Huseyin Bostanci/iStock via Getty Images

A Quick Take On Red Cat Holdings

Red Cat Holdings (NASDAQ:RCAT) went public in April 2021, raising $16 million in gross proceeds in an IPO that priced at $4.00 per share.

The firm provides various drone-related equipment products to consumers, professionals and military & policing drone users.

Risk-on investors may wish to consider buying RCAT in advance of this assumed sales increase, although I’m more conservative and need to see increased Golden Eagle deliveries in the following quarter to determine actual demand pull-through and production success.

I’m on Hold for RCAT until we see actual results of growing revenue in its financial reports.

Red Cat Overview

Humacao, Puerto Rico-based Red Cat was founded to provide high performance viewing and related products for drone racing and other drone use cases including police and military reconnaissance applications.

Management is headed by president, Chairman and CEO Jeffrey Thompson, who has been with the firm since May 2019 and was previously founder and CEO of Towerstream (OTCPK:TWER), a fixed wireless internet service provider.

The company’s primary offerings include:

-

Race and freestyle products

-

SMB / Drone service providers

-

Platform / enterprise

- Teal Drones – Golden Eagle

The company sells products to different sectors of the drone market, including first person view products sold to racers and freestyle drone enthusiasts as well as other drone products to industry and government.

Red Cat also offers a data acquisition and storage platform for compliant operations for business and related drone operators.

Red Cat’s Recent Financial Performance

-

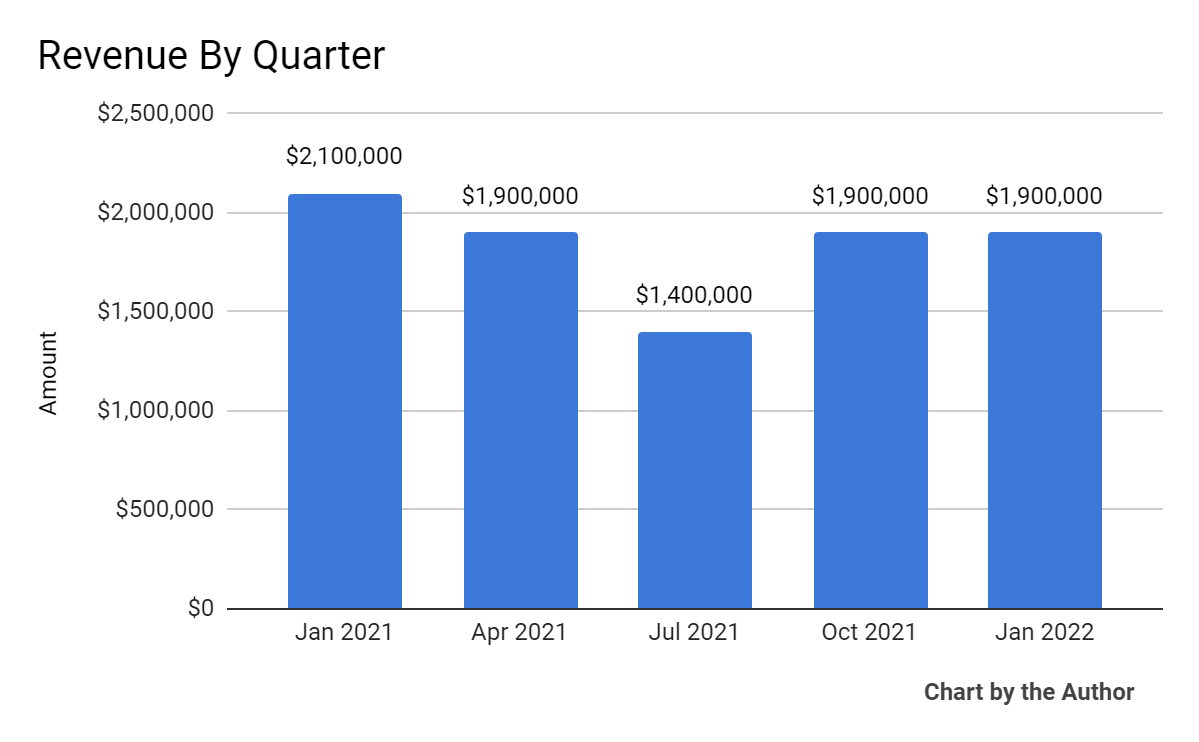

Total revenue by quarter has trended lower over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

