Sundry Photography

Elevator Pitch

I rate CrowdStrike Holdings, Inc.’s (NASDAQ:CRWD) shares as a Buy.

This is an update of my initiation article for CrowdStrike written earlier on August 26, 2021. In this current article, I evaluate the key investment considerations for CRWD prior to the company’s upcoming Q2 FY 2023 (year ended January) financial results announcement next week.

I am upgrading my investment rating for CrowdStrike from a Hold to a Buy. After considering how CRWD would have performed in Q2 FY 2023 and the company’s long-term growth expectations, I have turned bullish on the stock. In my view, an earnings beat next week is highly probable, and I am impressed with CrowdStrike’s growth trajectory for the next five years.

Is CrowdStrike Doing Well Financially?

CRWD has performed very well financially, both on an absolute basis and relative to the market’s expectations.

CrowdStrike has delivered YoY top line expansion in excess of +60% in every quarter since Q3 FY 2020. Also, the company has turned profitable on a non-GAAP basis starting in the first quarter of fiscal 2021, and it has continued to consistently generate positive non-GAAP earnings in the subsequent quarters.

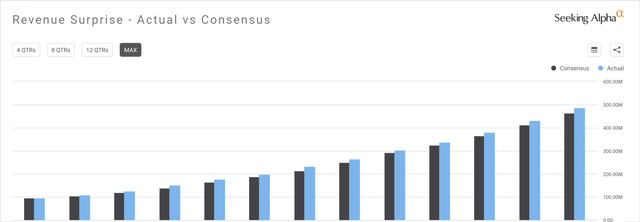

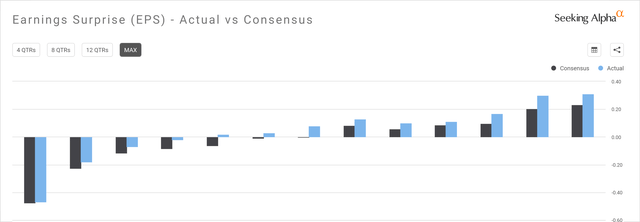

More importantly, CrowdStrike’s quarterly top line and bottom line have surpassed investors’ expectations for the past 13 quarters as per the charts presented below.

CrowdStrike’s Actual Quarterly Revenue As Compared To Consensus Forecasts

Seeking Alpha

CRWD’s Actual Quarterly Normalized EPS Versus Consensus Projections

Seeking Alpha

In the subsequent section, I highlight some of CrowdStrike’s most recent Q1 FY 2023 key metrics.

CRWD Stock Key Metrics

There are a number of key metrics from CrowdStrike’s most recent Q1 FY 2023 earnings that are worth mentioning.

Firstly, CRWD is doing a great job winning new clients and retaining existing ones.

CrowdStrike achieved net new client additions of 1,620 in the first quarter of fiscal 2023 to bring its total subscription client base to 17,945 as of end-April 2022. This implies that CRWD’s total number of customers grew by +57% YoY and +10% QoQ in Q1 FY 2023.

Separately, CRWD’s gross retention rate reached a new historical peak of 98.1% in the recent quarter as indicated in its June 2022 investor presentation. At its Q1 FY 2023 results call, CRWD stressed that its “high gross retention rate reflects our strong commitment to stopping the breach, delivering value to customers and restoring trust to the security posture of companies worldwide.”

Secondly, CrowdStrike disclosed a new metric, “customers with 7 or more modules” (representing 19% of total clients), when it released its Q1 FY 2023 financial results. Previously, CRWD has only revealed the proportion of its subscription clients adopting more than 4, 5, and 6 modules, respectively. More significantly, CrowdStrike is also doing away with the old metric of “customers with 4 or more modules (accounting for 71% of the customer base).”

The company’s new metric disclosure sends a clear signal to investors that it is very confident in an increasing number of customers consuming a large number of modules going forward. As per the management’s comments at the company’s recent quarterly earnings briefing, the mean number of modules that new clients initially adopted rose from 4.3 in fiscal 2021 to 4.7 in FY 2022. Furthermore, CrowdStrike also revealed at its Q1 FY 2023 investor call that its large clients, who contribute at least $1 million in annual recurring revenue, are each averaging about 7 modules.

Thirdly, CRWD’s non-GAAP adjusted operating profit margin of 17% for Q1 FY 2023 represented a +700 basis points YoY improvement and exceeded the sell-side’s consensus operating margin forecast by +3 percentage points as per S&P Capital IQ data.

At its first-quarter earnings call, CrowdStrike highlighted that the company’s better-than-expected operating profitability in the recent quarter was attributable to the fact that “we continued to maintain very high unit economics, drive leverage and remain very capital efficient.” This provides investors with the confidence that CRWD is gradually moving closer to its goal of achieving operating profit margins in the 20%-22% range in the long run.

