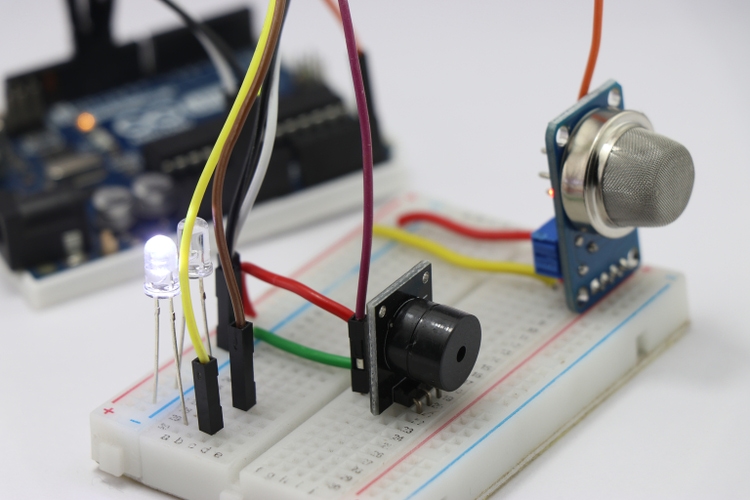

Jeevan GB/iStock via Getty Images

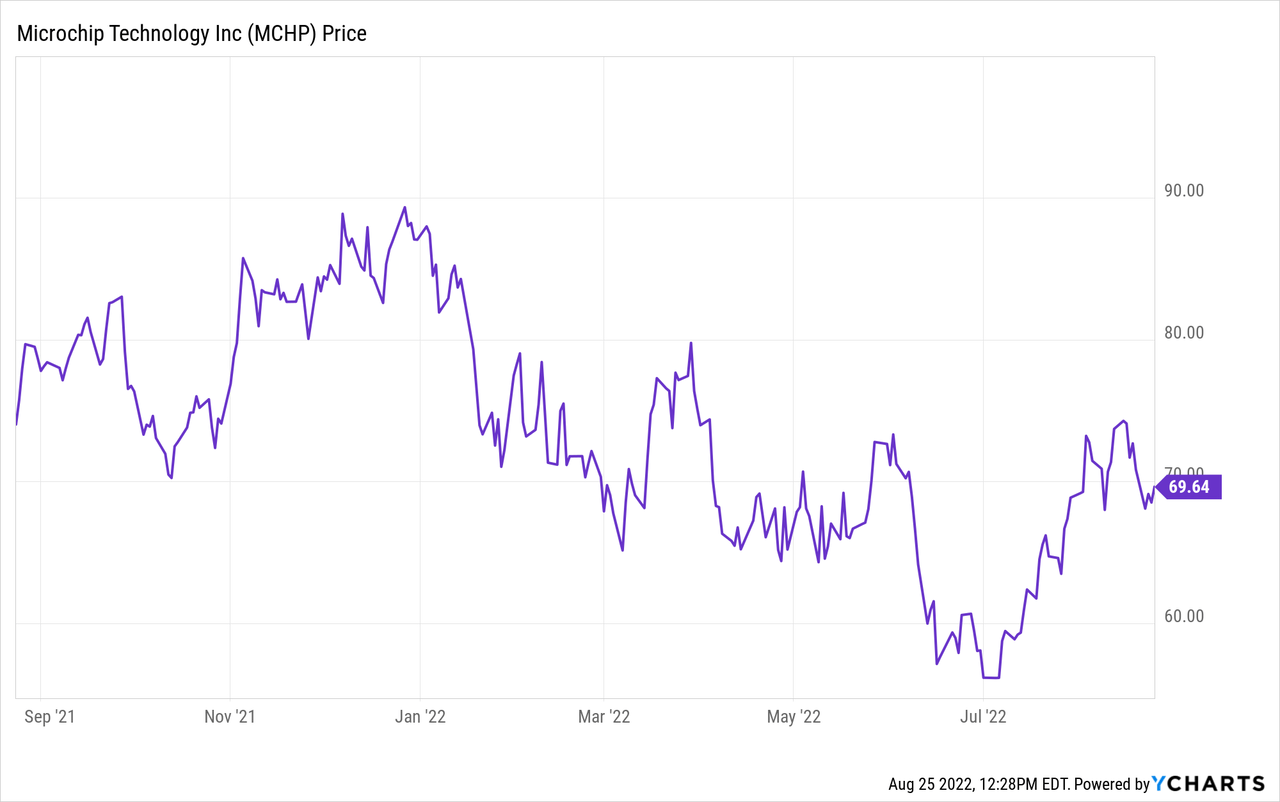

Microchip Technology (NASDAQ:MCHP) is an industry leader in the manufacture of microcontrollers and analog semiconductor devices. The stock price has been quite volatile this last year despite continuing strong revenue and profit growth. The 52-week low was $54.33, while the high hit $90.00, a tremendous range for what is a very steady company. Partly this is because its price can be affected by the outlook for other semiconductor companies that are more affected by the consumer cycle or a potential recession. In this article, I will look at Q2 results, projections for capacity, and projections for demand.

MCHP Q2 2022 Results

Microchip Q2 2022 results (fiscal Q1 2023) were released on August 2, 2022. The Microchip investor conference was held the same day. Revenue was a record $1.96 billion, up 7% sequentially from $1.84 billion, and up 25% from $1.57 billion in the year-earlier quarter. GAAP net income was $507 million, up 16% sequentially from $438 million, and up 100% from $253 million in the year-earlier quarter. GAAP EPS (diluted earnings per share) were $0.90, up 16% sequentially from $0.77, and up 100% from $0.45 year-earlier.

On a non-GAAP basis, Microchip reported net income of $767 million, up slightly sequentially from $764 million and up 37% from $559 million year-earlier. EPS was $1.37, up 2% sequentially from $1.35 and up 37% from $0.99 a year earlier.

These strong y/y results reflect a famously well-managed company competing well in end-markets that are growing. Part of Microchip’s advantage is that it owns its own foundries and assembly factories, though it does outsource some of its production. For the quarter Microchip reported that microcontroller revenue was 54.1% of its sales and hit a new record. 29.5% of revenue was from sales of analog chips, which grew even faster y/y than microcontrollers and hit a new record. An Other category includes licensing, memory, FPGA and miscellaneous revenue sources. It was also up strongly y/y. Microchip noted that for the quarter FPGA revenue hit a record.

Capacity

The semiconductor industry has gone through cycles in the past, largely due to macroeconomics, but sometimes due to specific forms of demand for semiconductors. Investors may worry that even if a company is doing well at the moment, too much capacity in the industry, combined with a slackening of demand, could result in lower prices and margin pressures. With predictions of a recession, either in the U.S. or global, and a possible saturation in parts of the market, particularly personal computers and phones, these questions have again been raised. Another sector that may see slowing growth in 2023 is memory chips.

Microchip reported that, again, its demand outstripped supply in the quarter while the increase in demand outstripped its expansion of production capacity. It is expanding that capacity as rapidly as possible. In the quarter it spent $122 million on capital goods to expand capacity. Its ability to ship product is its main revenue constraint. Because of supply chain issues, Microchip has not been able to increase capacity as quickly as it would like. In particular, the shutdown of Shanghai in the quarter affected both Microchip’s suppliers and some of its customers. This could be an issue again this current quarter as heat and drought in China has reduced generation of hydroelectricity, causing some factories to cut back production, including in Shanghai.

Demand and Backlog Trends

Demand remained strong in the quarter and during July. The order backlog increased during the quarter. Some of the backlog of orders that existed as the new quarter began will not be filled until the December quarter. This year Microchip created a Preferred Supply Program in which orders are not cancellable. Over 50% of the backlog at the end of the quarter was in the program. Microchip expects demand to exceed supply well into 2023. Some of the possible issues in specific end markets of the semiconductor industry are not likely to impact Microchip. It has little presence in the PC or cell phone markets. It does not make mass-market memory chips; its memory chips are specifically for use with microcontrollers. Its chips go into a wide variety of industrial products. Chips for the automobile sector are also a strength as car and truck manufacturers are still producing below demand levels. The number of microcontrollers and related chips in each vehicle continue to climb, and even more so with the switch to electric vehicles. I think it is unlikely that capacity improvements at Microchip in the September quarter will allow it to reduce its order backlog.

Cash and Debt

One area of concern is debt. Due to two large acquisitions in past years Microchip ended the quarter with $7.56 billion in long term debt, which was down sequentially from $7.69 billion. Microchip has prioritized paying off debt, which to some extent, combined with the need to expand capacity, restricts its ability to return cash to shareholders. Cash and investments ended the quarter at $379 million, up sequentially from $319 million. Cash flow from operations was a very healthy $840 million.

Dividend and Buybacks

Microchip’s other use of cash was buybacks and dividends. The company has a long record of steadily increasing dividend payments. It used $153 million for dividends in the quarter and $195 million for stock repurchases. The dividend was declared at $0.276, to stockholders of record on August 20, payable on September 3, 2022. Annualizing $0.276, although it will likely be raised at least incrementally each quarter, gives us $1.104 per year. At a stock price of $70.00 that works out to a yield of near 1.6%.

Conclusion

I think Microchip is undervalued. The counterargument is that, despite the backlog of orders, a global recession would eventually have a negative impact on revenue and profit growth. But with an impressive 25% y/y current growth rate, and a P/E ratio of only 12.1, far more negative impact from the economy is figured in than I think we are likely to see. What I do expect is that as capacity catches up to demand the sequential and annual growth rates will slow to meet the end-demand growth rate. I see nothing but positives for long-term demand growth for microcontrollers, especially now that China and California have essentially declared an end to gas-powered vehicles. The rest of the world is likely to follow, the only question is the pace. A more realistic P/E of 15 would bring the stock price to $87.50, and even that is still below the 52-week high of $90.00. Of course, in a volatile stock market there are no guarantees, but I believe the trend should be up. The dividend is a bonus, and Microchip has indicted that as debt is paid down it will also resume higher levels of share buybacks.

Be the first to comment