georgeclerk/E+ via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 22nd.

Real Estate Weekly Outlook

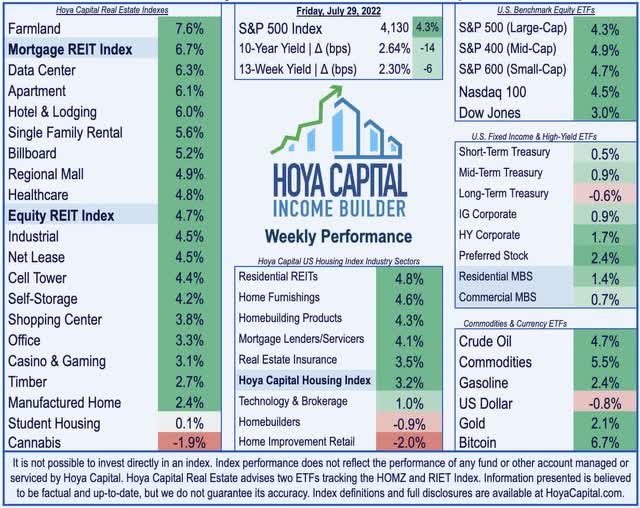

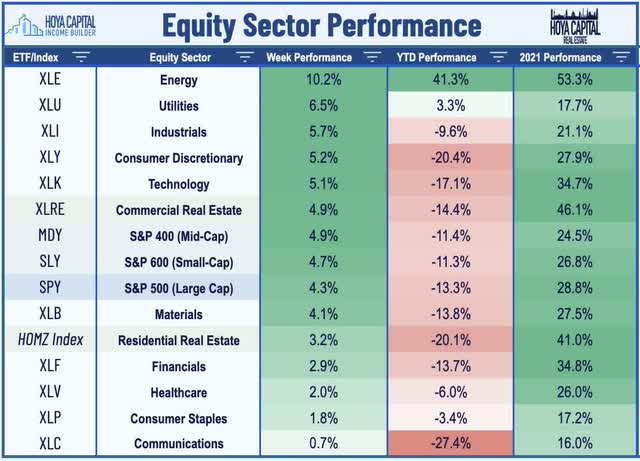

U.S. equity markets ripped higher this past week after GDP data showing a second-straight quarter of contraction sent long-term benchmark interest rates plunging to their lowest levels since April. Anticipating that recessionary conditions will cool the surge in inflation rates that resulted in a historically brutal first half of 2022 for investment returns, investors shrugged off a second-straight “triple” rate hike from the Federal Reserve and inflation data showing that prices continued to rise at 40-year highs in June in a broad-based rally that propelled equity markets to their best month since late 2020.

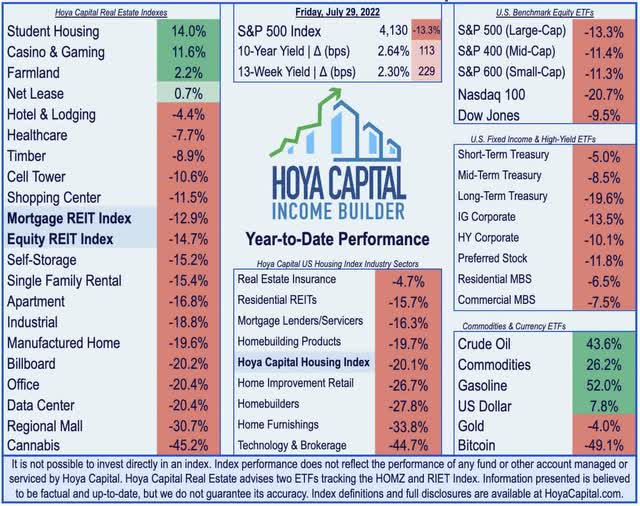

Delivering its first back-to-back weekly gains since March, the S&P 500 rallied 4.3% on the week to push its gains for July to 9.1%. The tech-heavy Nasdaq 100 advanced 4.5% on the week and 12% for the month. Domestic-focused market segments continued their outperformance this week as the Mid-Cap 400 and Small-Cap 600 each rallied nearly 5%. Real estate equities and other yield-sensitive sectors were among the leaders for the week. Lifted by retreating long-term rates and a strong slate of earnings reports, the Equity REIT Index advanced 4.7% on the week with 17 of 18 property sectors in positive territory while the Mortgage REIT Index rallied by nearly 7%.

