fotolinchen/iStock Unreleased via Getty Images

Investment thesis

Mercedes-Benz Group AG (OTCPK:DMLRY, OTCPK:DDAIF) has been beaten down like many stocks in the current bear market, where automakers all have taken a huge hit as fears of a recession and soaring inflation worry investors. However, I think the selloff of the company opens up an interesting opportunity to start a position in the stock. Mercedes-Benz already had been reshaping its business model and its main focus before the pandemic in order to become a more profitable company. It seems like the undertaken efforts are already paying off, thus positioning the company to withstand any major market downturn with a solid position.

The strategy shift

Between 2019 and 2020, Mercedes-Benz announced that it wanted to shift its business model from targeting volumes to focusing on moving its product portfolio towards higher tiers that ensure better profitability. Following this decision, the company completed in 2021 the de-merger of Daimler Trucks (DTRUY, DTGHF), which I recently covered in an article. In this way, Mercedes-Benz turned away from a conglomerate structure in order to be clearly perceived as an automaker that aims at being one of the market leader not in terms of sold cars, but in terms of profitability.

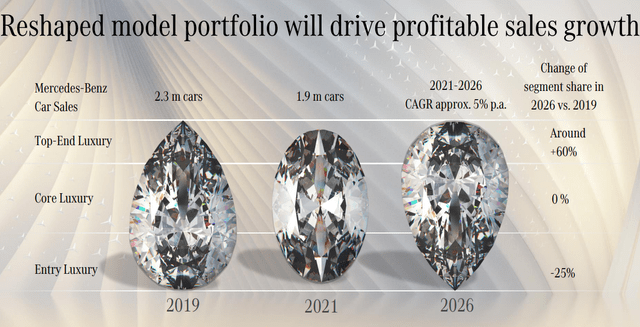

This goal was stated once again during the last capital markets event, where Mercedes provided some interesting data.

Mercedes-Benz 2022 The Economics of Desire Presentation

As we can see, the company is planning to decrease by -25% its entry luxury sales, reducing volumes from the 2019 680k units to around 510k, while changing the average sale price (ASP) up by 20%, in order to achieve by 2026 a double-digit margin. For the core luxury segment, sales volume is expected to remain flat around 1.2 million units, with an increasing ASP of 25%. This segment is already providing Mercedes with higher margins. The top-end luxury tier already sells more than 100k units and it is expected to grow by 60%, with an ASP increase of around 15%. When we speak of top-end-luxury we are talking about cars that have an ASP over €100,000.

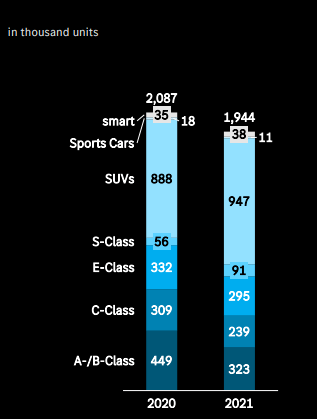

Now, Mercedes’ strategy will clearly lead to an initial decrease in volumes, that will benefit margins and free cash flow. From 2019 to 2021 the company already saw its sales go down by about 400k units. Let’s take a deeper look into Mercedes-Benz sales last year. Even though sales did decrease, we see that the low three segments went down, while the top three (S-Class, SUVs and Sport Cars) all saw increasing volumes.

In particular, S-Class was up by 56%, SUVs up by 6.6% and sports cars up by a staggering 63.6%, as shown from the graph below.

Mercedes-Benz FY2021 Results Presentation

True, after the pandemic many automakers have seen their volumes shrink, as a result of supply chain constraints and semiconductors shortages. This gave all of them increased pricing power facing the huge surge in demand we saw. However, Mercedes-Benz had already started to shift towards a business plan that was perfect for the situation we faced because it enables the company to funnel up demand and lead it towards higher margins segments.

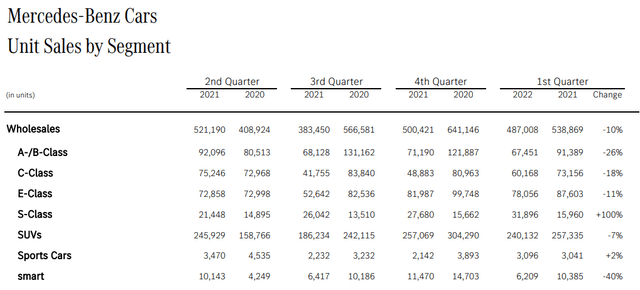

In the Q1 2022 Fact Sheet, Mercedes showed that it was not immune from the general decrease in auto sales we are seeing, especially in Europe. However, it posted outstanding results for the S-Class, up 100%, and still positive results for the sports cars segment. SUVs were indeed down, but not as much as the lower segments. In other words, I see a strategy that is holding up well in a difficult environment and that is providing Mercedes Benz with the opportunity to enjoy higher profitability.

