Justin Sullivan

Thesis:

It is my opinion that there are five foundational areas of strength that Tesla (NASDAQ:TSLA) maintains that its competition cannot match. It is these areas of strength that have drawn me into becoming a long-term investor in Tesla. These areas of strength very rarely get examined in my opinion and some are hard to put a quantifiable value on. However, when I invest in companies, these are some of the most important areas of a business I examine. After doing my research on Tesla, I went from owning zero shares a year ago to making Tesla one of my top five holdings. So now let’s dive into these five areas of strength that Tesla maintains and should not be ignored by investors.

1. The Drive of Co-Founder and CEO Elon Musk:

Now I know what you may be thinking right after this subtitle, “Elon wasn’t the Founder of Tesla,” so let us begin there. In 2009, what was Tesla Motors at the time announced an agreement after a lawsuit from co-founder Martin Eberhard, that there were five founders of Tesla not two. Elon Musk was one of those five, who was CEO and chief product architect at the time and now labeled as Technoking of Tesla, a.k.a. CEO.

The drive of Elon’s entrepreneurial and visionary spirit, I believe is not appreciated enough in the market. If Elon Musk doesn’t risk everything, including his personal life, money, time, and health, then we would never have an entire automobile industry putting efforts into building electric vehicles. We would not have reusable rockets going through space or space exploration for consumers.

I love these excerpts from the book “Elon Musk” by Ashlee Vance, as this sums it up perfectly.

“His willingness to make large personal investments is what sets him apart from other entrepreneurs and makes him so successful. Musk’s ability to handle stress complements his high-risk tolerance. This means he doesn’t create any safety nets for himself should he fail. This mindset has given him an edge in his professional life. He’s willing to risk everything-his money, his possessions, his health, and so on-to make his vision a reality. Most people would find what Elon Musk risks to be extremely stressful, but Musk sees it as necessary in order to achieve his goals. He’s willing to invest all of his time and money into his businesses for the possibility of even bigger gains.”

So why does this matter to a thesis on Tesla stock? Because Elon is far from done achieving his future reality, so he will continue to reinvest in his goals and vision until they are reached. Elon will push himself and his employees to new heights of success. It is this intensity in drive and the company’s proven track record of execution, that will allow Tesla to continue to obtain the best talent in the world. Did you know after Tesla’s first AI Day in August 2021, Tesla’s AI applicants rose 100x the following week after the event? We will talk more about Tesla’s excellence in creating a brand awareness and customer experience later.

2. Vertical Integration and Max Manufacturing Efficiencies

The vertical integration of the Tesla Gigafactories has created more efficiencies than any other car manufacturer, but will not be fully realized until peak production is reached at each location. This will take time, as Elon’s goal is to have each factory producing 1.5 million to 2 million cars per year. The primary long-term goal for Elon for the automobile portion of the company is to reach 20 million vehicles annually by 2030, which could require at least a dozen factories total. So for any investors that think they missed the boat on getting massive returns on Tesla, they may be misinformed.

Currently, Tesla is projecting for 1.5 million vehicles created and delivered by the end of 2022, which will require a record pace, flawless execution, and no more Shanghai shutdowns for COVID to accomplish this. In my opinion, it appears to reach that goal of 1.5 million vehicles is not fully in Elon’s control with possible future Shanghai lockdowns, but only time will tell to see what happens. The stock has been rewarded and punished depending if commitments of vehicle deliveries are missed. However, this is where I believe the media and investors can lose perspective.

During the previous quarter, Tesla delivered 254,695 vehicles which was 96.4% to the estimates Wall Street expected. This was with its fastest producing plant in Shanghai being shut down for most of the quarter due to COVID lockdowns and supply chain challenges globally. The way Elon and his teams have navigated COVID, supply chain disruptions, and semiconductor challenges has been exceptional in my opinion. The question I ask myself is not ‘will Tesla hit its quarterly commitment goal of deliveries?,’ but ‘do I believe the company can reach remotely close to the ambitious 20 million vehicle goal in 2030?’ And my answer is most definitely, because I believe Tesla’s efficiencies and optimizations continue to improve with each factory that is created and we will not always have these current supply chain disruptions occurring.

There are other questions that I must ask myself that are important to the thesis, that I will cover in our next section as well.

Before We Continue, What Risks Must We Weigh?

I believe these top five factors investors should consider in their thesis about Tesla make it much easier to invest in the stock. However, we have to look at both sides of the potential investment. What could go wrong? Are there any thesis breakers that exist within Tesla or could happen in the future?