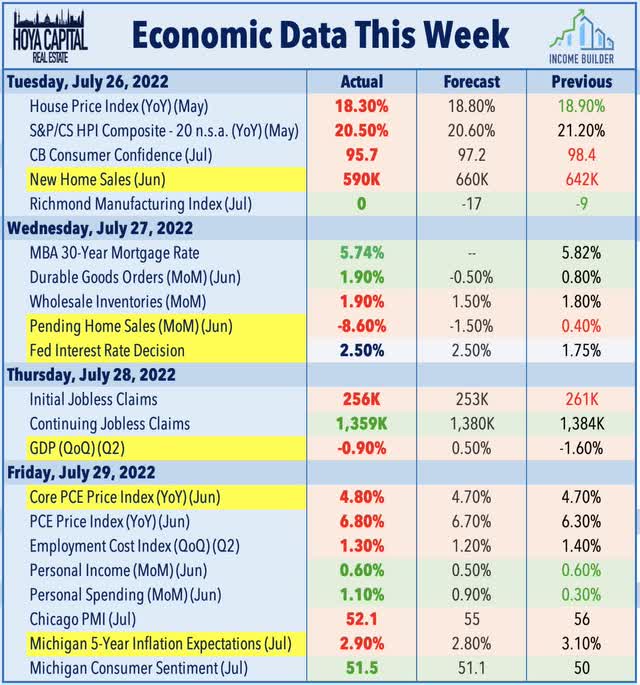

The “bad news is good news” dynamic was once again the theme of the week – and of the month of July – as a stretch of weaker-than-expected employment, housing, and sentiment data climaxed in a closely-watched GDP report that showed that the U.S. economy shrank at a 0.9% annual rate last quarter, marking a second straight quarterly decline in gross domestic product. Reflecting an anticipated need for the Federal Reserve to pivot on its aggressive tightening path, the 10 Year Treasury Yield dipped to the lowest level since April, retreating by 14 basis points to close the week at 2.64% – barely above the new 2.50% target Fed Funds rate. Buoying hopes for a “soft landing” and reversion to the “Goldilocks” conditions of the late 2010s, the weak economic data this week coincided with a more upbeat slate of corporate earnings results following a soft start to the quarter with strong reports from energy, real estate, and a handful of mega-cap technology companies.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Counting the chickens before they hatch? Following the downbeat slate of economic data early in the week, inflation data on Friday called into question some of the optimism around an imminent Fed pivot as two closely-watched price gauges – the Core PCE Index and the Employment Cost Index – each posted hotter-than-expected increases. The Core PCE – the Fed’s preferred inflation metric – unexpectedly accelerated in June with its highest month-over-month increase since last May. Meanwhile, the Labor Department’s employment cost index increased 1.3% in the second quarter from the prior three months, compared with a 1.2% estimate. Rising gasoline prices drove much of the increase, however, as average consumer gas prices in the U.S. peaked in mid-June at $5.03/gallon, but prices at the pump have declined 16% over the past six weeks to $4.20/gallon – roughly consistent with the decline in Crude Oil prices during this period.

