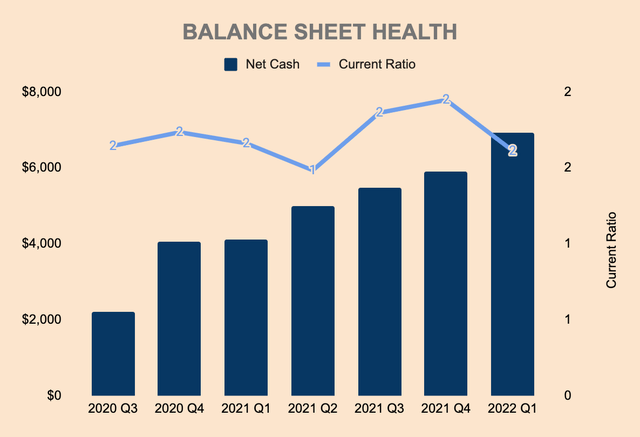

Turning to the balance sheet of the company, Airbnb had $9.3 billion of Cash & Short-term Investments as of Q1. The company has $2.4 billion of Debt, comprising mainly of $2 billion of Convertible Senior Notes issued in March this year. That brings its Net Cash position to $6.9 billion. Airbnb also has a Current Ratio of about 2x.

Source: Airbnb Investor Relations and Author’s Analysis

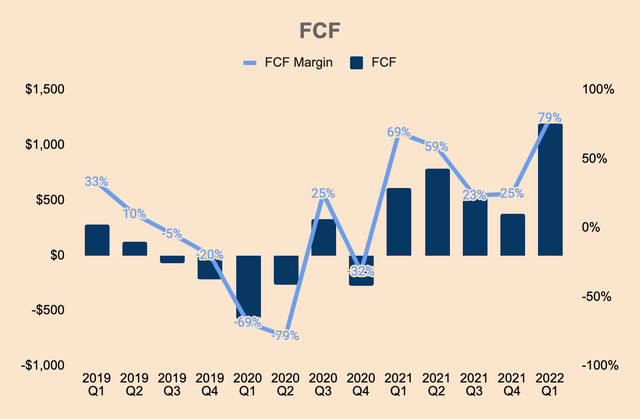

In addition to its fortress balance sheet, Airbnb is also Free Cash Flow positive. For the trailing twelve months, Airbnb generated $2.9 billion of FCF. In Q1, FCF was $1.2 billion, representing a whopping 79% FCF Margin. The increase in FCF was driven by Revenue growth as well as GBV growth. GBV and FCF tend to be the highest in the first two quarters of the fiscal year.

Consistent with seasonal trends, Q1 Cash Flow from Operations benefitted from increased Unearned Fees generated by record-high GBV. Unearned Fees were $1.7 billion in Q1 as compared to $904 million at the end of FY2021 Q4.

Conversely, GBV tends to drop as people check in during the Q3 and Q4 holiday seasons, which leads to a decrease in Unearned Fees and subsequently lower FCF in the back half of the year.

Source: Airbnb Investor Relations and Author’s Analysis

Nevertheless, Airbnb has a pristine balance sheet and it is also highly FCF-positive. Thus, the risk of a liquidity crisis for Airbnb is unlikely here.

Outlook

Management provided the following outlook:

- Night and Experiences Booked and GBV

- Q2 — Nights and Experiences Booked growth rate will approximate the growth rate in Q1, which was a 26% growth from FY2019. This implies Q2 numbers to be approximately 106 million Nights and Experiences Booked. ADR is also expected to be flat on a YoY basis, which is about $161.

- Q3 — “Substantial demand for summer travel months in EMEA and North America”.

- Q4 — “Higher than historical demand”.

- Revenue and EBITDA

- Q2 Revenue is expected to be between $2.03 billion and $2.13 billion, implying a 56% YoY growth rate and 71% growth rate compared to FY2019 levels.

- Q2 EBITDA Margin to gain low double-digit percentage improvement YoY.

As we’ve seen from previous sections, Airbnb has experienced monumental growth as a result of a relatively weak FY2020 due to travel restrictions. As such, FY2021 and FY2022 growth numbers may be inflated solely because of pent-up demand. Once this surge in demand stabilizes, growth rates should normalize as well. In my opinion, we could see a steep deceleration of growth in FY2023 and beyond as Airbnb faces tough YoY comps from the great travel rebound of FY2022.

Nonetheless, Airbnb is well-positioned to continue to grow and gain market share, strengthening its position as the ultimate host.

