courtneyk

All men make mistakes, but a good man yields when he knows his course is wrong, and repairs the evil. The only crime is pride.”― Sophocles

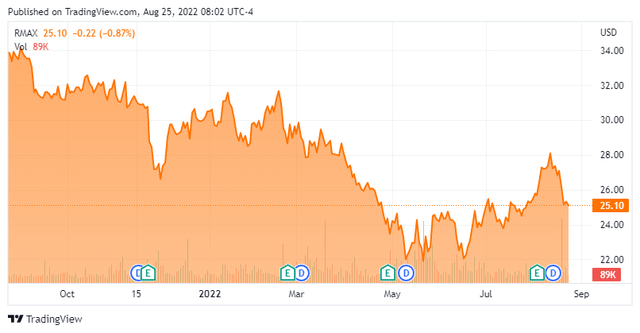

Today, we take an in-depth look at a well-known name in the housing sector. The recent weakness in housing activity has triggered an approximate 20% decline in the stock so far in 2022. The shares now trade at around 10 times earnings with a near 4% dividend yield as well as some recent insider buying. An analysis follows below.

Company Overview:

Headquartered in Denver, Colorado, RE/MAX Holdings, Inc. (RMAX) is the largest real estate broker in the world, as measured by residential transaction sides (buyer or seller). It is a 100% franchisor of both real estate and (more recently) mortgage brokerage services, boasting over 142,400 agents in 110 countries as of March 31, 2022. RE/MAX was formed in 1973 and went public in 2013, raising net proceeds of $224.9 million at $22 per share. Its stock currently trades around twenty five bucks a share, translating to a market cap of just south of $800 million.

Business Model

The franchisor differentiates itself from other brokers through its operating model. The most significant aspect of this model is that its agents usually receive 95% of the commissions from a transaction versus 70/30 or 60/40 arrangements typical of other brokerages. In return, RE/MAX franchisees pay fixed fees to share in the overhead costs of the brokerage and fund their own marketing campaigns, either locally or through fees to the franchisor that in turn go to support brand awareness efforts. In addition to providing greater incentive to produce, this arrangement allows agents the flexibility to negotiate commission rates with sellers, which can sometimes make the difference when vying for a listing. Owing to this model, RE/MAX attracts productive full-time brokers, borne out by the fact that its U.S. agents averaged 16.1 transaction sides in FY21, bettering second-place Realty Executives by four transactions, while doubling the output of other large brokerages.

While promoting a more entrepreneurial culture for its agents, RE/MAX does not leave them out on an island, providing technology tools, including a consumer facing app. It also requires each franchisee to attend a four-to-five day educational seminar and provides agent support through RE/MAX University, which contains downloadable videos and webinars. Furthermore, being the most recognized name in real estate is a strong marketing tool, resulting in considerable free referrals for its agents.

From this model, RE/MAX receives four revenue streams: 1. monthly franchise fees – which amounts to ~1,550 per agent annually; 2. annual dues of $410 from each of its U.S. agents; 3. broker fees from transactions; and 4. franchise sales. The first two streams are a function of the number of agents under its umbrella and accounted for 62% of the franchisor’s FY21 revenue. Brokerage fees delivered 26% while franchise sales generated the other 12%. It should be noted that the franchisor also receives marketing fund fees, which is its own separate revenue line item but is offset with a similar expense line further down the income statement. It is essentially a cost that is charged to franchisees but must be recognized as revenue due to an accounting standard change in 2019. All references to revenue going forward will exclude these marketing fees.

RE/MAX also has areas in the U.S. where it has sold the regional franchise rights to independent owners, pursuant to which they have the exclusive rights to sell franchises in those regions. The economics are less beneficial to RE/MAX in those locales and as such, it has employed a strategy to reacquire those rights – more on this forthcoming. In addition to the U.S. (60,717 agents as of March 31, 2022), the franchisor has a significant footprint in Canada (24,443 agents) and is present in another ~110 countries (57,245 agents). That said, the U.S. provided 81% of its FY21 top line, Canada 14%, with only 5% coming outside those two countries. To further belabor the point, its franchisor model in the U.S. and Canada generated revenue of ~$2,900 per agent in FY21, while its independent territories contributed ~$800 per agent. Outside the U.S. and Canada, RE/MAX only averaged ~$200 per agent. It was these economics that compelled management to purchase independent owner RE/MAX INTEGRA in July 2021. For a consideration of $235 million, RE/MAX returned nine U.S. states (~7,000 agents) and five Canadian provinces (~12,000 agents) into its fold.