Mercedes-Benz Q1 2022 Fact Sheet

Mercedes choice comes from an understanding of the market that I will quickly recall. The company stated that it expected the global car market to grow at a CAGR of 1.2% during this decade, while the premium segment will grow at a faster pace of 1.7% and the luxury segment, the real aim of Mercedes-Benz, will grow at a CAGR of 4.2%.

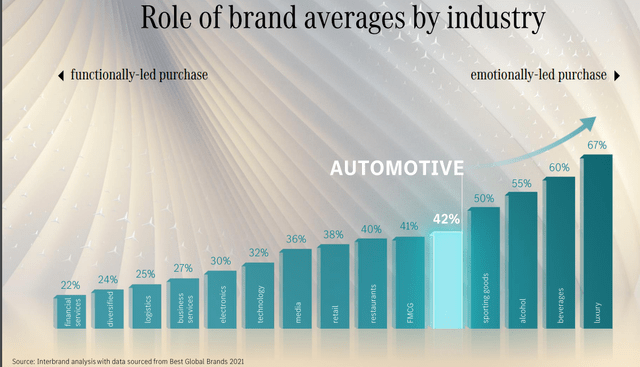

The focus on the upper segments comes from a clear understanding of two main drivers. First of all, a car is one of the most emotionally-led purchased objects. This is even more true when the car is positioned among the top segments of the industry, thus being perceived as not only a vehicle, but a luxury item.

Mercedes-Benz 2022 The Economics of Desire Presentation

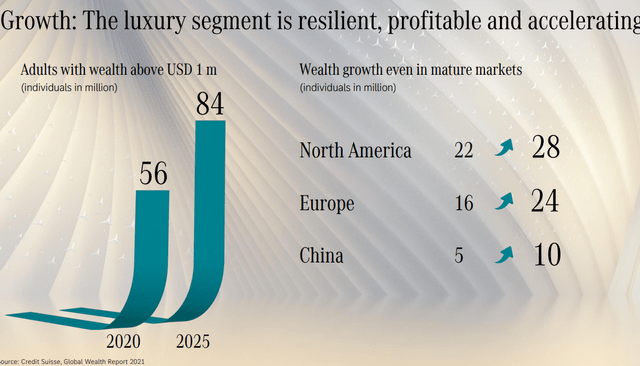

The second driver Mercedes is aware of is that, between 2020 and 2025, a 50% increase in adults with at least $1 million net worth is expected. This will bring the total addressable market (“TAM”) to 84 million individuals. This will make the luxury segment resilient, as more and more individuals will have the wealth to purchase, maybe for their first time, a luxurious car.

Mercedes-Benz 2022 The Economics of Desire Presentation

Mercedes-Benz vs. BMW: different sources of margins

The Mercedes-Benz Group sold a total of 2.75 million vehicles in 2021, out of which approximately 2 million were cars, while the remaining were vans. Its revenue from the industrial division was €105.95 billion and an EBIT of €12.54 billion. This is an 11.83% margin. The revenue from the financial services (Mercedes-Benz Mobility) was €27.7 billion with an EBIT of €1.44 billion is a 5.2% margin. As we can see, Mercedes’s margins come more from car sales, than from financial services.

On the other hand, Mercedes-Benz’s major competitor BMW (OTCPK:BMWYY) sold in 2021 approximately 2.5 million cars, with a revenue of € 95.48 billion and an EBIT of €9.87 billion. The margin is here 10.33%. The revenue from the financial services was €32.87 billion with an EBIT of €3.7 billion, with a margin of 11.26%. As I already pointed out in a recent article, BMW has been focusing on growing its financial branch in order to expand volumes and revenues. Furthermore, it is from this branch that the company is making its margins, but, as I pointed out, this strategy may be at risk as it is linked to pre-owned vehicles value and to interest rates that may become too high, thus pushing customers to buy directly a car without being financed.

