z1b

Co-produced by Austin Rogers for High Yield Investor

As a searing heatwave scorches the United States and Europe, pushing temperatures to their highest ever recorded levels from Salt Lake City, Utah to the United Kingdom to Italy and Norway, concerns are mounting that this may be the world’s new normal during the summertime due to climate change.

Now, we are investors, not climate scientists. We do not wish to weigh in on the debate about how concerned we should be about climate change or what to do about it.

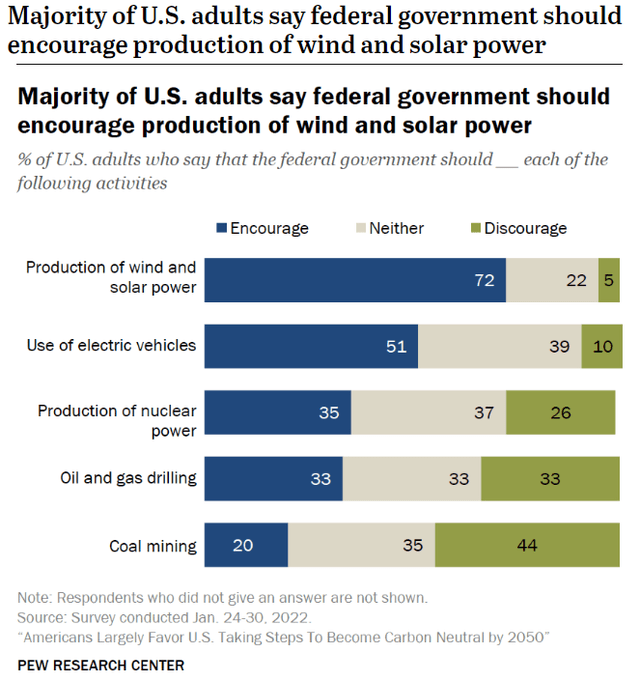

But it is undeniable that the population of the developed world is becoming more concerned about climate change over time, and that concern drives them to believe that more wind and solar power production is an attractive solution. A Pew Research poll from early 2022 shows that 72% of US adults (including 54% of self-identified Republicans) think the federal government should encourage wind and solar as sources of power.

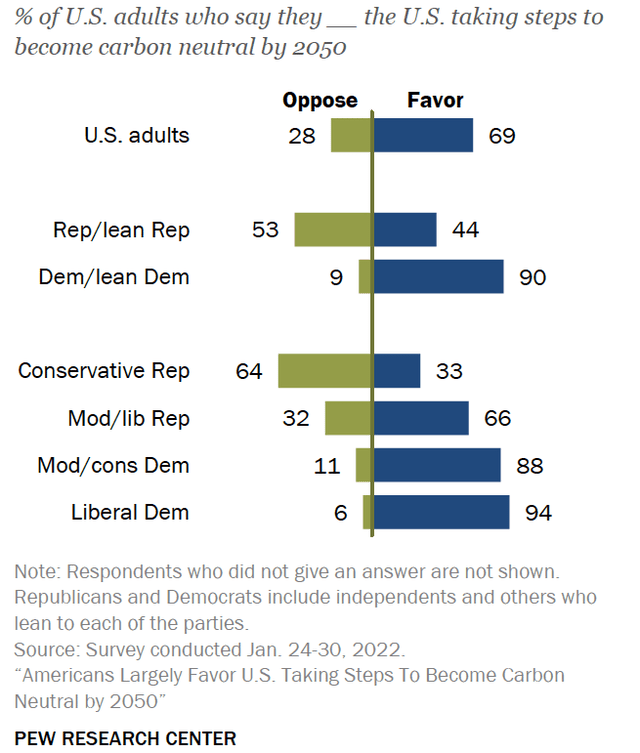

What’s more, Pew Research survey data shows that 69% of US adults support their country “taking steps to become carbon neutral by 2050.”

Again, we are not trying to make any political statement here. Rather, we are simply showing that the winds (pardon the pun) favor the continued rapid growth of power production from renewable energy sources.

Demand for more green energy should continue to grow regardless of whether governments enact more pro-renewables legislation or not.

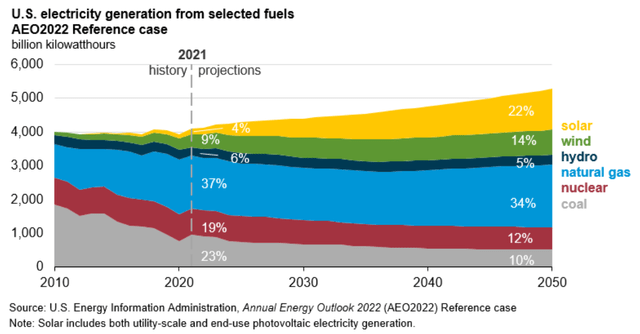

Hence, we find that the US Energy Information Administration projects in their 2022 Annual Energy Outlook that American electricity generation from renewables should more than double from 2021 to 2050. In fact, the EIA projects that the vast majority of growth in electricity generation over the next 30 years will come from renewables.