In addition to real estate brokerage, RE/MAX launched a mortgage brokerage business in 2016 dubbed Motto Mortgage that operates under a similar franchisor model with 200 offices open in the U.S. as of July 7, 2022. With obvious synergies to purchase mortgages necessitated by RE/MAX agents, it generated FY21 Adj. EBITDA of negative $5.3 million on revenue of $10.1 million Although its top line grew by 52% year over year, it still represented only 4% of total. However, it should continue its growth spurt and turn into the black during FY23. Supporting Motto is the franchisor’s fintech solution named wemlo, which was purchased in 2020. It’s a cloud-based, third-party loan processing platform designed for mortgage brokers, including those outside the Motto network. For use of the platform, RE/MAX receives fees on a per-file basis. Management believes that Motto and wemlo can eventually generate $100 million in total annual revenue.

May Company Presentation

Stock Price Performance

With secular tailwinds generated by a decade of low mortgage rates, the gradual southern migration of the Baby Boomers, and generally prosperous economic conditions, the real estate market intrepidly climbed out of its Great Recession slump, with 2021 existing home sales up ~50% from their 2008 lows – although still below the record levels of 2005 and 2006. The pandemic drove housing affordability to levels not seen since 2014, but RE/MAX shareholders were not beneficiaries. After peaking at $67.50 a share in October 2017, their stock has experienced a protracted decline to the mid-20s, except for a brief accelerated detour below $15 during the pandemic selloff.

There are several reasons for this result. First, RE/MAX was ridiculously overvalued. Its model is driven by agent growth and that metric is generally going to correlate with population growth. Even with higher than industry average market share gains, organic growth could not be expected to climb into the double digits. (How many real estate agents does the world need?). But in October 2017, it was trading at 44.7x FY18 EPS of $1.51 (GAAP), while from FY17 to FY21, its top line grew (predictably) at CAGR of 6% to $247.3 million.

Throw in the penetration of discount brokers such as Redfin (RDFN), as well as the entry of iBuyers such as Opendoor (OPEN), and the market further discounted shares of RMAX, perceiving (at last) a real threat to the oddly and quasi-unbreachable real estate brokerage model. That said, 88% of all buyers and sellers in real estate transactions were represented by a broker in 2021 while the number of licensed real estate agents grew to a record ~2 million (approximately 1.6 million of which are members of the National Association of Realtors). Either way, RE/MAX stock has fallen over 60% from its all-time high in 2017 and 18% in 2022YTD, as a spike in mortgage rates has plunged housing affordability to its lowest level since 2006, while the number of active listings is down by approximately half from June 2019.

Recent Earnings:

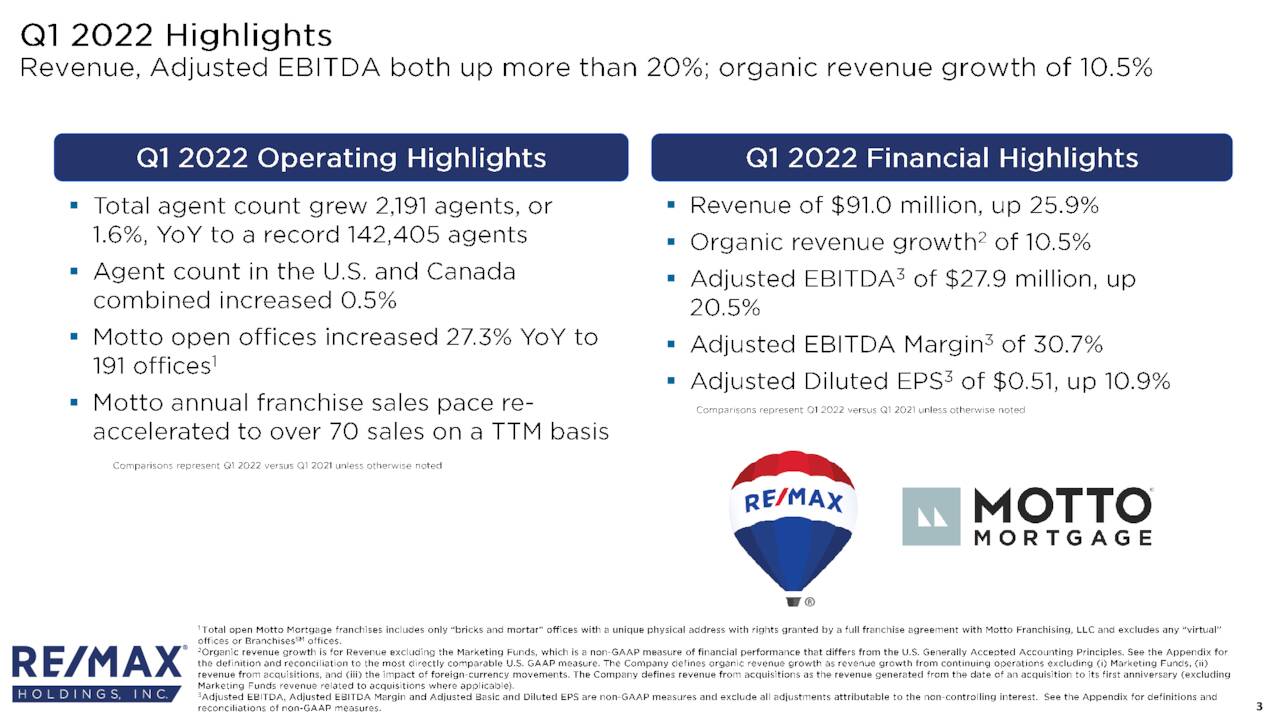

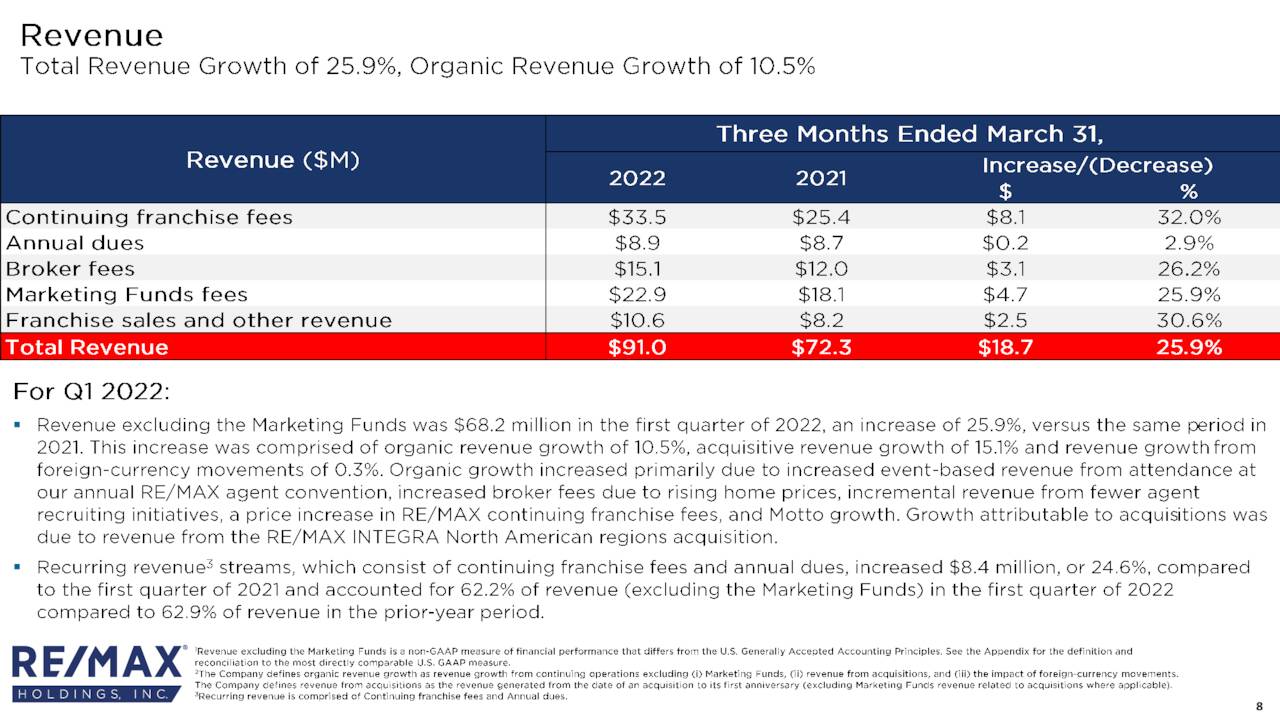

With those events unfolding, the franchisor reported 1Q22 earnings on April 28, 2022, posting EPS of $0.08 (GAAP) and Adj. EBITDA of $27.9 million on revenue of $68.2 million versus $0.06 a share and Adj. EBITDA of $23.2 million on revenue of $54.2 million in 1Q21, representing 33%, 20%, and 26% increases, respectively. However, RE/MAX INTEGRA was responsible for ~60% of the top-line improvement and earnings missed the Street consensus by $0.06 a share.

May Company Presentation

Management projected YE22 agent count up 3% to ~146,250, as well as FY22 Adj. EBITDA of $132.5 million (up 11%) on revenue of $277.5 million (up 12%), all based on range midpoints.

May Company Presentation

On July 7th, the franchisor announced several initiatives, including inducements to convert competing brokerages to the RE/MAX network, accelerated investment in Motto Mortgage, and a 17% reduction in its workforce (120 employees).

