gorodenkoff/iStock via Getty Images

Alexandria Real Estate Equities (NYSE:ARE) is the leading owner of life science properties in the major research hubs of the U.S. Unrivaled market share grants the Pasadena headquartered REIT superior relationships with large cap biotech and pharma tenants as the trusted provider of the highest caliber of life science real estate. Even as rising rates and a crashing market have driven venture capital money out of the space and reduced tenancy in lower quality assets, Alexandria is experiencing ample demand, full occupancy, and has the pricing power to raise rents approximately 30% across their portfolio.

This sort of market leading operational performance is par for the course with Alexandria and it has historically traded at a premium multiple to match. Today’s investment opportunity is the mismatch between ARE’s continued strong fundamentals and a now extremely cheap valuation.

The Buy Thesis

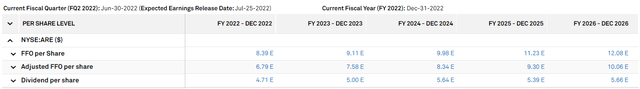

ARE is expected to grow its AFFO/share by 77% by 2026 from 2021 levels. They have a clear pathway to get there with in-place developments which are largely pre-leased and already have financing in place that is locked in at low fixed rates. Such growth warrants a premium multiple, but ARE is trading at just 19.2X current year AFFO. Its asset value has been demonstrated with property sales over $1 billion at cap rates below 4%, yet ARE trades at 65% of net asset value (NAV).

ARE is a clean quality growth play at highly opportunistic pricing. Let me begin with a look at how ARE got so cheap.

Origin of discount

When the market gets choppy, correlations between stocks tend to rise. This top-down trading often leads to stock specific details getting lost which can exacerbate mispricing. Some terrible companies end up being buoyed to a mere market drop while some great companies needlessly collapse with the market. ARE represents the latter category as it got lumped in with office REITs.

REITs consist of over 20 distinctly different property types, but most information sources place them into seven categories:

- Retail

- Residential

- Office

- Industrial

- Diversified

- Specialty

- Healthcare

Oddball things like communications towers and data centers have traditionally been placed in specialty, but will likely soon become their own category due to the enormity of their collective market capitalizations.

There is no life science or lab category, so Alexandria is tagged as office.

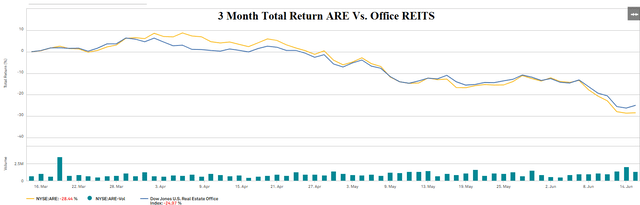

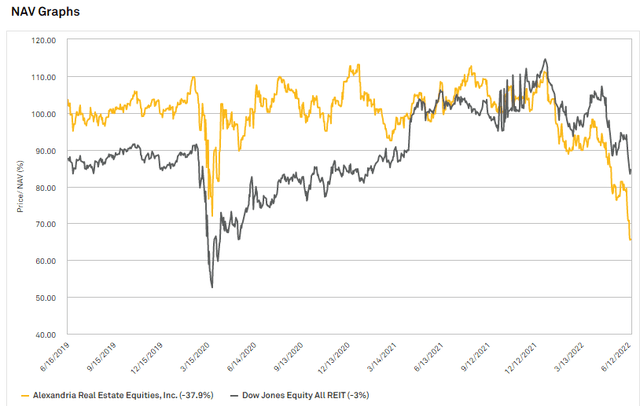

The previous mention of correlations rising in this sort of market is a bit of an understatement. Correlations have gotten so high that individual stock performance is almost indistinguishable from the group. Shown below is a 3-month chart of ARE and the office REIT index.

S&P Global Market Intelligence

They have moved in complete lockstep, the absurdity of which will become clear in a bit.

Fundamentals could not be more divergent with traditional office struggling at best and outright failing in many cases while life science is in high demand.

Vacancy, Leased Occupancy and Physical Occupancy

Vacancy rates in traditional office are around 15.7% which of course means 84.3% of space is leased. Healthy occupancy would be in the low to mid 90s, but the occupancy rate doesn’t tell the real story because of the gap between leased and physical occupancy.

