sefa ozel

With a recession imminent, investors are looking for safer places to invest their capital as they opt out of risky investments, and move capital into larger firms more prepared to weather the storm of a recession.

If investors are looking for safer havens, then chances are they will be looking at blue-chip stocks and mega-cap stocks, so that’s where our focus is.

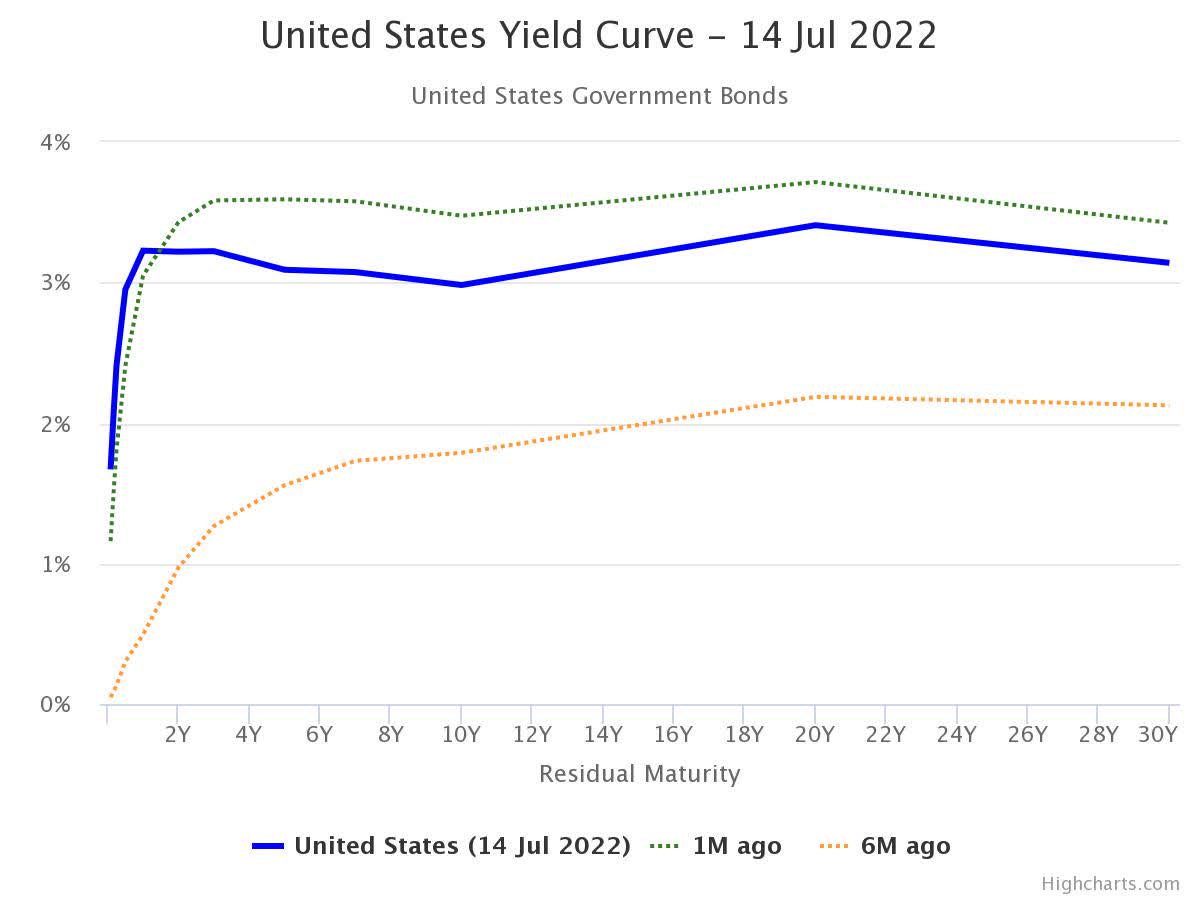

In context, US yield curves are inverted, with inversion between 2 and 10 year rates at their largest since the year 2000 (Highcharts.com)

But how do we know which firms are well prepared to face a recession, and which firms balance sheets are a ticking time bomb?

Ranking Recession Readiness is a series of articles I’m authoring based on academic research along with advice from business leaders who took their firms through the Great Recession of 2008, to help investors identify which top 100 US firms are positioned to strive through a downturn, and which firms will stumble.

Today’s article will focus on eCommerce behemoth Amazon (NASDAQ:AMZN), a growth firm with a large debt-laden balance sheet that divides investors into those who see an exciting future for a firm disrupting the retail industry, and those who warn of weak margins and slowing growth.

A full breakdown of the methodology and explanation behind the calculations is available in my introductory article, Ranking Recession Readiness: Is Google Prepared For The Recession?