My biggest thesis breaker would be if something happened to Elon Musk and he was no longer the CEO of Tesla. Whether Elon were to step down from Tesla and be forced to buy Twitter (TWTR), or only focus on SpaceX, this would be a game changer for the worst. I do not find any high probability of any of these things happening, but one cannot predict the future either. We have also lost other great CEOs and innovators of our time, way before we thought would happen, for example Steve Jobs. I do believe Elon has a strong executive leadership team alongside him, but this would make any shareholder stop in their tracks if Elon was not at the helm.

Another short-term headwind that could impact the stock is if China were to push Tesla out of the country and take a more domestic approach, due to political tensions between the U.S. and China. China is making more traction with all the different domestic EV companies growing deliveries annually. A particular winner in the Chinese EV market is BYD (OTCPK:BYDDY) who completed the most deliveries in China, at 162,000 in the month of July. I believe Tesla being forced out of China is also unlikely, for the following reasons.

-

Elon has never taken a political stance against the Chinese government, and recognizes the Chinese EV market as a formidable competitor.

-

China is the highest annual emitter of greenhouse gases and mercury. EVs are highly needed in China, to the point there is an extra tax citizens pay to have an ICE vehicle.

-

Tesla still generates the second most deliveries for EVs in China, so demand is still high by consumers.

The other short-term headwinds that could impact Tesla’s stock would be if it missed its annual delivery goal of 1.5 million vehicles in 2022. This is a real possibility due to the lack of ramp the Berlin and Austin Gigafactories have achieved, and more potential Shanghai lockdowns.

Lastly, if Elon Musk was forced to purchase Twitter, then this could cause less short-term focus on running Tesla. Once again, I do not believe this will be a high probability, but investors should be aware of all these potential risks.

3. The Innovation of Tesla and Revenue Optionality

Besides Tesla possibly reaching its mass delivery goal of 20 million vehicles 2030, there are other innovations and revenue streams I foresee with the company. I believe if Elon only delivers on one or two of these questions below, Tesla will be able to exceed all expectations of institutional investors, as they are not factoring these possibilities into their valuations.

- Can Tesla create new vehicles that attract new buyers and expand customer adoption?

- Can Tesla achieve autonomous driving and possible robotaxi services? And what revenue opportunities could this bring?

- Will the humanoid Optimus robot ever make a meaningful revenue impact to Tesla?

- Will Tesla be able grow its solar panel and battery storage business into a larger part of the business?

- Could Tesla create new synergies between Starlink, Tesla Vehicles, and the edge compute the Dojo architecture could provide?

Cybertruck Image from Tesla Media Gallery

Tesla is currently creating new vehicles that will attract new buyers. It has been working on having the Cybertruck available by the end of 2023, which would open the number one vehicle spot in the United States to Tesla. Whenever this moment does happen, there will be a whole new set of customers coming to own a Tesla Cybertruck. The revenue in the pickup trucks market segment in the US is projected to finish the year at $78.46 billion and reach $85.17 billion by 2026. Tesla is also working on a Model-2 vehicle that will be closer to the $25,000 price point, but dates for this release will be years in the future.

Tesla-Semi Fleet (Tesla Media Gallery on Website)

The company also has a Tesla Semi that will be coming out towards the end of 2022, which will be another revenue stream not factored in. The Tesla Semi could compete against other electric vehicle semi-transportation companies like Embark (EMBK) for future autonomous trucking business. This is a zero-emissions freight-hauling cargo machine that will average over 500 miles before it needs to charge. Once autonomous driving does occur, this will change the trucking industry forever, and make it where the trucker may drive the last mile or two and then do the unloading of the shipments. A lot more possibilities in revenue and new partnerships for Tesla in my opinion.

Tesla currently had to raise costs of its Full-Self Driving (“FSD”) mode 25% to $15,000 annually. I do not anticipate this always costing this much but being a feature drivers do not want to give up, once they use it. I wouldn’t know where to begin on calculating the value of robotaxis and full autonomous driving on all Teslas, but Elon has stated that many people are underestimating the value it will unlock from even a monetary perspective.

One of the most exciting revenue possibilities is the Optimus Tesla Bot. A humanoid robot that could be used for manufacturing plants and laborious work and repetitive tasks that could accelerate time to value for businesses and help with labor shortages. It was shocking for most to hear Elon say he believes this could be the most valuable thing Tesla creates. Many investors are skeptical of this being able to actually provide enough value to replace human workers in factories and be able to be created at scale. However, coming from an investor who just started owning the stock a year ago and immersing himself in the history of the company and Elon, I say, “Don’t Underestimate Elon in the Long Run”. He may be off on his timelines sometimes, but overall he has done many unthinkable accomplishments, and this could be his next.

