franckreporter

Transcript

We don’t think the U.S. midterm elections will be the catalyst to boost stocks.

Recession eclipses U.S. midterm result

We see a recession caused by sharp Federal Reserve rate hikes – that eclipses any impact from U.S. midterm elections.

1) Warning signs

We have argued how central banks rushing to hike policy rates to get inflation back to target would need to crush interest rate-sensitive parts of the economy first, since this higher inflation is driven by production constraints.

Recession will pressure other sectors in time, but we’re already seeing damage in important rate-sensitive sectors like housing. As mortgage rates soar along with rate hikes, new housing construction is diving.

2) The fiscal dilemma

We see gridlock as the likely outcome – either in a divided Congress or a slim majority in both chambers.

That makes a fiscal response to recession less likely, in our view. Fiscal spending doesn’t avoid recession in this new regime anyway. Trying to boost growth with fiscal stimulus doesn’t result in stronger growth, just higher rates.

Here’s our Market Take

We’re underweight developed market stocks. We see rising rates causing recession as inflation persists, and only see the Fed pausing after realizing the economic damage it’s caused.

_____________

Equities usually do well after U.S. midterms. Why? Gridlock is common and prevents policy change that could spook stocks. We don’t see that past playbook working this time, due to the recession we expect from the Fed ratcheting up rates. Gridlock dims any prospect of fiscal stimulus that only works at cross-purposes with monetary policy in the new regime – take the UK. We stay underweight DM stocks but see the politics of higher rates taking over from the politics of inflation.

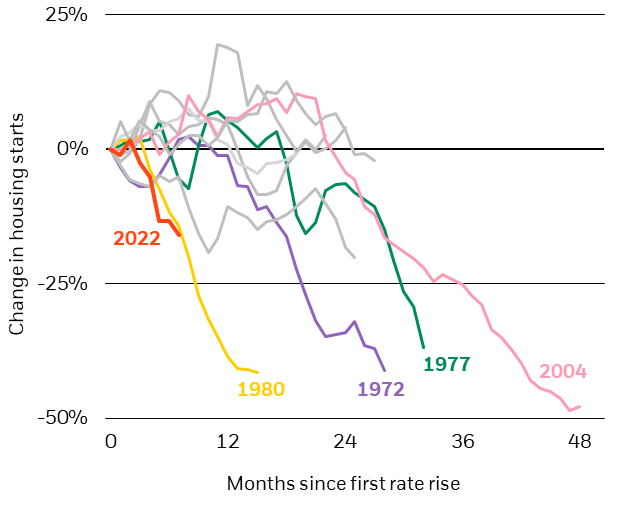

Housing stops

U.S. Housing Starts During Policy Rate Tightening Cycles, 1972-2022 (BlackRock Investment Institute and U.S. Census Bureau, with data from Refinitiv Datastream, October 2022)

Notes: The chart shows how quickly in months housing starts changed during policy rate tightening cycles between 1972-2022. The colored, labeled lines highlight 2022 and the years when housing starts fell most quickly.

We see a bigger problem for stocks than any potential positives from the midterm election outcome: a looming recession. We have argued how central banks rushing to hike policy rates to get inflation back to target would need to crush interest rate-sensitive parts of the economy first. That’s because higher inflation is driven by production constraints. Recession will pressure other sectors in time, but we’re already seeing damage in important rate-sensitive sectors like housing. As mortgage rates soar along with the Fed’s aggressive rate hikes, the number of new housing starts is falling quickly. The slide in housing starts this year (see orange line in the chart above) is already steeper than past mega Fed rate-hike cycles such as in the 1970s and early 1980s – as well as the unwind of the mid-2000s U.S. housing boom (other colored lines).

We’ve said the playbook from the Great Moderation, a four-decade period of steady growth and inflation, won’t work in this new regime of heightened macro volatility. Recession outweighs factors in previous U.S. midterm elections that were seen as positive for stocks, such as resulting policy gridlock. Gridlock typically meant lower odds of change that could affect stocks. Equities also have yet to fully reflect recession and earnings risk, we think. We’re not chasing bear market rebounds.

Midterms hold no sway

The midterms won’t sway our view. Recession matters more, and any resulting fiscal stimulus can only work at cross-purposes when inflation and debt levels are high and rates are rising. We’ve seen how it can threaten a fragile equilibrium and revive bond vigilantes. Case in point: the UK. The episode of historic long-term gilt volatility shows what can happen when governments try to respond to high inflation with unfunded fiscal spending. We’ve moved to neutral on UK gilts from underweight as perceptions of fiscal credibility have improved after the U-turn on the fiscal mini-budget. We think the Bank of England will have to hike rates less than we assumed immediately after the plan. Still, political turmoil and the resignation of Prime Minister Liz Truss warrant caution. Fiscal policy can’t save the day, we think – it’s a recession foretold. Production constraints mean the only way to get inflation down to target would be to curb the level of activity to what the economy can comfortably produce now. We don’t think fiscal stimulus would result in stronger growth but just higher interest rates and debt servicing costs.

We see political focus increasingly shifting to the economy. We expect inflation to come down but stay above target – and recession will still hit. We then think the politics of inflation could switch to the politics of higher interest rates. We see the politics of rates creeping into the politicization of everything, with more voices beginning to decry the aggressive rise in interest rates that is causing recession. We see the Fed stopping its hikes amid the economic damage and pressure to ease up on tightening, but price pressures will persist. That’s why we think it will eventually have to live with some inflation.

Our bottom line

We’re underweight DM equities. We see rising rates causing recession as inflation persists. The Fed is responding to the politics of inflation or the pressure to tame it, we think. We see the Fed pausing, but only after the economic damage of rate rises is clear. All this outweighs any expected boost for stocks after the midterms, in our view. We also think any resulting fiscal stimulus would only work against monetary policy in this new regime. We eventually see the politics of rates overtaking the politics of inflation as political focus sharpens on the economy into the 2024 elections.

Market backdrop

U.S. and German bond yields hit new multi-year highs as markets brace for more central bank rate hikes. That has kept equities pinned near two-year lows despite occasional bear market rallies. Major central banks are expected to deliver big rate rises at upcoming meetings as they pursue a “whatever it takes” approach to curb inflation, starting with the European Central Bank next week. We expect them to carry on until the economic damage caused becomes clear.

We expect the European Central Bank to stick to an aggressive tightening path and raise rates on Thursday. The Fed’s preferred metric for inflation – the PCE – comes out on Friday, a week before markets see it lifting policy rates 0.75% to 3.75-4.0%. Manufacturing September data around the world could also give early signs of the recessions we expect.

Be the first to comment