(Data & prices correct as of pre-market 13th July, 2022)

(The Top 100 US Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 US Firms compare on Recession Preparedness

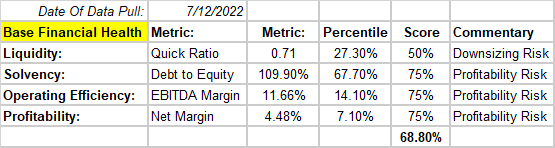

Amazon’s Base Financial Health

Starting with Amazon’s current financial health, we assess how the firm is performing in the current operating environment.

Author

There are two thoughts that we need to hold in our heads simultaneously while we consider the above:

The first, is that AMZN is a high-growth firm that uses leverage to drive big double-digit revenue growth, so debt on the balance sheet is to be expected and reasonably forgivable, given a good level of growth performance.

The second, is that heading into a recession, we see rates being raised by the Federal Reserve, increasing the cost of debt, right before we will see a downturn in consumer spending, the main source of revenue for AMZN. So we need to consider the future while assessing the firm’s current financial health.

With both of these thoughts counter-balancing each other, I assign scores to these metrics.

Firstly, the quick ratio is a really good representation of AMZN’s buffer against a catastrophic scenario where its debts are required to be paid immediately. Here we see a shortfall of 0.29, indicating that the firm faces a downsizing risk associated with its debt levels in a worst-case scenario.

Next is solvency, and this is where those two thoughts we consider simultaneously come into play, as a 109% debt to equity ratio is considered a significant level of debt compared to the rest of the top 100 US Firms, and therefore presents as “riskier” than its peer group.

As far as EBITDA and net margins go, AMZN is considered to have extremely low-profitablitliy, so is marked down as a profitability risk, bit I won’t mark it down further at this stage.

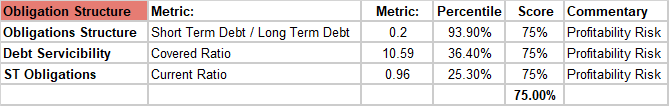

The next task is to consider AMZN’s current obligation structure.

Author

Again, recall we are comparing a growth firm to the top 100 US firms, so a 20% short-term debt vs long term debt is considered extreme, and I’m on the fence about considering this a downsizing risk, but we will be generous to AMZN and give it just a markdown of 75%.

The same goes for debt serviceability and current ratio, as all 3 metrics on their own are not absolutely terrible, but in the context of the top 100 US firms, they’re risk factors that other large firms don’t have.

Overall AMZN earns a 75% score for its obligation structure.

Ordinarily, I would assess dividends at this point, but AMZN does not pay dividends, so we’re straight onto the firm’s future outlook.

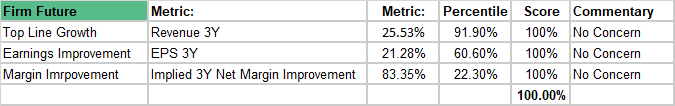

Author

Here is where AMZN outshines its peers, given it is entirely geared towards growth.

With some of the best growth metrics in its peer group, it earns a 100% score here, and despite a lower margin improvement rate, I give it a no concern score for a very healthy 83% margin improvement.

Author

AMZN scores a slightly troublesome 77.5% overall financial health score when compared to the peer group, but now it’s time to look at how it is geared heading into a recession.

Assessing AMZN’s Recession Readiness

Firstly, let’s take a look at the critical balance sheet items identified in our methodology as key points of interest in assessing recession readiness.

Author

First off, the size of AMZN’s debt stands out immediately given the sheer size, and right alongside it is the cash balance which we see is less than half the size of total debt.

Casting our minds back to the advice from the 2008 Great Recession, these two figures immediately begin to ring alarm bells in our minds, given the first two pieces of advice:

First, deleverage, manage your debt, and reduce it before a recession hits.

Second, build and maintain a stockpile of cash in order to maintain the business as cash flow shrinks.

We know that AMZN’s annual capital expenditure was $63.9B in the most recent TTM report, so there is concern that CAPEX may shrink significantly as a part of the overheads reduction, reducing the firm’s ability to “bounce back stronger” after a recession.

We see a number of metrics we covered earlier in the overview of the firm’s financial health, along with a negative free cash flow margin of -1.89%, which will present a risk to operations.

Now we score these metrics, apply our weights as per our methodology, and see how well AMZN is prepared to face a recession relative to it’s peers.

Author

Ouch. A negative 60% score here shows us that AMZN has an extremely ill-prepared balance sheet to face a recession in comparison to its peers in the top 100 firms.

We can see from the above that the size of its debts and negative free cash flow margin are the biggest detractors for the firm.

Ranked 85th, AMZN represents a high-risk firm in my opinion for investors looking to put money into large firms as a hedge against a recession, compared to the rest of the top 100 US firms.

However, we need to dive deeper into AMZN to get a more detailed understanding of how the firm may react to a downturn.

A Deeper Dive Into AMZN’s Preparedness

The advice from 2008 covered several other key items that we can find good quantitative or qualitative measures for.

First is accounts receivable, where the advice was to minimise this figure, to reduce your exposure risk to customer’s financials.

Unsurprisingly, AMZN as a growing firm has a growing accounts receivable, though the growth doesn’t appear to be at the same level as its top-line revenue growth.

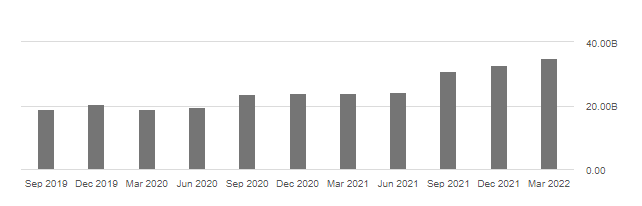

AMZN Accounts Receivable (Seeking Alpha)

At $32.3B, total accounts receivable represents 24% of total current assets and 7.8% of total assets. I don’t view these as extreme values, though a reduction would certainly be advisable.

The next piece of advice was to minimise inventory due to the costs of holding unsold goods. This is an interesting one for AMZN, given the scale of it’s warehousing operations and the volume of inventory they hold.

At ~$35B, AMZN has an extreme level of inventory, which is growing at a solid pace, and makes up 26% of current assets, and 8.5% of total assets.

AMZN Inventory (Seeking Alpha)

Given accounts receivable and inventory make up a combined 16.3% of current assets, this presents a double-whammy risk component for AMZN, as products may sit on shelves incurring costs while accounts receivable may go unpaid for extended periods leaving AMZN carrying costs without being offset by revenues.

The next piece of advice to firms was to cut or reduce costs aggressively, but avoid layoffs given the cost of hiring and training new staff. The logic here is that coming out of a recession, firms will need to be able to return to full operating capacity, and a shortage of labour will slow that return to normal, while the costs associated with scaling up again will be damaging.

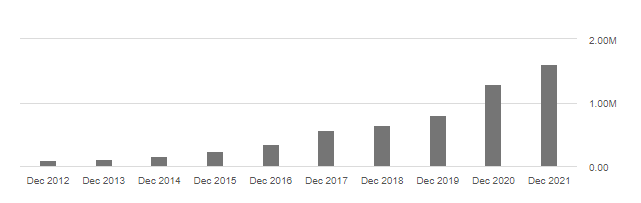

As a growing firm, AMZN has unsurprisingly been increasing its employee headcount, with the most recent report showing 1,608,000 employees. But revenue per employee and profit per employee suggests to us that the firm will likely consider layoffs if it wishes to maintain profitability, or minimise it’s losses in a recession.

Revenue per employee $297,106, profit per employee $13,316

AMZN Total Employees (Seeking Alpha)

The final piece of advice from 2008 was around how firms can find a positive from a recession, by increasing CAPEX and investing while the opportunity cost of capital is lower.

This is a hard one to predict by numbers alone, but taking a qualitative approach to thinking about AMZN, we already know they are champions of innovation and technology.

AMZN’s R&D budget has grown exponentially year on year (32% CAGR since 2012), it acquires businesses it sees as complimentary to it’s operations or have proprietary tech it wants to exploit, and being a tech firm, AMZN is well and truly focused on finding ways to constantly innovate.

This is an area that may provide a lot of hope for investors, where the firm might be able to find a way of operating that drastically changes the recession narrative for AMZN while it’s competition plays a defensive stance and scales back.

I believe that in an economic downturn, it is companies like AMZN that have a world of opportunity at their fingertips to turn a recession into a period of highlights for the firm thanks to their resourcing, attitudes to risk and innovation, and ability to scale new ideas very quickly.

Closing Remarks

I don’t offer any kind of thoughts on how investors should price firms based on recession readiness, but I feel that AMZN presents too much of a risk to be considered “recession ready” compared to the top 100 firms peer group. Given the size and structure of debt on the balance sheet, an insufficient cash balance to maintain operations during a significant and prolonged downturn, its significant accounts receivable and inventory levels, and the likelihood of layoffs through a recession, I’m putting AMZN down as a Sell vs its peer group.

Of course, smart investors will point to the firm’s revenue growth throughout COVID and suggest that this business is geared to perform through economic downturns. However, I would remind these investors that COVID lockdowns and its economic impacts were very different to how we would expect the economy to perform in a recession, noting that consumers’ savings rates increased dramatically while spending profiles changed and shifted toward online spending, as consumers were stuck at home flush with cash. This isn’t a scenario I expect to see repeated in a recession, especially a prolonged one.

This is the second piece in the Ranking Recession Readiness series and I hope the insights have been useful to you so far.

Be the first to comment