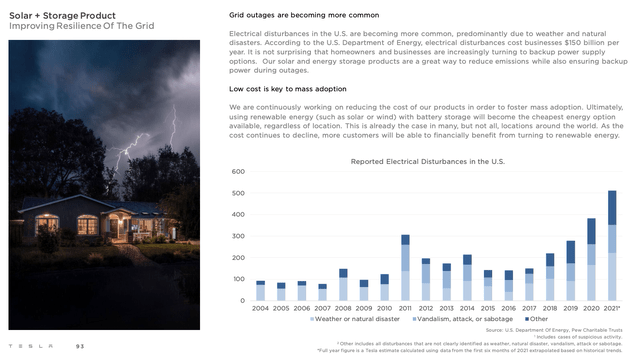

An already growing revenue stream that is separate of the automobile segment is Tesla’s solar panel and battery storage business. Power grid outages are becoming more common and impacting costs to businesses and consumers. As the transition to renewable energy occurs, high performing battery storage will be crucial to solve for intermittent energy spikes with solar and wind. Tesla continues to grow its energy storage deployments and sold last year 15% of the 25GWh global market energy storage.

Reported Electrical Disturbances in the U.S. (Tesla 2021 Impact Report)

This past August, over 3,500 homes with Tesla Powerwalls were able to connect to each other via the app, sell excess power and push up 24MW of power back to the power grid as one entity, to help reduce stress to the grid. This is just another example of the innovation and capabilities the other car competitors do not have in their wheelhouse.

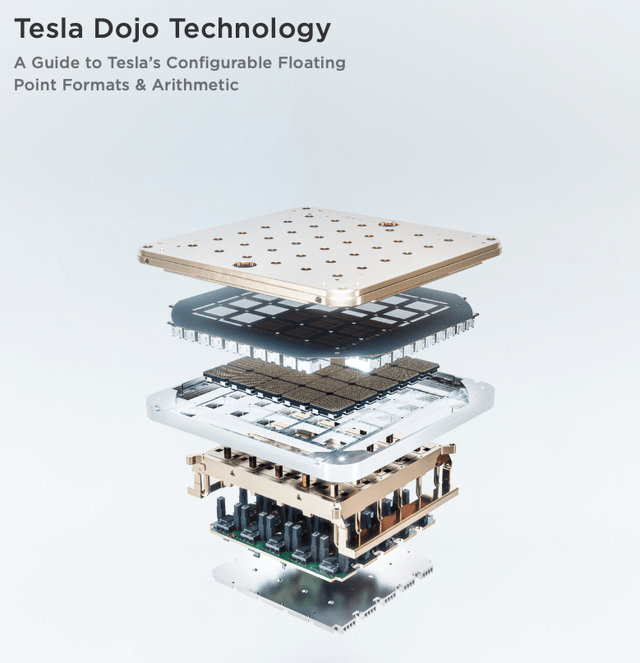

The last question is one of more speculation but one to ponder on. As you know Tesla has created Dojo, one of the world’s fastest AI Supercomputers, and the Dojo CPU architecture provides massive computation at scale. What if this computation could be moved to the edge, and if every Tesla had a Dojo CPU in it, could this compute power be accessed all at once when cars are not on the road? Essentially allowing owners to rent out the compute capabilities of their car, to a Tesla cloud or “neural network” of compute for others to use.

Dojo CPU (Tesla’s Dojo Technology Whitepaper)

This would be similar to the virtual power plant example we examined earlier. Hyperscalers such as AWS (AMZN), Microsoft (MSFT), and Google (GOOG) make a lot of margins and revenue out of the convenience they provide businesses by allowing them flexibility to spin up & spin down the CPU and storage when needed. What if Tesla could do this at the edge?

If Tesla could pull something off like this and create a more efficient way to do compute at the edge vs. centralized clouds, this would take serious market share away from players moving forward like AWS, Microsoft Azure, and GCP. I believe the Dojo architecture could be a much bigger part of future product releases and revenue streams from Tesla.

It just seems to me there are more possibilities & future synergies between Elon’s companies and products like Tesla, Starlink, Neurolink, SpaceX, and The Boring Company. Even if I am way off base here, I feel the other revenue streams and innovations will yield well for Tesla.