August Company Presentation

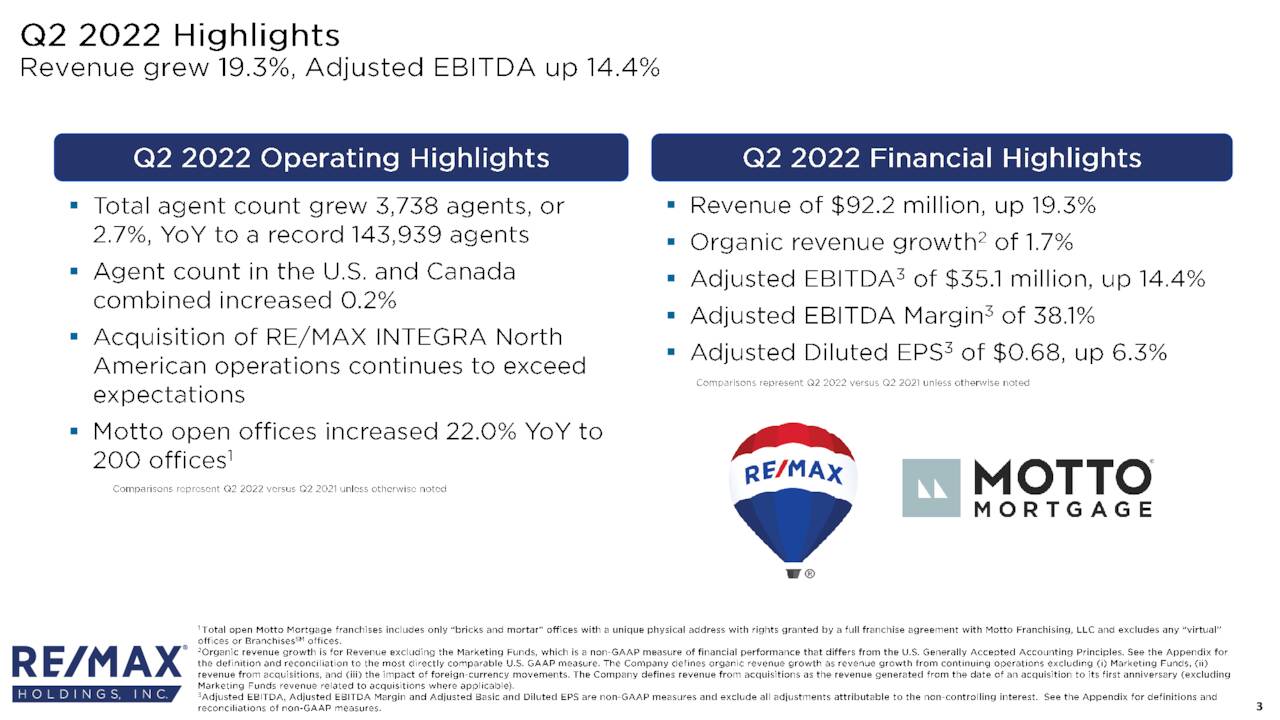

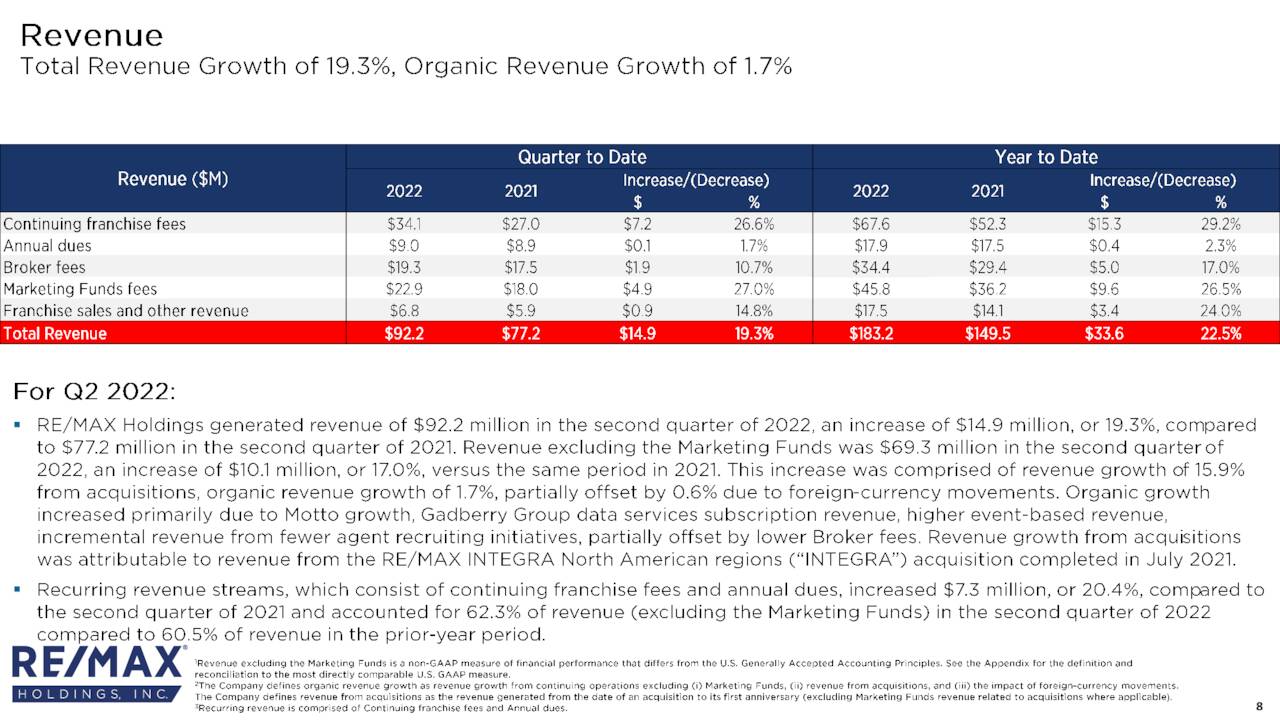

On August 4th, the company posted second quarter numbers. RE/MAX saw revenues grow just over 19% on a year-over-year basis to $92.2 million as GAAP earnings came in at 68 cents a share. Revenue was in line while profits were slightly above expectations.

