porcorex

Safe high yield may sound like an oxymoron, but that doesn’t always have to be the case. This is especially true among REITs, which are designed for high yield. That’s because they don’t have to pay corporate taxes so long as they distribute at least 90% of their taxable income.

Even more so, many REITs carry investment grade credit ratings, which is important for bond and equity investors alike in assessing the overall quality of an enterprise. This brings me to National Retail Properties (NYSE:NNN), which throws off a yield that’s far higher than that of the S&P 500 (SPY). This article highlights why NNN remains a sound buy after its recent quarterly results.

Why NNN?

National Retail Properties is a truly national triple net lease REIT with a diverse high-quality portfolio of 3,349 properties that span across 48 states in the contiguous U.S. It has over 380 tenants and this includes long-standing relationships, with its top 25 tenants representing 55% of NNN’s annual rent.

NNN is led by an experienced management team, with an average 21-year tenure in the senior leadership team. Moreover, 61% of NNN’s employees have been with the company for over 5 years. Like its peer, Realty Income (O), NNN is also a dividend aristocrat, with 33 consecutive years of raises under its belt, including the last 3.8% raise to $0.55 per share per quarter.

NNN maintains sound operating fundamentals, with a high occupancy rate of 99.4% as of the end of Q3, and has a long weighted average lease term of 10.4 years, putting it on par with that of net lease peers. Notably, NNN also carries a strong balance sheet, with a long 14 year weighted average debt maturity for fixed rate debt.

Moreover, it appears that management hasn’t found a shortage of investment opportunities, as it invested $223 million during the third quarter, comprising 52 properties with an aggregate 613K square feet of gross leasable, at a relatively high (compared to prior years) initial cash yield of 6.3%. Management has also proven to be active managers of its portfolio to maximize opportunities, by selling 8 properties producing $5.9 million of gains on the sales.

Encouragingly, management raised Core FFO per share guidance from $3.10 at the midpoint to $3.13. NNN also appears to be well-positioned from a balance sheet standpoint with no material debt maturities through the end of next year. It also carries a BBB+ rated balance sheet, a low debt to EBITDA ratio of 5.3x, strong fixed charge coverage ratio of 4.7x, and has over $1 billion of available liquidity on its bank credit line.

Risks to NNN include the current high inflation rate, which outpaces NNN’s ability to raise rents as well as its dividend growth rate. However, this isn’t limited to just NNN or even REITs in general, as many C-Corp companies are also experiencing pains with supply disruptions and commodity price inflation, without being able to fully pass on higher costs to their consumers. Plus, while NNN’s annual lease escalators may be below the current pace of inflation, it should be able to adjust expiring leases to a higher rate, but this of course, takes time.

Nonetheless, I see value in NNN as it currently yields an attractive 5%. Plus, the dividend is very well covered at an AFFO payout ratio of just 67%, giving management plenty of headroom to raise the dividend and maintain its 33 year track record of annual raises.

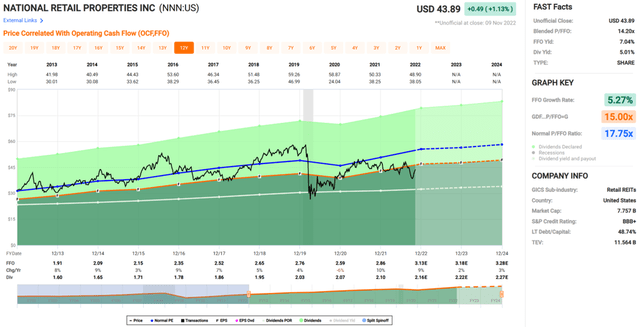

Lastly, at the current price of $43.89, NNN carries a blended P/FFO of 14.2, sitting well below its normal P/FFO of 17.8 over the past decade. Analysts have a consensus Buy rating on the stock with an average price target of $47.30, translating to a potential 13% total return including dividends.

Investor Takeaway

National Retail Properties reported strong results for its third quarter and appears to be well-positioned for the future. The company’s dividend is very well-covered and it offers an attractive yield of 5%, all while maintaining a very strong balance sheet. Investors looking for a quality high yield could do a lot worse than investing in NNN. As such, I view NNN as being a sound buy and a port in the storm amidst a choppy market.

Be the first to comment