4. The Focus on Customer Experience and Brand Awareness

Tesla has demonstrated its focus on customer experience and brand awareness flawlessly over the years and continues to improve. Think about the risk and contrarian act Elon took with not working with dealerships and middlemen in their business model. Instead, he chose a direct to consumer business model and very few show stores globally, compared to the amount dealerships that exist for competition to sell their cars. Elon was so focused on the customer experience of owning and driving a Tesla being superb that the customer would be the marketing for the company. The Go-to-Market strategy for Tesla is the product executing exactly to users’ expectations and delivering such an experience that drivers want to tell everyone about it. That is a big bet to make that is opposite to every other competitor in the industry.

Tesla is also unique in that 100% of its cars that are in the United States are made in the United States, where the average for all other competitors is 52%. That is amazing in my opinion that the company can have 100% made-in-America cars and still deliver 14.6% operating margins last quarter, making it the fourth highest in the industry. This is another result from the vertical integration manufacturing that Tesla uses. An example would be its single-piece casting which reduces weight, simplifies the factory, increases ride quality, and reduces road noise. This single-piece rear casting in the Model Y replaces 70+ underbody parts! The manufacturing excellence and focus on the customer experience in driving a Tesla is unmatched.

Hertz Tesla Rental Program (Hertz.com)

There is a reason Hertz signed a 100,000-vehicle deal with Tesla and another 50,000 for selling Tesla cars to Uber. The software platform and updates that Tesla delivers will not be matched by traditional competitors, in my opinion. Here are just a few of the customer experience features that Tesla delivers to its owners and most of these features were created from customer requests reaching out directly to Elon and Tesla on Twitter. The customers’ Tesla car experience objectively gets better than when they first purchased it. Now that is a first in the industry!

Introducing Dog Mode (Official Tesla YouTube Channel)

- Tesla Dog Mode – which locks the doors of the car and keeps the AC on with a message on the dashboard screen saying, don’t worry I am okay, my owner will return shortly, and shows the temperature of the car.

- Tesla Video Dash Cam Capture Mode – Can save footage of up to 10 minutes from when a user hits their honk button, to see things like a hit and run or accident etc.

- Tesla Sentry Mode – If someone tried to break into the Tesla, it records the video and this feature is triggered upon someone getting trying to break in or just getting too close to the car for elongated time.

- The Tesla Entertainment system – A fun use case for the Tesla owner who can watch their Netflix or Hulu streaming, or play videogames etc.

- Tesla Vent Mode – Users are always notified about the temperature inside the car and you can drop the windows to level out the temperature in the car. It now also automatically rolls up your windows when you forget to, when leaving the car unattended.

- Upgrades to the Software OS to activate Full-Self Driving Mode – in just a 2-minute download the customer is able to start using the FSD feature, if they pay the annual $15,000 subscription.

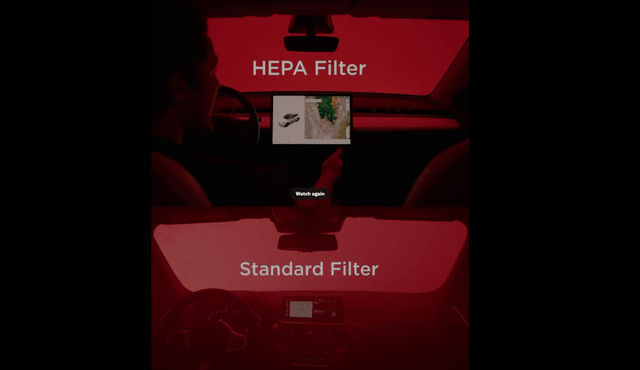

- A HEPA Air Filter in the Model Y, S, and X – Removes greater than 99.97% of dust, pollen, mold, bacteria, and any other airborne particles. (The video in this demonstration vs. a standard car HEPA filter is eye-opening.)

Tesla HEPA Filter Preventing Red Air Particles Inside Car (Official Twitter Page)

- The Tesla App – Allows a full breakdown of the charging history of the car and how much gas savings the customer has received. It also allows the car to melt snow and ice off the car remotely. The Tesla Solar Roof does this as well, which I am sure those in the northeast appreciate.

- Tesla Car Insurance – In certain states, which helps reduce the cost of insurance for users. I believe this will be a big revenue driver long term.

- Tesla Higher Safety Rating – Cars are statistically safer vehicles when using Autopilot. In the Q1 2021, Autopilot was approaching a 10x lower chance of an accident than an average vehicle.