August Company Presentation

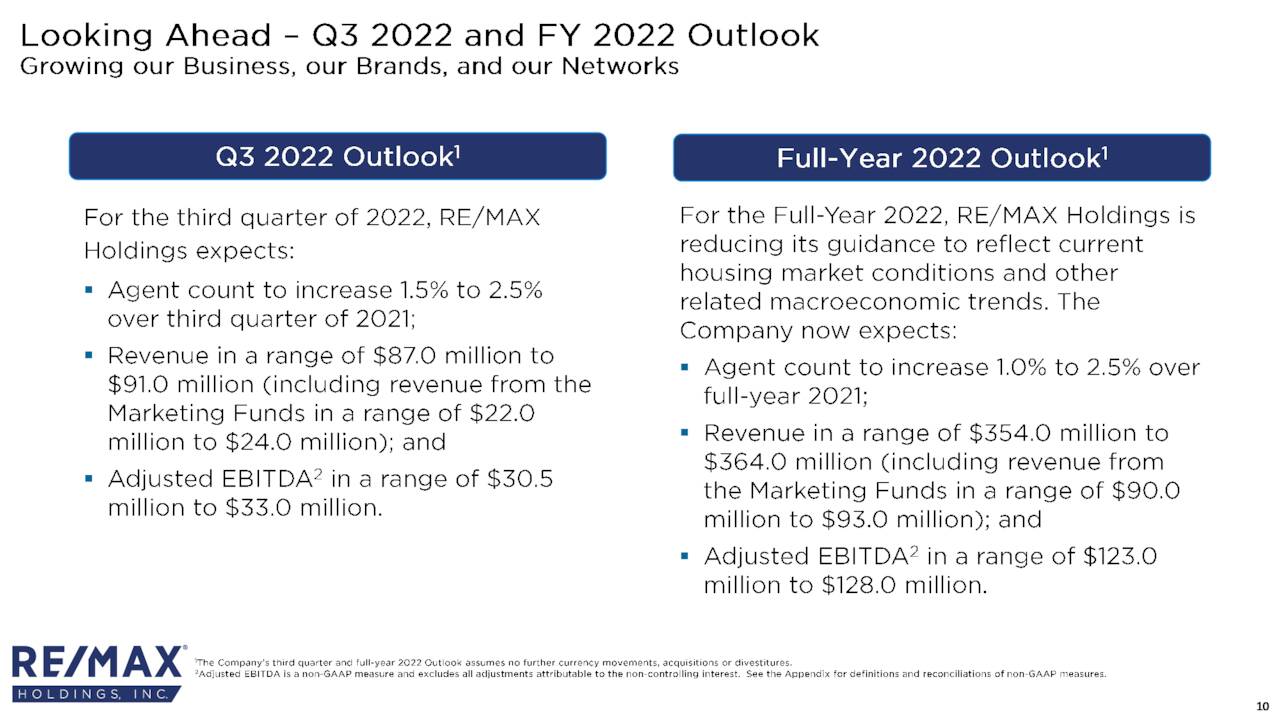

Management did shave approximately $5 million at midpoint of the Q3 revenue forward guidance as well as $10 million off FY2022 sales guidance, which is now expected to be in the $354 million to $364 million range.

August Company Presentation

Balance Sheet & Analyst Commentary:

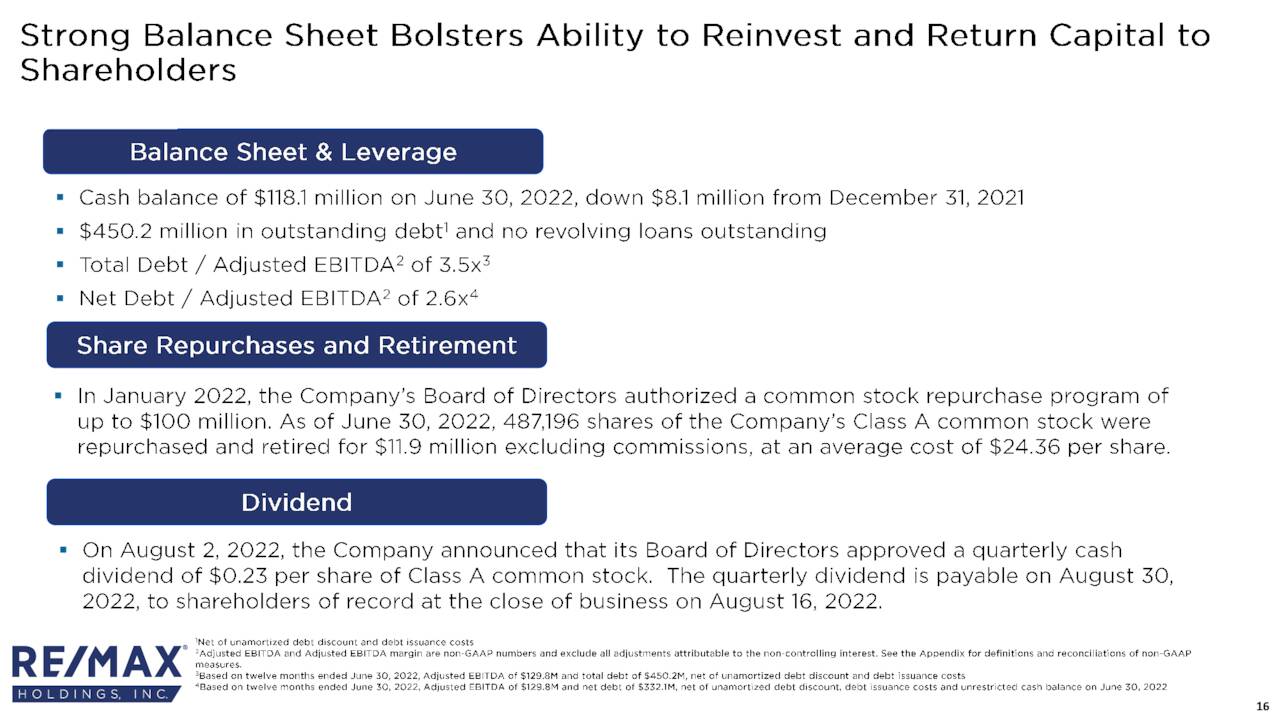

The recently announced programs will be funded from resources on hand, which were cash and equivalents of $118.1 million as of the end of the first half of 2022.. Debt was employed to finance the RE/MAX INTEGRA acquisition and stood at $450.2 million on the same date, putting net leverage at 2.6. RE/MAX pays a $0.23 quarterly dividend for a current yield of 3.7%.

August Company Presentation

It also announced a $100 million share repurchase program in January 2022, of which some 12% has been executed through the first six months of this year. Cash from operations, typically $70 million to $80 million per annum, will be deployed to grow the agent count, expand Motto, pay its dividend, and repurchase stock.

Only five Street analysts have made commentary on RE/MAX so far in 2022, split equally between two buy and three holds, while their price targets ranging from $28.00 to $38.00 a share. On average, they expect RE/MAX to earn just over $2.40 a share on revenue of $360 million in FY22, followed by just over $2.50 a share on revenue of just under $375 million in FY23.

Beneficial owner Adam Peterson remains bullish on RE/MAX’s future, purchasing 152,552 shares since mid-June, upping his ownership interest to 11%

Verdict:

With only approximately one-quarter of its top line transaction dependent, RE/MAX is more insulated than other real estate brokers to downturns. And with its foray into mortgage brokerage considerably more purchase (than refi) dependent, the franchisor is also somewhat protected from sharp spikes in interest rates. That said, a 25-basis point increase in mortgage rates reduces its full-year earnings by ~$0.03 a share, and with the unprecedented spike in rates over the past six months, RE/MAX’s bottom line will certainly be impacted.

However, the collective yawn by the market over the past three months – illustrated by its tight trading range around the low-to-mid 20s – to any news in this highly volatile economic milieu is suggestive of a bottom being put in place. Buttressed by a share repurchase program, a 3.7% dividend yield, and a fast-growing mortgage brokerage franchise that should turn profitable in FY23, its share price is relatively cheap at just over 10 times FY22E EPS, considering the amount of steady cash flow it can generate.

There is too much uncertainty in the housing market to increase exposure much to the sector at this time. I believe RMAX would be an ideal covered call candidate given its valuation and high dividend yield. Unfortunately, there is not enough liquidity in the options against the equity to make that strategy viable at this time. Therefore, I have taken a small “watch item” in the equity as I want to circle back on this name after the housing market stabilizes.

Generosity is giving more than you can, and pride is taking less than you need.”― Khalil Gibran

Be the first to comment