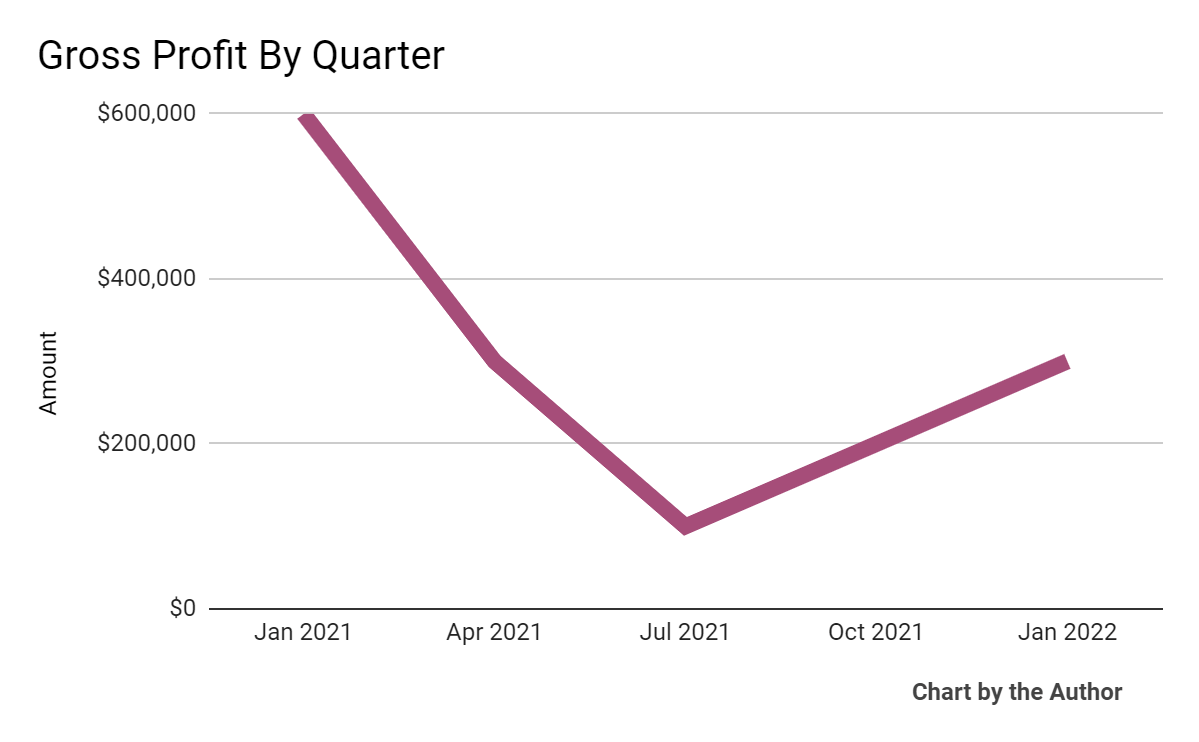

Gross profit by quarter has dropped materially, as the chart shows below:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