It is also important to note that Airbnb has beaten analyst estimates in each and every quarter. This could be an assurance that Airbnb will continue to outperform growth expectations.

Competitive Moats

Based on my research and analysis, I identified 5 competitive advantages that Airbnb possesses: technology, brand, scale, network effects, and culture.

Technology

In my Airbnb: Rethinking Real Estate article, I wrote about the evolution of the travel/lodging industry and how Airbnb disrupted the value chain. In a nutshell, Airbnb pioneered the home-sharing business model whereby Airbnb connects homeowners and guests together, as opposed to online travel agencies (OTAs) which connect hotels and guests. Airbnb enables guests with the opportunity to stay in other people’s homes, allowing them to fully experience local cultures and ways of living. These are things that traditional hotel companies fall short in.

More importantly, the home-sharing business model revolutionized the travel/lodging industry, providing individual entrepreneurs the tools to compete with hotels while giving guests more options in terms of accommodations — financially, geographically, and experientially.

Not only is Airbnb the first mover to the home-sharing business, but the company consistently reinforces its platform through countless product innovations, which further enhances its technology moat.

Brand

Airbnb is undoubtedly the go-to platform for vacation rentals, creating some level of stickiness among consumers. During the Q1 earnings call, CEO Brian Chesky explains why that is so:

The reason we are growing fast is

- Number one, I think a lot of people want to have a local experience they travel;

- Number two, they want to save money when they travel;

- Number three, Airbnb allows them to travel with groups, and increasingly people are traveling in groups;

- Number four, Airbnb allows them to travel and stay in nearly every community in the world, hotels on unlimited markets around the world, and;

- Number five, the longer you’re away from home, the more you want to be in a home and length of stay is going up.

So I think all those reasons explain the stickiness.

In addition, Airbnb has joined the short list of companies that became verbs, including Google (GOOG), Uber (UBER), Photoshop (ADBE), Netflix (NFLX), and Zoom (ZM), and that is a testament to its brand power.