Offices are often signed with fairly long lease terms which keeps the tenant on the hook for paying rent even if the space is not being used. Aside from some moderate delinquency, tenants are broadly paying, but a massive chunk of the real estate is going unused. Physical occupancy, the measure of space actually in use, varies broadly by submarket but is as low as 30% in key areas and quite consistently lower than leased occupancy across the country.

Low physical occupancy just about guarantees leases will not be renewed as they expire. So while office REITs are generally collecting solid rent currently, the consensus is that rents have a long way to drop before they hit equilibrium.

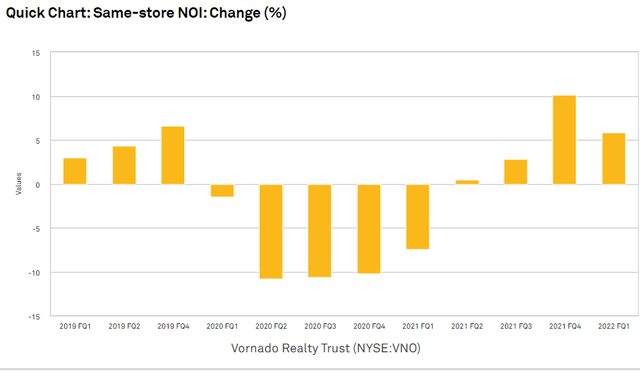

Vornado (VNO) can be used as an example because it is a large and generally respected office REIT and its numbers are in-line with much of the sector. Same store NOI declined sharply during the pandemic and recovered slightly in the aftermath as tenants resumed paying rent.

S&P Global Market Intelligence

We should keep in mind, however, that NOI is based on leased occupancy, not physical occupancy. Since the rent checks are presently coming in, the cuts that will happen on lease roll are not yet in the same store NOI numbers.

The market largely understands this. They know rent cuts are coming to office and that is why the office real estate sector is down about 30% year to date.

Alexandria, due to being tagged as office, has been pulled down by the group and is actually down a bit more at -40% year to date due to an equity offering in January which dropped the stock for mechanical reasons.

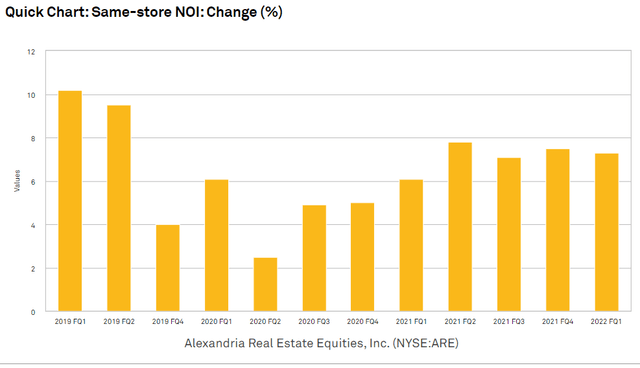

However, if we look at ARE’s fundamentals, the numbers are the polar opposite.

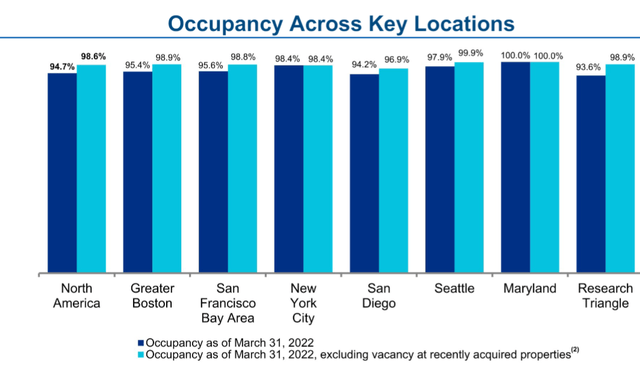

Occupancy is close to 100%.

Supplemental

Life science properties are physically occupied as the tenants actively use the space. Alexandria’s same store NOI growth remained strong throughout the pandemic and accelerated afterward.

S&P Global Market Intelligence

Rather than looking at sizable rent rolldowns, ARE’s current rents are about 30% below market rates.

Lastly, and this is the big one, life science properties do not compete with work from home. Here is an example of a property ARE is building for Bristol-Myers (BMY).

Company Presentation

In addition to being a gorgeous property located in the San Diego mega campus which has the second best life science employment talent pool in the U.S. (Cambridge #1), the facility is going to be a research hub for cancer as well as immune-mediated and neurodegenerative diseases.

That is not the sort of work that can be done remotely.

