MicroStockHub/iStock via Getty Images

The Real Good Food Company (NASDAQ:RGF) expects more than 80% sales growth in 2022, and invests in growing markets like the high protein-based food market. I believe that the future of the company is sweet, however the current valuation per share appears too expensive. Under normal conditions that include sales growth close to that of the high protein-based food market, I obtained a valuation of $4.69. In my view, the risks of contracting clients, relationships with co-manufacturers, and increase in interest rates could bring the free cash flow down. As a result, the stock price may decrease to lower price marks than the current market price.

The Real Good Food

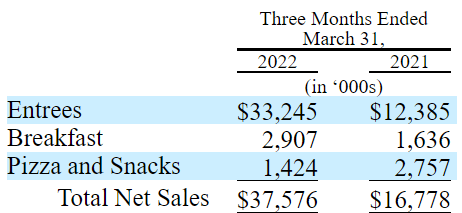

The Real Good Food runs a frozen food business offering high protein, low sugar, gluten- and grain-free products. According to the most recent quarterly report, the company is specialized in entrées, but it also sells breakfasts, pizza, and snacks.

10-Q

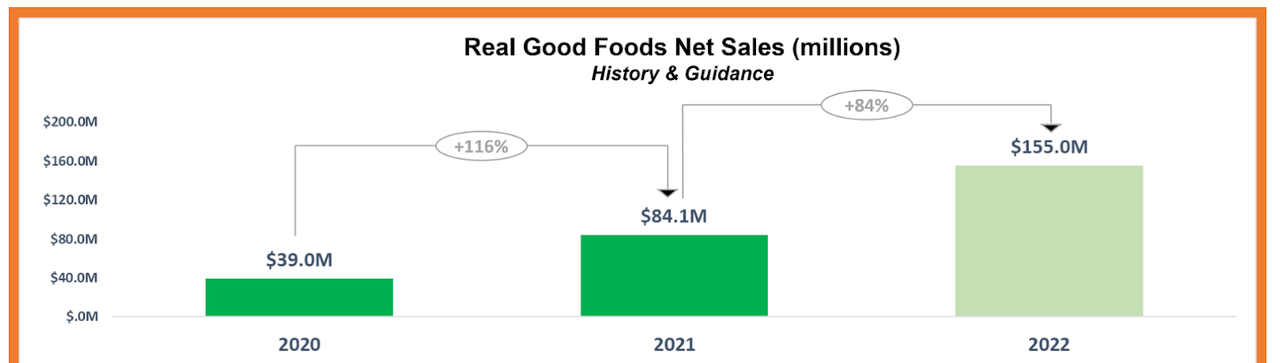

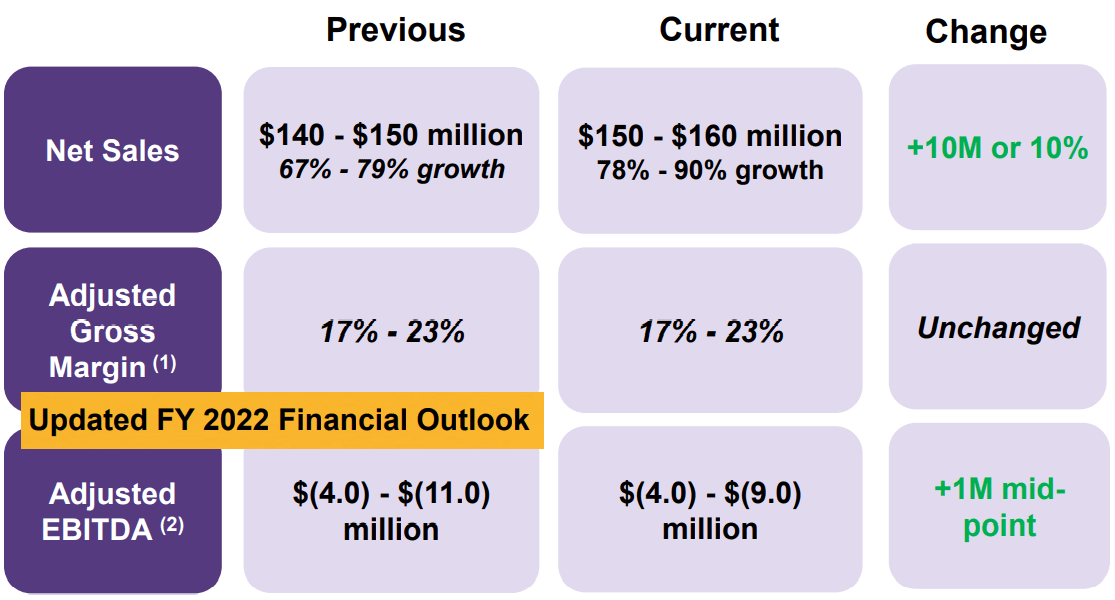

If I can go straight to the point, I am writing about the company because the guidance is impressive. Management expects to deliver close to 84% sales growth in 2022 and an adjusted gross margin close to 17%. If we do not take into account the company’s valuation, it is a company that grows at a very decent pace.

Company’s Website Q1 Earnings Presentation

Under Normal Circumstances, I Obtained A Valuation Of $3.57-$4.69

In my opinion, if management successfully communicates with the market that chooses The Real Good Food products, revenue growth will trend higher. The company’s mission was clearly established in the annual report:

Our mission is important to us because we believe an increasing number of consumers are seeking to make healthier food choices yet face limited options when it comes to the convenience of products found in the frozen food aisle. Source: 10-K

In my view, under normal conditions, The Real Good Food will likely trade somewhere close to the growth of the global food & beverage market. Market experts believe that the market will trade at close to 5.8%.

According to the latest research study, the demand of global Food & Beverage Metal Cans Market size & share was valued at around USD 27,419.5 million in 2021 and it is expected to surpass a value of around USD 38,456.8 million Mark, by 2028, at a compound annual growth rate of about 5.8% during the forecast period 2022 to 2028. Source: At 5.8% CAGR, Global Food & Beverage Metal Cans Market Size

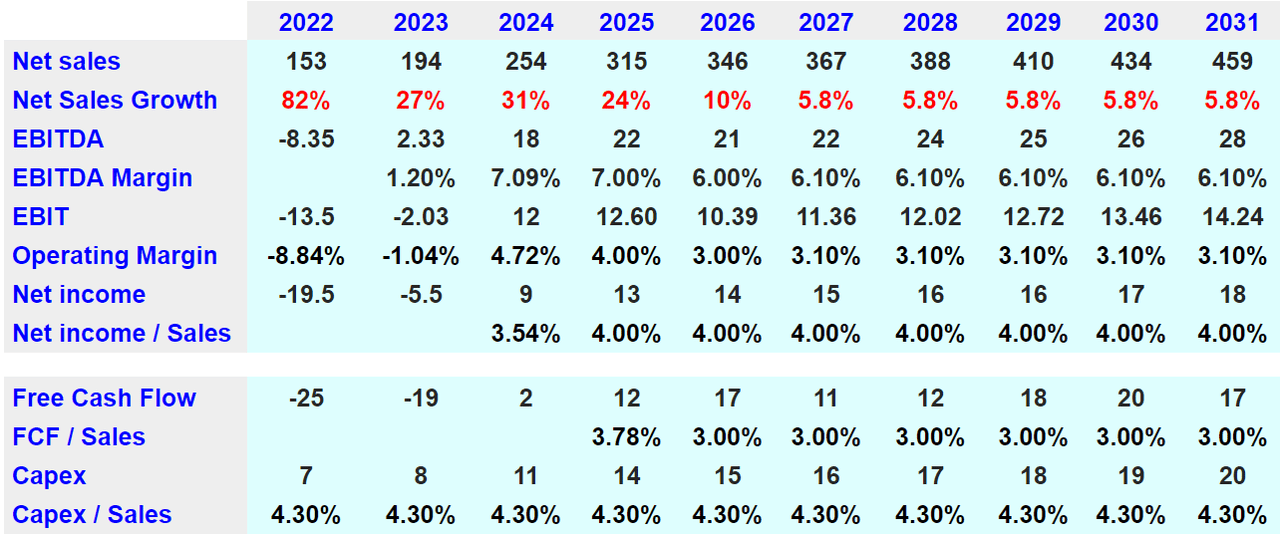

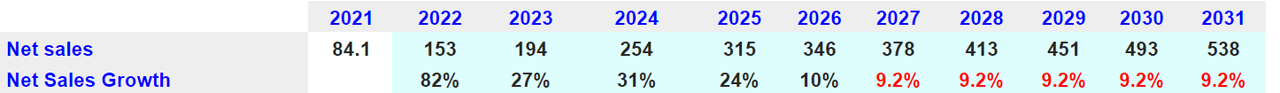

Using the expectations of other analysts and sales growth of the market, I believe that 2031 sales of $459 million is achievable. Note that I included double digit sales growth from 2023 to 2026 and 5.8% sales growth from 2027 to 2031. I also included a conservative EBITDA margin around 6% and positive net income from 2024.

Arie Investment Management

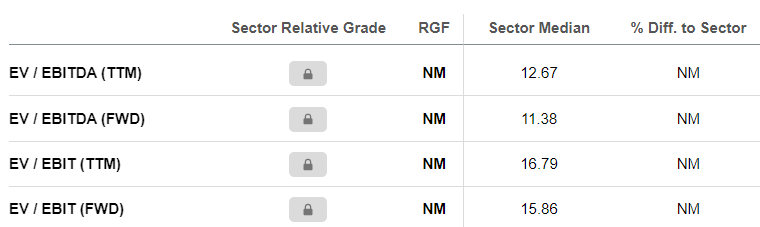

With conservative changes in receivables, changes in inventories, and capex around $7-$20 million, 2031 free cash flow would stand at $17 million. My numbers included free cash flow of more than $12 million from 2025 to 2031. My exit multiple stands at 11x EBITDA, which I consider conservative, and equal to the median in the industry. Finally, I obtained an equity valuation of $92 million and a fair price equal to $3.57.

SA Arie Investment Management

Let’s note that the company has two types of shares, which I don’t really appreciate. Usually, the market also dislikes it. In May 2022, the company reported close to 25.7 million shares:

As of May 12, 2022, there were 6,169,885 shares of the registrant’s Class A common stock and 19,577,681 shares of the registrant’s Class B common stock, par value $0.0001 per share, outstanding. Source: 10-Q

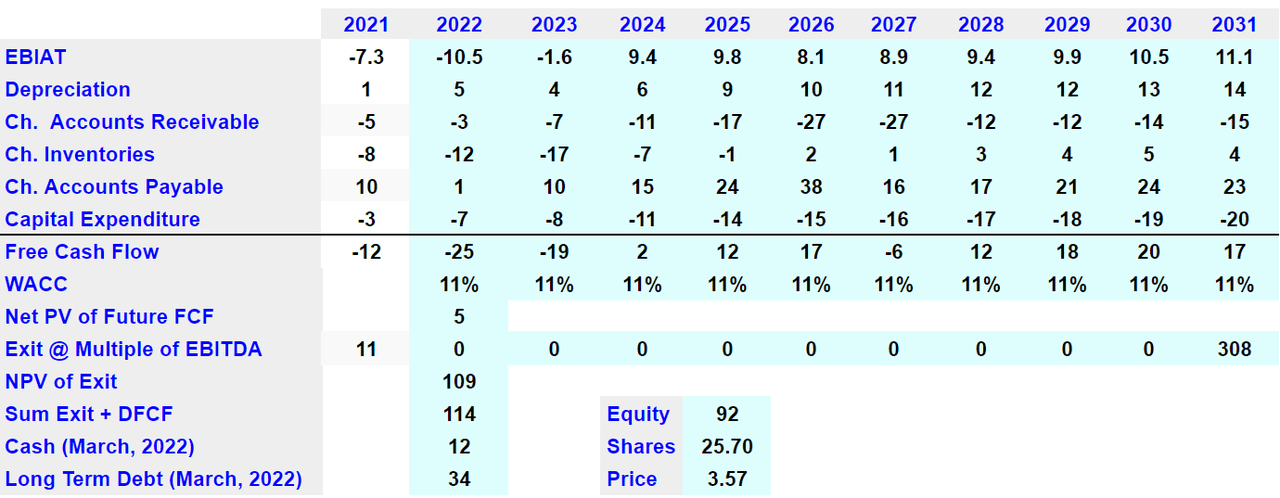

The Real Good Food is also operating in the global high protein-based food market, which grows at close to 7%. In my view, if management successfully invests in this market, sales growth may be close to 7% in the long term. With this in mind, I ran another case scenario with sales growth exceeding 7% from 2027.

The global high protein-based food market size is expected to grow by USD 27.49 billion from 2019 to 2024 and is expected to grow at a CAGR of 7% as per the latest market report by Technavio. Source: High Protein-Based Food Market

Arie Investment Management

My results were a bit better than that in the previous case scenario. Assuming an exit of 11x EBITDA, the implied valuation is equal to $4.69.

Arie Investment Management

Risk Factors: Concentration Of Clients, Need For New Co-Manufacturers, Manufacturing Capacity, And Increase In Interest Rates

The Real Good Food is still a small entity, so there are many things that could go wrong. First, the company suffers from a significant concentration risk. Two large supermarkets represented, in 2021, more than 70% of the total amount of sales. If one of these supermarkets leaves The Real Good Food, the decline in sales could be substantial. As a result, the valuation of the company would decline.

We have been and continue to be subject to substantial customer concentration risk. During the year ended December 31, 2021, Costco and Walmart accounted for approximately 71% of our net sales, collectively, and accounted for approximately 51% and 21% of our net sales, respectively, for the year ended December 31, 2021. Source: 10-K

The Real Good Food also manufactures some products in manufacturing facilities with co-manufacturers. Management is building new capacity, but the company expects to continue to rely on external manufacturing facilities. In sum, The Real Good Food needs to collaborate with other partners to manufacture. If it loses one or more manufacturers, the production could decline, and revenue may decline too:

Loss of one or more of our co-manufacturers, or our failure to identify new co-manufacturers, could harm our business and impede our growth. For the year ended December 31, 2021, up to 30% of our products were manufactured at various facilities operated by our co-manufacturers. During 2021 we began manufacturing in our City of Industry Facility, and although our growth strategy involves the enhancement of our overall manufacturing and production capabilities over time, we also expect to continue to rely on our co-manufacturers to provide us with a portion of our production capacity for the foreseeable future, and we may identify new co-manufacturers to provide additional capacity or flexibility. Source: 10-K

It is also worth considering that management may overestimate future demand. Too much capacity or too little capacity could affect future financial conditions. The company’s valuation could be affected:

If we do not accurately align our manufacturing capacity and production capabilities with our current or future demand, or if we experience disruptions or delays in scaling our manufacturing facilities, our business, operating results, and financial condition may be materially adversely affected. Source: 10-K

Finally, The Real Good Food may also suffer from potential increases in interest rates. Note that in the annual report, management noted that certain of the company’s debt does have a variable component. The total amount of debt is not significant, but future interest expenses could push the company’s free cash flow down:

The interest rate on the Company’s secured credit facility and certain other debt has a variable component, and which is reflective of the market for such instruments at any given date, and as such the carrying value this debt value approximates its fair value. Source: 10-K

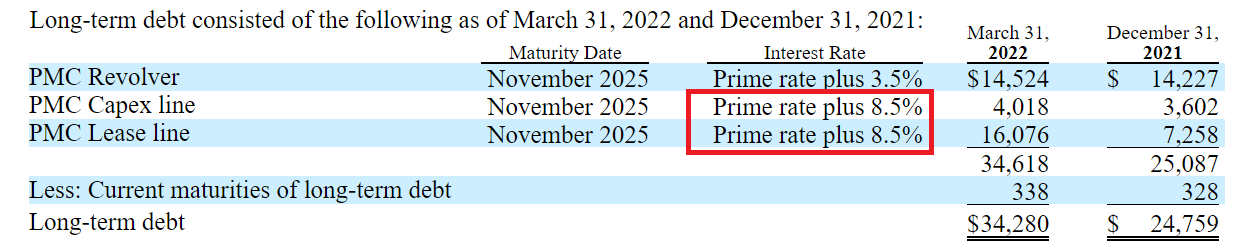

10-Q

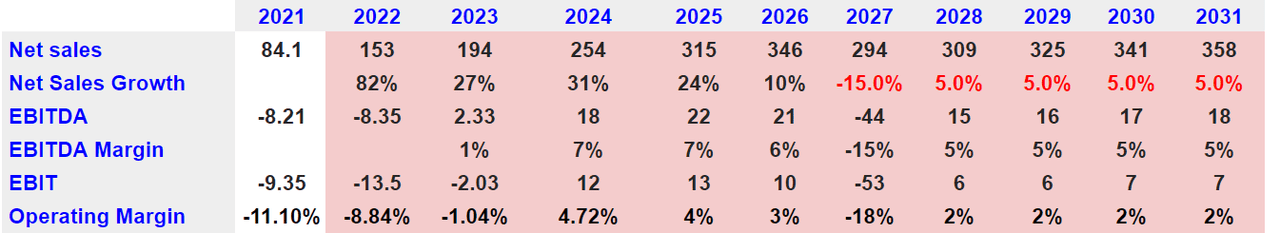

Under my pessimistic conditions, I used -15% sales growth in 2027 and -5% from 2028 to 2031. My EBITDA margin would also stand at close to 5% from 2028 to 2031, and the operating margin would not exceed 2%.

Arie Investment Management

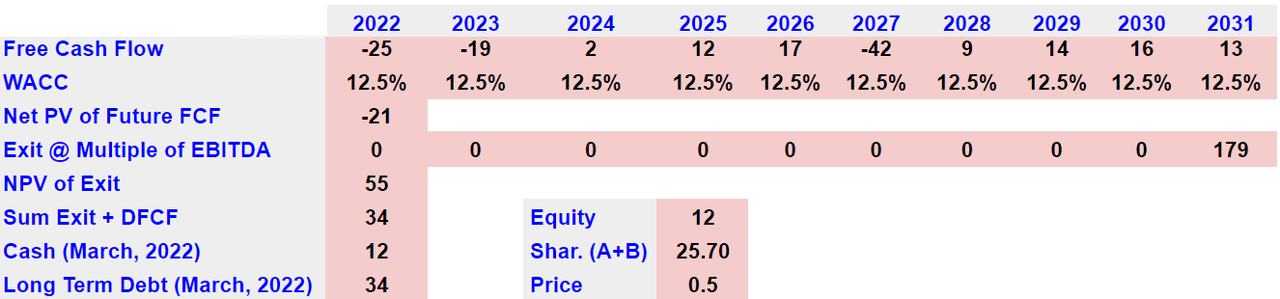

With a discount of 12.5% and exit multiple of 10x, the implied equity would be close to $12 million. The fair price could stand at $0.5.

Arie Investment Management

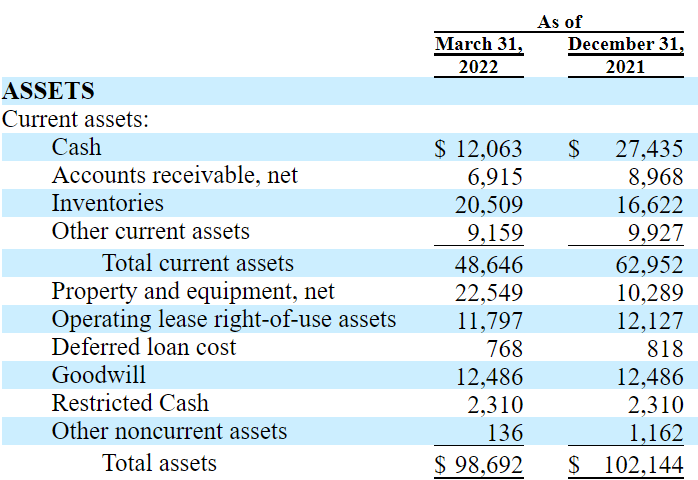

Balance Sheet

As of March 31, 2022, The Real Good Food reported $12 million and an asset/liability close to 1x. In my view, the total amount of liquidity is substantial, but management may need to raise more capital in order to pay marketing expenses as well as to finance sales growth. An eventual increase in the share count could lead to a decrease in the stock price.

10-Q

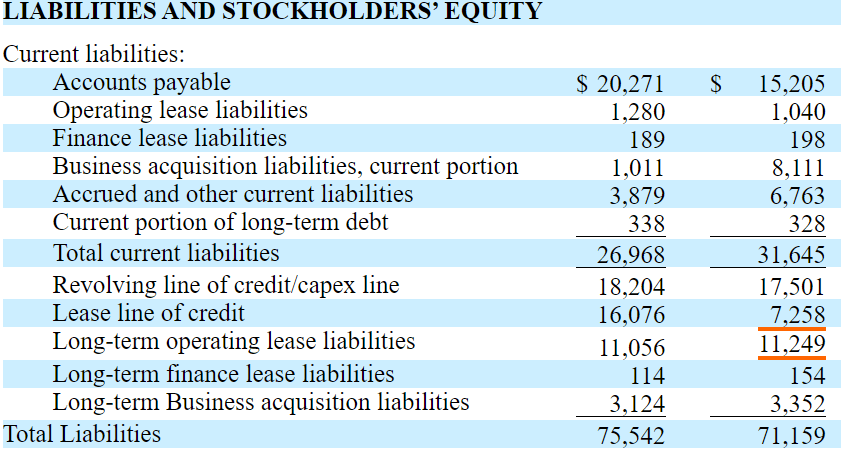

The total amount of liabilities is not large, but in my view, it is relevant noting the revolving line and other lines of credit. If the total amount of debt continues to increase, the equity valuation will likely decline.

10-Q

My Takeaway

The Real Good Food is a company that should be followed closely as its revenue growth guidance is quite impressive. Management expects double-digit sales growth way above the market. With that, I believe that the current valuation is too expensive. Considering future free cash flow, under normal conditions, I believe that a valuation of $3.57-$4.69 per share looks fair. More investments in the high protein-based food market will likely bring future free cash flow up. However, I cannot justify the current valuation, over $4.7 per share. Under my worst case scenario, which I consider quite unlikely, the stock price could even decline to lower than $2-$3.

Be the first to comment