In summary, CRWD’s key operating and financial metrics for the most recent quarter were excellent.

Is CrowdStrike Expected To Beat Earnings?

I think CrowdStrike can beat market expectations with its upcoming Q2 FY 2023 financial results announcement on August 30, 2022 after trading hours.

According to S&P Capital IQ’s sell-side consensus data, CRWD’s revenue is projected to increase by +6% QoQ to $516 million. This is also equivalent to a slight moderation in CrowdStrike’s YoY top line expansion from +61% in Q1 FY 2023 to +53% for Q2 FY 2023. With regards to the bottom line, Wall Street analysts are anticipating that CrowdStrike’s normalized earnings per share or EPS will decrease by 13% QoQ from $0.31 for Q1 FY 2023 to $0.27 in Q2 FY 2023. This suggests that CRWD’s EPS growth on a YoY basis will slow from +210% in Q1 FY 2023 to +148% for Q2 FY 2023, which is still a very strong pace of bottom line expansion.

The market’s expectations for CrowdStrike’s Q2 FY 2023 aren’t unreasonably high, and there is a very good chance that CRWD will achieve an EPS beat for Q2 FY 2023.

An August 16, 2022 research report (not publicly available) titled “Customer Survey Points To Sustained Momentum” published by Stifel (SF) highlighted that SF’s “annual survey of the CrowdStrike customer base (~50 orgs of various sizes)” found that “the vast majority of respondents expect to increase their spend in coming quarters/years.” One of the respondents in the survey specifically mentioned that “our intention is to reduce number of suppliers so this made us to continue to invest in the (CrowdStrike’s) Falcon platform.” As per the results of this survey, I expect CRWD to have likely generated higher-than-expected revenue for the second quarter of this fiscal year.

Also, CrowdStrike should have continued to benefit from the positive effects of operating leverage on its profitability in Q2 FY 2023. CRWD had guided at its Q1 FY 2023 investor briefing that “we expect to see the year-over-year operating margin leverage for the year materialize in the first half of fiscal 2023 (which includes Q2 FY 2023).” In other words, the expected QoQ contraction in CrowdStrike’s earnings for the second quarter might not be as significant as what the market expects (-13% QoQ), as the company continues to maintain a fast pace of revenue growth and benefits from positive operating leverage.

What Is CrowdStrike’s Annual Earnings?

Moving beyond the quarterly results, I focus on CRWD’s full-year FY 2023 earnings expectations in this section of the article.

CrowdStrike’s annual earnings per share for fiscal 2022 was $0.67 and the sell-side analysts expect CRWD’s yearly EPS to grow by +81% YoY to $1.21 in FY 2023 as per data taken from S&P Capital IQ. Wall Street’s current consensus bottom line estimate for FY 2023 falls within the company’s earnings guidance in the $1.18-$1.22 range.

CRWD is a clear outlier in the market, it is expected to generate strong bottom line growth this year whereas most companies are expecting earnings contraction or even losses for the current fiscal year. As a result of the company’s subscription model and the importance of security for its clients, CrowdStrike isn’t affected by macroeconomic issues to the same extent as other more economically-sensitive companies.

What Is CrowdStrike’s Long-Term Outlook?

CrowdStrike’s long-term outlook is great. Based on S&P Capital IQ data, analysts are predicting a top line CAGR of +35% and a bottom line CAGR of +56% for CRWD for the FY 2023-2027 period.

As discussed earlier in this article, CRWD’s clients are spending more and increasing the number of modules consumed. Furthermore, an increasing number of its customers want to deal with fewer vendors and they are consolidating their spending with CrowdStrike. Robust revenue growth for CrowdStrike helps to drive positive operating leverage, which in turn results in an expansion of CRWD’s profit margins over time. As such, CRWD’s long-term growth outlook as implied by the sell-side’s consensus financial projections are pretty realistic and achievable in my opinion.

As another indication of CRWD’s long-term growth potential, CrowdStrike’s new emerging modules such as “Discover, Spotlight, Identity Protection and Log Management” as mentioned at its Q1 earnings call are still experiencing annual recurring revenue growth in excess of +100% in the recent quarter. This is a strong indication that CRWD is still in the early innings of growth.

Is CRWD Stock A Buy, Sell, or Hold?

I rate CRWD stock as a Buy. In the near-term, an earnings beat for Q2 FY 2023 could be a key short-term catalyst for CrowdStrike’s shares. CRWD is also an excellent investment candidate for the long run based on an analysis of its future growth prospects.

Be the first to comment