- Tesla Supercharger Destination GPS – Drivers can enter their destination and their Tesla will automatically include Supercharging stops in their route.

5. Financial Fortitude and Optimization

Elon Musk is aligned with the success of his customers, shareholders, and employees. After all that stock selling that the media made a big deal about, Elon is still the number one shareholder at nearly 15%. I believe Elon and his leadership staff make nearly every business decision with long-term optimization and financial fortitude in mind.

An example of this was the approach to single-piece casting and other efficiencies within the Gigafactory workflows. Once all four Gigafactories reach a capacity of 1.5 million units per year, with the average sales price for a vehicle at $53,000, and operating margins staying flat at 15.7% operating margins (which they won’t), Tesla would net nearly $50 billion in operating profits annually. Show me another automobile maker that has the manufacturing optimizations and business model that would deliver those kinds of profits.

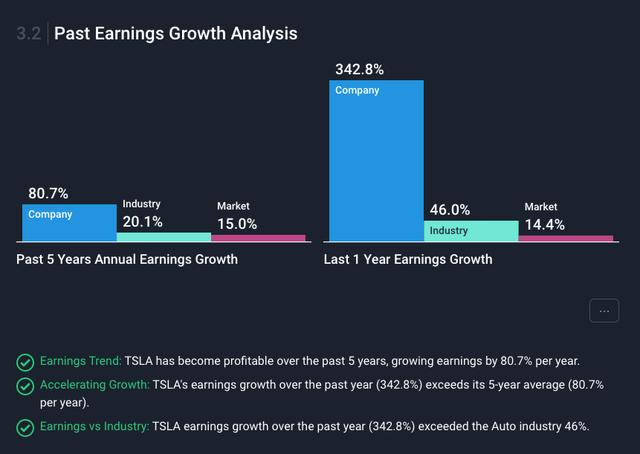

It is interesting how the 33 analysts that cover Tesla stock today have an average price rating of $308 a share, which is essentially flat from where it is today. Tesla’s analysts currently forecast the company to generate over $85 billion in revenue. They also have anticipated annual growth rates on earnings declining from its previous 5-year average of 80.7% to a mere 20%. This illustrates to me a major disconnect how some investors are measuring the company and what their growth expectations are for the future. I believe the operating margins and revenues only compound more with improved delivery rates, more factories being created, and the improvement in technology like the 4680 batteries.

Tesla Financials from Simply Wall St.

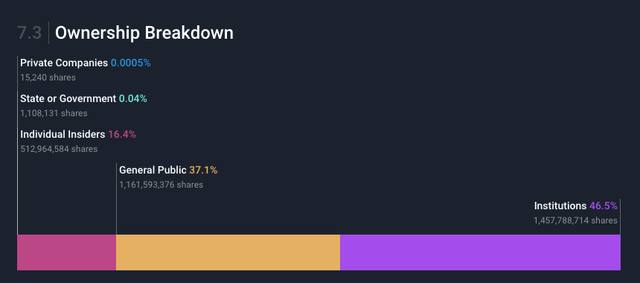

Tesla is the 6th largest market cap company in the world and yet it has a junk bond rating, even with the large amount of cash and low debt it has. Tesla reduced its debt to equity ratio over the last 5 years from 122.5% to a simple 8.4%. I believe as many other investors that Tesla will finally get re-rated as a blue chip stock credit rating which would open up a large number of institutional investors, that have not been able to participate in owning Tesla, due to credit restrictions on who they own. Currently there is only a 46.5% percent of ownership in total Tesla shares by institutions.

Shareholder Percentages (Simply Wall St. )

Tesla continues to attract the top talent and retain them which will only further drive innovation and new optimizations for the company. In 2021, the company received 3 million job applications and has created in the last 10 years over 100,000 direct new jobs. Not only does Tesla attract the top talent, but it builds a culture within that rewards them from a compensation perspective, mission perspective, and promotion from within. Over 70% of Tesla’s leadership team is promoted from within the company, and just in 2021, the global headcount at Tesla increased over 40%.

Tesla has reached a new trajectory point in its journey and is one of the few companies that are challenged with over-demand from its customers, not over-supply in inventory. Tesla has a strong balance sheet and business model with nearly $19 billion in cash and only $3.2 billion in debt and generating consistent free-cash flow. I believe these five things that I outlined that investors should not ignore will be what propel Tesla to thrive in the current market, and reach new heights in the long run. Let me know your thoughts and comments below.

Be the first to comment