Scale

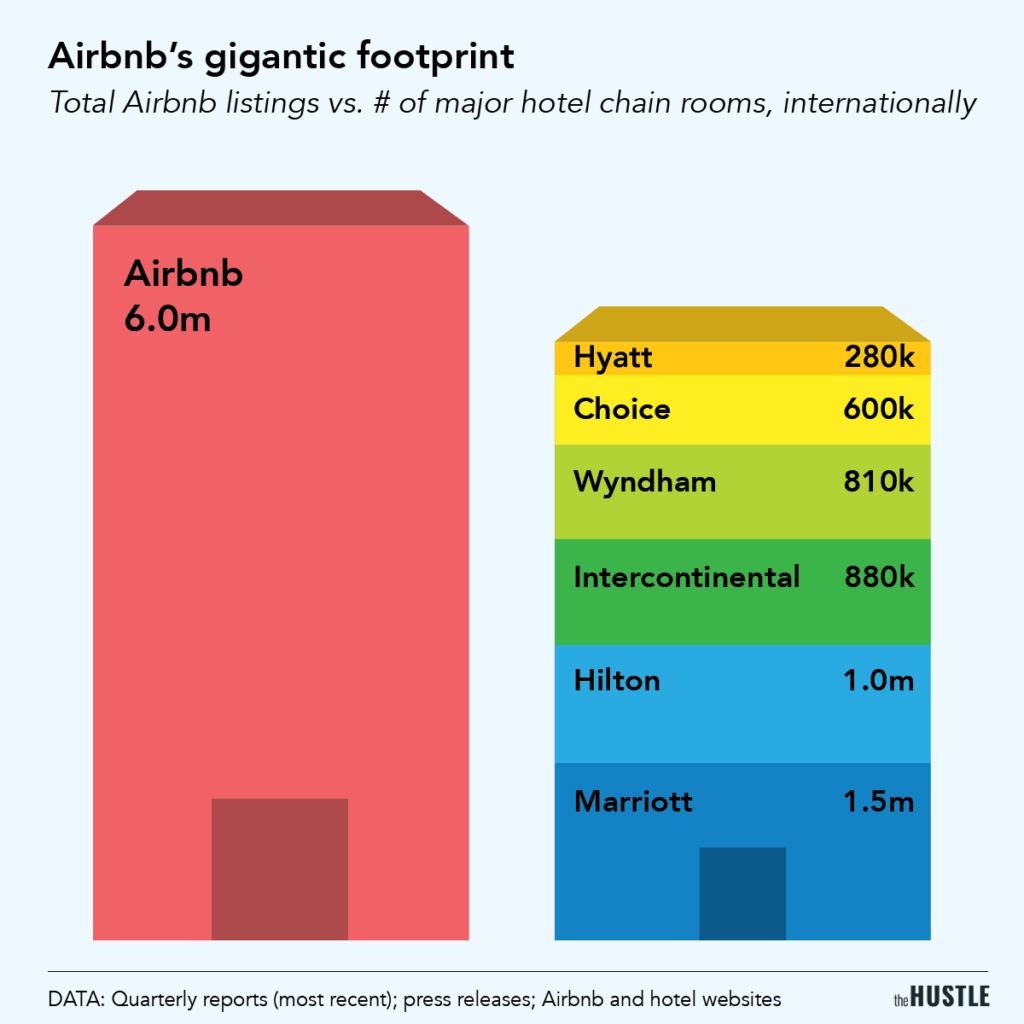

Airbnb is a behemoth in the lodging industry. Airbnb ended Q1 with over 6 million active listings, which according to The Hustle, is higher than the number of listings on Hyatt, Choice, Wyndham, Intercontinental, Hilton, and Marriott… combined!

Source: The Hustle

It is also worth noting that Airbnb’s listings are spread across a wider area from metropolises to the countryside. In contrast, the major hotel chains above are primarily concentrated in urban/suburban areas. In a sense, Airbnb is location-agnostic, and that is a competitive advantage that pairs well with its scale moat.

Network Effects

On top of its over 6 million active listings, Airbnb’s two-sided marketplace boasts the following metrics:

Airbnb’s massive network is made possible due to the company’s focus on growing both supply (Hosts) and demand (Guests). During the Q4 earnings call, CEO Brian Chesky explains how Airbnb expands its ecosystem, leading to powerful network effects:

Number one, guests become hosts. And so, as we get more hosts, a percentage of them — as we get more guests, a percentage of them become hosts. And we’re going to continue to focus on converting as many guests to hosts as possible. This is a really interesting flywheel.

Number two, the way we grow primarily is word of mouth. So, as regular people get more bookings, they tend to tell other regular people about it. If a hotel gets a lot of bookings, they’re not going to tell the next hotel who’s a competitor. Most regular people don’t think of themselves that way. So, word of mouth starts to spread.

But the other thing, once again, I also want to underline is the Holy Grail of supply is also being able to point demand where you have supply. And we are not even close to supply constraints any night of the year, if you take a global average of every city, all 100,000 cities around the world. And so, what we want to do is as people are more flexible, and we are moving top of funnel, we want to continue to point demand where you have supply–and all of that is in addition to our very specific efforts to continue to recruit hosts, which we’re really focused on.

Culture

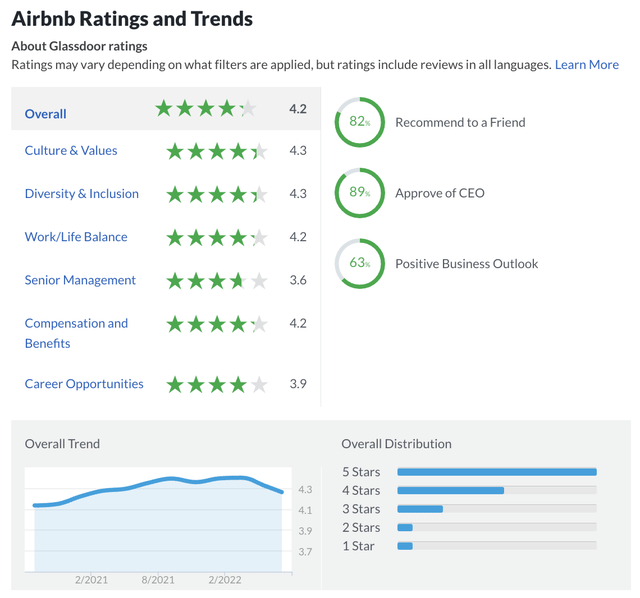

Airbnb has a high Glassdoor rating of 4.2/5.0 despite having scaled to 6,000+ employees as of the end of FY2021. Maintaining a strong culture whilst scaling is no easy feat, and management does so by getting the right people on the bus. Put simply, management believes that hiring is the strongest lever of culture. In particular, candidates undergo “culture interviews” to ensure that they are aligned with the company’s mission to “create a world where anyone can belong anywhere”. Airbnb also instills a culture of living and working anywhere, a policy that surely contributes to high employee satisfaction.