Energy Information Administration

As you can see, the EIA forecasts that renewable sources of electricity production should increase from 19% in 2021 to 41% in 2050. That second number is actually down one percentage point from 2021’s Annual Energy Outlook, which posited 42% of electricity generated from renewables in 2050.

But here is an important point to note: the EIA built into their forecast an assumption of natural gas prices averaging around $4 per million British thermal units (“MMBtu”). Today, natural gas prices are roughly double that, driven by the decoupling of the Western world from Russian gas supplies.

The 2022 Annual Energy Outlook assumes that natural gas will account for about 40% of capacity additions over the next three decades. But if the price of natural gas trends meaningfully higher than the EIA’s assumption for many years, this could further jumpstart the shift toward renewables.

What’s more, about half of the expected new gas-fired electricity production capacity expected to come online in the next 30 years is for peaking purposes. In other words, it is expected to operate only during the parts of the day with the highest demand/load. But battery storage technology continues to improve and could reduce the need for some of those expected future gas-fired peaker plants.

In short, if renewable energy technology continues to get cheaper and more efficient, the EIA’s most recent projection may prove to be too conservative.

The past decade has shown that it is more dangerous to underestimate the rise of renewables than to overestimate it.

With that said, let’s take a look at two companies that are currently undervalued, and yet, they own stabilized, long-contracted renewable energy assets like wind farms, solar arrays, and battery storage facilities.

NextEra Energy Partners (NEP)

NEP is the renewable energy YieldCo of parent company, sponsor, and external manager, NextEra Energy Inc. (NEE), which owns a utility company serving Florida as well as a massive renewable energy development business called NextEra Energy Resources.

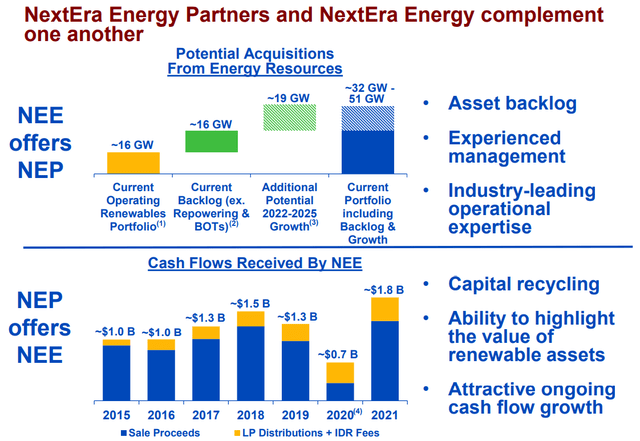

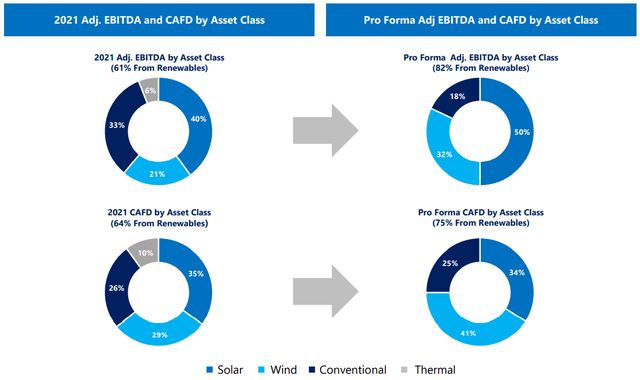

NEE and NEP have a symbiotic relationship in which NEE sells or “drops down” completed and stabilized renewable energy projects to NEP, which raises capital through a variety of means to buy them. As NEP’s portfolio expands, it is able to pay out more distributions, which also benefits NEE because of its ownership of over half of NEP’s operating company units.

Though investors are right to worry about external management structures in most cases, the management arrangement between NEE and NEP is one of the best for NEP unitholders, in our opinion, for at least two reasons:

- Because NEP issues equity in order to purchase assets from NEE, it is in management’s interest to do everything possible to keep NEP’s stock price performing well.

- NEE owns a majority of NEP and receives more distributions when NEP’s cash available for distribution (“CAFD”) increases.

Unlike many external management agreements, in which management gets paid to increase assets under management regardless of whether it benefits shareholders, NEE’s structure specifically rewards the parent company for increasing the distribution to common unitholders of NEP (like you and me). That aligns incentives between management and unitholders.

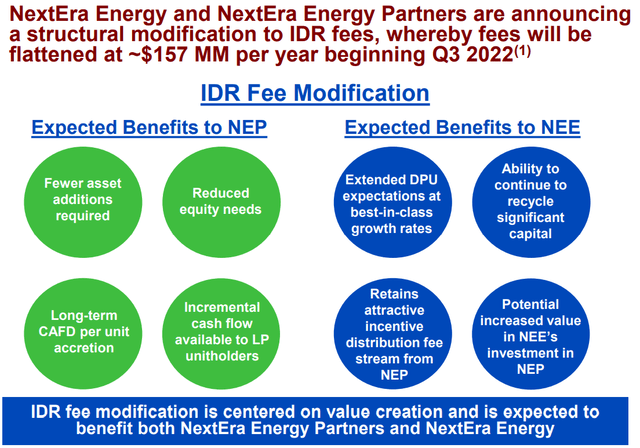

Evidence of this alignment of interests came with the recent announcement that management decided to cap incentive distribution rights (“IDR”) fees around their current level. This will make NEP’s payout ratio lower than it otherwise would be while making each new portfolio addition more accretive to CAFD per unit going forward.

Because of NEE’s skilled management and smart structuring of the two symbiotic companies, we are confident that NEE’s massive renewable energy development pipeline will translate into continued growth of both NEP’s portfolio and its distribution per unit.

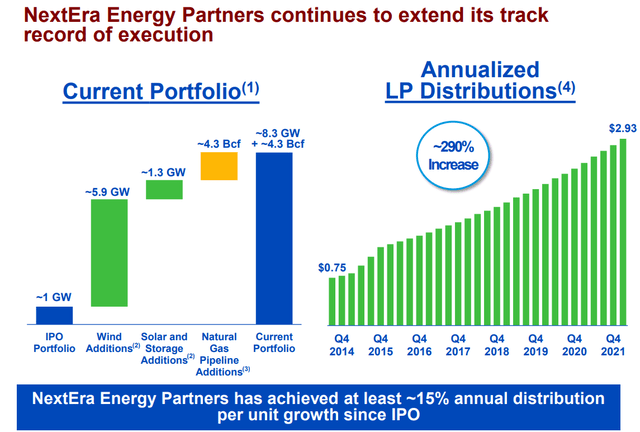

Since NEP’s IPO eight years ago, the company has increased its distribution by ~290% in total, or an annualized rate of about 15%. Management targets that growth to continue at a pace of 12-15% per year through at least 2025.

With a dividend yield of 4%, growth of 12-15% per year, and no K-1 Form to deal with, NEP makes a fantastic dividend growth play on the green energy transition.

Clearway Energy Inc. (CWEN, CWEN.A)

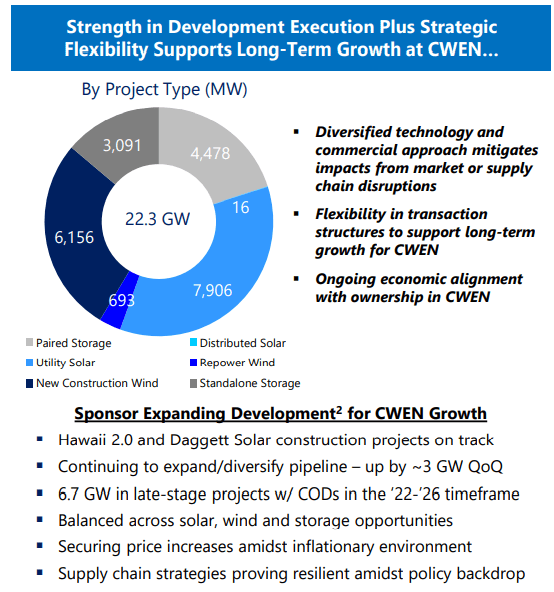

CWEN Presentation

CWEN is the publicly traded YieldCo majority-owned by its sponsor, Clearway Energy Group (“CEG”), a private company that develops renewable energy projects. CWEN’s 7.7-gigawatt portfolio consists of utility-scale wind, solar, battery storage, and natural gas-fired generation plant assets.

Unlike NEP, CWEN is internally managed, which means that its management team are employed by CWEN itself rather than the parent company or sponsor.

For a number of years, CEG has been 100% owned by Global Infrastructure Partners, but recently, GIP agreed to sell 50% of its ownership in CWEN to the French energy giant TotalEnergies (TTE). This new partnership between GIP and TTE is a powerful one that, combined with CEG’s own expanding development pipeline, should ensure CWEN has ample growth opportunities for the foreseeable future.

CWEN Presentation

After selling its thermal generation assets at an opportune time, CWEN’s management has stated that they have the dry powder to fully fund their investment pipeline for the next few years.

Moreover, these planned investments in long-duration wind, solar, and battery storage projects, plus any new opportunities presented from the partnership with TTE, should allow CWEN to raise its dividend to the upper end of its target growth rate of 5-8% per year through at least 2026.

Currently, CWEN offers a dividend yield of over 4%, while CWEN.A yields over 4.5%. Even though Class A shares (CWEN.A) are the smaller share class, it is our preferred way to own the company because the discount to Class C shares (CWEN) renders a higher yield with no noticeable difference in liquidity.

Bottom Line

Regardless of one’s personal view about climate change or green energy, it is undeniable that the US and the developed world are ramping up their investments to achieve carbon neutrality in the electric power sector at some point in the future. This will be a multi-trillion-dollar transition that investors can either ignore or take advantage of.

At High Yield Investor, we choose to tap into this massive growth trend and profit from it. Though we like both NEP and CWEN, our top pick in the sector is higher yielding yet with a similar growth profile as CWEN.

Be the first to comment