Equity REIT Week In Review

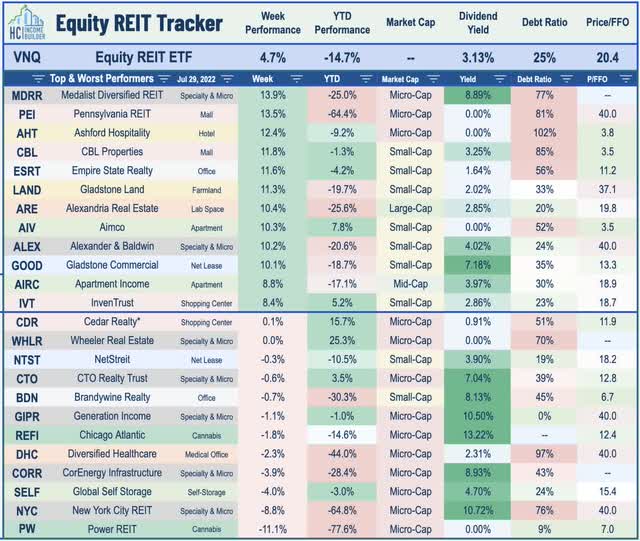

Best & Worst Performance This Week Across the REIT Sector

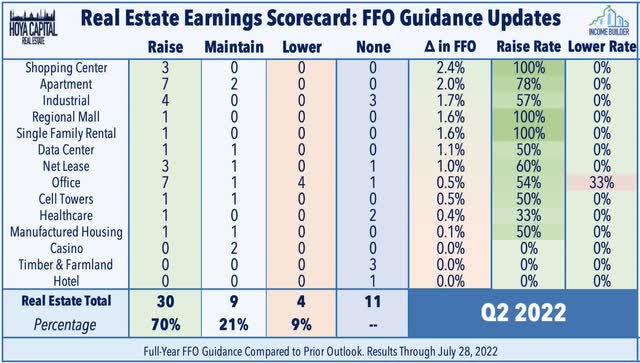

As discussed in our REIT Earnings Halftime Report, we’re now at the halfway point of another newsworthy real estate earnings season with 55 REITs representing roughly 50% of the total market capitalization having now reported results. Among the 43 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 30 REITs (70%) raised their outlook while just 4 REITs (9%) have lowered or withdrawn their outlook. (Excluding several REITs that withdrew guidance due to pending acquisitions.) Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 45% of S&P 500 companies boosted their outlook while 55% have lowered. Upside standouts this earnings season have been apartment, shopping center, and industrial REITs. Currency headwinds have been a theme in the technology space, but core results have surprised on the upside while office REITs have been the lone source of negative revisions.

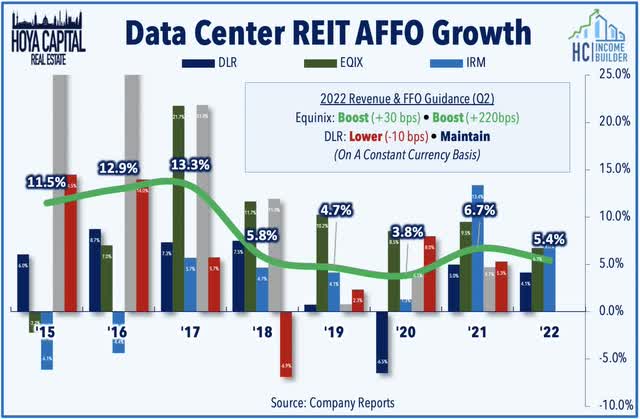

Data Center: Equinix (EQIX) – which has been one of our three “Best Ideas in Real Estate” – rallied more than 8% on the week after reporting better-than-expected results driven by record-high levels of gross bookings in the first half of the year. EQIX raised its full-year FFO outlook to 9.5% on a constant-currency basis, up 220 basis points from its prior outlook. Data center REITs have become “battleground” stocks in recent months after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. Results from Digital Realty (DLR) were less impressive, however, with gross bookings falling short of estimates and with a slight downward revision in its full-year revenue outlook, consistent with our belief that network-dense data centers – which are the focus of EQIX – are more immune to the persistent competition from hyperscale cloud companies – Amazon (AMZN), Google (GOOG), and Microsoft (MSFT) – with nearly limitless resources.

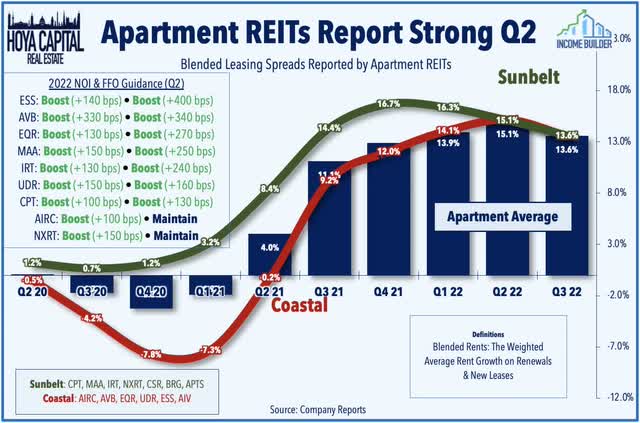

Apartment: Nine of the ten major apartment REITs have reported results this week – nearly all of which have significantly exceeded expectations. All nine raised their full-year same-store NOI growth target – which is now expected to average more than 13% this year – while seven of the nine boosted their full-year FFO target with an average increase of 2%. Benefiting from the affordability issues plaguing the ownership markets of late, both Sunbelt and Coastal-focused REITs are seeing similar trends of sustained double-digit rent growth, historically high occupancy rates, and record-low turnover. The upside boosts from Camden Properties (CPT) and Mid-America (MAA) bring their cumulative FFO growth since 2019 to over 30%. Among the coastal REITs, Apartment Income (AIRC) – which seemingly continues to fly under-the-radar after its split from Aimco (AIV) in 2020, rallied nearly 9% after raising its full-year NOI outlook and posting its six straight quarter of sequentially accelerating rent growth including the acceleration reported into early July.