Airbnb is also founder-led, with CEO Brian Chesky leading the charge since day one, blitzscaling the company past competitors and copycats. According to Comparably, Brian Chesky is also a Top 5% based on 2,655 ratings.

Valuation

Airbnb went public in December 2020, and just like any other tech/growth stocks that went public at that period of time (whether through traditional IPO, direct listing, or SPAC), Airbnb’s stock price skyrocketed, almost doubling its debut price. Since then, the stock price has been trading sideways between $130 to $210, up until recently when the stock broke major support following the recent broad market selloff.

However, this valuation reset is a healthy development for the markets as a whole, and maybe especially so for Airbnb. The reason I say this is because Airbnb was trading at unsustainably high valuations. As seen in the chart below, Airbnb was trading at an EV/Sales and EV/Gross Profit multiples as high as 32x and 48x, respectively. Today, it has compressed to just 6x and 10x, respectively — these are much more reasonable valuations for long-term investors.

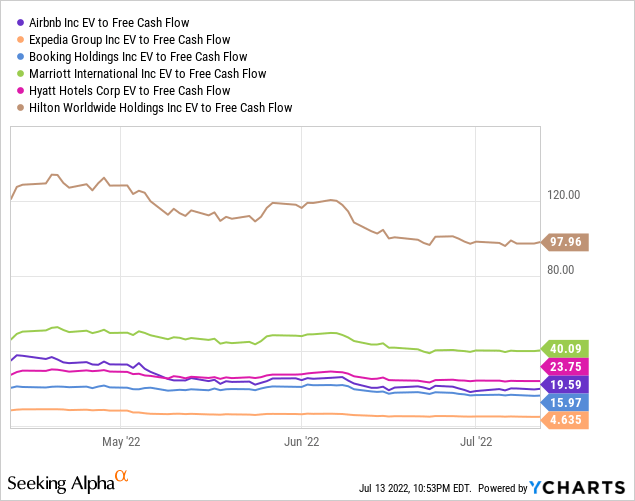

We can also take a look at Airbnb’s EV/FCF multiple since the company is already profitable on an FCF basis. Today, the company trades at around 19x EV/FCF. To add further context, I have added the valuation multiples of some of the major OTAs and hotel chains. As you can see, Airbnb trades cheaply compared to hotel chains Marriott, Hilton, and Hyatt. On the other hand, Airbnb trades at a premium compared to OTAs such as Expedia (EXPE) and Booking.com (BKNG). Since Airbnb is more similar to OTAs, Airbnb may still be overvalued. However, the premium is more than justified given Airbnb’s growth trajectory and competitive moats discussed earlier.

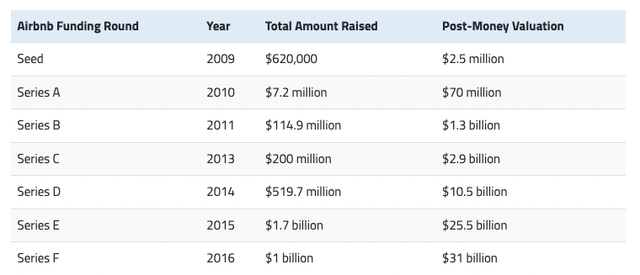

At $91 a share, Airbnb trades at a market cap of $58 billion. The table below shows how this figure compares with its previous funding rounds. In April 2020, Airbnb also raised $1 billion at a valuation of $26 billion which is below its Series F valuation of $31 billion back in 2016. As such, Airbnb still trades at a massive premium compared to its previous funding round, which happened months before its IPO.

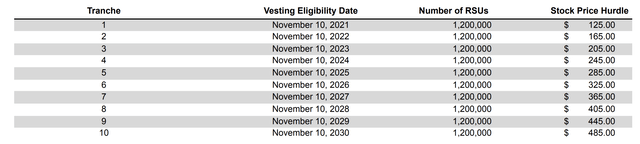

Despite being seemingly overvalued, management is still well-incentivized to generate stock price appreciation for shareholders. In particular, Airbnb has set up a long-term performance-based RSU award for CEO Brian Chesky. The performance awards are divided into 10 tranches, covering 10 years of compensation. In 2021, the first two price hurdles were achieved. The last tranche consists of a stock price hurdle of $485, which is roughly a 5x return from current prices. In addition, it can only vest in November 2030, which not only shows that management is aligned with shareholders but also in it for the long game.