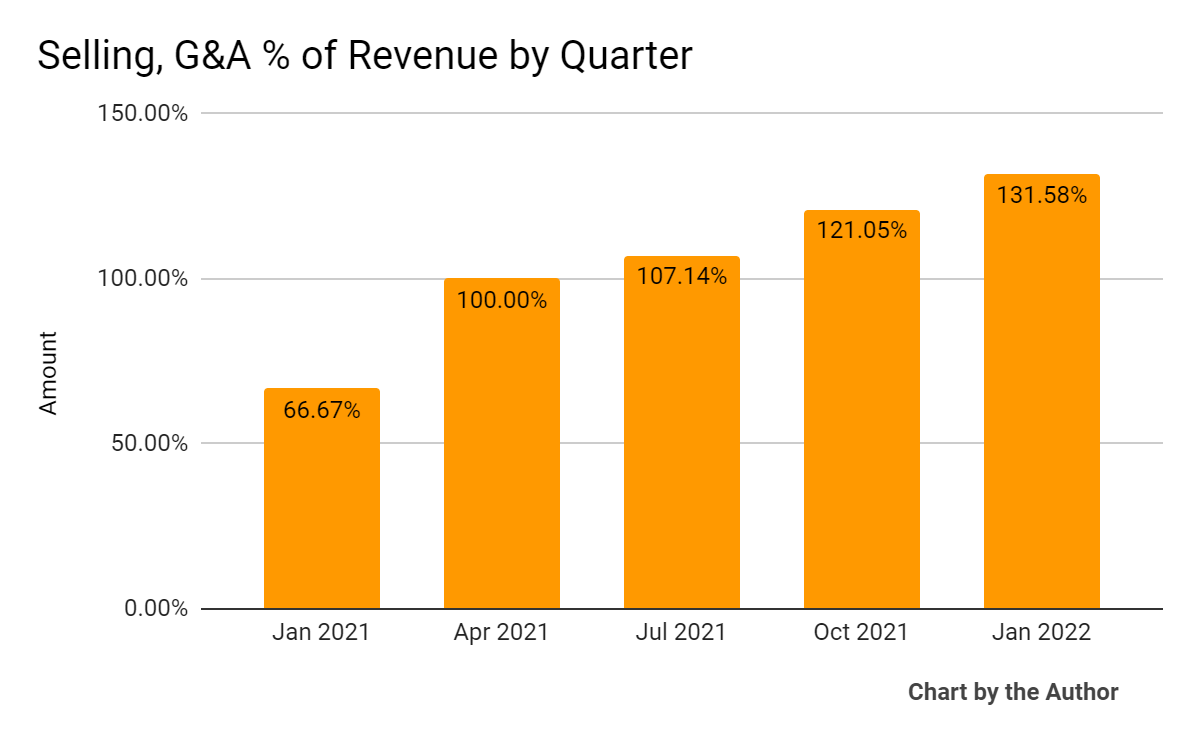

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly in the past 5 quarter period:

Selling, G&A % of Revenue (Seeking Alpha and The Author)

-

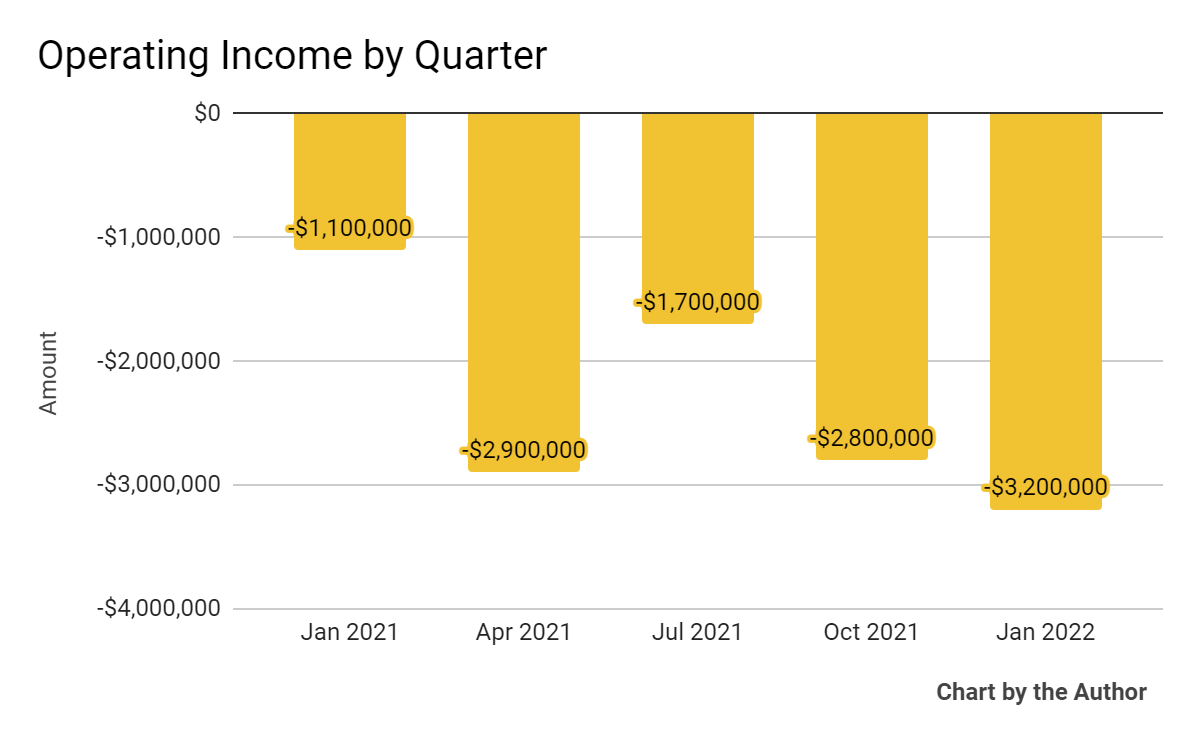

Operating losses have worsened, as shown below:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