In summary, ARE is not office. Their properties are distinctly different, their tenants are different and the fundamentals of life science are excellent. The market has delivered a gift of an entry point by trading ARE down to these levels.

This is a premier company that consistently trades at a premium and it is now available at 65% of NAV.

S&P Global Market Intelligence

Growth is ample with consensus estimates calling for rapid growth through 2026.

S&P Global Market Intelligence

Such growth figures are backed up by the development pipeline which is positioned to provide an incremental $665 million of annual rental revenue.

Supplemental

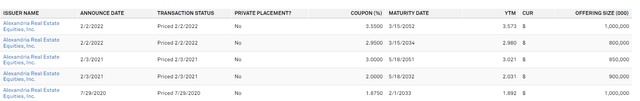

Most of it is pre-leased and the cost of capital is locked in with freshly issued long-term fixed rate debt.

S&P Global Market Intelligence

The February 2022 issuances were extremely timely as it was right before interest rates shot up. $900 million of 2% debt due 2032 is just incredible given that the 10-year treasury is now over 3%. ARE is financing these developments at below the “risk free” rate.

The only parameter that may have changed a bit for the negative is the construction cost. While lumber prices have come back down, these high-end properties are mostly metal, glass and of course labor which are still at elevated prices.

As of the 1Q22 conference call, ARE said the development pipeline was coming in at cap rates above original underwriting due to rental rates moving up. My guess is it will come back down to underwriting because costs have remained quite elevated since 1Q22.

This development growth will be supplemented with organic growth in two sources:

- Lease escalators

- Rent roll-ups

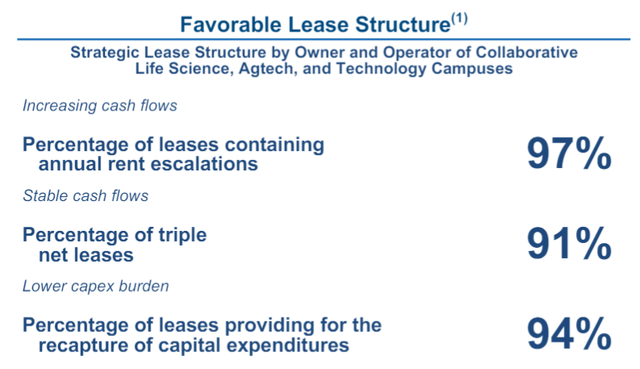

97% of ARE’s leases have annual escalators.

Supplemental

These are not going to fully keep up with inflation, but they don’t need to because ARE’s cost structure is fixed.

Beyond the highly favorable February debt issuance, ARE’s entire balance sheet is well positioned for a rising rate environment with a 13.8 year weighted average remaining debt term and no debt maturing prior to 2025.

As of 1Q21, rent rolls were expected to be a positive 30%. Perhaps that number has moderated a bit due to recession talk that has since surfaced, but it is worth pointing out that ARE’s tenant base is quite recession resistant.

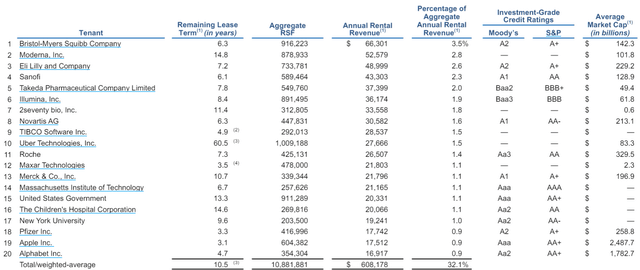

Supplemental

These companies are huge, have great credit and are overwhelmingly in sectors of the economy that are recession resistant. Bristol Myers, ARE’s largest tenant, is actually trading up 18% year to date against the down market.

Alexandria is high quality growth trading at a huge discount. I think it is one of the strongest stocks to buy right now. With that said, I do like to keep an eye on the risks.

Risks to investment in ARE

There are three fundamental aspects of life science that I think investors should keep an eye on.

- 2020-2022 has been white hot for the sector. Demand is well above normal levels and will likely come back down at some point.

- Tightening of financial markets has pulled money out of the more speculative side of biotech. This is not ARE’s tenant base, but there is potential for trickle up effects as lower end properties may pull some demand from high-end space if companies are tightening purse strings

- With a 4-year development pipeline, construction inputs will be an area to watch. I think there is some room for improvement here as bottle necks are eased, but also potential for delayed delivery or higher costs.

Be the first to comment