Source: Airbnb FY2021 Proxy Statement

Catalysts

Endless Hosting Opportunities

In my previous Airbnb article, I explained why Airbnb is not an OTA, but rather, a hosting platform that can expand well beyond accommodations and experiences. Here’s what I wrote:

Since Airbnb is uniquely positioning itself as a hosting platform, the hosting opportunity, in my eyes, is endless. Coupled that with network size, Airbnb will be a formidable force to be reckoned with. Here are some of the categories Airbnb can expand to (related to hosting):

- Coworking spaces — compete with WeWork (WE)

- Yachts and boats — no need to be a millionaire

- Mobile homes — vans, campers, and RVs

- Tour agencies — compete with Tripadvisor (TRIP)

- Events — compete with Meetup

- Gyms — eliminate gym membership requirements

- Car rentals — outsource cars like Turo

- Babysitting and dogsitting — compete with Rover (ROVR)

- Chefs — homecooked meals at chefs’ homes

- Sports — e.g. booking soccer courts

In other words, the hosting opportunity is enormous. Here are some of the market sizes of the categories mentioned above:

Slowly but surely, I expect Airbnb to expand to some, if not all, of the categories above.

Experiences

While all the attention is on accommodations and how much larger the lodging industry is, many ignore the market opportunity that Airbnb Experiences can capture. Here’s CEO Brian Chesky on Experiences during the Q1 earnings call:

I think that experiences is a massive, massive opportunity. When we started Airbnb, air homes took off. And I remember saying at the time, Mark, well, we’ve monetized people’s biggest asset already, which is their home, what do we do next, we go to the next largest asset. And it actually turns out your home is not your largest asset from a latency standpoint, I think it’s your time for most people, your time ultimately can generate more revenue for the average person than their property can. And so that’s a bit of an insight of where experiences came. It also came from the fact that a lot of people book Airbnb not just to save money, but to have a local travel experience. And I think experiences are a great way to do that.

Therefore, the hosting opportunity is not exclusively in accommodations per se, but also by monetizing people’s most valuable resource: time.

Risks

Competition

While Airbnb has strong competitive advantages, the risks of competition cannot be ignored. In particular, the elephant in the room is Booking.com. According to its website:

Booking.com is available in 43 languages and offers more than 28 million total reported accommodation listings, including over 6.2 million listings alone of homes, apartments and other unique places to stay.

Booking.com’s 6.2 million unique stays is on par with Airbnb’s over 6 million stays. Such similarities can mean one thing: a large number of Hosts list their properties on both platforms. This means that there are threats of substitutes for Airbnb whereby Hosts and Guests can easily visit and utilized other platforms like Booking.com. Not only that but there is a myriad of competitors including Expedia, Google, Sonder (SOND), trivago (TRVG), Traveloka, and more.

With competition piling up, this is where providing ancillary services, refining user experience, and offering benefits (like AirCover) come into play.

Recession

There has been quite a chatter lately about the global economy heading into a recession. Layoffs are also getting more and more common these days, even among tech giants like Tesla (TSLA), Coinbase (COIN), and Netflix (NFLX) letting go of workers. To make matters worse, raging-high inflation is also destroying people’s purchasing power. The Russia-Ukraine war is also driving higher fuel prices, which translate to more expensive travel tickets. All of these decrease discretionary income, thus causing consumers to reduce spending on travel and leisure.

Despite the worsening macro environment, management remains confident in the Airbnb business model. Hypothetically speaking, more people would probably turn to hosting to earn extra income during an economic downturn — to help them pay for their rent or bills, for example. Moreover, travelers would become more budget conscious, thus turning to the Airbnb platform to find affordable stays. As such, a recession may actually be a net benefit for Airbnb.

Conclusion

To wrap up, Airbnb is building the ultimate hosting platform — it is not a travel or hotel company. Essentially, Airbnb is rethinking what constitutes real estate and how those assets can be put to good use. Even though the company is primarily focused on accommodations, Airbnb has the potential to branch out to other categories such as peer-to-peer car and boat rentals. In my opinion, there are endless hosting opportunities for Airbnb.

While the growth story looks compelling, Airbnb still trades at a premium compared to other OTAs. Furthermore, technicals look bearish as the price action broke major support, sending the stock in what seems to be in the mid-stages of a major downtrend. Not forgetting to mention, growth is expected to slow down as the company faces tough YoY comps ahead. A recessionary environment may also put additional pressure on growth. These are reasons why we may see further downside for the stock.

Regardless, Airbnb has a resilient business model, strong cash flow, and long growth runway ahead, supported by its technology, brand, scale, network effects, and culture moats. I’d be happy to start a position in this high-quality company if we see new lows.

Thank you for reading my Airbnb deep dive.

Onward and Upward.

Be the first to comment