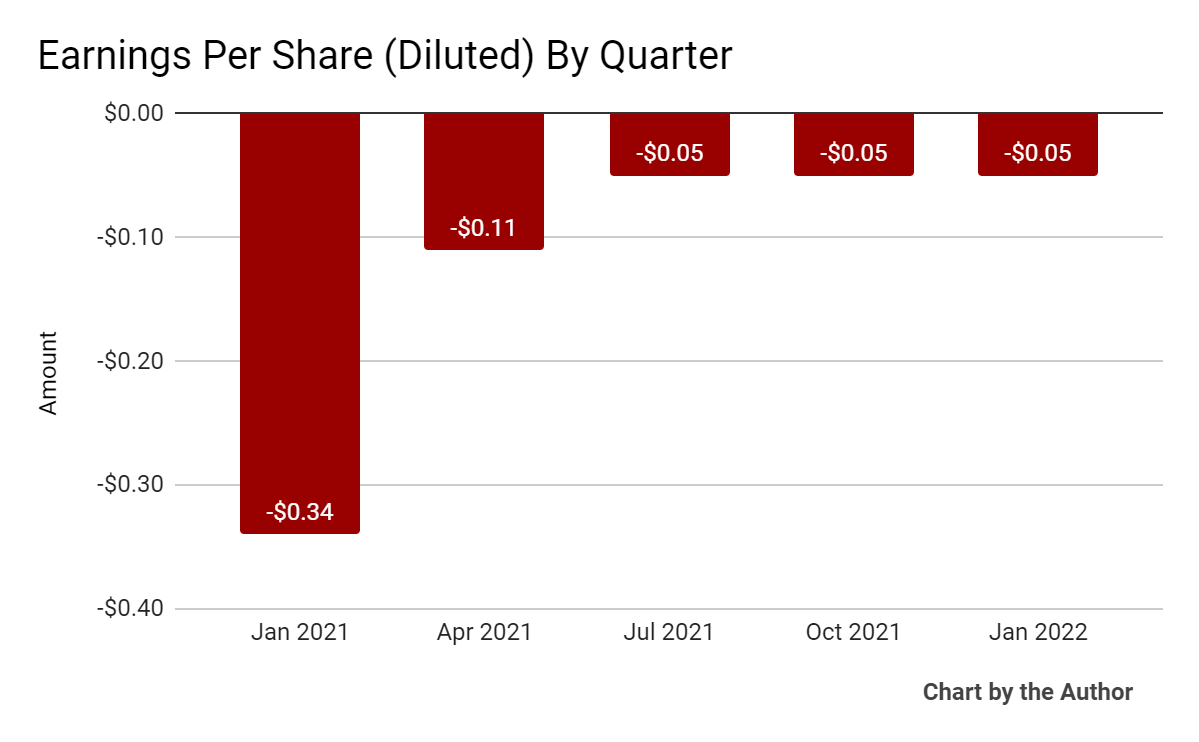

Earnings per share (Diluted) have remained materially negative in the past 5 quarter period:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

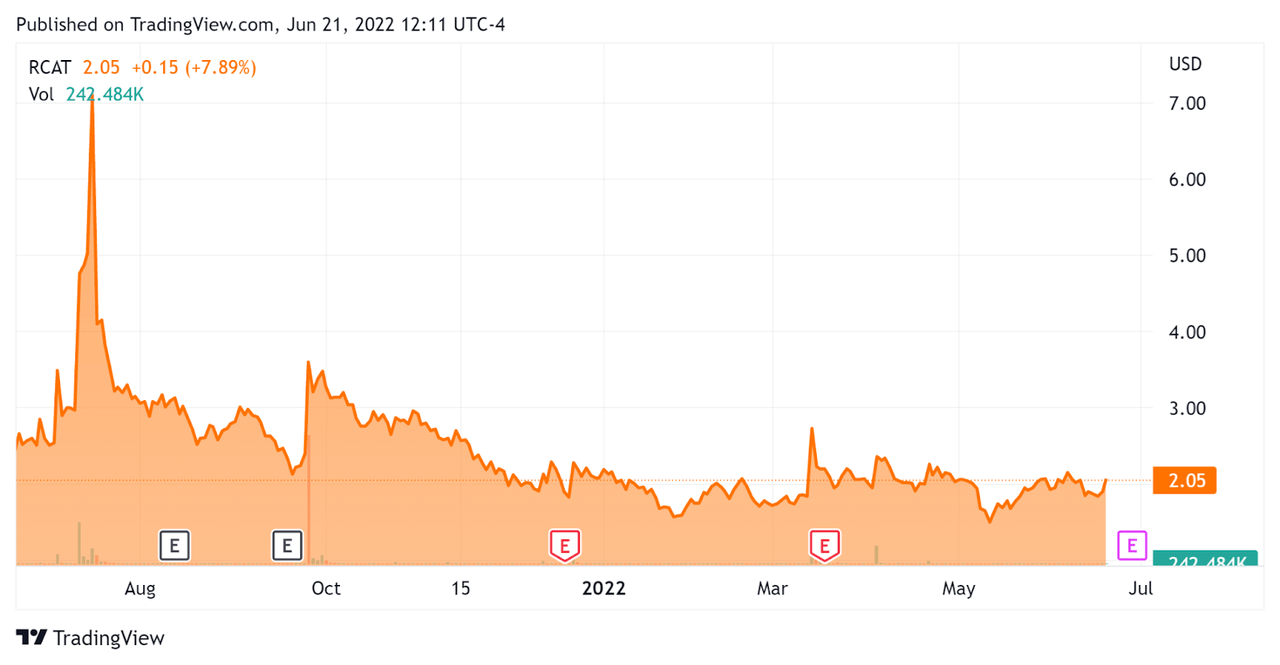

In the past 12 months, RCAT’s stock price has dropped 33.0 percent vs. the U.S. S&P 500 index’ fall of around 11 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Red Cat

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$101,980,000 |

|

Enterprise Value |

$49,770,000 |

|

Price / Sales [TTM] |

11.41 |

|

Enterprise Value / Sales [TTM] |

7.12 |

|

Operating Cash Flow [TTM] |

$12,520,000 |

|

Revenue Growth Rate [TTM] |

100.32% |

|

CapEx Ratio |

125.00 |

|

Earnings Per Share |

-$0.26 |

(Source)

Commentary On Red Cat

In its last earnings call (transcript), covering FQ3 2022’s results, management highlighted the potential for its Teal Drones Golden Eagle model.

The Golden Eagle is primarily a reconnaissance drone made for all-weather environments with military and police applications and the firm has been fielding strong inbound demand for this model as a result of the Ukraine conflict.

However, although management referenced its nearly 4,000 chipsets available for use in manufacturing Golden Eagle drones, the firm’s challenges include scaling production to meet demand as well as obtaining additional chipsets.

As to its financial results, management said that its focus on doubling the size of its Teal Golden Eagle drone facilities has impacted its revenue ramp and expense profile.

Looking ahead, it appears the primary work of management will be to capitalize on the interest and resulting orders for its Teal Golden Eagle drone system, especially from various European countries seeking to supply them to Ukraine.

The primary risk to the company’s outlook is whether it will be able to ramp up production and drones and related parts for delivery.

A potential upside catalyst would be if the firm secures additional orders related to the Ukraine conflict or from other countries seeking drone technologies for their defense or security needs.

The firm recently announced an order for 15 Golden Eagles from a NATO country. These units sell for around $15,000 each, which is $225,000 in revenue (plus spares and training).

While RCAT’s revenue growth prospects look enticing, management will need to convert all the inbound interest into delivered products despite facing all of the usual current challenges with increased supply chain issues and labor shortages and high cost.

Risk-on investors may wish to consider buying RCAT in advance of this assumed sales increase, although I’m more conservative and need to see increased Golden Eagle deliveries in the following quarter to determine actual demand pull-through and production success.

I’m on Hold for RCAT until we see actual results hitting its financial reports.

Be the first to comment