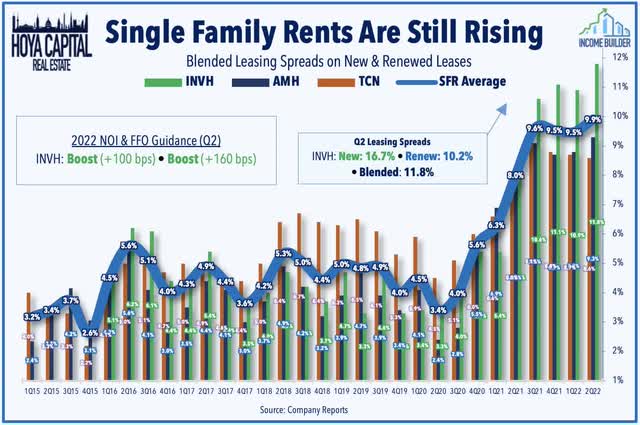

Single-Family Rental: Invitation Homes (INVH) – the nation’s largest housing owner – also reported strong results and raised its full-year NOI and FFO guidance. Citing “favorable supply and demand fundamentals” in its markets, INVH saw an acceleration in rent growth in Q2 to an 11.8% blended rate – its strongest quarter on record. The “embedded” rent growth potential is substantial with INVH estimating that its current leases are 16% below market rate, on average, as SFR REITs have perhaps been a bit too “generous” to existing tenants on lease renewals. The SFR REIT now expects FFO growth of 12.5% this year – up 160 bps from its prior outlook – while also raising its NOI growth outlook by 100 basis points to 10.8%. Notably, INVH did scale back on its acquisition plans for the rest of the year citing the rate-driven rise in its cost of capital, and commented that it is instead looking at opportunities to expand its investment management business.

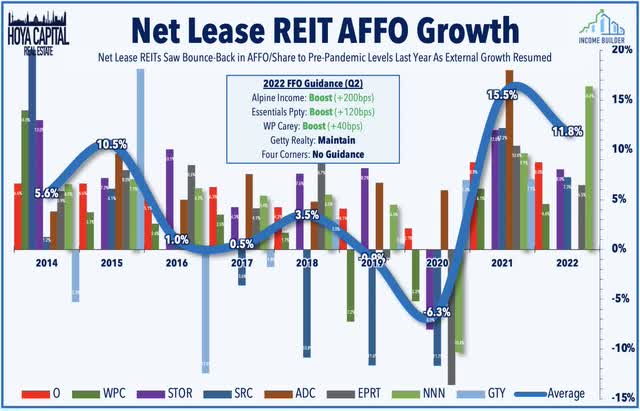

Net Lease: Earnings season is still young for the net lease and retail sector, but results thus far have been quite strong while these more rate-sensitive segments have also benefited from the retreat in long-term benchmark interest rates. W.P. Carey (WPC) rallied more than 7% this week after it delivered very strong results, benefiting from its sector-leading upside exposure to inflation through its CPI-linked lease structure. WPC raised its full-year FFO outlook by 40 basis points while delivering record-high same-store rent increases. Results earlier in the week from Essentials Property (EPRT) and Getty (GTY) were also solid – each of which has decent inflation-hedging characteristics per our recent analysis. The week ahead features reports from Realty Income (O), National Retail (NNN), and STORE Capital (STOR).