Mercedes-Benz is seeing improved financials

So far we have seen two points: the strategy shift and the difference between Mercedes and BMW. Now we can see further how Mercedes’ strategy is indeed being executed with interesting results.

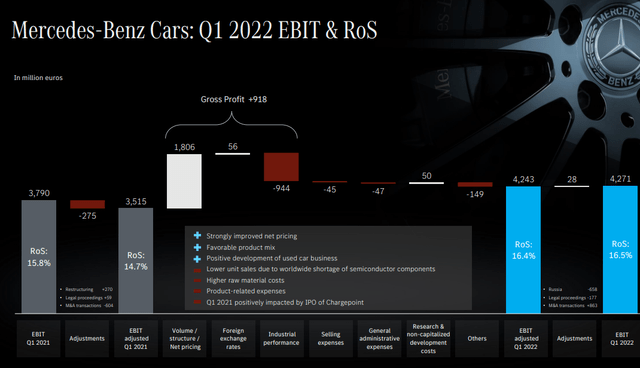

As we wait for the 1H 2022 results, which Mercedes will publish at the beginning of August, we can take a look at 1Q 2022 to notice that with volumes generally decreasing, EBIT was strong and growing, with a RoS that reached 16.5%, more than 1% point above BMW. This was well above the expected return on sales cars that in its previous guidance Mercedes planned to be between 11.5% and 13%.

Mercedes Benz Q1 2022 Results Presentation

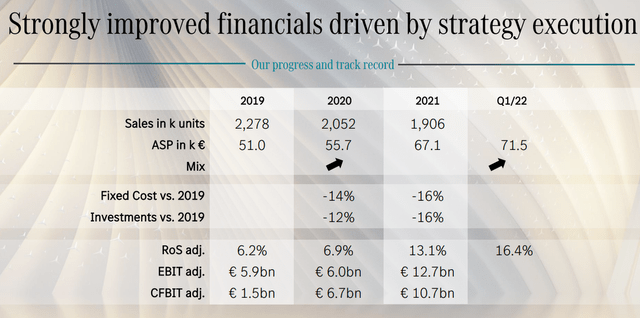

Let’s see where these results come from. As we can see from the slide below, Mercedes has increased its ASP by 40% in just two years. In the meantime, it has also managed well its fixed costs, reducing them by 16%, just like its investments as the EV production is starting to take off and is thus needing less money to grow. The result is an increasing RoS that moved up from 6.2% in 2019 to 16.4% in Q1 2022. This is really a big jump in a short period of time and I think it is the way Mercedes leveraged its strategy shift in a favorable environment.

Mercedes-Benz 2022 The Economics of Desire Presentation

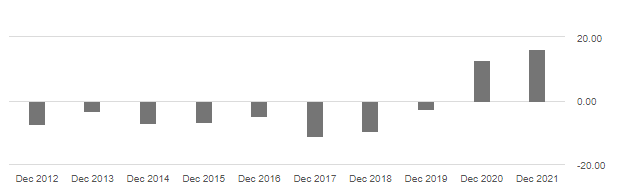

Another result we can see from Mercedes’ shift is that the company is turning free cash flow positive as we can see from the graph below showing the free cash flow per share. Please notice that Mercedes is not doing share buybacks, thus the free cash flow per share spike is all due to a real free cash flow increase.

Seeking Alpha

Valuation

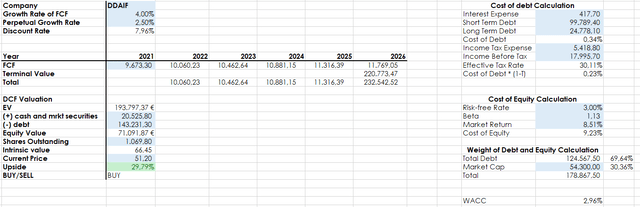

Here is my discounted cash flow model. I am being a bit conservative by expecting over the next five year a free cash flow (“FCF”) growth rate of just 4%, even though I believe we will see it benefit more from the new strategy Mercedes has undertaken. The result is that Mercedes is currently undervalued by around 30%, which, in my case begins to be a good enough margin of safety. Furthermore, I think that even if a recession will take place, a company that is more focused on luxury should hold up better than others.

Author, with data from Seeking Alpha

The stock is also beginning to trade around $50, which has been both a support and a resistance line over the past decade. For investors with a long-term mindset, this could be a good entry point to cautiously start a position that could be increased in case this bear market provides us with even better opportunities.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment