Kwarkot

Investment thesis

Ready Capital Corporation (NYSE:RC) is an integrated real estate finance company that provides financing solutions to its customers in the commercial and multifamily real estate markets. I believe the company represents a great investment opportunity because of its robust dividend yield and margin of safety, which provide to investors both a significant dividend stream and capital appreciation. Moreover, as it was demonstrated by the Mosaic recent merger, I think that the management team’s experience and capability constitutes a great catalyst for the following years. Based on these factors, I give to RC’s stock a buy rating.

The business

The company was founded in 2011 and is headquartered in New York City, NY. Ready Capital Corporation has grown rapidly since its inception and currently operates across the United States with offices located throughout the country.

The company’s business model involves originating, acquiring, managing, and servicing loans secured by first mortgages on commercial properties as well as providing bridge loans for transitional projects such as the construction or renovation of existing buildings. The company also offers mezzanine debt products which are used to provide additional capital for larger projects where traditional bank financing may not be available.

Ready Capital Corporation has established itself as a leader in the industry through its innovative approach to loan origination, underwriting, structuring, and servicing of both conventional mortgage-backed securities (MBS) and non-conventional structured finance transactions such as CMBS conduit loans, B-notes/mezzanine debt investments, preferred equity investments, joint venture equity investments, and other alternative investment strategies.

The business generates revenue primarily through three main operating segments: small to medium balance commercial loans (SBC) and Acquisition, Small Business Administration (SBA) loans, and residential mortgage banking.

Small Balance Loans

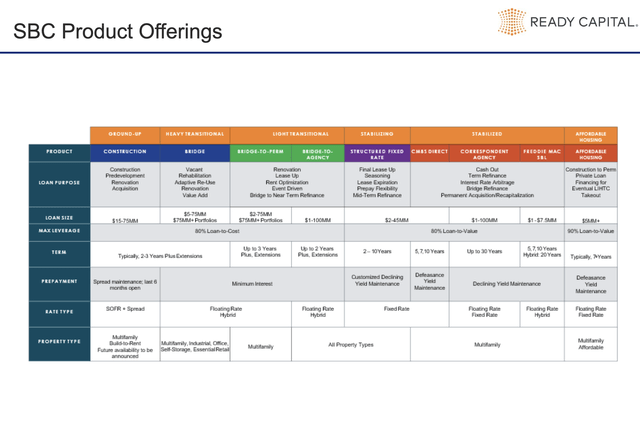

Ready Capital offers SBLs for both multifamily and commercial properties with loan amounts ranging from $1 million to $7.5 million. These loans are typically short-term, non-recourse, floating-rate loans with interest rates determined by market conditions at the time of origination. Ready Capital’s SBL portfolio consists primarily of fixed-rate mortgages secured by stabilized income-producing properties located throughout the United States.

The company also provides bridge financing for transitional assets such as value adds projects or repositioning opportunities which can provide higher returns on investment than traditional SBL investments due to their higher risk profile. The organization has also recently acquired Knight Capital in 2019.

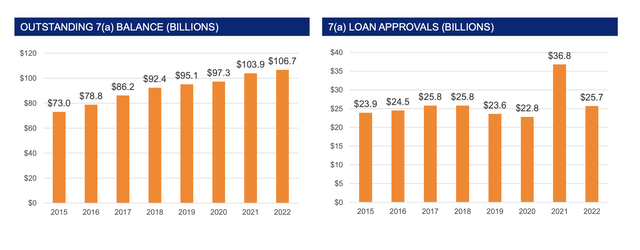

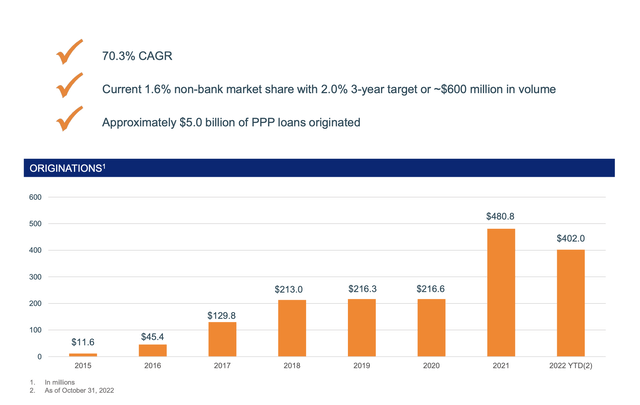

This fintech integration has enhanced Ready Capital’s technology and supports lead generation and underwriting efficiencies. This has allowed them to provide small businesses with additional capital to help them succeed. As one of fourteen non-bank Small Business Administration license holders, Ready Capital has experienced a surge in popularity since its acquisition from CIT in 2014. This makes it the second non-bank 7a lender and sixth overall lender.

Ready Capital Corporation Ready Capital Corporation

Residential Mortgage Banking

Ready Capital’s Residential Mortgage Banking division provides a full range of home loan products including conventional, FHA/VA, jumbo and reverse mortgages through its network of correspondent lenders across the country. This division focuses on providing competitively priced mortgage solutions tailored to meet each borrower’s individual needs while ensuring compliance with all applicable federal regulations related to consumer lending practices.

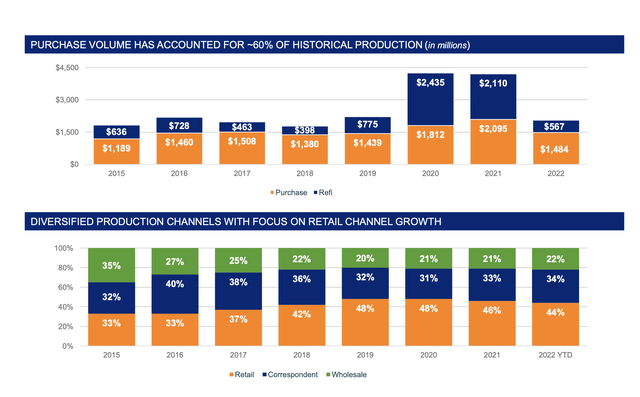

Ready Capital Residential Mortgage Banking segment is a leading provider of residential mortgage services in the Southeast United States. GMFS, one of the company’s subsidiaries was founded in 1999 and has since become a leader in its market segment. In 2016, Ready Capital acquired ZFC through a merger to further expand its reach and services. GMFS provides customers with a wide range of residential mortgage services including home purchase financing, refinancing, and other related products.

The company operates 12 retail branches located throughout Louisiana, Georgia, Mississippi, Alabama, and Texas which allows them to provide local service while still having access to national resources. Their servicing retained model provides a natural hedge against production losses which helps protect their bottom line from potential risks associated with volatile markets or economic downturns. Year-to-date GMFS originations have reached $2.2 billion showing that they are continuing to grow despite current economic conditions. This demonstrates Ready Capital’s ability to adapt quickly and take advantage of opportunities as they arise while also providing quality customer service at competitive rates for those looking for residential mortgages in the Southeast region of the US.

Small Balance Commercial Lending and Acquisition

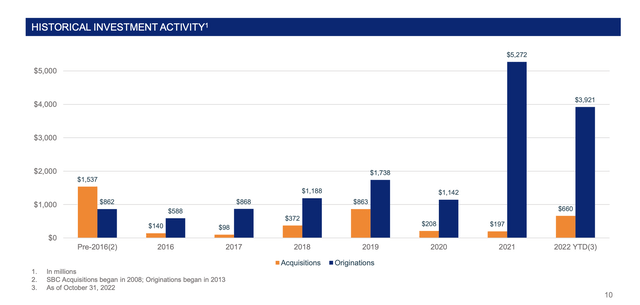

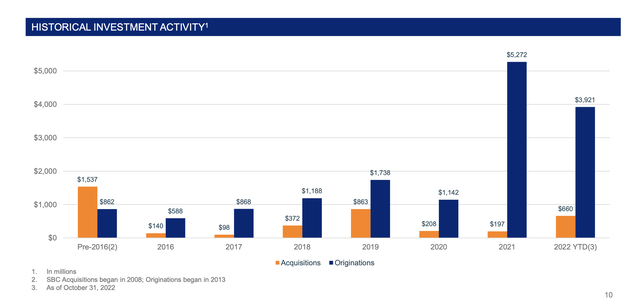

Ready Capital is an industry leader in the small-balance commercial real estate market. With over $15.7 billion in originations since 2013, Ready Capital has established itself as one of the top Freddie Mac Small Balance Loan lenders, ranking fifth based on 2021 volume. The company offers nine products spanning ground-up stabilized loans which range from $1 million to $100 million. This all-weather origination platform allows Ready Capital to allocate capital to the best opportunities available across its loan products.

In addition to its SBC lending capabilities, Ready Capital is also the largest acquirer of small-balance commercial loans since the financial crisis with over 5200 or $4.1 billion of loans acquired since then. This demonstrates their commitment to providing customers with quality financing solutions that meet their needs and help them achieve their goals. Furthermore, this segment focuses on first liens on investor or owner-occupied commercial real estate assets with appraised property values not higher than $10M and 50,000 square feet providing a relatively low-risk investment opportunity. Furthermore, the segment has demonstrated strong long-term performance, with a 10-year CAGR of 39.0%.

Ready Capital Corporation Ready Capital Corporation

Mosaic Real Estate Credit merger

In 2022, Ready Capital completed the merger with Mosaic Real Estate, a real estate investment platform that focuses mostly on construction loans. In 2022, Ready Capital acquired Mosaic Real Estate Credit TE, so that it could expand Ready Capital’s construction assets portfolio.

I believe this merger to be a favorable move for the company since it is expected to create a $1.7 billion combined equity base and reduce the company’s leverage risk thanks to Mosaic’s unlevered portfolio. Moreover, Mosaic’s portfolio accounts for close to 25 percent of stockholders’ equity and the company expects the repositioning of lower-yielding assets into higher-yielding core products to further enhance its earnings. As it was previously said, the transaction is expected to be accretive to core earnings and book value per share over the next 12-14 months and will result in a strong portfolio yield of 10%+.

Additionally, the CER structure creates a strong alignment between Ready Capital and Mosaic to promote desired performance outcomes, while the acquisition will also provide access to new markets with strong borrower relationships, and potential cost and operational efficiencies resulting from the increased scale of the combined platforms. Thomas Capasse, CEO, and chairman of Ready Capital commented the merger deal closed during the first quarter of 2022.

“We are excited to integrate the Mosaic team and origination platform and we believe the diverse portfolio of construction assets with attractive portfolio yields will further differentiate Ready Capital’s financing solutions for borrowers and investors.”

Robust and high dividend yield

The company has declared a quarterly dividend since its initial public offering in 2013, and has increased its dividend pay-out each year since then. I believe that Ready Capital Corporation has been an impressive example of consistent yield generation for the past nine years. With an average yield of over 10% during this period, it is no surprise that investors have been drawn to the company’s strong performance and robust CAGR among its different business segments.

However, in 2022, the dividend yield has gone up significantly to 12.8%, compared to a five-year average dividend yield of 11.53%, resulting ultimately in a significant jump from previous years. This impressive dividend yield growth is due to the 2022 price action, which resulted up to September in a 41% sell-off of the company’s shares followed by a significant recover later on.

The company’s dividend policy is based on the premise of maintaining a healthy balance sheet and an appropriate capital structure and as a REIT it has the obligation to distribute at least 90% of its taxable income to its shareholders. This has been their focus over the past few years, and they have managed to deliver on these objectives.

Moreover, the company has been able to generate consistent cash flows, which gives them the ability to fund their dividend pay-outs. For the past 6 and a half years, the company has generated consistent net operating cash flows, with the exception of the pandemic period. This has enabled them to consistently pay out dividends, and to do so without impacting the balance sheet.

|

Amounts |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

|

EPS – diluted |

$0.60 |

$0.68 |

$0.66 |

$0.45 |

$0.50 |

|

Dividend per quarter |

$0.42 |

$0.42 |

$0.42 |

$0.42 |

$0.42 |

|

Payout ratio |

70% |

61.7% |

63.6% |

93.3% |

84% |

Financials

Ready Capital reported a 42% YoY net income growth in Q3 2022 due to the merger with Mosaic and higher rental revenues from its portfolio of properties, as well as gains on dispositions and investments. Non-interest income declined 11%, while total assets increased 24%, reflecting increasing investor demand for high returns.

Additionally, total equity also increased by 13% YoY, further demonstrating the company’s strength and long-term stability throughout market cycles. Moving forward into Q4 2022, I expect Ready Capital will continue to focus on expanding its portfolio through strategic acquisitions while focusing on risk management practices such as diversifying across different asset classes and geographic locations; this will help them better manage risk while continuing to generate strong returns for shareholders over time.

Moreover, they have plans to reduce debt levels as part of their strategy going forward; therefore, I believe this should enable them to become more financially flexible while maintaining healthy margins and cash flow generation capabilities going forward. Overall, I think that Ready Capital is doing very well going into Q4 2022 with solid growth opportunities ahead of them given these positive trends in financial performance seen thus far during the third quarter.

Risks

The company reported significant YoY growth, but is now feeling pressure from the FED rate hikes and inverted yield curves. This was demonstrated by missing estimates with three consecutive QoQ earnings decline. I believe this environment will cause increased interest expenses to outweigh income for the rest of 2022 and 2023. This is due to the company’s reliance on SBC loans, ABS investments and other real estate-related instruments which are sensitive to higher borrowing costs as they reduce mortgage demand.

The company uses hedging instruments, such as interest rate swaps, to guard itself against increasing interest rates up until a certain point. This effectively fixes the expense of borrowing for a duration close to the weighted-average life of the company’s fixed-rate assets and provides some insulation against rising rates. Nevertheless, this does not keep RC from the possibility of NBV impairment which could still affect its net income.

Valuation

Ready Capital has lost since its 52-week high approximately 22% of its market capitalization primarily because of Mr. Market’s sell-off caused by the 2020 and 2021 “irrational exuberance”. I believe Ready Capital is undervalued according to the dividend discount model calculation performed below:

|

Assumptions |

Data |

|

Dividend payout ratio |

84% |

|

Return on equity |

14.5% |

|

Expected growth rate |

2.32% |

|

Dividend per share |

$1.68 |

|

Expected dividend |

$1.72 |

|

Risk-free rate |

3.5% |

|

Beta |

1.31 |

|

Market risk premium |

6% |

|

Cost of equity |

11.36% |

|

Fair value per share |

$19.02/share |

|

Margin of safety |

32% |

According to the dividend discount model, Ready Capital is currently undervalued and I estimate that the investor could have a 32% margin of safety as a cushion against possible calculation errors. Despite the potential price appreciation, I believe that a 12%+ yield represents a good investment opportunity for investors seeking a stable dividend income.

Conclusion

According to the valuation performed above, I’m comfortable with saying that RC constitutes a good investment opportunity both from a price appreciation and dividend distribution standpoint. Moreover, the company has industry-leading ROE and capable management which has demonstrated its competency thanks to the company’s recent M&A activity.

Be the first to comment