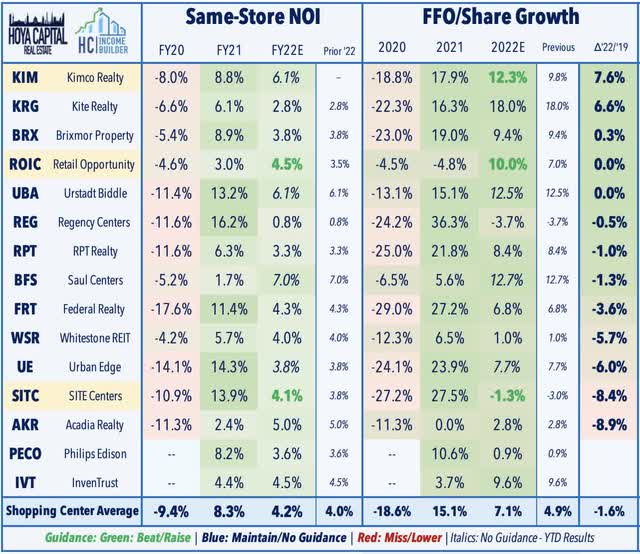

Shopping Centers: Retail REIT earnings season also got off to a strong start with a trio of better-than-expected results from shopping center REITs. Kimco (KIM) advanced 3% after boosting its full-year FFO growth outlook to 12.3% – up 250 basis points from its prior outlook. Of note, KIM commented that one of the key drivers is their focus on “last mile locations” which are seeing positive traffic patterns at 101.3% relative to the same period last year, consistent with the trends discussed in Shopping Center REITs: Winning The Last Mile. Retail Opportunities (ROIC) rallied 6% after it raised its FFO growth outlook to 10.0% this year – up 300 basis points – which would bring its FFO back even with its rate in full-year 2019, driven by double-digit rent growth on same-space new leases and renewals. SITE Centers (SITC) gained 5% after boosting its FFO growth outlook by 170 basis points while recording its highest quarterly new leasing volume since early 2017.

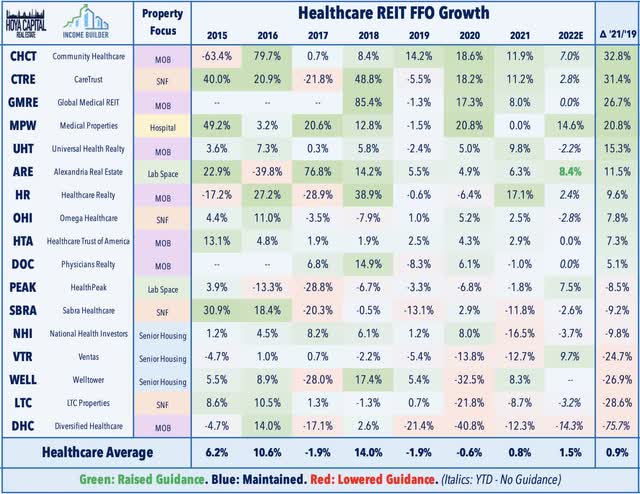

Healthcare: Lab space-focused Alexandria Real Estate (ARE) rallied more than 10% on the week after reporting better-than-expected results and raising its full-year outlook. As discussed in our report this week, Healthcare REITs: Coming Out of Rehab, lab space demand showed few signs of cooling as ARE’s beat was driven by a record rental rate increase – 45.4% GAAP and 33.9% cash – and a historically high leasing volume of 2.3M square feet, the third-highest quarter of leasing volume in the company’s history. ARE now sees FFO growth of 8.4% this year – up 40 basis points from its prior outlook – and raised its same-store NOI growth outlook by 30 basis points to 7.8% at the midpoint. LTC Properties (LTC) advanced 6% after the skilled nursing REIT reported an active quarter of lease renegotiations with troubled tenant operators, a chronic issue that has re-emerged for SNF REITs as government relief funds have dried up – a focus in the week ahead with results from Omega Healthcare (OHI) and Sabra Health Care (SBRA).

Mortgage REIT Week In Review

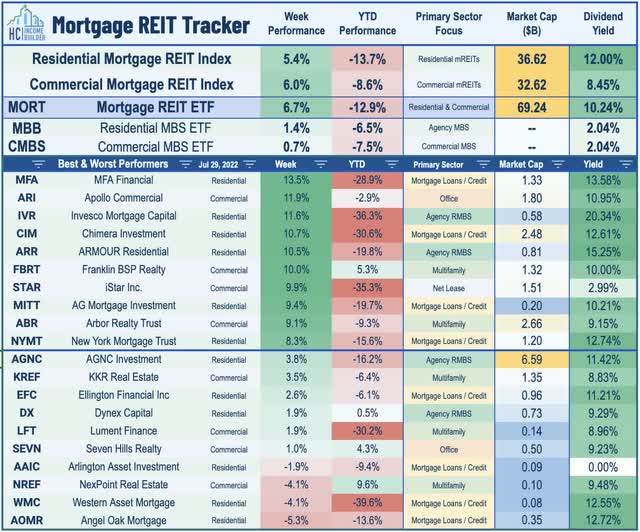

Mortgage REITs continued their resurgence over the past week, fueled by a strong bid for mortgage-backed bonds and by generally upbeat earnings results. Residential mREITs gained 5.4% while commercial mREITs rallied 6.0% as the Mortgage REIT ETF (REM) has now rebounded by 27.5% from its recent lows in mid-June. Annaly Capital (NLY) rallied nearly 7% after reporting decent results in Q2 with its distributable EPS beating consensus estimates despite a 12.9% decline in its book value per share (“BVPS”) while AGNC Investment (AGNC) advanced 4% after posting an identical BVPS decline offset by a similar EPS beat. Annaly and AGNC each provided an upbeat outlook on recent conditions with NLY management citing the “historically attractive new investment returns” on Agency MBS. ARMOUR Residential (ARR) also rallied more than 10% after reporting similar results of better-than-expected EPS despite a 14.5% decline in its BVPS.

Highlights on the commercial mREIT side included Arbor Realty (ABR) – which reported better-than-expected results and raised its dividend for the ninth consecutive quarter – and Blackstone Mortgage (BXMT), which advanced 6% after beating EPS estimates, citing its “floating-rate portfolio and strong liquidity position.” Ladder Capital (LADR) also gained more than 6% after reporting a 0.3% increase in its BVPS. Through the first week of earnings season, residential mREITs have reported an average decline in their BVPS of about 11% amid a historically brutal quarter for fixed income securities while commercial mREITs have reported an average BVPS decline of 0.3%. The earnings calendar heats up in the week ahead with results from two dozen mREITs including New Residential (NRZ) on Tuesday, New York Mortgage (NYMT) on Wednesday, and Starwood Capital (STWD) on Thursday.

2022 Performance Check-Up

Through seven months of 2022, Equity REITs are now lower by 14.7% on a price return basis for the year while Mortgage REITs have slipped 12.9%. This compares with the 13.3% decline on the S&P 500 and the 11.4% decline on the S&P Mid-Cap 400 as well. Led to the upside by the casino, farmland, and net lease REIT sectors, four real estate property sectors are now in positive territory for the year while the cannabis and regional mall sectors have lagged on the downside. At 2.64%, the 10-Year Treasury Yield has climbed 113 basis points since the start of the year, but has been under pressure since briefly breaking through the prior post-GFC-high rate of 3.25% reached in 2018 and touching an intra-day high in June of 3.50%.

Economic Calendar In The Week Ahead

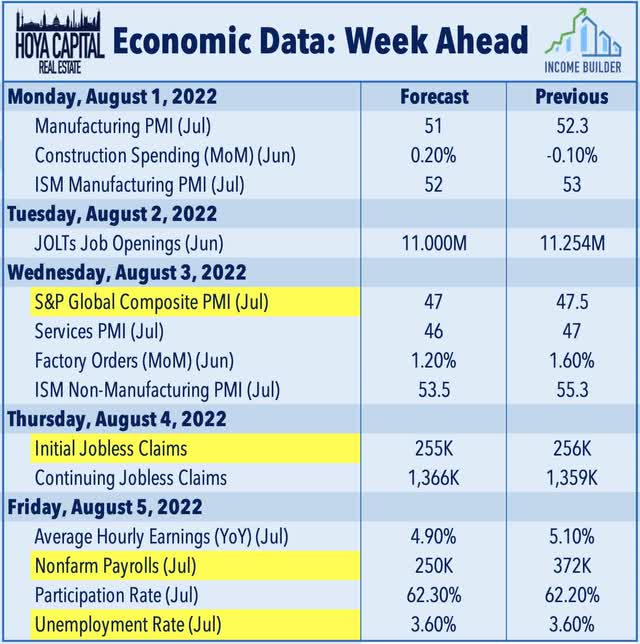

Employment data highlights another busy week of economic data and corporate earnings reports in the week ahead, headlined by JOLTS data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 250k in July which would be the lowest month-over-month increase since the start of the pandemic as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. Purchasing Managers’ Index (“PMI”) data will continue to be a major market focus – particularly in Europe and Asia – as recent reports have barely managed to hold on to the breakeven 50-level.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment