MikeMareen/iStock Editorial via Getty Images

Investment Thesis

During the last 2022 Capital Markets Day, held on June 16th, 2022, Ferrari (NYSE:RACE) unveiled its roadmap for the next five years, a time span during which we will see the first all-electric Ferrari, along with many hybrid ones. One of the surprises of the event was that Ferrari declared its commitment to doubling its share buybacks and raising its payout ratio to 35% for a total return of $4 billion. With the stock price following the general bear market, it could now be interesting to pick up Ferrari as part of a dividend growth portfolio.

A Brief Overview

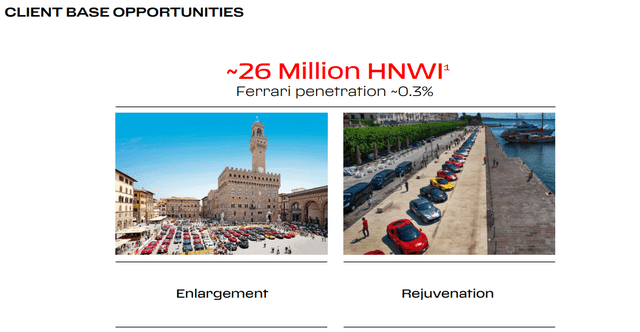

I covered Ferrari after its Q1 2022 results, arguing that the company is one of the best inflation proof bets in today’s environment. In fact, Ferraris are exclusive cars that appeal to many, but can only be bought by a few. The company estimates that its total addressable market is made of 26 million individuals, who have at least $1 million in investable assets.

Ferrari 2022 Capital Markets Day

In my past article, I showed how Ferrari had accomplished its goals over the past year, despite the pandemic, and that it was managing to increase revenues and margins while keeping volumes relatively low. I also pointed out that, when we consider Ferrari, we have to think that its business model is built upon what Enzo Ferrari, the company’s founder, used to say:

“Ferrari will always deliver one car less than the market demand”

Thus, when we try to figure out a valuation for Ferrari, we have to price in this intangible asset that is exclusivity, which makes customers wait a year or more to have their Ferrari delivered. Since Ferrari has great control over its volumes and its order book, it can provide quite accurate guidance for the next 12-18 months. This is why I stated that it is quite likely to expect its revenue to come in this year at €4.8 billion, with an EBIT margin of 23-24%. In addition, I tried to show how the introduction of the first SUV, the Ferrari Purosangue, will give further expansion to the company without hurting its brand image. Finally, I suggested keeping an eye on Formula 1 performance, which seems to be turning around after years of poor results. Even though in the last month and a half the team has made many mistakes and lost point, it is clear that this year the competition will be between the Redbull racing team and Ferrari. This, at least, is a big improvement on the brand image compared to the past.

Since I wrote the article, the stock has underperformed the market. Even though there have been events that have put downward pressure on the market as a whole, I don’t see any major hurdle before Ferrari and I still believe it is worth a look and I still see its financials as very healthy and strong. Hence, I would argue that Ferrari is becoming more and more interesting for long-term investors.

New Things To Consider After Ferrari Capital Markets Day

Ferrari announced that, just as it did in the past five years, it will unveil another 15 new models from 2022 to 2026. This ability to produce exclusive cars that have a short life span on the market shows, on one side, Ferrari’s technological and manufacturing power, on the other, it keeps demand always high, as customers who want a certain model need to rush to Ferrari’s dealers before they are too late.

Investors were also waiting for the company to shed some light on two points: the Purosangue, Ferrari’s first SUV, and the electrification roadmap. While regarding the Purosangue, Ferrari kept its mouth shut, stating that we will see the vehicle presented to the public in September, the company did give a lot of information about how it intends to develop its hybrid and electric cars.

Ferrari 2022 Capital Markets Day

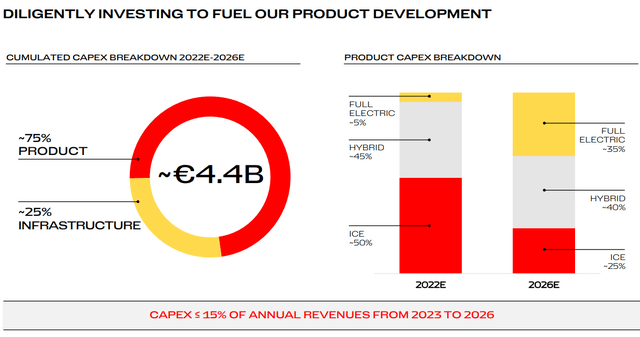

The company will be able to deploy €4.4 billion in capex to cover both product and infrastructure. Regarding the former, we will see the company shift over the next five years from spending 50% on internal combustion engine vehicles (ICE) to only 25% by 2026, with a capital reallocation that will be directed towards hybrid and full electric cars that will cover respectively 40% and 35% of the expenditures. Thus, the company showed its clear commitment to releasing best in class luxurious sports cars, which, as we hear during the event, will also have a solution to preserve the special sound ICE gave by creating a sound linked to the electric engine. This addressed one of Ferrari customers’ major fears, as the iconic sound is part of the experience people expect when driving such a car.

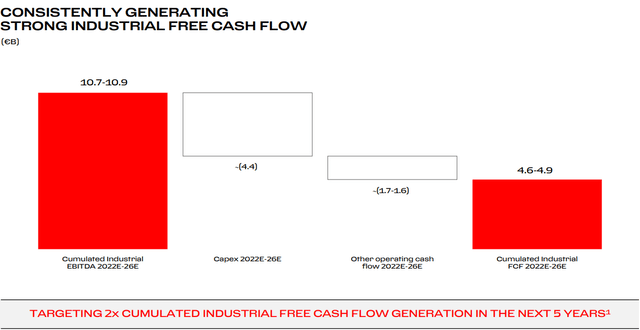

Investors could be worried that capex will hurt Ferrari’s cash flow in future years, but the guidance Ferrari gave is reassuring. In fact, as we can see from the slide below, Ferrari aims at generating over the next five years a cumulated industrial EBITDA of almost €11 billion that will more than cover the capital expenditures, leaving the company with almost €5 billion in cumulated industrial free cash flow. Over the past 5 years, Ferrari generated almost €2.5 billion in cumulated industrial free cash flow. Now, investors have been told this will result will double during the next five years. In an environment where investing is leaning towards strong free cash flow generation, Ferrari seems year after year more interesting.

Ferrari 2022 Capital Markets Day

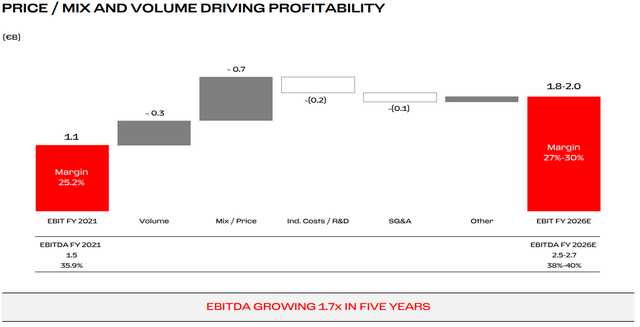

What is behind this strong generation of free cash flow? Ferrari plans on growing its net annual income at a 9% rate, with the EBIT margin that will keep on increasing, just as it did during the last 5 years, moving up, as we can see from the slide below, from the current 25% to the 27%-30% range. Keep in mind that at the end of 2017 the EBIT margin was 22.7% and the guidance Ferrari gave for 2022 was to be above 25%. This is just one example among many that prove the company’s guidance quite reliable.

Ferrari 2022 Capital Markets Day

Of course, these are all forecasts. However, I will never stress enough that Ferrari’s business model of low volumes and quick model renewal is designed to keep demand up, enabling in this way the company to have a strong and growing pricing power.

Shareholder Reward

The most interesting thing I found during the Capital Markets Day is something I didn’t highlight as much in my previous coverage of the stock. Ferrari is relatively new to the markets, since its IPO happened in 2015, and is not usually considered as a dividend stock. Its current dividend yield is 0.84% and the dividend is paid once a year, usually in April. These are not very alluring numbers for dividend seeking investors.

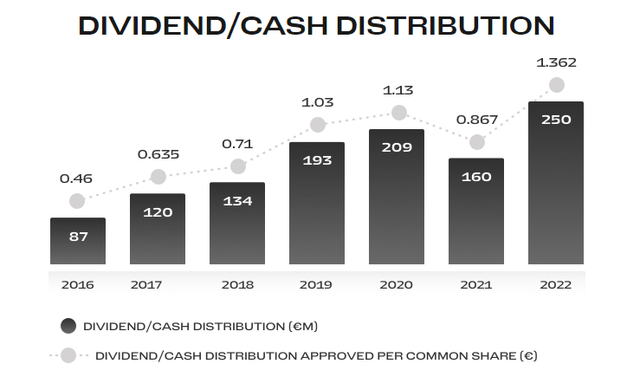

However, investors should know that Ferrari has begun a cash distribution that is trending upwards and that, as we will see in a moment, will increase its rewards. On the other side, we have to keep in mind that Ferrari links its cash distribution to its net income, thus, in case of major drawbacks, such as the pandemic was, Ferrari may not raise its dividend or even cut it. The overall trajectory of the dividend is in any case clearly upwards, as we can see from its history, where Ferrari was quick to recover from the pandemic.

Ferrari Investor Relations web page

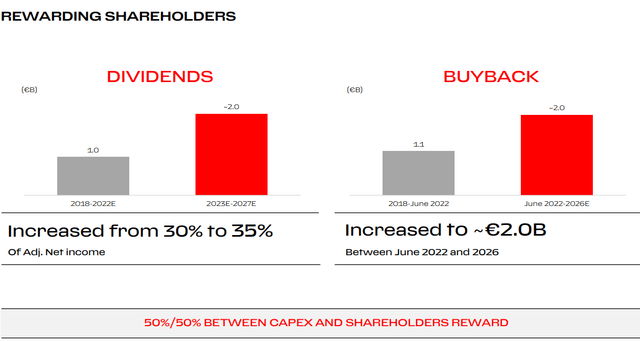

Now, at the 2022 Capital Markets Day, Ferrari announced that the strong generation of free cash flow it plans on having will make the company even more committed to rewarding shareholders. This part of the event made me think that Ferrari could enter into a dividend growth watch list because it is increasing steadily its dividend and its buyback program. During the next 5 years, shareholders can expect a total return of €4 billion, evenly split between dividends and buybacks. As we see from the slide below, Ferrari is almost doubling its money return compared to the previous five-year period. The payout ratio will be raised from 30% to 35%, which is a very healthy parameter.

Ferrari 2022 Capital Markets Day

Compared to today’s Ferrari’s market cap of €32 billion, Ferrari offers a 12.5% yield, which turns out to be a 2.5% annual yield. Sure, there are many stocks with higher rewards, but Ferrari seems to be going in the right direction. I think part of the commitment is due to its shareholder structure, where the major owners are the Agnelli family and Piero Lardi Ferrari, who are both interesting in receiving their dividends from this profitable company.

Valuation

In my previous analysis, I reached a $293 stock price using my discounted cash flow model. With the recent interest rate hikes I plugged in a higher discount rate of 10%, and I used the assumption that EBIT margin will reach the low-end guidance Ferrari gave of 27% by 2026. With this change, my target price still reaches $252 which increases the potential upside from the 30% of my last article to the current 44%.

Conclusion

Even though the capex increase may give some concerns over the mid-term, we have seen that Ferrari will have the financial strength to sustain its investments, without hurting its margins while also being able to increase its shareholder return. Even in case of a recession, I expect the luxury industry to hold up better than most of the others, as the customer base for these products usually manages to stay wealthy even during hard times. Ferrari has a product that is always appealing and a business model that is able to face almost every economic condition. With increasing shareholder reward, the stock may well be part of a dividend growth portfolio, offering also a significant potential upside of the share price. I rate it a strong buy, suggesting long-term investors to pick up some shares during this bear market.

Be the first to comment